Nonprofit organizations work tirelessly to serve the public good through crucial missions like helping the poor, improving education, enhancing healthcare, protecting the environment, and strengthening communities. While nonprofits produce invaluable benefits for society, they also face unique financial challenges in managing donations, grants, volunteer efforts, and program expenses.

Using an easy-to-learn financial software like QuickBooks for nonprofits can help them gain control of their money and ensure every dollar is working hard toward its mission. QuickBooks for Nonprofits is designed specifically for 501(c)(3) charities and other nonprofits. This comprehensive guide will walk you through setting up QuickBooks for Nonprofits, tracking donations and revenue, handling expenses, managing grants and restricted funds, creating solid budgets, generating insightful reports, and staying compliant with nonprofit standards.

With the guidance in this article, you’ll have QuickBooks for Nonprofits up and running efficiently and have more time to focus on fulfilling your nonprofit’s vision and serving communities. From establishing fiscal policies to month-end procedures to year-end reporting, this guide covers all the financial responsibilities of managing a nonprofit organization. By following along step-by-step, any nonprofit can gain a tighter grip on their finances using QuickBooks.

While QuickBooks simplifies paperwork, nonprofits still need diligent oversight and prudent decision-making. This guide will give you the software skills and financial best practices to reach further with every donation and optimize your organization’s impact. Nonprofits around the globe rely on the help made possible by funds entrusted to them—funds that are now easier to account for and diplomatically deploy for maximum good. Use the following pages to build financial fluency for the important work ahead.

QuickBooks For Nonprofits – The Scope?

The scope of nonprofits serviced by QuickBooks Desktop is boundless. QuickBooks is an exceptionally versatile, valuable solution to all manner of organizations, including:

- Churches and places of worship seek to strengthen their financial management.

- Schools aim to allocate scarce resources strategically while staying compliant.

- Charitable causes like food banks, children’s hospitals, Habitat for Humanity, and animal shelters hope to maximize every donation.

- Social clubs and professional associations want more financial transparency and accountability.

- Service organizations focused on community development, healthcare, education, and the environment are looking to fulfill their mission affordably yet effectively.

- Philanthropic foundations establish endowments and grant programs to support noble initiatives for years to come.

QuickBooks for Nonprofits is robust accounting software tailored to any group that requires rigorous oversight of funds to achieve meaningful impact. It streamlines processes like accounts payable/receivable, general ledger, financial reporting, budgeting, and more while fortifying nonprofits’ ability to steward resources prudently.

The Two Different QuickBooks Nonprofit Desktop Products

The QuickBooks solution set features two software options tailored for nonprofits:

QuickBooks Premier for Nonprofits and QuickBooks Enterprise for Nonprofits. Evaluating each will help determine which most capably serves your organization’s financial management needs now and into the future.

QuickBooks Premier for Nonprofits is affordable, locally installed software suitable for groups with up to 100 employees or $10 million in revenue. Designed for small- to mid-sized nonprofits, this solution streamlines accounts payable/receivable, general ledger, financial reporting, budgeting, and payroll while strengthening oversight and compliance. Over 200 nonprofit-specific reports and integrations provide insights into key metrics, and five licensed users keep costs under control as your nonprofit grows.

Though Premier reigns for smaller nonprofits, larger and more complex organizations require the advanced capabilities of QuickBooks Enterprise for Nonprofits. This robust enterprise software supports up to 5,000 users and $500 million in annual income. In addition to Premier’s functions, Enterprise enables sophisticated budgeting, project accounting, auditing features, and holistic business insights through reporting and dashboards.

Each option within the QuickBooks Nonprofit product family leverages the same compliance, security, and ease-of-use standards. Differences in available features, price point, scalability, and number of supported users based on a nonprofit’s size and needs. Evaluating technical requirements, resources, financials, and long-term ambitions helps determine whether Premier or Enterprise fits current and future management demands.

QuickBooks For NonProfits – Features

QuickBooks Nonprofit delivers all the essentials for managing a nonprofit’s finances effectively and ethically. Beyond strong invoicing, expense tracking, time management, inventory oversight, and contact information, nonprofit houses are tailored specifically for charities, foundations, schools, places of worship, and more.

