Fraud in the retail industry manifests in two distinct forms – refund abuse and friendly fraud. It is called refund abuse when a fraudster initiates a refund without the cardholder’s knowledge or consent. Conversely, friendly fraud occurs when a cardholder requests a refund or chargeback without a valid reason. Both types of fraud can inflict financial losses on merchants and erode consumer trust within the retail sector.

It is crucial to differentiate between refund abuse and friendly fraud due to the various legal ramifications associated with them. While refund abuse is deemed illegal and can lead to criminal charges, friendly fraud often stems from misunderstandings or disputes between customers and merchants. A comprehensive understanding of the variances between these fraudulent activities empowers merchants to implement preventative measures and address them effectively.

This article discusses the definitions of refund abuse and friendly fraud, explores their common manifestations, provides real-world examples, and elucidates the key distinctions between the two. Additionally, it examines the contributing factors to their occurrence.

What Is The Confusion Between Refund Abuse Vs Friendly Fraud

The confusion arises from certain parallels between refund abuse and friendly fraud, primarily centered around customers receiving funds they had initially paid for an item.

A common source of misunderstanding stems from customers not discerning the distinction between obtaining a standard refund directly from a merchant and reclaiming money through a bank-initiated chargeback. Remarkably, 81% of customers acknowledge resorting to chargebacks for the sheer convenience it offers, further contributing to the conflation of these two processes.

Understanding Refund Abuse

Refund abuse happens when a buyer makes a purchase, receives and uses the items or product, and then falsely claims that the shipment was never received. This puts merchants in a tough spot as they must decide whether it’s more prudent to accept the loss as a part of conducting business online or to implement stricter controls on orders, risking potential frustration among legitimate customers.

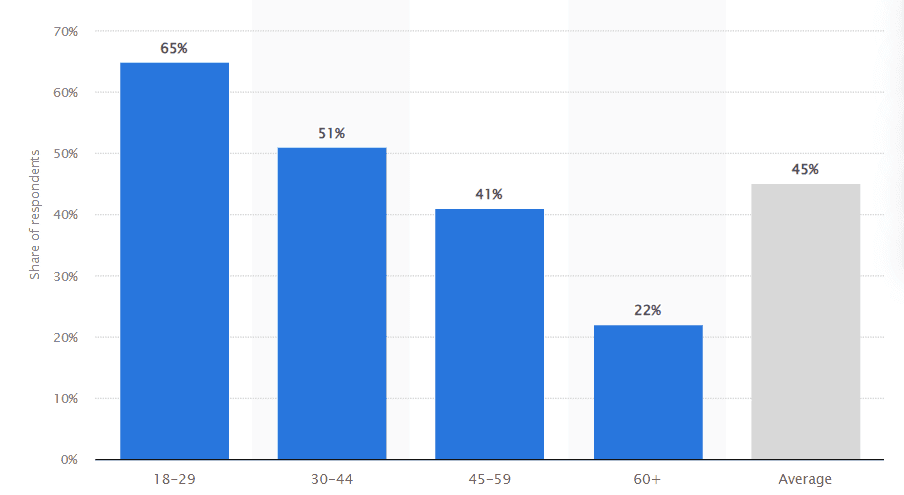

Most merchants are well-acquainted with return abuse, a practice where customers exploit return policies by sending back used or damaged items. Studies indicate that in 2022, return fraud and policy abuse in e-commerce were notably higher among younger buyers. Nearly two-thirds of “GenZ” shoppers aged 18 – 29 admitted to doing such deceptive practices while making online purchases.

Source: Statista – Percentage of shoppers who admitted to committing return fraud or e-commerce policy abuse in the United States in 2022, by age group

One of the challenges in detecting refund abuse lies in the lack of objective data to pinpoint fraudulent refund requests. If both the customer and the transaction are legitimate, it’s challenging to ascertain any wrongdoing. Merchants may sense something is awry if there’s a surge in claims of lost or stolen packages but proving and preventing refund abuse remains a complex task.

How Does Refund Abuse Work?

Refund abuse can manifest as a sophisticated scam, similar to organized retail crime (ORC) or an overpayment scheme. Alternatively, it could be a straightforward, isolated act carried out by an otherwise legitimate customer. The items in question might be stolen, marked as final sale, or tampered with in a manner that renders them ineligible for return.

