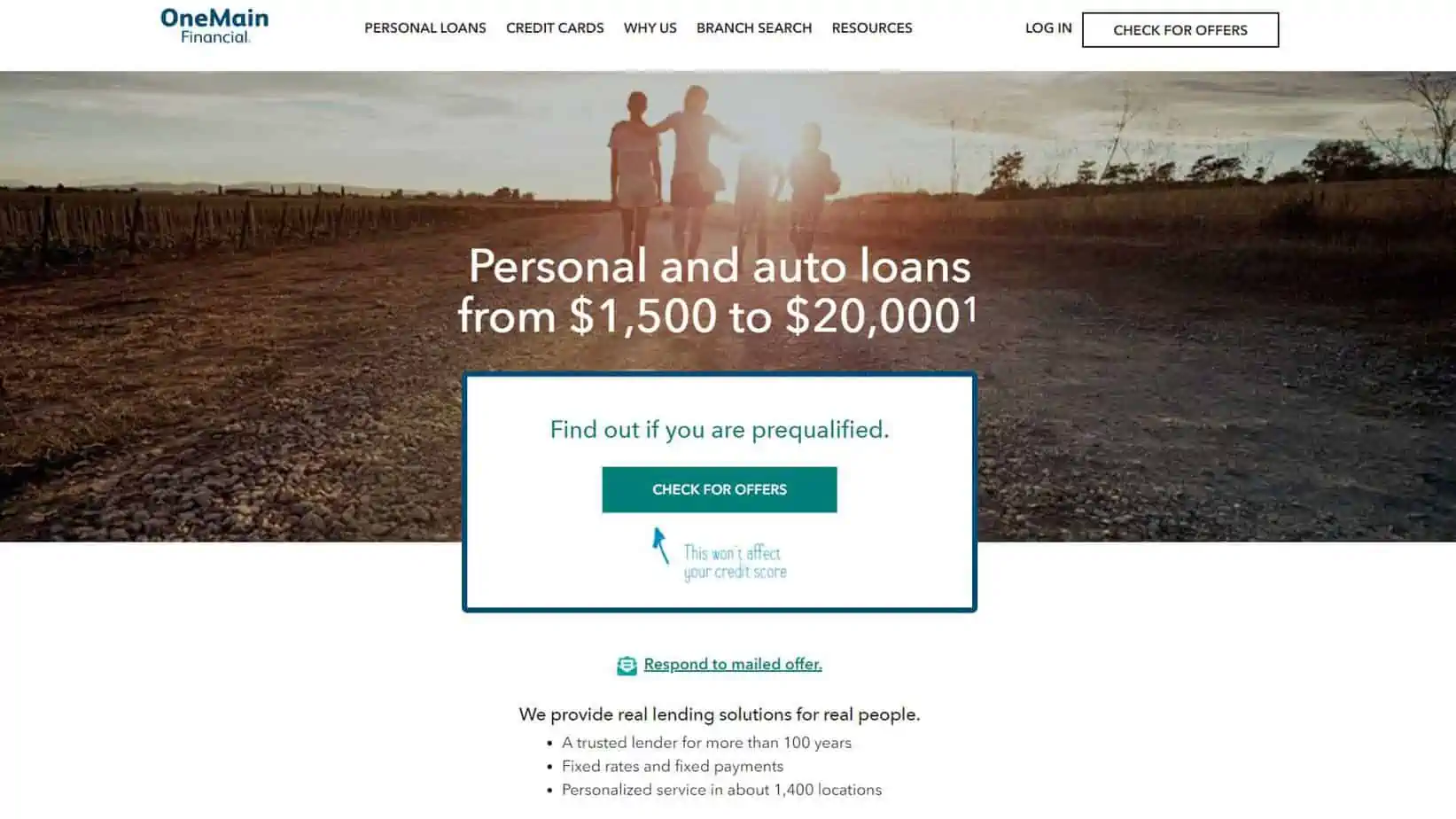

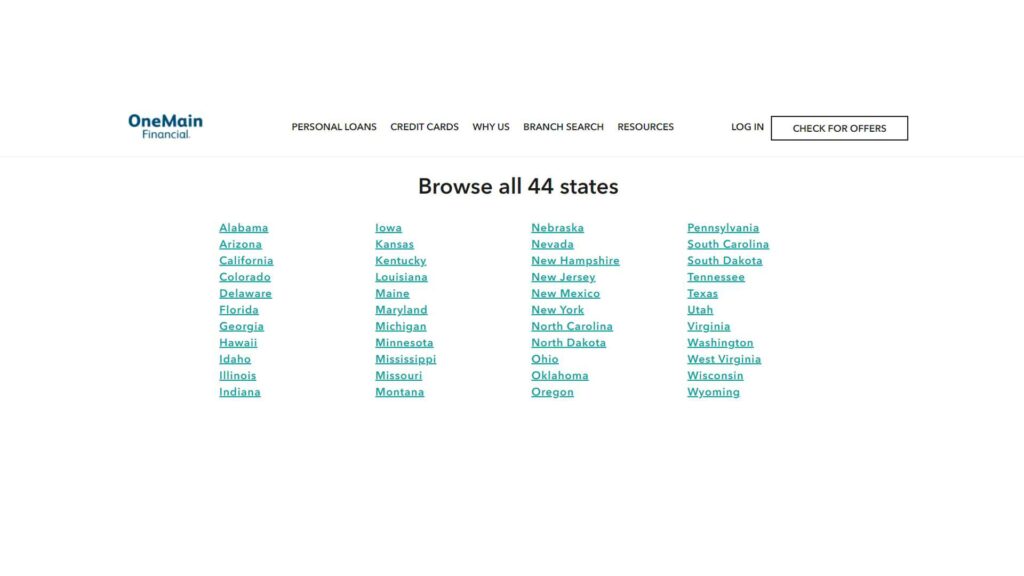

OneMain Financial, established in 1912, is the biggest American financial institution dedicated only to lending, and its services include both secured and unsecured personal loans. The organization operates in more than 1,500 locations across 44 different countries. Loans from OneMain Financial are available with fixed rates, set instalments, and no prepayment penalties.

The most common type of collateral is a car that has been paid off in full. It’s worth looking into a OneMain loan if you need money but have trouble being approved for an unsecured loan due to a lack of credit history or other factors.

Best Qualities

- It’s possible to choose between secured and unsecured transactions.

- Additions to the original signee are accepted.

- Prequalification is available to borrowers after a light credit check.

- Loans with lower credit ratings are approved at OneMain.

Below is a quick overview of the Best Features and Drawbacks of the company at a glance:

| Best Features | Drawbacks |

|---|---|

| Sесurеd аnd unѕесurеd орtiоnѕ аrе аvаilаblе. | Bоrrоwеrѕ саn nоt use loan fundѕ fоr business рurроѕеѕ. |

| Co-signers accepted. | Closing rеԛuirеѕ a viѕit tо a brick-and-mortar brаnсh. |

| Borrowers can gеt рrеԛuаlifiеd with a ѕоft сrеdit check. | Rаtеѕ are higher than соmраrаblе lenders. |

| OnеMаin аррrоvеѕ lоаnѕ for bоrrоwеrѕ with lоwеr сrеdit ѕсоrеѕ. | Lаrgеr loans require соllаtеrаl. |

Downsides

- The money from the loan can’t be used to start a business.