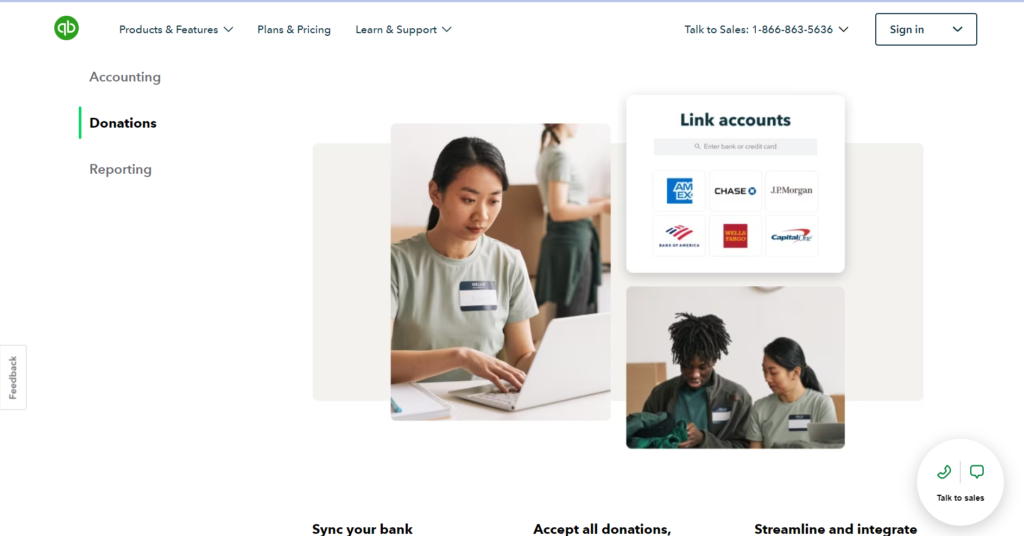

Chief among these are pledges, donations, programs, donor communications, and a customized chart of accounts matching the Uniform Chart of Accounts for Nonprofits. Pledges record promised gifts, item details, descriptions, amounts, taxes, and more for future fulfillment. Donations log checks, eChecks, credit/debit cards, cash, and relevant data to record each contribution received correctly.

Programs monitor key initiatives, projects, and services provided. Donor letters streamline communication with templates for customization or standardization as needed. While the chart of accounts adapts to nonprofit requirements, additional reports deliver transparency and accountability.

Nine industry-specific reports join hundreds of standard financial reports. Together, they demonstrate sound fiscal management to boards, funders, and communities served, including:

- Biggest Donors/Grants

- Budget vs. Actual by Donors/Grants

- Donors/Grant Report

- Donor Contribution Summary

- Budget vs. Actual by Programs/Projects

- Program/Projects Report

- Statement of Financial Income and Expenses

- Statement of Financial Position

- Statement of Functional Expenses (990)

How Much Does QuickBooks For Nonprofits Cost?

QuickBooks Premier and QuickBooks Enterprise each offer affordable options for nonprofits; however, associated costs remain significant. While discounts frequently arise for new customers, budgets still require consideration.

QuickBooks Premier presents three purchase pathways. A Premier Plus subscription costs $499.99 annually, including the selected nonprofit edition, unlimited support, automatic data backups/recovery, and optional add-ons like payroll users or remote access fees. The 2021 + Payroll edition adds enhanced payroll for $999.99 per year (single user). Though savings potential exists, reduced support/recovery and three-year product life expectancy also follow.

One-time software fees start at $649.99 for a selected edition but limit support, backups/recovery. Added users, support contracts and payroll capabilities increase pricing.

QuickBooks Enterprise arrives in local storage ($1,655-$5,275/year for one to five users, respectively) or Hosting models enabling remote access ($180/month, single user and up). Local plans limit remote data access while hosting options provide access to any device at additional monthly costs for licensed end users.

Scalability, advanced features, and security/compliance benefits accompany higher Enterprise pricing than Premier. However, affordability depends on nonprofit priorities, technical needs, growth plans, and available budgets.