To illustrate, consider a scenario where a customer possesses two items from the same store. If only one item qualifies for a return, the buyer might interchange the price tags on the items to secure a refund that would typically be disallowed. Alternatively, they could swap the tags to manipulate the refund amount, obtaining a significantly larger reimbursement for one item compared to the other.

Here are some other common refund fraud tactics to be aware of:

- Box Switching: This occurs when a shopper buys an item and subsequently returns an older or non-functional version of the same product, utilizing the packaging from the newer purchase. Another variation involves exchanging similar-looking items with distinct features and prices, returning the lower-cost item while presenting it as the more expensive one.

- Bricking: This tactic involves a customer purchasing an item, extracting valuable components for resale, and then returning the item while pocketing the profits. Electronics, in particular, are frequently targeted in this type of refund fraud.

- Empty-Box Con: Empty-box fraud occurs when a shopper contacts you, asserting that the item they ordered never arrived. The customer alleges receiving an empty box instead. If this scam succeeds, the customer retains the purchased item while also securing a refund for the supposedly “missing” item.

- Price Switching: Price switching unfolds when a shopper acquires an item at one price, then swaps the price tag with that of a higher-priced item before returning the item to claim a refund.

- Item Not Received Fraud: A consumer makes untrue assertions, stating that they did not receive the product or service or that the transaction was unauthorized.

Understanding Friendly Fraud

Friendly fraud also referred to as chargeback fraud, takes place when a customer uses a debit or credit card to make a purchase and subsequently disputes the charge with their bank without a valid reason to do so. Legitimate grounds for disputing a charge include being a victim of true fraud or not receiving the purchased service or product, especially when the merchant proves unresponsive or uncooperative.

For any transaction-related concerns, cardholders are encouraged to contact the merchant directly, as most issues can be resolved more swiftly and effortlessly in this manner. Filing a chargeback should only be pursued after attempting to resolve the matter directly with the merchant. Usually, in the case of friendly fraud, there are mainly two types – Intentional and Unintentional, let’s learn each type:

- Intentional:

Distinctly, some consumers deliberately exploit chargebacks for personal gain. These individuals possess a comprehensive understanding of the system and strategically use it to their advantage.

The best example is “cyber shoplifting.” This occurs when cardholders make purchases with the explicit intention of initiating a chargeback later. Essentially, it amounts to theft. It’s comparable to ‘lifting’ items from a physical store without paying. In both instances, the wrongdoer is attempting to acquire something for nothing.

- Unintentional:

Friendly fraud can occur inadvertently due to ignorance or an honest mistake. The cardholder might be perplexed or misinterpret a charge reflected on their monthly statement.

A prevalent scenario contributing to friendly fraud chargebacks is family-related misunderstandings. Family fraud, for example, occurs when a relative, such as a child, has access to the cardholder’s payment information and makes a purchase without their explicit knowledge. This illustrates how friendly fraud can stem from unintentional actions within familial connections.

How Does Friendly Fraud Work?

Friendly fraud occurs when customers either fail to recognize a purchase or dispute a payment on their credit card statement, sometimes with the intent to keep the goods or services without payment.

Several factors contribute to the occurrence of friendly fraud, with some common reasons being:

- Forgetfulness: A prevalent cause of friendly fraud is forgetfulness. Customers may overlook a purchase or not identify a charge on their credit card statement. Consequently, they may dispute the charge, unaware that they made the purchase themselves.

- Cyber-Shoplifting Intention: Occasionally, customers intentionally purchase to falsely dispute the charge. This may stem from the belief, often found online, that disputing a charge guarantees a refund, essentially allowing them to acquire the purchased item for free. Some may have legitimately filed a chargeback in the past and later decided to exploit the process.

- Misunderstandings: Friendly fraud often arises due to misunderstandings, where customers misinterpret the terms and conditions of a sale or are unclear about cancellation and return policies, leading to disputes and chargebacks.

- Dissatisfaction: Customer dissatisfaction is another key factor. If a customer feels deceived or believes they didn’t receive what they paid for, they may opt for a chargeback without attempting to communicate with the merchant, even if their dispute is not entirely legitimate.

What Is The Difference Between Abuse Refund And Friendly Fraud?

The primary distinction between Abuse refund and Friendly fraud lies in the involvement of chargebacks—friendly fraud incorporates chargebacks, while refund abuse does not.

In the case of refund abuse, the process adheres to the merchant’s established refund policies. Conversely, friendly fraud takes a direct route to the banks, bypassing the merchant altogether.

