Starting a business involves a thorough review, decision-making, market research, and gaining expertise in various unforeseen areas. The process demands significant time, effort, and resources from the initial idea phase to the eventual launch.

While certain aspects of this journey may be unique to your specific business or ideas, there are commonalities that most entrepreneurs have when starting their ventures. This guide breaks down the initial steps you need to take when starting your own business.

- Easy Step-By-Step Process For Starting A Business In 2024

- Step 1: Defining Your Viable Business Concept

- Step 2: Researching The Market

- Step 3: Writing Down Your Business Plan

- Step 4: Choosing A Catchy Name With an Attractive Logo

- Step 5: Getting Your Business Structure Right

- Step 6: Arranging Your Finances

- Step 7: Getting The Licenses And The Permits

- Step 8: Safeguarding Your Business With Insurance

- Step 9: Building Your Team

- Step 10: Getting a Merchant Account

- Step 11: Purchasing the Necessary Hardware and Software

- Step 12: Get Your Business Off The Ground

- Step 13: Marketing

- Conclusion

- Frequently Asked Question

Easy Step-By-Step Process For Starting A Business In 2024

The new year comes with its own promises of change and growth, whether for individuals or startups. For today’s entrepreneurs, 2024 is a unique chance to turn their business ambitions into achievable dreams.

There are great possibilities as well as challenges facing those who will be venturing into the business arena this year. Changing economies, market trends, and evolving technologies can be both exciting and terrifying for novices in entrepreneurship. Not knowing where to start, financing issues, and adjusting to the changing tastes of consumers might seem like insurmountable problems.

The 13 critical steps entrepreneurs need to take on their journey into the business world are described below. But before we get started, there are some important things that you should consider.

What Does It Mean To Start A New Business?

Starting a business requires meticulous planning and preparation, as setbacks are virtually guaranteed. To ensure success, one must possess the ability to adapt quickly to changing circumstances. Merely selling products or services is not enough; establishing a robust brand and cultivating a loyal following of customers who genuinely value what your business offers is imperative.

Capital also plays a significant role in launching any venture. Many business plans can kick off from the comfort of your home with minimal overhead, and the prevalence of remote businesses and e-commerce has surged, mainly due to the impact of the pandemic of 2019.

While refining your options, it’s crucial to ensure that your chosen idea has the potential to generate revenue. As you narrow down possibilities, consider the practicality and profitability of your business concept.

Starting a new business demands considerable time and commitment. Unlike the success stories we see on social media, which often portray overnight successes, achieving a solid business launch will demand years of unwavering determination, visionary goals, strategic planning, and relentless perseverance – these enduring elements are behind credible enterprises that withstand the test of time. Building a loyal customer base takes time and consistent effort. Developing an authentic brand identity through transparent, helpful communication helps people feel invested in your company’s mission.

While starting a business may require upfront capital, maintaining positive relationships provides enduring rewards far beyond initial financial gains. Though the path is not quick or easy, focusing on serving others with integrity paves the way for stable, meaningful progress that uplifts all involved.

Factors To Consider While Starting A Business

When contemplating the type of business to launch, two critical factors come into play:

- Does your business address an unmet consumer need in your area?

- Are you passionate about your business, and do you possess a level of expertise in that domain?

Discovering the perfect recipe for a successful business involves not only solving a problem for people but also engaging in something you genuinely enjoy. A fantastic idea and a deep passion for your business is undoubtedly an excellent starting point. But the question remains – where do you go from there? Informed entrepreneurs understand that market research and analysis are key steps to take after identifying their passions and areas of expertise. Conducting thorough investigations on local demographics, competition, economic trends, and consumer preferences will provide invaluable insights necessary to make informed decisions about launching or refining their businesses (we will get on this later in the article ).

By utilizing reliable data sources such as government reports, industry publications, surveys, focus groups, and interviews with potential customers or experts in the field, aspiring entrepreneurs can gather credible information that will guide them toward making well-informed strategic choices essential for success. The key thing here is “being informed,” emphasizing the importance of relying on data rather than mere intuition (which most people do rely on) or guesswork when shaping one’s entrepreneurial journey, as “gut feeling” may not always be 100% right.

Checklist To Starting Your Own Business

Before jumping into specific steps, we’ll equip you with key elements to start your business. Here is the checklist for starting a business (use this brief to tick off and evaluate your progress):

- Start by having a solid concept that meets your audience’s needs and desires and matches your likes.

- Following that, draft a comprehensive business plan—a vital component of the entire process.

- Ensure accuracy in outlining your business’s structure, conduct thorough market research, and seek feedback from friends, mentors, and family members. Getting these foundational aspects right is crucial for your business’s success.

- Then, you need to focus on the legalities to dodge hitches. If your business is a Corporation, LLC, Partnership, or Sole Proprietorship with a team, start getting a Federal Employer Identification Number (FEIN) from the IRS.

- This is followed by identifying your business model, registering it, securing the mandatory licenses and permits, and setting up bank accounts.

- Armed with your concept and a deftly drafted plan, it’s time to secure your product or service launch funds (optional).

- Sort office or storage space as needed, and initiate your team assembly.

- Eventually, turn your attention to ramping up sales and growing your business—an ongoing task on your entrepreneurial pathway.

These compact sections sum up a couple of years of business evolution. Let’s dig deeper into each stage, and feel free to hop over any steps if you’re already firm on the basics.

Step 1: Defining Your Viable Business Concept

Basically, a business idea is the foundation for establishing a company. It influences every aspect of the business, determining the products and services offered and the marketing strategies. Although the idea doesn’t necessarily have to be unique, it should possess the potential to carve out a niche within its target market. In simpler terms, it must present something distinctive compared to existing companies in the market, as their established reputation and lead may otherwise pose significant competition challenges.

Potential business ideas include:

- Identifying a gap in the market

- Introducing a new product, service, or invention

- Offering an innovative solution to an everyday problem

- Monetizing an interest or hobby

- Leveraging skills acquired in one’s career

The possibilities for creating a business are limitless. While the specifics may differ, successful businesses share consistent key elements that contribute to their achievements, such as:

- Evident Market Demand:

At the core of any successful business lies the fundamental principle of supply and demand. For every business idea, it is imperative to present compelling and verifiable evidence of demand within your chosen market or industry.

Various methods, such as outreach and marketing software or engagement through interest surveys and forums, can be employed to assess market demand. This step is crucial, as inadequate market demand contributes to the closure of 42% of businesses within their first five years.

- Clear Short and Long-Term Objectives:

A comprehensive plan is indispensable for the success of any entrepreneurial venture. Your short-term and long-term goals should be intricately woven to provide a roadmap for achieving success. Establishing clear and goal-setting frameworks in the short term lays the foundation for a successful journey toward long-term objectives.

- Flexibility for Expansion:

Prepare to fine-tune parts, or even all, of your business plan based on new facts or insights. Being adaptable is vital for staying current in the changing market scene and reacting to surprise customer responses. Being flexible and receptive could turn your dream into real life. Remember, tweaks can always be done after you’re settled in.

- Motivation:

Love for your business is crucial. But there’s another key: steady motivation. This comes from a goal that truly excites you. You might be moved by a dedication to a good cause, by wanting to perfect your skills, or by helping others with their struggles. Motivation is like a guiding light when times get tough.

Even better, if you’re motivated, your team will notice. Your energy might even influence them. Studies show that teams work better when motivated – up to 20% better. That can lead to a 21% boost in profits overall.