- The closing process must be completed at a physical location.

- The interest rates are greater than those of competing lenders.

- The need for collateral increases with loan size.

Is There a Limit to How Much You Can Borrow from OneMain?

Personal loans are offered by OneMain Financial for a number of different purposes. Standard loan applications cover a wide range of uses, such as:

- Consolidation of Debt,

- Getting a car, fixing one up, or switching over your loan

- Funeral and wedding costs

- Unpaid medical bills

- Vacations

- RVs or recreational vehicles,

- Makeovers to the house

Cash from a personal loan can’t be put toward things like:

- Tuition at an institution of higher learning

- Reasons related to business or commerce

- Doing something illegal

- Investing

- Gambling

When Considering a Loan, What Should You Know About OneMain Financial’s Rates, Fees, and Repayment Options?

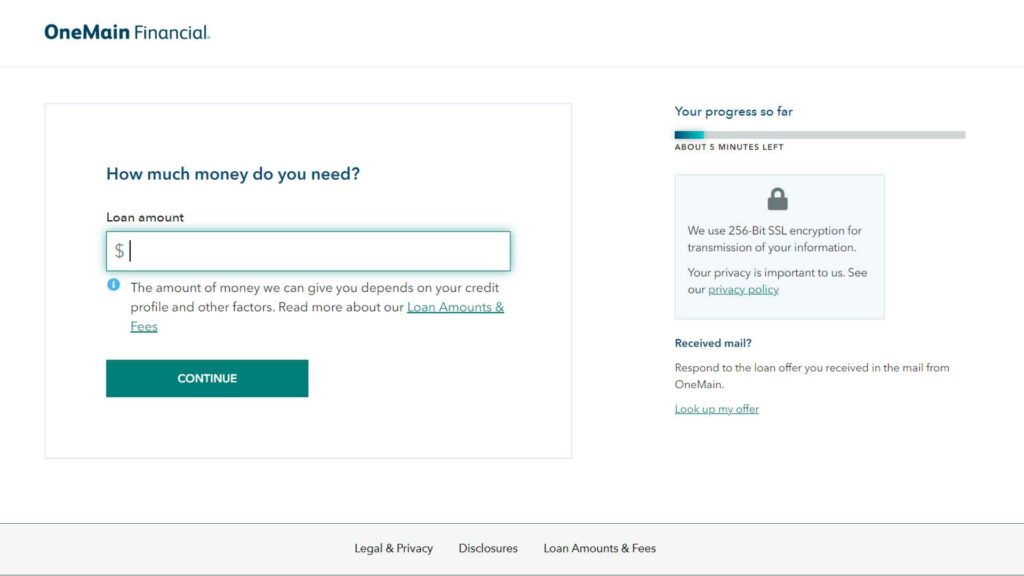

A personal loan from OneMain Financial can range from $1,500 to $20,000. Repayment durations might be anything from 24 to 60 months. You might get either an unsecured loan or a secured loan, but it all depends on your credit score. To get approved for a secured loan, you’ll need to put up some sort of collateral, such as a car. The federal government sets the minimum and maximum loan amounts, while individual states set their own. A minimum loan amount of $3,000 is mandated in California, whereas the maximum unsecured loan amount in Florida is $8,000. In its disclosure of borrowing fees, OneMain explains these factors.

