In today’s world, we do a lot of transactions online, and many of us rely on credit cards to pay for things. But it’s really important to keep our sensitive information safe and secure. If credit card data is mishandled, it can cause big problems for both people and businesses.

It can lead to data breaches, where hackers get access to personal information, and that can make customers lose trust in companies.

It might even lead to legal issues. With the rise of contactless payments and online shopping, it’s crucial to know the best ways to store credit card information safely. So, let’s learn together how to protect ourselves and our businesses in this ever-changing digital world.

Why is it Important to Store Credit Card Info?

Storing credit card information securely is of utmost importance, especially in light of events like the Equifax data breach, which highlighted the devastating consequences of mishandling personal data. For businesses, especially those with recurring or subscription-based models, securely storing credit card information is a routine necessity.

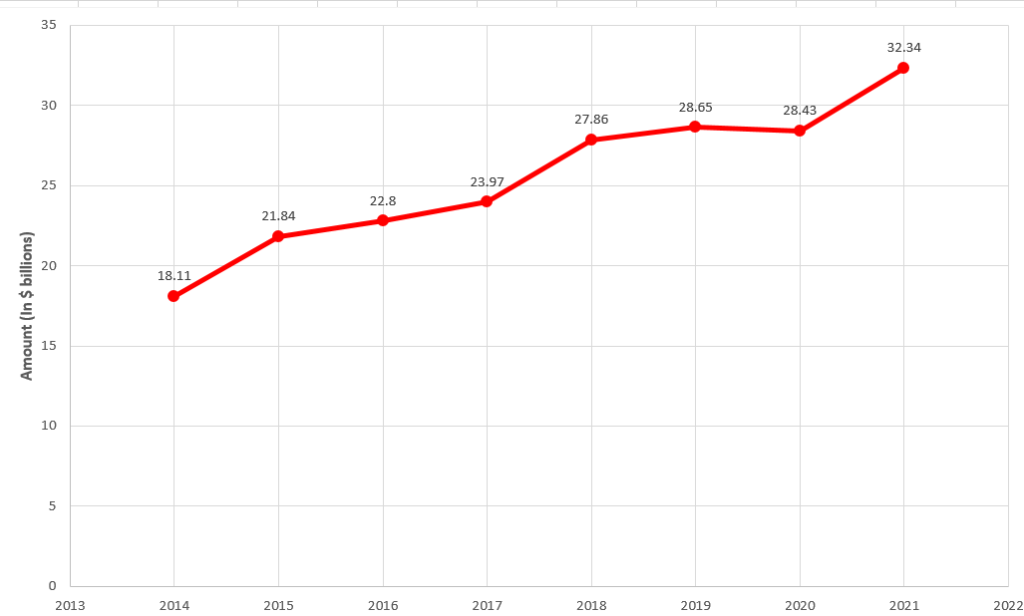

Credit card fraud globally: Source Nilson

The first step in finding a reliable solution is reaching out to your merchant service provider. They often offer services specifically designed to securely store your customers’ credit card information, ensuring peace of mind for both you and your clientele.

When utilizing a merchant service provider’s storage solution, it’s essential to inquire about their data security measures. Reputable providers should have robust data security protocols in place to protect sensitive information from unauthorized access or breaches. These measures might include encryption, tokenization, and other advanced security techniques.

Implementing best practices for storing credit card data not only safeguards your customers’ trust but also shields your business from potential legal and financial repercussions. By entrusting your credit card information storage to a trusted and secure provider, you can focus on running your business while knowing that your customers’ sensitive data is handled responsibly and protected from potential threats.

Considerations for Storing Credit Card Information

In today’s digital age, the proper storage of credit card information is a critical responsibility for businesses that handle financial transactions. The increasing reliance on online payments and the prevalence of data breaches make it imperative for companies to implement robust security measures. In this guide, we’ll explore the essential considerations for storing credit card information securely, ensuring the protection of both customers and businesses.

1. Legal and Regulatory Compliance: One of the primary considerations when storing credit card information is compliance with legal and regulatory requirements. Businesses must adhere to industry standards and regulations, such as the Payment Card Industry Data Security Standard (PCI DSS).

To protect customer credit card information, firms must adhere to a set of security guidelines outlined by PCI DSS. Customers are given trust that their private information is safe when these standards are followed, which also helps to avoid penalties and legal problems.