What Type Of Business Founder Do You Consider Yourself To Be?

Deciding to transform an idea into a business is the straightforward part. Bringing a profitable business to life requires commitment.

Becoming a successful entrepreneur begins with understanding yourself. By identifying your strengths, weaknesses, and interests, you can utilize your strengths, foresee potential challenges, and stay motivated through the business development process.

Some individuals appreciate the art of business and designing systems that create value. For them, revenue serves as a way to measure success. On the other hand, most entrepreneurs are driven by a problem, pain point, or passion, aligning themselves with their customers. Witnessing people enjoy their products is what brings them the most satisfaction.

Ask yourself these essential questions:

- Do you have powerful beliefs?

- Do you know your product well?

- Does your experience connect closely with your product?

- Can you explain your ideas quickly to businessmen and form strong bonds?

- Do you have expertise in crafting an attractive brand image?

Understanding your product boosts your reputation and helps you sell it. You should also check if you have the skills that fit your idea. Noticing any missing skills is also important – don’t worry – You can often fill these gaps by hiring skilled workers. Plus, caring about the problem you’re fixing or a very specific hobby makes you a better creator.

It may not be necessary, but such care can drive your determination to tackle hurdles and win in your industry. Building active fans online is a pillar for successful businesses. By creating interesting content on YouTube, social media, or emails, business people can grow a devoted fan base that can power their business growth.

How Financially Viable Is Your Business Idea?

All business concepts must hold the potential for profitability to make them worthwhile. However, determining profitability goes beyond ensuring your company has a positive balance after subtracting total expenses from total revenue.

Let’s consider you aim to sell an item for $20. If it costs you $10 to manufacture and prepare for shipping, your profit per unit sold is $10. A 50% margin may seem high at first; still, this amount might not be sufficient to cover the expenses of acquiring customers, not to mention other business costs you’ll encounter, like rents, electricity, and salaries, among other things. The positive news is there are numerous strategies you can employ to enhance the profitability of your new venture. You might consider:

- Adjusting your pricing. (While this may be apparent, having a well-thought-out pricing strategy is vital for establishing a sustainable business model.) To understand and evaluate better, you can first start with a few samples manufactured by a third-party vendor – it will give you a clear and concise idea about the unit economics of the product.

- Creating product bundles to increase the average order value from each customer.

- Selling in larger quantities to other retailers.

- Encouraging your previous customers to make repeat purchases, as it’s more cost-effective to market to existing customers.

- Based on your product type, introduce a subscription model to prompt more repeat orders.

- Diversify your offerings by introducing new, more profitable products or services to the same audience.

When assessing the feasibility of your business plan, it’s crucial to understand the interaction among the following factors:

- Break-even Point: The break-even line is the number of products or services to sell so as to cover the production and other costs like warehousing and inventory. It could be calculated by dividing fixed costs by average price minus variable costs.

- Repeat buyer rate: It is the probability that a client would come back again for your product. In case it’s low, question yourself if one or at least two transactions will produce sufficient earnings for business success.

- Buyer lifetime value: How much money do you plan to make from a typical customer throughout their association with you? The higher the amount spent per an average customer in time, the stronger the basis of your business.

- Customer acquisition charges: How much can you reasonably spend on getting a buyer? The higher lifetime value of a customer leads to a bigger investment in attracting new clients, even if it means little or no profit at their first order.

A solid business idea should enable you to extract more value from your customer base than what you spend to acquire it.

Examples Of Popular Industries

If you’re seeking inspiration for starting a specific type of business, consider exploring these examples:

- Real estate

- E-commerce

- Finance

- Cleaning

- Construction

- Healthcare

- Online course

- Pet sitting

- Retail

- Childcare services

- IT Tech Support

- Tax Preparation

- Delivery services

- Transportation

- Application development

- Consulting

- Edtech

- Graphic design

- Hospitality

- Online Subscription Service

- Cigar and Tobacco Business

- CBD Business

- Industrial Repair

- Manufacturing

- Dropshipping

Step 2: Researching The Market

After identifying the right product, you have a clearer understanding of your business idea. The next step in starting a business is grasping the market and your role within it. Market research involves gathering information about your target market and customers. It validates a new product’s success, aids your team in refining an existing product, or comprehends brand perception to ensure effective communication of your company’s value.

While market research can address various questions about an industry, it’s not a crystal ball providing marketers with absolute insights on their customers. Market researchers get their legs extended into multiple aspects of the market, and it may take weeks or even months to form an accurate depiction of the business landscape.

Focusing on just one of these aspects can enhance your intuition about your buyers and how to provide unique value not offered by any other business at present. While your industry experience and existing customers can guide your decisions, remember that market research extends benefits beyond these strategies.

There are two main types of market research that you can do.

- Primary: Primary research involves gathering data to understand your specific customers or target market segment. It’s beneficial for developing buyer personas, segmenting your market, and enhancing your product to meet customers’ needs.

- Secondary: On the other hand, secondary research relies on data not collected by you. This includes industry reports, public databases, and proprietary data from other companies. These sources offer insights into your target market segment and industry.

Identifying Your Buyer Persona

Before getting into the intricacies of how customers in your industry make buying decisions, it’s essential to grasp who they are, which starts with the primary research. This is where your buyer personas prove invaluable. Buyer personas, sometimes called marketing personas, are fictional yet generalized representations of your ideal customers. Utilize a free tool to craft a buyer persona that your entire company can employ for improved marketing, sales, and service.

These personas assist in visualizing your audience, streamlining communications, and guiding your strategy. Some key characteristics to include in your buyer persona are:

- Gender,

- Age,

- Job title(s),

- Location,

- Family size,

- Major challenges,

- Values,

- Income.

The goal is to use your persona as a reference for effectively reaching and understanding the real audience members in your industry. Additionally, you might discover that your business aligns with more than one persona — that’s perfectly acceptable! Consider each specific persona when optimizing and planning your content and campaigns. Here are some tips to comprehend buyer personas:

- Examine Your Audience: Gather information about your target audience by analyzing customer data, surveys, or interviews and exploring online forums and social media groups.

- Identify Customer Pain Points: Understand your customer’s pain points and goals. This understanding helps in crafting messaging that directly addresses their needs.

- Identify Customer Goals: Recognize the motivations of your target audience. Customer goals can be professional or personal, depending on your product and service offering.

- Segment Customers: Understand who your customers are and why they decided to buy from you.

Understand The Potential Of Business

During the secondary research, gain insights into your industry and its future direction by researching its trends. Also, consider aspects such as the earning potential in your field, projections for the next six months, one year, and five years, and whether there’s higher potential in one area compared to another.

Assess if your industry has been on the decline or is seeing growth, and if it’s seeing a decline, what is the reason behind it, and if your business has the potential to turn it around. Additionally, explore if there’s a growing emphasis on sustainability in your field, which could impact your product line. These factors are crucial for establishing a solid market understanding while doing the research. Here are some additional aspects of secondary research that you should follow:

- Sales Research: This is a popular choice for established businesses with a sizable customer base. You can gather data through focus groups, surveys, observations, and interviews. But as you are starting a new business, what you can do is go through your competitors’ sites and find any publications and research done by them.

- Studies: This might involve UX research, pricing interviews, industry reports, and brand health studies.

- Customer and Prospect Interviews: This is the most reliable source of information as it directly comes from the mouths of real buyers. So start asking your family, friends, neighbors, relatives, and even categorically asking random strangers about your competition’s products/services to assess how you can make it better.

