Amidst a period of volatility, there is a noticeable sense of optimism surrounding the cryptocurrency market in 2024. The US Securities and Exchange Commission (SEC) approved the introduction of Bitcoin exchange-traded funds (ETFs) by eleven prominent entities last year, including industry giants such as BlackRock and Fidelity.

The approval of Bitcoin ETFs has generated enthusiasm among retail crypto investors, contributing to a notable upsurge in cryptocurrency valuation as market participants eagerly anticipate forthcoming regulatory guidelines. For individuals entering the market and contemplating investment allocation, a comprehensive understanding of the sector and making well-informed decisions are imperative.

This article facilitates newcomers by outlining some popular cryptocurrencies worthy of consideration as they venture into their investment journey.

*Remember, this list shows a compilation of the popular crypto coins in 2024 – it’s not investment advice. All investors should research carefully before investing in crypto.

What are Cryptocurrencies?

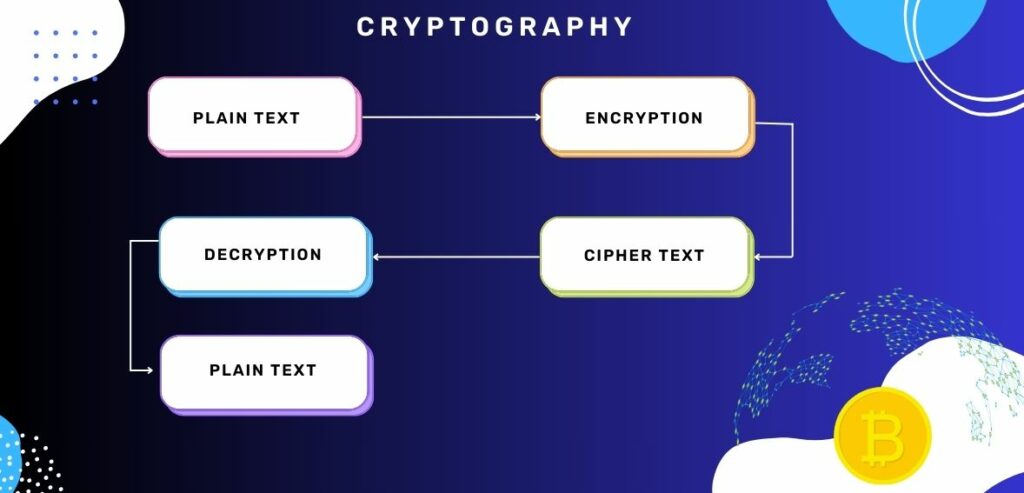

Cryptocurrencies are virtual currencies that exist purely digitally and operate on cryptographic principles. They serve as decentralized mediums of exchange, with cryptography used to verify and process each transaction. Additionally, cryptography plays a crucial role in creating units of various cryptocurrencies.

Cryptocurrency exchanges operate mainly on blockchain technology, providing a decentralized structure. This technology is essentially a shared public ledger that records all transactions occurring within a network. Consequently, every participant in the network can view all transactions and account balances.

Blockchain technology addresses one of the primary concerns of digital payment platforms: double-spending while ensuring that no single authority is in control. This is achieved because each party involved in a transaction verifies and processes the activity themselves within the blockchain network.

How Do Cryptocurrencies Work?

As mentioned above, cryptocurrency operates on a decentralized public ledger known as the blockchain, which serves as a ledger of all transactions updated and maintained by currency holders. These digital currencies are generated through mining, using computer power to solve complex mathematical problems to produce coins.

Alternatively, users can purchase cryptocurrencies from brokers and manage them using cryptographic wallets for storage and spending. It’s important to note that owning cryptocurrency doesn’t mean owning something physical. Instead, you possess a key that enables the transfer of a record or unit of value from one person to another without needing a trusted third party.

What are Altcoins?

Altcoins, short for alternative coins, refer to all cryptocurrencies apart from Bitcoin. They’re dubbed “alternative” because they offer alternatives to Bitcoin and traditional fiat currencies. However, some define altcoins as any cryptocurrency other than Bitcoin and Ethereum (ETH), as many cryptocurrencies stem from one of these two. Various altcoins employ different consensus mechanisms to validate transactions, create new blocks, or distinguish themselves from Bitcoin and Ethereum by offering new features or purposes.