2. Encryption and Tokenization: Encryption and tokenization are two powerful security measures that help protect credit card data from unauthorized access. Encryption involves converting credit card information into an unreadable format using algorithms. Only authorized parties with the decryption key can convert the data back into its original form.

On the other hand, tokenization replaces sensitive data with non-sensitive substitutes (tokens) that have no intrinsic value or meaning. The actual credit card information is stored securely in a separate, heavily guarded system while the token remains within the business’s environment.

3. Access Control and Authentication: Limiting access to credit card data is crucial for minimizing the risk of data breaches. Businesses should implement strict access control policies, ensuring only authorized personnel can access the stored information. Multi-factor authentication adds an extra layer of security by requiring multiple forms of verification before granting access to sensitive data.

This could involve combining something the user knows (password), something the user has (smartphone or token), and something the user is (biometric data).

4. Regular Security Audits and Updates: Maintaining a secure storage system for credit card information is an ongoing process. Regular security audits should be conducted to identify and address potential vulnerabilities in the system.

Security updates and patches should be promptly applied to all software and systems used for storing and processing credit card data. Hackers are constantly evolving their tactics, so staying up-to-date with security measures is essential.

5. Secure Payment Processors: For businesses that process credit card transactions online, choosing a secure payment processor is crucial. Payment processors should have robust security measures in place to protect credit card data during transmission. Look for reputable payment processors with PCI DSS compliance and a track record of handling transactions securely.

6. Data Retention Policies: Having a clear data retention policy is essential for managing credit card information responsibly. Businesses should only retain credit card data for as long as necessary and should have procedures in place for securely disposing of the data when it is no longer needed.

Storing credit card information securely is a multifaceted task that requires careful consideration of legal, technical, and procedural aspects. By adhering to industry standards, implementing robust security measures, and continuously updating and auditing systems, businesses can ensure the protection of sensitive data, build customer trust, and mitigate the risk of data breaches.

7 Best Practices for Storing Credit Card Information

As the world becomes increasingly digitized, credit card transactions have become a ubiquitous part of our daily lives. However, with convenience comes responsibility. Properly storing credit card information is a crucial aspect of maintaining trust with customers and protecting sensitive data from potential breaches. In this comprehensive guide, we will delve into seven best practices that businesses should adopt to ensure the secure storage of credit card information.

1. Never Store Credit Card Info in Compromising Places

One of the cardinal rules of credit card data security is to never store credit card information in compromising places. Storing credit card details in plain text, spreadsheets, or easily accessible databases is a recipe for disaster. Such practices leave the data vulnerable to unauthorized access, making it an easy target for hackers.

Instead, employ secure data storage practices such as encryption and tokenization. Encryption converts credit card information into an unreadable format using complex algorithms, requiring a decryption key to render the data usable.

Tokenization, on the other hand, replaces sensitive data with non-sensitive substitutes (tokens) that have no value or meaning outside of the system. By employing these methods, even if a security breach occurs, the actual credit card data remains safeguarded.

2. Ensure Data is Encrypted

Encryption plays a central role in safeguarding credit card data. All stored credit card information should be encrypted, rendering it indecipherable to unauthorized users. Employing strong encryption algorithms ensures that even if hackers gain access to the data, they will find it virtually impossible to decode.

For businesses handling credit card transactions online, it is essential to use secure communication protocols, such as HTTPS, to encrypt data during transmission. By encrypting data both at rest (when stored) and in transit (when transmitted), you establish a robust security foundation, reducing the risk of data breaches.

3. Be Extra Careful with Recurring Billing

Businesses that operate on a recurring billing model must exercise extra caution when handling credit card information. Storing credit card data for future billing cycles increases the potential risk associated with unauthorized access.

To mitigate these risks, adopt a “token-first” approach for recurring billing. Rather than storing actual credit card data, rely on tokenization to manage subsequent transactions. Tokens are unique, randomly generated codes that serve as placeholders for credit card information. When the time comes for billing, the token is used to initiate the transaction without the need to store the actual credit card data.

Additionally, provide customers with the option to update or delete their stored credit card information easily. This not only enhances customer trust but also reduces the liability associated with handling sensitive data over extended periods.

4. Look for Hardware Updates

Keeping hardware up-to-date is another crucial aspect of credit card data security. Outdated or unsupported hardware may lack critical security features or be vulnerable to known exploits. Regularly update and patch all hardware components involved in credit card data storage and processing, including servers, point-of-sale terminals, and payment gateways.