- Web Analytics: This encompasses digital surveys, digital panels, social media insights, and social listening tools.

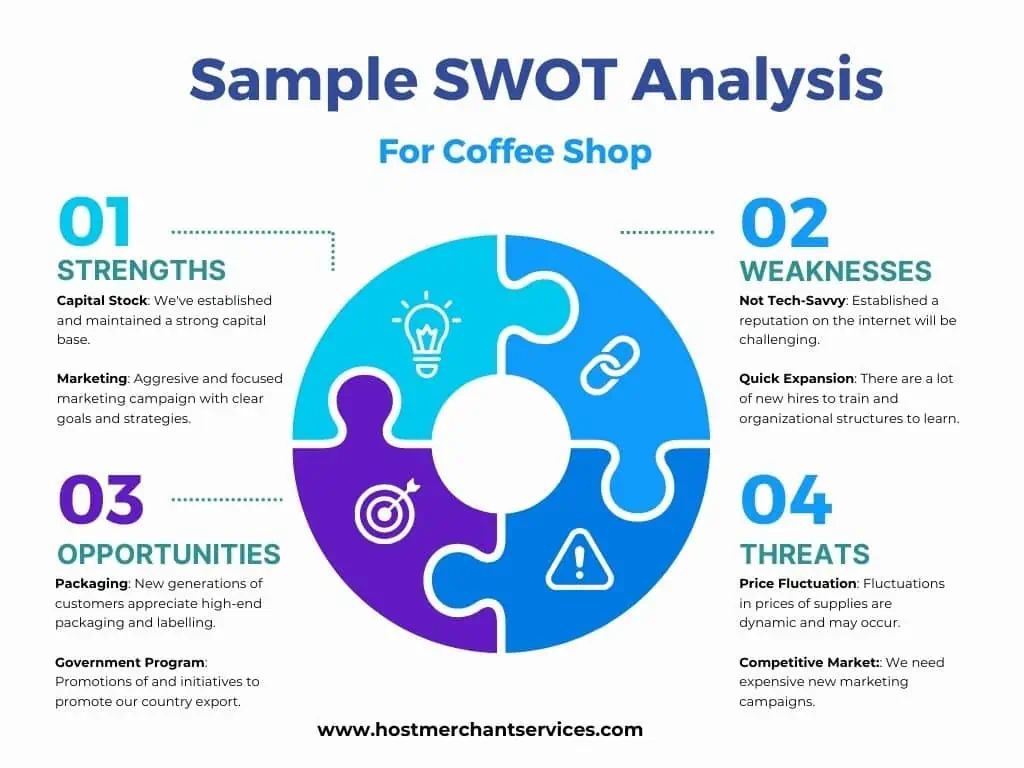

Once you’ve conducted your initial research and identified your niche and unique selling proposition (USP) to attract customers, experts suggest performing a SWOT analysis to fine-tune your USP and niche. A SWOT analysis is a tool to help you analyze your business’s strengths, weaknesses, opportunities, and threats.

A Simple Overview of SWOT Analysis

- Strengths: What will your business be good at? What skills do you bring to the table in your field? These might be your unique ideas, decades of experience, or sharp marketing skills.

- Weaknesses: How do you think your business might be limited? These growth areas could relate to your location, employees, financial resources, or market competitiveness. Identifying your weaknesses puts you in control of addressing them proactively.

- Opportunities: What opportunities are out there for your business to grow? A savvy business owner is always looking for ways to expand their business. For example, you might want to partner with a local coffee shop to launch a limited-time product. The grand opening may be timed to attract a lot of foot traffic during the local parade.

- Threats: How can you plan for internal and external threats to your business?

Step 3: Writing Down Your Business Plan

A business plan is a strategic document that lays out a company’s goals, the strategies to achieve them, and the timeframe for their accomplishment. It encompasses elements like market analysis, financial projections, and organizational structure, acting as a roadmap before you do and start your business.

Financial institutions and investors often require a business plan before considering any project for funding. A well-crafted plan becomes the guiding framework for your business as it expands.

This comprehensive guide should outline the products or services you plan to offer, your revenue strategy, the necessary team members, and more. Include detailed financial projections, budgets, and thorough explanations of how you intend to allocate investor dollars or loans. Since cash flow projections may change with adjustments in income and expenses, view the plan’s financials as a living, evolving document.

It will likely undergo multiple revisions before your idea becomes a reality. Seeking feedback from industry colleagues and accountants can provide valuable insights into the realism of your projections and uncover any overlooked costs. Here’s a step-by-step guide to composing your business plan.

- Draft an Executive Summary:

A well-crafted executive summary is one of the most pivotal sections of your plan; interestingly, it’s the last one you should write. The executive summary distills all that comes after and offers time-conscious reviewers, such as potential investors and lenders, a concise overview of your business, convincing them to delve deeper.

Remember, it’s a summary, so emphasize the key points you’ve uncovered during the plan’s development.

- Compose a Company Description:

Creating a detailed business plan needs a clear company description. This section gives your business identity and direction. Answering precisely who you are and what your goal is to provide a believable overview of your venture. Underlining what makes your business unique is vital when detailing your company.

Highlight what sets you apart – special skills, unique qualities, or creative methods. It should be easy to see why your business is different. Also, we should know why investors should pick you. Show them why your business will succeed. Maybe you have a market report showing a need for your product or service. Maybe you have a dedicated team with amazing skills. Or perhaps you have extraordinary tech that gives you a leg up in your industry.

- Write Goals Based on Numbers:

Goals encompass various aspects of your business. While financial and profit goals are paramount during the establishment phase, other objectives relating to brand awareness and growth are equally crucial. For instance, you might aim for a specific number of followers across social channels or aspire to elevate your engagement rates.

Additional goals could involve attracting new investors or securing grants, especially if you operate as a nonprofit business. If expansion is on your agenda, setting revenue targets becomes pivotal for achieving that growth.

- Intangible Goals:

Beyond measurable metrics, goals unrelated to traceable numbers hold significance. These could involve witnessing your business’s advertisement reach the general public or receiving stellar client reviews. These goals contribute to shaping the trajectory of your business and determining its future course.

- Detail Your Products or Services:

Your business plan should dedicate a section to elucidate your services or products. You can also explain how they align with the current market, fulfilling a necessary or innovative role. If there are any patents or trademarks associated with your offerings, include them in this section.

If you possess visual aids, incorporate them here. It’s also an apt space to outline your pricing strategy and provide insights into the materials you use.

- Detail the Management and Organization:

Your business plan’s management and organization segment provides insight into the individuals steering your company. If there’s a management team, utilize an organizational chart to illustrate your company’s internal structure. This chart should outline roles, responsibilities, and relationships among team members. Convey how each person contributes to your startup’s success.

- Outline Your Marketing and Sales Plan:

In this section, write down your strategy for convincing customers to purchase your products or services. Additionally, discuss how you intend to foster customer loyalty, leading to repeat business.

- Present a Logistics and Operations Plan:

Creating the right operations plan can make your business dream a reality. Touch on every angle of the plan with knowledge and credibility. When picking suppliers, remember it’s important to think about where your raw materials or products come from. Make sure you have dependable sources that give you top-notch materials but are also cost-effective. It’s also key to plan out production thoroughly – whether you make, manufacture, wholesale, or drop ship. This choice will affect your production schedule and ability to manage a sudden surge in orders.