Developers typically design and release altcoins with unique visions or applications for their tokens or cryptocurrency. Early altcoins aimed to enhance aspects of Bitcoin, such as transaction speeds or energy efficiency. The first altcoins emerged in 2011, and thousands have been introduced since then. It’s important to note that all cryptocurrencies have different functions and can be created in various ways, like:

- Mined Coins

Mining of the coin is the method employed by Bitcoin and numerous other cryptocurrencies to create new coins and authenticate transactions. It entails extensive, decentralized networks of computers globally, which validate and safeguard blockchain digital records of cryptocurrency transactions.

However, this process consumes significant energy, leading environmentalists and others to question whether the benefits outweigh the costs.

- NFT-based Coins

NFT coins are the native tokens of a specific NFT ecosystem, which is essential for utilizing NFTs within that protocol. While most NFTs are created on the Ethereum network, their associated coins or tokens are usually ERC-20 tokens. However, this is only sometimes the case. Other networks, such as Tezos, Solana, WAX, BSC, and Flow, also generate NFTs.

These NFTs can be held indefinitely but are also tradable, similar to cryptocurrencies or other assets. To utilize an NFT, the owner must actively participate in the corresponding ecosystem, often represented by a metaverse, digital game, or marketplace.

- Memecoins

Meme coins are cryptocurrencies inspired by internet jokes. They often experience significant price fluctuations and typically lack practical utility compared to more serious crypto assets. While these playful cryptocurrencies can inject humor into your digital investments, they also come with higher risk levels.

- Stablecoins

Stablecoins are a category of cryptocurrency designed to maintain a stable value by pegging it to another asset class. The most commonly used stablecoins are fiat-backed, linked to currencies like the US dollar.

Is the Cryptocurrency Market Regulated?

Regulation of cryptocurrencies in the U.S. varies depending on their usage and location. Entities such as the Securities and Exchange Commission (SEC), the Commodity Futures Trading Commission (CFTC), the Chicago Mercantile Exchange, and the Financial Industry Regulatory Authority are all involved to some extent. Transactions involving cryptocurrencies between private users, like private wallets to private wallets, remain unregulated.

In certain countries, there’s partial regulation, while others are working towards comprehensive regulation of space. In the United States, cryptocurrencies are regulated at both the federal and state levels. The SEC oversees the issuance and trading of digital assets classified as securities, while the CFTC regulates fund managers dealing in cryptocurrency futures contracts.

Best and Popular Cryptocurrencies to Watch Out in 2024

With so many options, finding the top cryptocurrency of 2024 can be challenging. Let our roundup guide you in your research.

1. Bitcoin (BTC)

Image source

- Market Capitalization: $1387 billion

- Current Price: $70,822.50

- All-time High: $73,835.57

- 6-Month Price Change: 162.04%

Bitcoin, introduced in 2009 by the enigmatic Satoshi Nakamoto, is the world’s pioneering decentralized cryptocurrency and payment system. As the cornerstone of the cryptocurrency revolution, Bitcoin remains the go-to reference when discussing digital currency. Since its inception, Bitcoin has experienced remarkable growth, capturing the attention of investors, media, and businesses alike. In January 2016, one bitcoin could be purchased for around $435. Fast forward to March 28, 2024, and the price of a single bitcoin has surged to over $70,000.

Operated as an alternative form of payment to traditional cash, the Bitcoin network relies on Proof of Work consensus for security. All transactions are recorded on a blockchain, with miners earning rewards for validating each block.

2. Ethereum (ETH)

Image source

- Market Capitalization: $421.60 billion

- Current Price: $3,570.13

- All-time High: $4,891.70

- 6-Month Price Change: 115.99%

Ethereum, conceived by Vitalik Buterin, empowers anyone to create secure digital technologies. Its token is crafted to compensate for work done to support the blockchain, but users can also use it to purchase goods and services if accepted.