Moreover, consider implementing secure hardware components, such as Hardware Security Modules (HSMs). HSMs are specialized devices designed to handle cryptographic operations securely. Integrating HSMs into your infrastructure can add an extra layer of protection to your credit card data.

5. Partner with a Reputable Service Provider

For businesses that lack the expertise or resources to handle credit card information securely on their own, partnering with a reputable service provider can be a game-changer. Trusted payment processors and service providers are well-versed in credit card data security best practices and are committed to maintaining the highest levels of data protection.

When choosing a service provider, consider their compliance with industry standards such as the PCI DSS. PCI DSS provides a detailed set of security requirements for businesses handling credit card information. A PCI DSS-compliant service provider ensures that your credit card data is in safe hands.

Furthermore, thoroughly review the provider’s data security policies, past security track record, and any data breach incidents they may have experienced. Selecting a service provider with a strong security reputation is vital to safeguarding your customers’ sensitive information.

6. Regular Security Audits and Penetration Testing

Storing credit card information securely is an ongoing process. Conducting regular security audits and penetration testing is essential for identifying potential vulnerabilities and weaknesses in your infrastructure. Penetration testing involves simulating real-world cyber-attacks to assess the effectiveness of your security measures.

Performing routine audits and penetration tests allows you to stay one step ahead of potential threats, enabling you to address any weaknesses promptly. By proactively identifying and addressing security gaps, you can minimize the risk of data breaches and keep your credit card data safe.

7. Educate Employees on Data Security

Last but not least, educate your employees on data security best practices and the importance of protecting credit card information. Employee awareness is a crucial component of a comprehensive data security strategy. Train your staff on recognizing phishing attempts, password hygiene, and the proper handling of credit card data.

Establish clear data security policies and protocols and regularly remind employees to follow them diligently. Encourage a culture of security awareness within your organization, making everyone responsible for safeguarding sensitive data.

The security of credit card information is not a matter to be taken lightly. By adopting these seven best practices for storing credit card data, businesses can build trust with their customers, protect sensitive information, and significantly reduce the risk of data breaches.

Emphasizing encryption, secure hardware, and compliance with industry standards will establish a strong foundation for your credit card data security strategy. Remember that data security is an ongoing journey, requiring constant vigilance and a commitment to staying ahead of evolving threats.

Conclusion

In conclusion, ensuring the secure storage of credit card information is a vital responsibility for businesses operating in today’s digitally driven world. Throughout this guide, we have explored essential best practices that can help fortify your data defenses, protect sensitive information, and build trust with customers.

By never storing credit card information in compromising places and prioritizing encryption and tokenization, businesses can significantly reduce the risk of unauthorized access and data breaches.

Frequently Asked Questions (FAQs)

Why is it important to store credit card information securely?

Storing credit card information securely is crucial to protect sensitive data from potential data breaches and unauthorized access. Mishandling credit card data can lead to severe consequences, including loss of customer trust, legal liabilities, and financial penalties.

What is encryption, and how does it help in securing credit card data?

Encryption is a process of converting sensitive data, such as credit card information, into an unreadable format using complex algorithms. Only authorized parties with the decryption key can access and decipher the data, adding an extra layer of security and preventing unauthorized access.

Is it safe to store credit card data for recurring billing?

Storing credit card data for recurring billing can pose security risks if not handled properly. To mitigate these risks, businesses should adopt a token-first approach, using tokens instead of actual credit card data for subsequent transactions. Providing customers with the option to update or delete their stored information also enhances security.

What role does employee education play in credit card data security?

Employee education is vital in creating a strong security culture within an organization. Proper training helps employees recognize potential security threats, understand data handling best practices, and promotes responsible data management.

Should businesses use third-party payment processors for credit card transactions?

Using reputable third-party payment processors can be beneficial for businesses, especially those with limited resources and expertise in handling credit card data securely. Reputable processors often have robust security measures in place and comply with industry standards, reducing the burden of data security for businesses.

How can businesses build trust with customers regarding credit card data security?

Building trust with customers regarding credit card data security requires transparent communication about data protection practices, compliance with industry standards, and a track record of reliable data security. Providing clear and easily accessible privacy policies and offering options for customer data management can also enhance trust and loyalty.