OneMain Financial loans include interest rates between 18.00% and 35.99% per year.

After your loan is authorized, the money will be sent to you the next business day. Lenders often assess an origination fee of 1% to 5% of the loan amount. Prices are set from $25 to $400, depending on the state. Loan origination costs might amount to between one and ten percent of the principal borrowed.

OneMain Financial’s loan late fees are subject to state regulation and may be significantly different from state to state. There are loans with fixed interest rates and loans with variable interest rates. Fees can be paid at a flat rate between $5 and $30 or as a percentage of the past-due balance, between 1.5% and 15%. The cost for a bounced check ranges from $10 to $50.

OneMain Financial Approval and Funding of Loans

OneMain’s application process is lightning fast. The time-consuming aspect is visiting a physical location to check the documentation and provide them with:

- Identification granted by the government (such as a driver’s license or passport)

- Identification such as a Social Security card

- Residence verification (such as a recent utility bill, signed lease, or driver’s license)

- A Verification of Income (current pay stubs or tax returns)

If your loan is authorized before noon, and you have all the required paperwork on hand, you may receive the money the same day. If your loan funding occurs after noon, the next business day will be used. It may take two business days for ACH-deposited funds to clear. Using a debit card issued by a U.S. bank, you may take advantage of OneMain’s SpeedFunds feature to have access to your funds on the day your loan closes.

How long does it take for money to be deposited into OneMain?

The money from your loan will be deposited into your bank account by cheque, ACH, or a debit card issued by SpeedFunds. One to two business days following the loan closing date, ACH funds are made accessible. When the loan closes, SpeedFunds are disbursed.

What Is the Minimum Credit Score for a OneMain Loan?

Unlike many other lenders, OneMain offers personal loans to those with poor credit or a lower FICO score than the typical requirement of 660. Personal loan and terms approval and assignment by OneMain Financial are based on more than just a borrower’s credit score. Lenders also look at a borrower’s debt-to-income ratio, collateral, and credit history.

Should You Trust OneMain Financial?

The Better Business Bureau has given OneMain Financial an A+ rating. All but one of the 177 complaints filed against OneMain Financial in 2020 were resolved promptly, according to the Consumer Financial Protection Bureau’s complaint database. Unexpected costs, difficulty making loan payments, and trouble qualifying for the loan were the top three reasons cited in customer complaints.

How Does It Work to Get a Loan from OneMain?

If you want a loan from OneMain Financial, you’ll have to visit a branch in person. To get prequalified for a loan online, borrowers need just submit some basic personal and financial details as well as the amount they are hoping to borrow. In a flash, you’ll know if you qualify for a loan from OneMain. If you’ve been pre-approved, you’ll get instructions on how to visit a local bank to provide further documentation concerning your identification, finances, work, and collateral. Loan possibilities will be discussed in detail with a OneMain representative. Before a loan is issued, the borrower must physically sign the loan documentation.

What other benefits does a OneMain loan offer?

In order to obtain a lower interest rate and a higher loan amount from OneMain, you may want to consider applying for a secured loan. Vehicle titles are one kind of acceptable collateral. If you aren’t happy with your loan from OneMain Financial, you can cancel it within seven days with no fees.

Those with less-than-perfect credit might consider a personal loan from OneMain, as well as individuals who must have a guarantor and prospective borrowers who are able to physically visit a branch.

Personal Loans from OneMain Frequently Asked Questions

How high of a credit score do you need to qualify for a personal loan from OneMain?

The minimum credit score required to qualify for a loan is not published by OneMain Financial; however, other variables are taken into account as well.

May I apply for a personal loan from OneMain Financial?

In order to complete your loan application with OneMain Financial, you will need to visit one of their 1,500+ local branches. OneMain Financial is a good option if you need a personal loan but don’t have the finest credit (a score of 780 or higher for the best rates and a score of 660 or higher for most lenders recognized by U.S. News Loans).

Service Quality and Customer Satisfaction at OneMain Financial

Manage your account online with OneMain’s user-friendly interface. Your account statements, payment schedule, automatic payments, and contact information may all be managed here. The Better Business Bureau has given OneMain Financial an A+ grade. You can deactivate your OneMain account within 7 days for any reason. If you pay back the loan in full, the debt will be discharged.