Designed to be scalable, programmable, secure, and decentralized, Ethereum is the preferred blockchain for developers and enterprises revolutionizing various industries and daily life. It inherently supports smart contracts, which are crucial for decentralized applications (DApps). Many decentralized finance (DeFi) and other applications leverage smart contracts alongside blockchain technology.

Ethereum provides an exceptionally adaptable platform for building DApps using the native Solidity scripting language and Ethereum Virtual Machine. Developers deploying smart contracts on Ethereum benefit from a robust ecosystem of developer tools and established best practices. This maturity also enhances user experience, with wallets like MetaMask, Argent, and Rainbow offering user-friendly interfaces for interacting with the Ethereum blockchain and smart contracts. As of writing this, Ethereum is trading at $3,558.15, which is a considerable increase from its price of around $11 in October 2016, resulting in over 32,300% returns.

3. Tether (USDT)

Image source

- Market Capitalization: $104.30 billion

- Current Price: $1

- All-time High: $1.32

- 6-Month Price Change: 0.03%

USDT, also known as Tether, is part of a rapidly expanding category of stablecoins. Unlike other volatile cryptocurrencies, stablecoins like USDT aim to maintain a stable value by pegging their worth to a traditional currency such as the U.S. dollar.

Initially launched as RealCoin in July 2014, it was later rebranded as Tether (USDT) in November of the same year. Originally built on the Bitcoin blockchain, Tether operates on various protocols, including Bitcoin’s Liquid and Omni, Avalanche, Ethereum, Polka, and Kava. As of March 29, 2024, Tether has reported assets exceeding $104 billion for USDT.

4. Solana (SOL)

Image source

- Market Capitalization: $83.04B

- Current Price: 188.05

- All-time High: $259.96

- 6-Month Price Change: 1366.59%

Solana is a blockchain often compared to Ethereum and even dubbed an “Ethereum killer.” Like Ethereum, the SOL token is available for purchase on most major exchanges. However, its true value lies in facilitating transactions on the Solana network, which offers unique advantages.

The Solana blockchain utilizes a proof-of-history consensus mechanism, leveraging timestamps to determine the next block in its chain. Notably, Solana boasts faster transaction processing and significantly lower fees than Ethereum.

Introduced in March 2020, Solana is a relatively new cryptocurrency known for its speed in completing transactions and the overall robustness of its “web-scale” platform. The currency, SOL, has a capped issuance of 480 million coins.

5. USD Coin (USDC)

- Market Capitalization: $32.13

- Current Price: $1.00

- All-time High: $1.19

- 6-Month Price Change: -0.0337%

USDC, also known as USD Coin, is another stablecoin that is tethered to the value of the United States dollar. It’s a type of cryptocurrency designed to mirror the worth of the US dollar and is backed by reserves. Each USDC is redeemable for one US dollar on a 1:1 basis. Presently, USDC operates on the Algorand and Solana networks, with plans to expand to additional networks in the future. Initially, USDC was built on Ethereum’s (ETH) blockchain.

Unlike decentralized cryptocurrencies like Bitcoin and Ether, USDC is issued by a centralized authority that adheres to regulations. If a regulatory agency takes action against a USDC holder, there’s a possibility that all their cryptocurrency holdings may be frozen.

6. Binance Coin (BNB)

Image source

- Market Capitalization: $89.53 billion

- Current Price: 581.05

- All-time High: $686.31

- 6-Month Price Change: 170.18%

BNB is the native token for Binance, a leading cryptocurrency trading platform. It’s used to pay fees on the Binance platform, often at lower costs than other payment methods. BNB can also be used to buy other cryptocurrencies on Binance. Users holding Binance Coin receive fee discounts on transactions made on the Binance Exchange as a perk. Additionally, BNB can be exchanged for other cryptocurrencies like Bitcoin, Ethereum, Litecoin, and more.

Introduced in July 2017, Binance Coin initially operated on the Ethereum blockchain as an ERC-20 token before transitioning to become the native currency of Binance’s blockchain, the Binance Chain.

Important Note: It is noteworthy that Binance and its CEO, Changpeng Zhao, entered a guilty plea to accusations of money laundering on November 21, 2023. In exchange for Zhao resigning as CEO and agreeing to pay $50 million toward the settlement, Binance agreed to pay $4.3 billion to resolve the claims. Binance nevertheless sticks to its position as a “secure exchange,” emphasizing ideas like “Proof of Reserves.”