Nonprofit requirements vary vastly, so each QuickBooks product presents unique advantages. Premier balances ease-of-use and affordability for small to mid-size nonprofits, while Enterprise scales complexity and competitiveness for larger organizations. Their capacities differ not in quality or purpose but in degree.

To select the best, nonprofits evaluate responsibilities, resources, technical fluency, reporting demands, and future potential. They discuss its needs with advisors, thoroughly research edition features/pricing, explore available discounts/options, and stay mission-focused throughout each financial decision.

Can I Use QuickBooks Online As A Nonprofit?

While QuickBooks Online (QBO) simplifies accounting for many businesses, nonprofits require specialized considerations before adoption. Though QBO accommodates nonprofit finances capably, an industry-specific nonprofit edition does not exist. Organizations electing QBO select ‘Nonprofit’ as their business type but gain no additional features; capabilities and interface remain equivalent to for-profit solutions.

Nonetheless, QBO provides essential nonprofit management, including donations, pledges, budgeting, reporting, and functions like disbursements, payroll, contacts, etc. Customization also arises through over 450 integrations, connecting QBO nonprofits with solutions benefiting their work, such as DonorPath, Kindful, and NeonCRM.

QBO merits nonprofits preferring cloud-based software, ease of use, or lack of technical/accounting fluency. However, compared to dedicated nonprofit editions, its generalized approach may inadequately address unique nonprofit complexities around restricted funds, program budgeting, compliance requirements, etc.

Nonprofit edition advantages include tailored features, compliance frameworks, improved scalability, and specialized support staff. These establish QBO as a stronger solution, providing technical aptitude, time for onboarding, or a willingness to adapt existing processes. Nonprofits should weigh QBO benefits against potentially greater resource demands versus a purpose-built alternative.

As with any software, QBO selection depends on organizational priorities, technical needs, growth plans, and available budgets/skills. Nonprofits must evaluate responsibilities, resources, reporting demands, and future potentials to choose the most supporting their mission and sustainable impact. Options may change, but the drive and commitment to prudent management, transparency, and meaningful results should not.

The Bottomline: QuickBooks For Nonprofits is Great For Organizations Of All Sizes.

The QuickBooks solution suite spans editions facilitating nonprofits of any size and scope. QuickBooks Premier enables effective management and meaningful impact for more minor to mid-sized nonprofits without excessive cost or complexity. Though QuickBooks Online also proves a viable option, especially with limited accounting experience, Premier better addresses nonprofit uniqueness.

Larger and more complex nonprofits require the advanced capabilities of QuickBooks Enterprise. Supporting up to 40 users and customizable permissions, Enterprise provides the scalability, security, compliance, and control important for sustainable success in the nonprofit sector.

Amid standard accounting features, QuickBooks Nonprofit editions house features essential to 501(c)(3) organizations, including nine industry reports and hundreds of options for deeper insights as needed. These help demonstrate accountability, optimize performance, and guide sound decision-making.

QuickBooks merits consideration, yet it has potential downsides before adoption. Learning curves exist for Desktop/Premier and upfront investments, especially Multiple user fees. However, featured benefits often outweigh costs for nonprofits, especially if resources allow time to gain fluency. Options may vary, but the ultimate purpose does not: prudent management, transparency, and meaningful impact.

Nonprofits evaluate responsibilities, resources, complexities, growth plans, technical aptitude, and budget when choosing between QuickBooks Premier, Enterprise, Online, or alternatives. Discuss requirements with advisors, research each edition thoroughly, consider available discounts/free trials, and stay mission-focused throughout. The solution that empowers purpose and potential without distraction or dilution is the best, regardless of brand or platform.

No QuickBooks option can achieve sustainable transformational impact alone. Together, they provide the tools, insights, and control nonprofits require to fulfill their missions responsibly and responsively. By gaining oversight through intuitive yet robust features, smaller and larger nonprofits move from good intentions to meaningful, measurable, lasting good.

For any sincere nonprofit, QuickBooks’s possibilities have no real limits. For organizations of each size and scope, sustainably achieving more demands prudent decision-making above any single product. The world needs every nonprofit’s vital work to thrive; QuickBooks makes that work more feasible and impact more meaningful. Overall, QuickBooks helps translate passion into transformation.