Plus, workspaces matter in your plan – choose wisely where you and your team work, as it can affect how well you perform and interact. If you plan to have storefronts, it’s even more important to consider logistics. And don’t forget about the equipment you’ll need. Identify the right ones for your needs, which are crucial for daily operations. Finally, shipping and order fulfillment must be planned in detail, showing your customers that you are professional and value their satisfaction.

- Conduct a Business Financial Analysis:

Your business financials may be limited if you’re a startup. For existing businesses, include income or profit-and-loss statements, a balance sheet outlining assets and debts, and a cash flow statement illustrating cash movements in and out of the company.

Consider incorporating metrics such as:

1. Net Profit Margin: Percentage of revenue retained as net income.

2. Current Ratio: Measurement of liquidity and debt repayment ability.

3. Accounts Receivable Turnover Ratio: Measurement of how frequently you collect on receivables per year.

Enhance this section with charts and graphs to facilitate a clear understanding of your business’s financial well-being for readers.

- Make a Financial Forecast:

This is key if you’re looking for funding or investors. It outlines how your business will profit enough to pay back loans or satisfy investors.

Here, provide monthly or quarterly sales, expenses, and profit predictions for your business for at least three years. This assumes you’ll get a new loan. Accuracy is vital. Examine your past financial records closely before guessing future numbers. Aim high, but stay realistic.

- Add Extra Data in an Appendix:

File any extra data or supplemental materials that couldn’t fit in elsewhere, such as key employees’ resumes, equipment leases, licenses, patents, permits, bank statements, receipts, personal and business credit history, and contracts. If the appendix is large, think about adding a table of contents at the start of this part.

Why You Should Also Have An Exit Plan As Well?

Remember to plan your exit. Savvy business bosses know it’s good to have several exit plans. This isn’t about doubting your business’s success. It’s about being ready for the unexpected. Like mapping out different roads on a long drive, considering exit strategies helps you handle surprises smartly.

When making your full business plan, do a deep impact analysis. Think about all possible outcomes. This way, you’re prepared for anything and won’t be surprised by the fast-changing world of owning a business.

Step 4: Choosing A Catchy Name With an Attractive Logo

Picking a name and logo for your business is fun. What’s in a business name? A lot! A good name is a powerful tool. It helps people remember your brand. When you’re thinking of a business name, keep some things in mind. Make sure your name tells people what you do. People should know what products or services you offer when they hear your name. Also, try to keep your name short and catchy.

This makes it easy to remember. It’s essential to see if anyone else has used the name you want. Check websites, trademarks, and social media handles to avoid problems later. Once you’ve found a great name, it’s time to design a logo. Your logo helps people recognize your brand. You can hire a designer online or use design tools like Canva or Adobe. You can still make a great logo even if you’re not a designer. Sure, it can be challenging, but with hard work and creativity, you can name your business and create a standout logo.

Crafting a compelling business name and logo typically involves these traits:

- Short and Simple: Aim for a name that customers can swiftly recall. Opt for one or two words, but if necessary, a memorable phrase of three to four short words could also work.

- Different: If your market research reveals a saturation of similar names, consider steering clear of that trend. Differentiation is the key to standing out in your small business.

- Original/Unique: Beyond avoiding similarities, ensure your small business name isn’t already in use by a competitor. Conduct a free trademark search in relevant countries, and check Google and social media sites for any matches.

Registering Your Business Name

Thought of a catchy business name? Awesome! Now you need to check if it’s available to use. Look around and see if any businesses sound alike. You don’t want customers getting mixed up, right? Also, ensure a matching domain name is ready for your future website. In this digital age, being online matters, and a matching domain name boosts your credibility. You can use a search engine to check domain name availability. But before you make your business name official, verify another entrepreneur hasn’t trademarked it first. Trademarks guard your creative rights and stop others from copying your brand. So, to dodge legal trouble, you must do careful research.

A great tool for this job is the Trademark Electronic Search System (TESS) in the United States. It helps you look up trademarks across the US. Remember, businesses register at a state level; a state business could use your chosen name. But respect trademark regulations when choosing your name. Neglecting this can lead to legal battles and infringement challenges over trademark-protected names. Trademarks offer protective rights to businesses over their brand, meaning no copycats are allowed without consent. To officially register your business name, submit it to your local and state government following your state’s process. Considering your state’s Secretary of State’s website could be a great place for helpful direction.

Trademarking Your Business Logo

Before going for the trademark registration process, consider its necessity, as it demands time, effort, and financial resources. Upon a business’s initiation of logo use for advertising and selling goods or services, it automatically secures common law ownership, accompanied by limited protections. However, these protections apply solely if the business can substantiate being the first to use the mark. Notably, common law protection is confined to the geographic area of the business’s operations. Registering the logo becomes a prudent choice for broader, nationwide protection.

Once the decision is firm, the unique logo can be trademarked by completing the registration process with the USPTO. Anyone can apply online via the USPTO website if the business is in the US. But we recommend working with a patent attorney as attorneys possess the expertise to craft logo descriptions using language the USPTO understands, providing a more practical approach than those new to the process.

Image source: USPTO website

Yet, there are certain details you should have ready, including the name, address, product/service that the logo will represent, a JPG image file of the final logo or design, and a PDF or JPG file of a “specimen” illustrating how the logo appears on the actual product or service.

What To Do After Registering Your Logo?

After the logo secures registration with the USPTO, the trademark owner gets exclusive rights to use it within its approved goods or services class anywhere in America. In this case, the owner has additional powers like suing anyone who uses his or her logo in an unauthorized way and blocking foreign products with that brand from entering the country.

Trademark owners can also establish a “trademark watch” by hiring an attorney or using a specialized service. This professional oversight continuously monitors and searches for unauthorized use of the trademarked logo. Such a service proves invaluable in promptly identifying potential fraud or misuse. It should be noted, however, that trademarks are ten years long and require renewal at their expiry.

Step 5: Getting Your Business Structure Right

Business structure refers to the legal setup of an organization as recognized in a specific jurisdiction. The chosen legal structure significantly influences the range of activities a business can engage in, such as capital raising, responsibilities for business obligations, and tax obligations to relevant authorities. There are various ways to structure a new business entity legally, and doing so brings two primary advantages: enhancing your business’s credibility and safeguarding your personal liability.

When deciding on the appropriate legal structure, business owners should carefully consider their specific needs and goals while also understanding the features associated with each business structure.

If you are in the US, then you should know that there are different types of business structures. They are

- Sole proprietorship

- Partnership

- Limited Liability Company (LLC).

- Corporation

A Brief Explanation Of Each Type Of Business Structure

Sole Proprietorship

It stands out as the most straightforward business structure, involving a single individual responsible for the day-to-day operations. From a tax standpoint, the business’s income and expenses are seamlessly integrated into the owner’s tax return.

Unlike other business structures, a sole proprietorship doesn’t necessitate separate income tax forms, as it doesn’t exist as a distinct legal entity apart from its owner. The owner is required to file Form 1040, and this form must include Schedule SE and Schedule C for self-employment tax. This straightforward structure ensures a clear and direct connection between the business and its owner.

Opting for a sole proprietorship business structure comes with several advantages. Firstly, it is cost-effective to initiate, with minimal fees incurred during the registration process. In most states, the sole costs associated with operating a sole proprietorship involve business taxes and operating license fees.

Business owners in a sole proprietorship may also qualify for tax deductions, including benefits like health insurance. Unlike a limited liability company, a sole proprietorship avoids ongoing requirements such as shareholder meetings and voting or the election of directors. However, it’s important to note that, as a sole proprietorship isn’t a separate legal entity from its owners, it bears personal liability for the business’s debts, liabilities, and obligations. This aspect is a consideration against the backdrop of the structure’s other costs and administrative benefits.