Chargebacks lead to the retrieval of funds from the merchant by the issuing bank, subsequently returning them to the customer. Notably, friendly fraud can constitute a significant portion, ranging from 60 to 80%, of all card chargebacks. Understanding this distinction is pivotal for merchants aiming to navigate and mitigate the impact of these distinct forms of fraud.

Let’s see the key differences:

Intention

- Abuse Refund: This type is characterized by deliberate actions with the clear intent to defraud the merchant.

- Friendly Fraud: In contrast, friendly fraud is often unintentional, with consumers unaware that their actions are causing financial losses for the merchant.

Perpetrator

- Abuse Refund: Typically orchestrated by a criminal or fraudster deliberately aiming to deceive the merchant.

- Friendly Fraud: Frequently initiated by the consumer, either knowingly or unknowingly, without malicious intent.

Outcome

- Abuse Refund: This results in a direct financial loss for the merchant, as the fraudster typically secures a refund without returning or paying for the product.

- Friendly Fraud: Culminates in a chargeback, leading to a financial setback for the merchant.

Liability

- Abuse Refund: The merchant bears the responsibility for the loss incurred.

- Friendly Fraud: Liability for the loss may rest with either the merchant or the payment processor, contingent on the specific circumstances.

Legal Implications

- Abuse Refund: Constitutes a criminal offense, potentially triggering legal actions against the perpetrator.

- Friendly Fraud: While not inherently illegal, it can instigate legal disputes between the consumer and the merchant.

Understanding these nuanced differences empowers merchants to enact appropriate preventive measures and navigate the aftermath effectively, safeguarding their businesses from financial setbacks. A clear grasp of intentions, perpetrators, outcomes, liabilities, and legal implications is essential for comprehensive fraud protection.

How To Avoid Refund Abuse?

Here are some ways to avoid being getting scammed through Refund Abuse:

- Understand Your Adversary

Refund abusers are essentially consumers who have taken a negative turn, becoming involved in deceptive practices. The key question is whether they are acting independently or collaborating with a professional. Regardless, the outcome remains fraudulent.

When operating individually, consumers often get acquainted with various refund abuse techniques through open discussion platforms like Quora or Reddit. A typical example involves buying high-value products, claiming a non-receipt, and then seeking a rebate.

However, this issue is not limited to these “GenZs Only”; professional fraudsters are also actively engaging in this misconduct by providing refund services. Consumers regularly connect with these seasoned refund experts to aid them in committing fraud. In exchange for a portion of the gains, a skilled criminal guides a customer on what to purchase and from where even making refund requests on their behalf by contacting customer service.

- Review and Change Your Return Policies

To prevent refund abuse, the initial step is to ensure that your shipping and return policies are designed to minimize opportunities for fraudulent activities. Consider implementing these best practices:

- Communicate shipping updates, including expected delivery dates, out-for-delivery notifications, and confirmation of delivery.

- Mandate couriers to capture photos of package deliveries for documentation.

- Set specific time constraints for refund requests to streamline the process.

- Require customers to submit formal refund requests, adding an extra layer of verification.

- Demand product-specific details such as serial numbers, SKUs, etc., to enhance the legitimacy and accuracy of refund claims.

The challenge in tackling refund abuse lies in finding effective measures without causing frustration for honest consumers with genuine refund requests. Introducing systems or policies that are overly stringent may lead to loyal customers being wrongly implicated in wrongdoing they did not commit. It’s a delicate balance that businesses must strike to maintain trust and fairness in their dealings with customers.

- Transition to Online

Minimizing subjectivity in the refund request process ensures that only individuals with suspicious behavior are identified. Instead of relying on customer service representatives as the initial defense against fraud, retailers should establish a dedicated webpage on their website for submitting claims related to undelivered items. Any inquiries received by customer service regarding undelivered packages should be directed to the online platform.

Shifting the process online facilitates enhanced data collection, monitoring, and analysis. Retailers can scrutinize details such as the type of device (mobile vs. desktop) used for the refund request, along with the associated IP address and location. Any significant disparities between the purchase and refund requests can then be subjected to further investigation.

- Seek External Assistance

The process of efficiently gathering, analyzing, and comparing data from both purchases and refund requests can be quite challenging for retailers, especially for large corporations with global sales. However, there’s no need to worry because you don’t have to tackle this task on your own.