7. Ripple (XRP)

- Market Capitalization: 34.476 billion

- Current Price: 0.63

- All-time High: $3.84

- 6-Month Price Change: 23.22%

XRP stands out from other general-purpose tokens because it’s tailored specifically to create payment solutions geared toward banks and financial institutions. It addresses various issues present in systems like SWIFT for international settlements. Unlike traditional methods that take hours or even days to complete transfers, XRP enables settlements to occur within seconds.

As the native token of Ripple, XRP powers the Ripple payment network, which caters to banks and financial institutions. Operating on its dedicated blockchain platform, the XRP Ledger, Ripple offers a swift and cost-effective means of settling transactions within the financial sector.

Thanks to its practical benefits for financial institutions, XRP has gained adoption by some of the largest banks worldwide.

8. Avalanche (AVAX)

Image source

- Market Capitalization: $21.07 billion

- Current Price: $54.02

- All-time High: $144.96

- 6-Month Price Change: 521.27%

Avalanche is a platform designed to launch decentralized apps (dApps) through its multi-chain smart contract system. The AVAX token serves as the native currency of the Avalanche blockchain, much like Ethereum, which supports various blockchain projects with smart contracts. Launched in 2020, Avalanche strives to offer speed, versatility, security, affordability, and accessibility. Additionally, it operates as an open-source project, allowing anyone to view and contribute to its code.

Reportedly, the Avalanche blockchain offers rapid transaction finality. AVAX is utilized to pay transaction fees, secure the Avalanche network, and serve as a fundamental unit of account across blockchains within the Avalanche network.

9. Cardano (ADA)

Image source

- Market Capitalization: $23.298 billion

- Current Price: $0.65

- All-time High: $3.10

- 6-Month Price Change: 161.62%

Cardano is a blockchain designed to offer scalability and efficiency, surpassing Ethereum while prioritizing environmental friendliness. Given the recent attention to Bitcoin mining consuming 2% of the US’s electricity, investing in Cardano could be a wise choice.

Like Ethereum, Cardano supports smart contracts and boasts a growing DeFi ecosystem. However, the currency has faced mixed reactions within the crypto community, partly due to initial volatility.

10. Dogecoin (DOGE)

Image source

- Market Capitalization: $29.22 billion

- Current Price: $0.22

- All-time High: $0.7316

- 6-Month Price Change: 259.49%

Dogecoin (DOGE) was created in 2013 as a “meme” and launched as a joke in response to the increasing popularity of cryptocurrencies. The currency was inspired by the popular Doge meme, which features a Shiba Inu dog and humorous captions in broken English.

Despite its playful origins, Dogecoin gained a significant following in the cryptocurrency world like a cult after getting some support from a tweet by Elon Musk. Touted as a cryptocurrency for the people, Dogecoin has also been involved in charitable endeavors, such as funding the construction of water wells in Kenya.

Conclusion

As we look ahead to the most popular cryptocurrencies to watch in 2024, it’s evident that the landscape of digital assets continues to evolve dynamically. With recent regulatory approvals and growing investor interest, cryptocurrencies like Bitcoin, Ethereum, Tether, Solana, USD Coin, Binance Coin, Ripple, and Avalanche are at the forefront of this transformative industry.

While Bitcoin remains the pioneer and standard-bearer of decentralized digital currency, Ethereum continues to lead the charge in enabling innovative decentralized applications and smart contracts. Stablecoins like Tether provide stability in a volatile market, while platforms like Solana and Avalanche offer scalability and speed for decentralized app development.

Plus, regulatory scrutiny and evolving frameworks highlight the increasing legitimacy and maturation of the crypto market. As investors navigate this landscape, thorough research and understanding are paramount. This list serves as a starting point, but prudent decision-making and diligence are essential for anyone considering entering crypto.

Ultimately, while the crypto market presents exciting opportunities, it’s crucial to approach it with caution and awareness of its risks and complexities. By staying informed and making informed choices, investors can potentially capitalize on cryptocurrencies’ transformative potential in the years to come.