Partnership

Similar to a sole proprietorship, a partnership is an unincorporated business structure. However, in this scenario, two or more owners contribute money, labor, skills, or property based on their individual strengths.

Opting for a partnership allows business owners to join forces with a partner, pooling resources and skills while giving out some control over decisions that would be solely theirs in a sole proprietorship. It’s important to note that the partners’ assets lack protection and may be utilized as collateral in legal proceedings. This aspect adds a layer of consideration when evaluating the partnership structure, balancing the benefits of collaboration with the potential exposure of personal assets.

Filing taxes for a business involves all partners. They report profits and losses on their returns using Form 1065. Plus, self-employment tax is paid based on each one’s profit share. Schedule K-1 gives details and should be with Form 1065. Being in a partnership has its perks for business leaders. Filling out less paper is one, for instance, not like LLCs. And there are also fewer rules to follow. Another good thing about partnerships is a special tax setup, meaning each partner reports their share of profits or losses on their tax return. This simplifies things!

On the downside, each partner could be financially responsible if the business fails. Creditors could use personal belongings to pay off debt. Disputes between partners about how the business is run or its strategy can also slow things down.

Corporations

A corporation represents a distinct business structure that grants the entity a separate legal identity from its owners. The process of establishing a corporation is intricate and comes with a higher cost, requiring owners to navigate through more tax obligations and regulations. Many corporations enlist the assistance of attorneys to oversee the registration process and ensure compliance with state laws.

For organizations aiming to go public by issuing common stock to the public, incorporating it as a corporation is a prerequisite. Corporations are obligated to fulfill both federal and state tax requirements, and shareholders must disclose their dividend payments when filing personal income taxes. Renowned for being more appealing to investors than alternative structures, a corporation stands as a legal entity distinct from its owners. Familiarizing yourself with the four main types of corporations is essential:

- S corporation,

- C corporation,

- Close corporation,

- B corporation.

Each type holds its own set of characteristics and considerations, catering to diverse business needs and objectives. The corporate structure boasts the advantage of capital raising through the sale of shares to the public, allowing the entity to secure substantial amounts of capital. Additionally, this business structure provides a level of limited personal liability, safeguarding owners against the business’s debts, liabilities, and obligations.

However, it’s essential to consider the drawbacks. A corporation is burdened with more requirements, including meetings, voting processes, and the election of directors. Moreover, forming a corporation incurs higher expenses compared to establishing a sole proprietorship or partnership. This balance of advantages and drawbacks underscores the strategic decision-making process when choosing a corporate structure for a business, weighing the potential for capital infusion against the increased administrative obligations and costs.

LLC

An LLC stands as a hybrid business structure, incorporating the favorable aspects of both partnerships and corporations. Furthermore, sole proprietorships and partnerships have the option to submit additional documentation to transform into an LLC or an LLP (Limited Liability Partnership), providing a degree of legal protection. The LLC seamlessly blends the pass-through taxation characteristic of sole proprietorships or partnerships with the little legal liability typically associated with corporations. In either case, business owners are liable to pay self-employment taxes rather than corporate taxes.

An LLC doesn’t have such restrictions on the number of shareholders. To register an LLC, the entity needs to file its articles of association with the Secretary of State in the designated business location. Depending on the state, submitting an operating agreement and the registration process might be required. This flexibility and combination of tax benefits and liability protection make the LLC a versatile and popular choice for many business owners.

Establishing an LLC offers the advantage of having fewer requirements in comparison to a corporation. The process involves less paperwork, and owners benefit from limited liability, safeguarding their assets from being utilized to cover the entity’s liabilities. Unlike corporations, an LLC faces no restrictions on the number of shareholders it can appoint.

However, it’s important to note that setting up an LLC can be costly, as it necessitates registration with the state where operations will take place. Additionally, the entity might need to engage the services of an accountant and an attorney to ensure compliance with tax and regulatory obligations. Despite the initial expenses, the streamlined requirements and asset protection make the LLC a viable option for businesses seeking a balance between ease of setup and legal safeguards.

For new businesses that may align with two or more of these categories, the decision on the most suitable structure can be challenging. It is crucial to weigh factors such as your startup’s financial requirements, risk factors, and growth potential. Changing your legal structure after registering your business can be complex, so a thorough analysis during the initial stages of business formation is essential.

In the next section, we have jotted down some key factors to consider when selecting your business’s legal structure. Remember, seeking advice from a CPA is also recommended.

Factors To Consider In Choosing The Right Business Structure

- Which Offers the Most Flexibility?

To steer your company in the right direction, contemplate the legal structure that aligns with your growth aspirations. Refer to your business plan, crafted in Step 3, to assess your goals and pinpoint the structure that best harmonizes with your objectives. Your chosen entity should not hinder but rather support the potential for growth and adaptability.

- Do You Want to Be Liable?

When it comes to personal liability, corporations stand out by holding the least amount of personal liability. The law recognizes them as distinct entities, shielding officers and shareholders from personal asset exposure.

This means that while creditors and customers can pursue legal action against the corporation, they are unable to access the personal assets of those involved. Similarly, Limited Liability Companies (LLCs) provide this protection along with the tax advantages of a sole proprietorship. Partnerships share liability among partners as outlined in their partnership agreement. Evaluating these liability aspects is crucial in determining the most suitable legal structure for your business.

- Choose an Easy Option:

If you are starting your own business with your own product and funding – the least complicated option is a sole proprietorship. Just register your name, start working, report your earnings, and pay taxes on them – as easy as pie. If you want outside funding in the future, partnerships are a step up, and it might be much easier with a partnership. They share duties and resources, but they need a neatly written agreement detailing each person’s role and profit share.

Further higher are corporations and Limited Liability Companies (LLCs). These come with many reporting duties for state and federal governments. Clever entrepreneurs know that understanding these detailed structures is key to building a bona fide business that meets all legal demands.

- Consider TAXES

If you want to open a small company, you need to know how taxes work with different types of businesses. LLCs are good for owners because they avoid double taxing in the early days. Profits in an LLC or partnership are seen as personal money.

That means that instead of the business being taxed, owners pay taxes through personal filing. An accountant might suggest paying in advance every quarter or twice a year to not hit hard on yearly returns. But, companies fill out their own tax forms and pay taxes on profits after taking out costs like payroll. If you get paid from your company, you must pay personal taxes like Social Security and Medicare on your own tax filing.

- Do You Require Capital Investment?

Establishing a corporation might be the more advantageous route when seeking external funding from investors, venture capitalists, or banks. Corporations generally find it easier to attract outside funding compared to sole proprietorships.

Corporations have the ability to sell shares of stock, thereby securing additional funds for expansion. In contrast, sole proprietors are limited to obtaining funds through their accounts, relying on personal credit, or bringing in partners. While LLCs may face similar challenges, being a distinct entity allows them to avoid potentially using the owner’s credit or assets. Assessing your capital needs and considering these funding dynamics can guide you in choosing the most suitable legal structure for your business.

- Are You Willing to Give Away the Control?

Want to call the shots in your business? Consider a sole proprietorship or LLC. You can also get that control in a partnership agreement. Corporations are a bit different. They have a board of directors making the big decisions. Sure, one person can steer a corporation at the start. But as the corporation grows, you need a board to run it. Yes, even small corporations must follow big corporation rules.