There are many online services dedicated to these problems. These services provide a user-friendly, comprehensive solution that is easy to implement with a sophisticated risk engine, behavioral biometrics, and device learning, these platforms create a new and secure way of each refund request. This empowers retailers to take proactive measures before issues escalate.

How To Avoid Friendly Fraud?

Even when facing a dispute, merchants can proactively take steps to combat and mitigate the impact of friendly fraud.

Preventing friendly fraud aligns with standard chargeback fraud prevention practices and closely relates to strategies for avoiding refund fraud. The key is to confirm the identity of the cardholder, ensuring they are indeed the same person as the customer, and maintaining comprehensive logs as evidence of their genuine intentions.

- Validate the Calls

One practical step involves validating calls and trying to record them. For instance, if a merchant typically processes transactions averaging $275 and suddenly encounters an order for $6,300, this should trigger heightened scrutiny by the fraud analyst.

A validating phone call or email outreach to the customer becomes essential in such cases. Merchants can use tools various tools online to record these conversations, creating valuable evidence for potential use with banks in the event of a chargeback dispute.

- Have the Proof of Delivery

It’s crucial for merchants to consistently gather and safeguard delivery documentation. A practical approach is to require a signature for package delivery, providing tangible proof that the purchaser or the designated recipient has received the order. Merchants can easily arrange with carriers like FedEx or UPS to enforce signature requirements for all their shipments, deterring claims of theft or non-delivery.

This signature serves as compelling evidence for merchants when communicating with banks, affirming that the customer indeed possesses the delivered merchandise. Implementing these measures not only strengthens the merchant’s position but also adds an extra layer of security against potential disputes.

- Strategize you Approach

Dedicate yourself to delivering exceptional customer service in cases of friendly fraud, especially with longstanding customers. Establishing a strong relationship with your customers significantly reduces the likelihood of them engaging in friendly fraud. When customers feel connected and valued, they are more inclined to seek a resolution with you rather than resorting to filing a chargeback.

In instances where issues arise with the product or service, knowing that you are willing to assist creates a customer mindset geared towards seeking help first before considering the chargeback route. This commitment to exemplary service not only fosters customer loyalty but also serves as a proactive measure against potential disputes.

- Use Buyer Deny Lists

Another effective method to combat friendly fraud is by creating a customer deny list, which comprises individuals likely to submit false chargeback claims. Identify customers with a history of initiating fraudulent disputes and include them on this list.

Utilizing a customer deny list serves a dual purpose: it helps thwart recurrent instances of friendly fraud and enables the detection and prevention of new attempts before they materialize. Platforms like Bolt automatically implement this strategy for their merchants. If a shopper appears on the deny list, any effort they make to execute an illegitimate purchase is automatically blocked. Importantly, retailers retain the discretion to override these decisions when necessary.

Conclusion

Understanding the distinctions between refund abuse and friendly fraud is paramount for merchants navigating the complex landscape of retail fraud. While refund abuse involves intentional deception by fraudsters, friendly fraud often stems from misunderstandings or disputes.

The key lies in recognizing the involvement of chargebacks—friendly fraud incorporates them, while refund abuse adheres to the merchant’s refund policies. Merchants must employ tailored prevention strategies for each type, fostering comprehensive fraud protection and safeguarding their businesses from financial setbacks.

Frequently Asked Questions

Q: What is a Refund Abuse?

Refund abuse, also known as returns abuse, transpires when a customer exploits a merchant's returns policy to such an extent that it becomes financially unsustainable. This may involve excessive use of returns, fabrication of returns or receipts, and the unauthorized resale of merchandise.

Q: Is Refund Abuse Deemed Fraudulent?

Certainly, return fraud, refund fraud, or return theft is considered illegal. Despite some perpetrators viewing it as a 'victimless crime,' regulatory bodies classify these actions as a form of theft since they involve defrauding stores and online eCommerce platforms.

Q: What Sets Apart Friendly Fraud from Chargeback Fraud?

Friendly fraud, also known as first-party fraud, occurs when a legitimate customer completes a purchase, receives the product, and subsequently initiates a chargeback with their bank to reverse the transaction, all while retaining the product(s) or service(s).

Q: What is the example of Friendly Fraud?

In certain situations, friendly fraud emerges when a customer's credit card or account information is either stolen or used without authorization. Instead of reporting the stolen card to their credit card company, the customer disputes the charge as fraudulent. Additionally, impulsive purchases can contribute to instances of friendly fraud.