Like recording major decisions that impact the business. Experts stress it’s vital to understand these differences. Why? Because it affects how much control you’ll have over your business. Whether you go for a sole proprietorship, LLC, partnership agreement, or try to incorporate, knowing how each one works is crucial. It aids in making smart business decisions while staying on the right side of the law and gaining trust in your field.

Step 6: Arranging Your Finances

While your business may have various objectives, the overarching aim is to generate profits. To realize this goal, it is crucial to assess your startup costs and diligently manage your finances. Because we have covered the most viable things that you should consider, like the Break-even point, How to price your product, and the importance of Repeat buyer rate, Buyer lifetime value, and Customer acquisition charges — So in this section, we will focus on how to get funding.

So, how do you get yourself ready with the funding you need?

The Need For A Business Bank Account

Having a business bank account is key to keeping personal cash and business funds apart. You need this split for legal and practical reasons. Having a separate business account makes bookkeeping easier, helps manage money flow, and simplifies tax time. When deciding on a business bank, ponder these: the bank’s street cred, services it provides, cost framework, and client service. Some banks give special treats to small businesses, like lower transaction charges or accounting software.

These perks can assist in making informed decisions regarding how to handle your firm’s money matters. Pinpointing the best banking choices available and evaluating their dependability can lead to a trusted banking partner. This decision-making process sets a strong footing for smart financial planning and protects against future issues. Besides this, knowing you can always reach the bank’s competent client service team, who knows what it’s like to run a business, can make you feel secure in keeping your personal and business finances separate within a framework of unquestioned professionalism and trust. To initiate the process of opening a bank account in the United States, follow these steps:

- Choose a Bank: Select a bank that aligns with your preferences and needs.

- Provide Identification and Proof of Address: Give your identification and validate your address through appropriate documentation.

- Provide Your Social Security Number: Share your Social Security number (SSN) as part of the account setup procedure.

- Share Contact Information: Provide your contact details, including your name, address, and phone number.

- Present a Secondary ID: Submit a secondary form of identification, which could be a driver’s license, a US-issued employment or work ID card, or a Visa or Mastercard debit/credit card in your name.

- Submit Proof of Address: Provide documentation confirming your address, such as a utility bill, bank statement, or lease agreement.

Raising The Fund

Raising funds is key to launching a business, and it can feel intense. But there are plenty of tools aimed to ease this journey. Simply put, you’ll find two types of funding options: personal and external. Personal funding taps into your cash reserves or leans on your network’s aid. Next, there’s external funding.

This type gives extra monetary support from outside your private circles. For instance, you could receive a unique small business grant. Think grants for women or minorities. These grants are a superb chance for those who fit the requirements and want to limit their payback duties. On top, there’s the trending external funding called crowdfunding, gaining popularity thanks to its knack for helping businesses build funds via platforms like Patreon, Fundable, or Crowdcube, riding on the strength of their existing networks.

Plus, there are other external funding types that loaners must return gradually. These types cover different finance methods like business loans from banks or unconventional lenders that assist startup growth and small businesses. Business credit lines that let owners use approved cash as required, bypassing instant payback. There are alternatives like merchant cash advances – here, lenders give funds based on potential future card-based sales income and take payments as a daily sales cut until it’s all paid back.

Step 7: Getting The Licenses And The Permits

When starting your own small business, paperwork becomes an integral part of the process. Nobody wishes to find themselves entangled in legal issues, and it’s essential to recognize that your business is subject to both local laws and regulations specific to your industry.

The initiation of a small business often involves acquiring various licenses and permits tailored to your business type and location. Identifying the specific licenses and permits relevant to your situation is crucial during the startup phase. Investing time and resources upfront to seek legal advice can be a prudent step, potentially shielding you from significant challenges in the future. This proactive approach ensures that your business is not only compliant with the necessary regulations but also sets the foundation for a smoother operational journey. The registration process primarily involves registering your business name with state and local authorities.

This can often be done conveniently online or by submitting paper documents to entities like the Secretary of State’s office or a Business Bureau. Upon completion, you receive a certificate that proves invaluable for obtaining licenses, establishing business bank accounts, and acquiring a tax ID number. In certain scenarios, such as conducting business under your personal name, registration may be optional. Nevertheless, it’s crucial to recognize that registering your business brings forth benefits like tax advantages, legal safeguards, and personal liability protection.

What Type Of Documents You May Need During The Process?

There are many documents that you may require depending on your business structure. Here are some common ones:

Article Of Incorporation

When you enter the market, it’s crucial to register your business with the government. The specific requirements for submission will vary based on your business structure. Articles of incorporation constitute a formal set of documents submitted to a government body, serving as a legal record of a corporation’s establishment. These articles typically include vital details such as the company’s name, physical address, designated service agent, and specifics regarding the issuance of stock. Essentially, the articles of incorporation play a pivotal role in the legal formation of a corporation.

This document serves as a prerequisite for registering a corporation with a state and functions as a charter, officially acknowledging the establishment of the corporation. Within the articles of incorporation, you’ll find fundamental information essential for forming and governing a corporation, along with details pertaining to corporate statutes specific to the state where the document is filed. Understanding and completing this process is key to legally solidifying your business as a recognized corporation.

In the United States, the formal documents known as articles of incorporation are submitted to the Office of the Secretary of State in the state of choice for business incorporation. Certain states offer more favorable regulatory and tax landscapes, making them attractive to a significant number of companies seeking incorporation.

For instance, Nevada and Delaware have emerged as popular choices. Delaware, hosting 1.9 million corporations with over 300,000 registrations in 2022 alone, stands out. And most recent reports suggest that more than 66% of Fortune 500 companies choose Delaware as their incorporation destination. Once these articles are officially established, they become public records, providing essential insights into the key details of the incorporated corporation. Understanding the dynamics of where and how to file articles of incorporation is vital for businesses seeking a solid and strategic start.

DBA

Every business has a legal name, and in the context of a sole proprietorship or partnership, it aligns with the name of the owner (s) of the business. On the other hand, for a corporation, LLC, or another statutory entity, the legal name corresponds to the one mentioned previously, which is the article of incorporation.

An individual or business entity can opt to operate under a name different from its legal name by filing a DBA, which stands for “doing business as.” This alternate name is also referred to as a “trade name,” “assumed name,” or “fictitious business name.” Registering a DBA serves the purpose of notifying the public that a specific person or business entity conducts operations under a name distinct from its legal identity. DBA registration, often termed assumed name registration, is rooted in consumer protection laws, ensuring transparency about the actual owner of the business.

And there are no inherent restrictions on the number of DBAs or assumed names a business can utilize. However, in most states, the law dictates that unless a DBA is officially registered — accomplished by filing with the state — a sole proprietor can only conduct business under their personal name. Similarly, corporations and LLCs are typically confined to operating under the name specified in their formation document unless a DBA is officially registered. Understanding these nuances is essential for businesses seeking to establish and operate under both their legal and assumed names.

Tax Forms

Business owners have to deal with tax forms—it’s part of business. Whether you’re a sole owner, an LLC, a corporation or in a partnership, you must understand your tax forms. Knowing what forms you need can be tricky.

Different businesses need different forms. Making sure you know what your state and local taxes ask for is key. Plus, you need to know federal requirements. You can check out official state and local websites. They offer clear info on what tax forms you need.

Federal and State IDs

Both federal and state laws mandate the payment of taxes on your business’s income, necessitating the reporting of profits and losses to the government. Obtaining federal and state tax ID numbers is crucial to fulfill these obligations.

Initiate the process by establishing your federal tax ID number and employer identification number (EIN). This identifier is vital for filing taxes, opening business bank accounts, and obtaining necessary licenses or permits. An EIN is mandatory if you plan to have employees in your company. It is also necessary if your company is structured as a corporation or partnership or meets other IRS requirements. Applying for an EIN is a straightforward process facilitated by the IRS.

Additionally, your state may mandate registration for a business tax ID number. This state tax ID number is essential for tax filings and employee hiring. Verify with your state’s requirements to determine if obtaining a state tax ID number is necessary for your business. Navigating these federal and state tax obligations ensures compliance and the smooth operation of your business.

Your company’s tax ID numbers, both federal and state, are like its SSNs. They’re the pass to let the government know about your business. They’re super important for many reasons. For starters, they help your company stick to tax laws. By reporting taxes correctly, businesses stay open and honest. This is good for everyone involved. Plus, tax accounts help with government record-keeping, audits, and any financial investigations done on your company. The transactions linked to your tax IDs allow the authorities to follow the money and notice any odd stuff happening. This not only stops fraud but also keeps our national economy running smoothly.

Other Licenses And Permits

All types of businesses need licenses and permits from local, state, and federal authorities. This is how they can legally work and serve people. These papers set the rules for each business. At the federal level, specific agencies issue licenses following rules for different industries. For example, a drug company needs approval from the FDA before making or selling drugs. State governments have their own licenses based on local circumstances and needs.

They consider stuff like labor laws and environmental rules. City governments also have their own licenses for city rules or zoning laws to keep order. Understanding these different licenses and permits is very important when making decisions. Staying compliant at all federal, state, and local levels protects a business’s image and builds customer trust. It shows you understand ethics and legal duties to all people.

Step 8: Safeguarding Your Business With Insurance

Business insurance plays a crucial role in protecting the investments you’ve dedicated to your business. Beyond this, it extends financial benefits to your employees in the unfortunate event of injuries or illness resulting from their job responsibilities.

While many commercial insurance policies remain optional, certain coverages may be obligatory based on state requirements. For instance, workers’ compensation insurance is mandatory for employers in most states.

Now, you might be thinking, “What type of insurance will I need to launch a company?” The answer depends on the nature of your business. To provide clarity, here are some key insurance policies you should be aware of:

- General Liability Insurance

General Liability, or GLI, is a key business protector if you are just starting and can’t afford unexpected expenses. It saves your business from potential claims. Having GLI makes you worry less about unpredictable issues. Let’s talk about ‘bodily injury claims.’ Accidents are common these days and could injure people. This might happen on your business property or due to your product or service. If a customer falls and gets hurt in your store because the floor was wet or there was stuff in their way, your GLI offers support. They cover the costs of any legal action filed against you.

GLI is important in more ways. It shields your business against ‘property damage’ claims when the destroyed property isn’t yours. For example, imagine you’re a contractor and you accidentally cause big damage while working at a client’s place. When things break unintentionally while in charge, your GLI comes to the rescue. It means you will not personally pay for fixing or replacing damaged property – that’s what your GLI is for.

- Commercial Property Insurance

Think of commercial property insurance as a safety blanket for your business. It protects your buildings, whether you own or rent them, along with crucial business assets. This assurance-backed policy keeps you from being left in a lurch if unexpected things like fires, robberies, or storms come your way. This all-inclusive insurance goes the extra mile for your business. It protects your stored items from harm and safeguards your valuable furniture, enhancing the customer experience.

Plus, companies cannot function without computers in a world ruled by technology. This insurance covers them, too. From hardware hiccups to cyber threats to your most private data, your concerns get a rest with this protective policy for every business-savvy owner keen on long-term success.

- Worker’s Compensation Insurance

Got a new business? Think about getting workers’ comp insurance. It’s needed by law in lots of places if you have staff. It’s good because it can help your team if they get hurt on the job. When you have workers’ comp, you know your employees can get help with medical costs if they have a work accident.

It also helps with physio fees if they need it after. Plus, if they can’t work because of the injury, this insurance can help replace their pay. Sometimes, a work injury might make a person unable to work for a short time or even ever again. In these cases, workers’ comp can offer them benefits. So, with workers’ comp, you can make a safe, good workplace and follow the law for your hardworking team.

- Auto Insurance

Commercial auto insurance is crucial. It protects your business and workers when driving. In many states, it’s a must-have for businesses with vehicles. Still, even without the law, it’s smart. If your employee causes a car accident, it can lead to money issues. Having this coverage shows good management. It keeps your team and the public safe.

- Data Breach Insurance

Data breach insurance is a super tool for businesses. It provides protection when confidential information gets exposed. If your important data gets into the wrong hands, this coverage provides help. It secures businesses against data breaches by handling different necessary costs. First, it helps you quickly inform customers or clients about the breach. This is key to keeping their trust and loyalty intact.

Secondly, this insurance supports a thorough public relations campaign. It works to repair any damage to reputation caused by the incident. This is critical to keep credibility in your market. Lastly, it provides credit monitoring services. This shows the businesses’ dedication to the safety of individuals’ finances. It also assures them of your commitment to their security. So, data breach insurance works like a safety net. It allows businesses to handle tough situations confidently by employing a well-informed approach.

Step 9: Building Your Team

The journey of launching your business demands a clear understanding of the work involved and the requisite skills. Addressing these fundamental questions becomes paramount, shaping your timeline and the investment level required for a successful launch. Whether you handle all aspects of the work yourself or opt for hiring assistance, these decisions significantly impact your time commitment and financial outlay.

If you’re taking on the responsibilities solo, your availability to invest time becomes a limiting factor. Conversely, if hiring help is in your plan, considerations must include the associated costs and the time dedicated to sourcing and onboarding freelancers or employees.

Building the right team, encompassing talents in marketing, design, engineering, finance, sales, and HR, demands a substantial investment of time and effort. In small business, cultivating a dependable and skilled team is a critical factor for ensuring long-term success.

Effective Strategies For Smart Recruiting

Streamlining your hiring efforts is crucial, allowing you more time to focus on steering your business. Here, we’ve compiled key strategies for small businesses to enhance their hiring process.

- Stress the Value of Your Employer Brand:

Establishing a robust employer brand is vital in portraying your small business as an appealing workplace. This is particularly crucial for small businesses with less name recognition compared to larger competitors. Craft a compelling elevator pitch that succinctly describes your business, its unique value proposition, and its mission when creating job postings. To attract potential applicants, highlighting the company culture, values, and enticing perks.

Ensure your employer brand is prominently featured on your website’s “about us” page, career pages, job descriptions, and social media profiles. Incorporate insights from current employees about what they enjoy most about working for your small business, and consider sharing client or customer testimonials for added credibility. This cohesive approach strengthens your brand and entices prospective candidates to join your team.

- Compose Job Descriptions That Are Effective

Getting the right people for your small starts with solid job descriptions. Some individuals might not think it’s a big deal. But it is. A neat and to-the-point job description boosts the likelihood of grabbing the attention of the right talent. This way, managers nail down what their teams are missing. It also helps them make smart choices about who to bring on board. Plus, well-put job descriptions don’t just bring in qualified people.

They also allow you to brag about why working for you is awesome. To really pack a punch, get your bosses to kick off with a paragraph that showcases your company glowingly. Pump this method into your recruitment drive. It presents a knowledgeable and trustworthy vibe to those who match the job’s needs and harmony with your pint-sized team.

- Speak with Eligible Candidates

Finding the right people to hire is a big issue for small businesses. To get the best results, consider these steps. Mix up where you advertise jobs. Put your job ads on global, college, and industry-specific job websites. Use words and phrases that people would use in online searches for this type of job.

Give details like if the job is full or part-time, if it’s remote or not. Use the typical job title and include similar words in the job details. Reach out to people you know. Go to job fairs at colleges, universities, and your industry. Ask people you know if they know suitable candidates. Encourage your staff to put the word out and offer them a bonus if their referral gets hired. Review resumes you’ve gotten before to see if there’s anyone who didn’t quite fit before but might now. These tactics will help you connect with the right people in the right way.

- Get in Touch with Eligible Candidates

Finding candidates is one of the challenges that small businesses face when hiring. To maximize your reach, you can adopt the following strategies.

1. Broaden Your Job Posting Approach: Make sure to post your job description on job boards that have an audience as well as on college and university job boards and industry-specific job boards. Include keywords and terms that candidates are likely to use when searching for positions on search engines or job board platforms. Provide details such as whether the role is full-time or part-time, its location, or if it offers remote work options. Use used job titles. Incorporate synonyms throughout the description.

2. Utilize Your Network: Expand your reach by leveraging your network connections. Attend job fairs at colleges, universities, and industry events where you can meet candidates in person. Reach out to people in your network. Ask if they know anyone who would be a fit for the position. Encourage your team members to share job openings with their connections by offering an employee referral incentive program. Additionally, review resumes you’ve received for openings and consider reaching out to candidates who weren’t suitable for those roles but might be a good fit for this new position.

By implementing these strategies, you can significantly improve your chances of reaching candidates while maintaining credibility and being well-informed.

- Use ATS to Filter out the Candidates

In big companies, the individuals in human resources typically create job postings, sift through resumes, and handle preliminary interviews. They then hand-pick the cream of the crop for the bosses to meet. New and small businesses function a bit differently, though. Here, heads of departments wear many hats, which includes making hiring decisions. Luckily, applicant tracking software (ATS) simplifies this process. The task, which eats up most of their time, is going through every cover letter and resume.

That’s where ATS steps in. It gathers, sorts, and assesses applications systematically. Managers can capitalize on this tool, using its built-in filters to find the right folks for the jobs. In turn, they bypass the need to manually scrutinize heaps of resumes and cover letters. An ATS with effortless reach to all stored resumes is a godsend. It helps discover promising individuals who didn’t apply directly but could still be a perfect fit. Thus, it not only speeds up hiring but also makes sure nobody slips through the cracks because of human errors.

Independent Contractors Vs. Employees

Across nearly every country globally, the distinctions between employees and contractors hold significant importance. Understanding these differences is crucial because misclassifying an employee as a contractor can lead to what’s known as misclassification risk. This risk can bring about substantial fines, penalties, and damage to your reputation.

In essence, the key disparities boil down to the following:

- Independent Contractors:

Independent contractors are self-employed and typically manage their own businesses. These professionals can be hired by companies for either one-time assignments or ongoing projects. The freedom granted to contractors is remarkable as it allows them to determine the when, where, how, and even who will complete the work as long as they meet the terms of the agreement.

However, it is important to note that despite this autonomy, independent contractors usually do not have access to workers’ rights or statutory benefits such as paid time off, sick leave, and other standard employee perks. Additionally, they bear the responsibility of handling their own taxes and social insurance contributions. This distinction underscores a key difference between employees and independent contractors in terms of legal obligations and entitlements.

- Employees:

Employees work directly for their employers, entitling them to certain legal rights. Similarly, as an employer, you bear specific responsibilities towards your employees. You possess the authority to regulate the terms and conditions of your employees’ work, determining aspects like when, where, and how they carry out their tasks. Disciplinary actions and terminations are within your rights as an employer, though adherence to local labor laws is paramount in these actions.

Your obligations extend to withholding and settling taxes and social contributions on behalf of your employees, encompassing healthcare, pension plans, and unemployment benefits. Employees under an employment contract benefit from a range of rights and protections surpassing those of self-employed contractors. These include entitlements like paid sick and parental leave, as well as specified notice periods upon termination. Understanding these distinctions is vital for promoting a compliant and equitable work environment.

Step 10: Getting a Merchant Account

To facilitate credit and debit card transactions, reaching out to a merchant account provider is a crucial step. These professionals assist in obtaining a payment processor, establishing a merchant account, and acquiring physical card readers, especially if your business has an in-person presence. Unlike a business account we discussed earlier, a merchant account is a specialized type of account that businesses require, albeit with a more focused purpose than a general business or personal account. In essence, these accounts serve a specific function—they enable businesses to accept online debit or credit card payments seamlessly and directly receive funds through their websites.

Incorporating a merchant account into your business infrastructure facilitates smooth and secure online transactions. A merchant account serves as a temporary repository for funds from customer transactions. It holds these funds until they are ultimately deposited into the business’s primary bank account. Acting as a crucial intermediary, a merchant account becomes the initial destination for funds post-transaction processing.

The impact of payment methods on consumer behavior is noteworthy. Studies reveal that shoppers tend to spend up to three times more when utilizing credit cards compared to cash transactions. Moreover, there is a 40% higher likelihood that consumers will opt for credit cards over cash for any given transaction. An impressive 70% of retail sales dollars nationwide stem from credit card transactions.

Understanding these trends sheds light on the significant influence of credit cards in driving consumer spending. As a business, recognizing and adapting to these preferences can be pivotal in maximizing sales and catering to the evolving landscape of payment preferences.

Merchant services provided by banks and financial institutions include the offering of these specialized accounts. While some banks may also supply businesses with software or hardware, they frequently limit their services to providing account services only. In many cases, businesses are left to assemble a comprehensive payment system by engaging with third-party providers. Understanding these dynamics is essential for businesses seeking to establish a seamless and efficient card payment system.

Step 11: Purchasing the Necessary Hardware and Software

Launching any business venture entails an investment in essential hardware and software to streamline operations. This technological infrastructure serves dual purposes – enhancing business management and fostering organizational efficiency. Having a comprehensive understanding of the necessary tools equips you to plan and budget effectively for your business. Companies rely on various tools to manage their operations effectively. Here are some key tools widely used in business:

- Accounting Software:

Every business requires a robust system to track financial transactions. User-friendly accounting software, like QuickBooks, Xero, or FreshBooks online accounting, allows you to manage transactions, invoice customers, make vendor payments, accept credit card transactions, and generate comprehensive financial reports—all within a single platform.

- Email Marketing Software:

Incorporating email communication into your marketing strategy is simplified with email marketing software. This tool streamlines the process of reaching out to customers via email, making your marketing efforts more efficient.

- Payroll Software:

For businesses with employees, payroll software is invaluable. It aids in calculating payroll taxes, facilitating direct deposit payments to employees, and managing various aspects of payroll administration.

- Project Management Software:

Efficient project tracking and management are made possible through project management software. This tool allows you and your team to monitor every stage of a project workflow, including due dates, project statuses, and other essential details.

Collectively, these tools contribute to the smooth functioning of a business, enhancing productivity and organizational efficiency.

- Payment Integration:

For easy and efficient transactions, businesses need the right mix of software and hardware. This blend is key for smoothly accepting credit and debit card payments. Without these tools, unless a business wants only to do cash transactions, it might find its income limited.

- POS Terminals: