In the digital world, mobile payment platforms have become very popular because they’re easy and fast. One of these platforms, Venmo, lets you make transactions with just a few taps on your phone. Both businesses and customers love it. So, is Venmo safe for sellers? Let us understand.

Some sellers are worried about its safety because there have been scams and fraud in the past. As more businesses use mobile payments to keep up with modern customers, it’s really important for smart merchants to understand if Venmo is safe or risky. In this article, we’ll explore Venmo’s safety features and the possible risks it might have for businesses.

What is Venmo?

Image source: Venmo

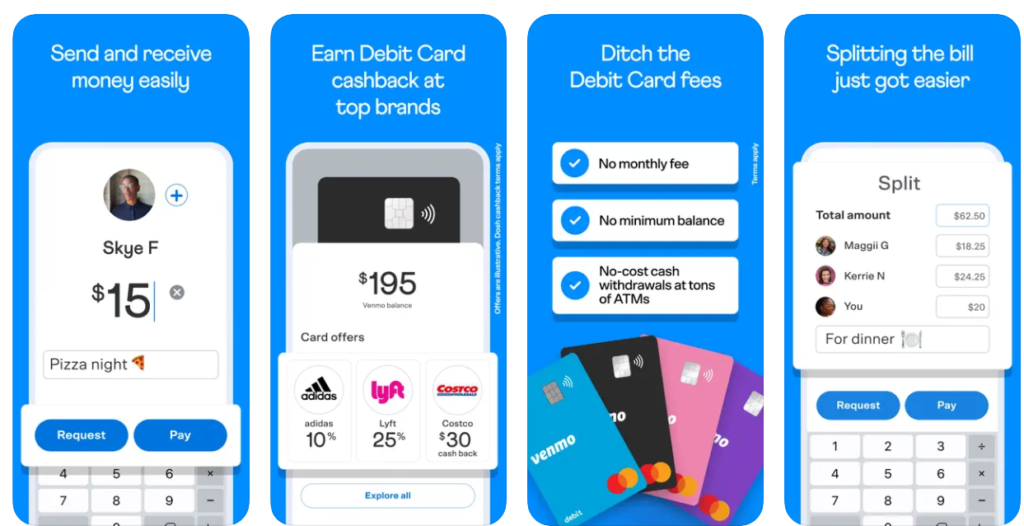

Venmo is a popular mobile payment service that revolutionized how people exchange money, making peer-to-peer transactions as easy as a few taps on a smartphone. Launched in 2009, the platform quickly gained traction among users as a simple, fast, and convenient way to split bills, reimburse friends, and pay for goods and services effortlessly.

Operating within the United States, Venmo allows users to link their bank accounts, credit cards, or debit cards to the app, facilitating seamless fund transfers between individuals. This digital wallet application eliminates the hassle of carrying cash and fosters a social aspect by enabling users to share payment descriptions and interact with their contacts.

The Venmo interface is user-friendly and has a distinct social media-like feed, where transactions are visible to friends. This further enhances its popularity among younger generations who embrace the concept of digital financial engagement.

Moreover, Venmo has expanded its offerings beyond just personal transactions. Recognizing its potential for business use, the platform introduced Venmo for Business, enabling merchants to accept payments from customers and clients easily.

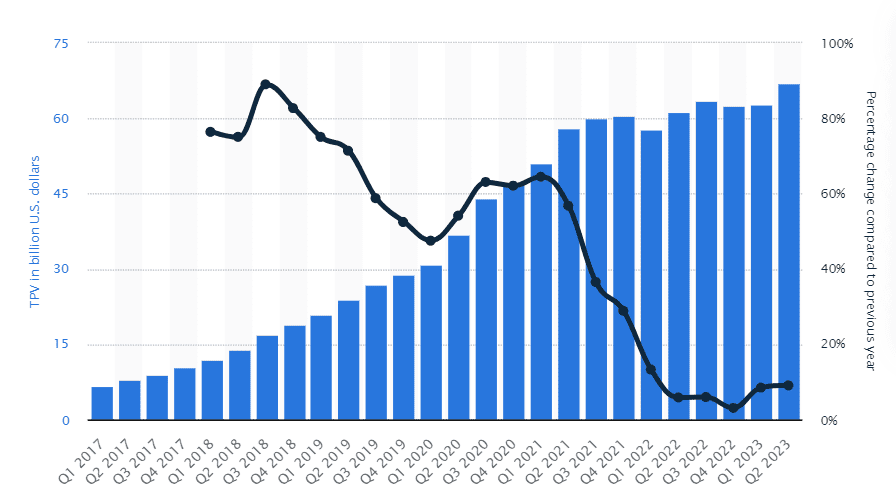

Value of payments processed. Data source: Statista

Despite its widespread usage and convenience, some concerns have arisen over Venmo’s security, as it has faced occasional scams and unauthorized transactions. However, the platform has continually improved its security measures and offers PIN codes, fingerprint authentication, and two-factor authentication to protect users’ accounts.

Overall, Venmo’s innovative approach to mobile payments has made it a significant player in the fintech industry, streamlining transactions and fostering a new era of digital financial interactions.

How Does Venmo Work?

Venmo app on Google Play Store

Venmo has become a game-changer in mobile payments, transforming how people exchange money with unparalleled ease. This innovative platform has eliminated the hassle of splitting bills, sharing expenses, and making transactions, all at your fingertips.

Let’s explore how Venmo works and the key features that have propelled it to the forefront of the fintech revolution.

Setting Up a Venmo Account

To start with Venmo, users must download the app from the App Store or Google Play Store. Once installed, they can create an account by providing their email address, phone number, and basic personal information. After verifying their identity, users can link their bank accounts, credit cards, or debit cards to their Venmo account.

Image source – App Store

Sending Money

Users can navigate to the “Pay or Request” screen to send money to someone and enter the recipient’s username, phone number, or email address. They then input the amount they wish to send and include a brief description of the purpose of the payment. Venmo also allows users to add emojis or select from a list of common transaction descriptions to add a personal touch to their payments. Once all details are confirmed, users can tap “Pay” to initiate the transaction.

Receiving Money

When someone owes a user money, they can request the payment through the app. By selecting the “Request” option and entering the amount owed, along with a description if needed, the user sends a payment request to their contact. The recipient will receive a notification, and upon approval, the amount is credited to the user’s Venmo balance.

Funding the Venmo Balance

When users receive payments through Venmo, the money goes into their Venmo balance, which acts as a digital wallet. From there, they have the flexibility to either keep the funds in the balance for future transactions or transfer them to their linked bank account. Venmo provides a “Transfer to Bank” option, allowing users to move money out of the Venmo app and into their bank account.

Security Measures

To ensure the safety of users’ financial information, Venmo employs several security features. It offers the option to set up a PIN code, use fingerprint authentication, or implement two-factor authentication for added account protection. Moreover, Venmo encrypts user data and financial details during transactions.

Social Aspect

One unique aspect of Venmo is its social media-like feed. When users make transactions, the payments and their descriptions (unless set to private) are visible to their Venmo friends. This feature adds a social element to the app, allowing users to engage with their contacts, like or comment on payments, and share their experiences, making it popular among younger generations.

Venmo for Business

Recognizing the potential for commercial transactions, Venmo introduced a feature called “Venmo for Business.” This enables merchants to accept payments from customers and clients easily. Businesses can display their unique Venmo QR code or links on invoices, websites, or point-of-sale locations, allowing customers to make payments swiftly.

Overall, Venmo is a seamless and user-friendly mobile payment platform that simplifies financial transactions between individuals and businesses. With its social feed, easy fund transfers, and robust security measures, Venmo has emerged as a dominant player in the fintech industry, reshaping how people interact and manage their finances in the digital age.

How Secure is Venmo for Business Owners?

The security of Venmo for business owners has been a topic of concern, primarily due to the platform’s history of encountering scams and fraudulent activities. So sellers are always worried about whether Vinmo is safe or not.

However, Venmo has taken significant steps to enhance its security measures and provide a safer environment for businesses to conduct transactions. Here are some key security aspects that make Venmo a relatively secure option for business owners:

- Encryption and Data Protection : Venmo employs encryption to safeguard user data and financial details during transactions. This encryption ensures that sensitive information remains encrypted and secure, reducing the risk of unauthorized access. This is one of the most important out of all the safety features of Venmo.

- Account Protection: To protect business owners’ accounts, Venmo offers multiple security options, including setting up a PIN code, enabling fingerprint authentication, or implementing two-factor authentication. These measures add an extra layer of security to prevent unauthorized access.

- Fraud Monitoring and Resolution: Venmo has implemented advanced fraud monitoring systems to detect and prevent suspicious activities. Venmo provides a process for users to report the issue and seek resolution in case of any fraudulent transactions.

- Buyer and Seller Protection: Venmo offers certain protections for both buyers and sellers. In cases where buyers do not receive the goods or services they paid for, Venmo may assist in resolving disputes and refunding the payment. However, sellers need to follow Venmo’s Seller Protection Policy to be eligible for this coverage.

- Business Profile Verification: Business owners can apply for a Business Profile on Venmo, which adds credibility and trust to their transactions. The verification process ensures that legitimate businesses are recognized and distinguished from personal profiles.

- Payment Privacy Options: Venmo allows users to customize the privacy settings of their transactions. Business owners can set their payments to private, ensuring that payment details are not visible on the social feed.

While Venmo has made significant strides in bolstering security, business owners need to exercise caution and follow best practices to safeguard their transactions further:

- Regularly monitor account activity and notifications to promptly identify any suspicious transactions.

- Avoid conducting business transactions with individuals or entities they are unfamiliar with, especially in high-risk scenarios.

- Enable additional security measures such as two-factor authentication for added protection.

- Keep business and personal transactions separate to reduce the risk of potential security breaches.

Overall, Venmo has made significant efforts to enhance security and protect its users, including business owners, from fraudulent activities. While it can be considered relatively secure, business owners must proactively implement security measures and exercise caution when using any mobile payment platform to ensure a safe and smooth payment experience.

Venmo Security Measures: Past Changes

Over the years, Venmo has continuously strengthened its security measures to enhance user protection and ensure secure transactions on its platform. Here are some of the past changes that highlight Venmo’s commitment to safeguarding its users’ financial information:

User Verification Through Phone Number and Email

Venmo requires users to verify their accounts through phone numbers or email addresses during sign-up. This step confirms users’ identities and acts as a foundational security measure to prevent fraudulent account creation.

Biometric Authentication

To add an extra layer of security, Venmo introduced biometric authentication options, such as fingerprint recognition or facial recognition (where supported by the device). This feature allows users to access their accounts securely, ensuring that only authorized individuals can access sensitive financial information.

Two-factor authentication (2FA)

Recognizing the importance of an additional security step, Venmo implemented Two-Factor Authentication (2FA). This feature requires users to provide a second form of verification, typically a one-time code sent to their registered phone number or email, in addition to their password. 2FA significantly reduces the risk of unauthorized access, even if a password is compromised.

Encrypted Data Transmission

Venmo uses encryption protocols to protect data transmission during transactions. This encryption ensures that sensitive financial information, including payment details, remains encrypted from the user’s device to Venmo’s servers. This measure reduces the risk of interception and unauthorized access to the data.

By implementing these security measures, Venmo has made significant strides in safeguarding its users and their financial transactions. These enhancements protect personal information and foster a sense of trust and confidence among users when using the platform.

Moreover, Venmo’s dedication to ongoing security updates and improvements demonstrates its commitment to staying ahead of potential threats and ensuring a safe environment for its vast user base. As technology evolves, it is likely that Venmo will continue to adapt and integrate further security innovations to maintain its position as a reliable and secure mobile payment solution.

Is Venmo Safe for Sellers Today?

As of today, Venmo is not considered safe for sellers who have not upgraded to a business profile. While Venmo is widely known for its convenient peer-to-peer (P2P) payment services, conducting business transactions through standard accounts poses several risks and is explicitly against Venmo’s terms and conditions.

Inadequate Protection from Fraudulent Transactions

When sellers use regular Venmo accounts for business-related transactions, they may not receive the same level of protection as official business profiles offer. Without the proper safeguards to address such issues effectively, they are at risk of potential scams, chargebacks, or disputes.

Privacy Concerns

Using a personal Venmo account for business can also raise privacy concerns. Standard accounts are designed for personal use, and by conducting business transactions through them, sellers may inadvertently expose personal information to customers, leading to potential privacy risks.

Lack of Records or Official Documentation for Tax Purposes

Business transactions on standard Venmo accounts often lack the necessary documentation required for proper record-keeping and tax purposes. This can create challenges during tax season, as sellers might find it difficult to provide accurate and organized financial reports to account for their income and expenses.

No Monthly Reports Detailing Income or Expenses

Venmo does not provide monthly reports specifically tailored for business transactions on standard accounts. This lack of detailed income and expense tracking could hinder sellers’ ability to analyze their financial performance effectively and make informed business decisions.

To mitigate these risks and ensure a safer and more streamlined business payment experience, sellers are strongly encouraged to upgrade to a Venmo Business Profile. By doing so, they gain access to additional security features, improved fraud protection, and enhanced tools for tracking financial records.

Venmo for Business allows sellers to conduct transactions in a manner compliant with the platform’s policies, promoting a more secure and professional environment for both buyers and sellers.

Overall, while Venmo is a popular P2P payment platform for personal transactions, using it for business purposes with a standard account is not recommended and is against Venmo’s terms and conditions. To ensure a safer and more reliable experience, sellers should opt for a Venmo Business Profile, which provides the nechiessary security and features to conduct business transactions with greater peace of mind.

Is Venmo Safe for Your Customers?

Venmo has implemented several security measures to ensure the safety of its users, including customers who use the platform for making payments and transactions. As of today, Venmo can be considered relatively safe for customers, but it’s essential for users to remain vigilant and follow best practices to enhance their security further. Here are some key aspects that contribute to the safety of Venmo for customers:

User Verification

Venmo requires users to verify their accounts through their phone numbers or email addresses during the sign-up process. This step helps confirm the identity of users and reduces the risk of fraudulent accounts.

Encryption and Data Protection

Venmo employs encryption to protect user data and financial details during transactions. Encryption ensures that sensitive information remains encrypted and secure, reducing the risk of unauthorized access.

Buyer Protection

Venmo offers certain protections for buyers. In cases where customers do not receive the goods or services they paid for, Venmo may assist in resolving disputes and refunding the payment.

Biometric Authentication and Two-Factor Authentication (2FA)

To enhance account security, Venmo provides options for biometric authentication (e.g., fingerprint recognition or facial recognition) and two-factor authentication (2FA). These features add an extra layer of protection to prevent unauthorized access.

It’s important to note that no digital platform can be entirely immune to security risks, and users should exercise caution while using any mobile payment service. By adopting best practices and staying informed about the latest security features, customers can maximize their safety and enjoy a secure payment experience on Venmo.

Risks and Limitations of Venmo

Venmo, while a popular and convenient payment platform, does come with certain risks and limitations that users, especially businesses, should be aware of. Here are some key considerations:

Payment Limits for Unverified Businesses

Unverified businesses on Venmo face transaction and transfer limits. The payment cap for unverified businesses is set at $2,499 per week, and the bank transfer limit is $999. These limitations can be restrictive for businesses with higher transaction volumes.

Verification Process and Higher Limits

To unlock higher transaction and transfer limits, businesses need to go through a verification process with Venmo. Verified businesses have more substantial payment capabilities, with weekly payments allowed up to $24,999 and bank transfers up to $49,999.

Limited Integration with Business Tools

One significant limitation of Venmo for Business is its lack of integration with other tools that businesses commonly use for daily operations. Unlike some other payment platforms, Venmo does not provide a comprehensive ecosystem that seamlessly integrates with accounting software, inventory management systems, or customer relationship management (CRM) tools. This can require businesses to perform additional manual work to synchronize data and manage finances effectively.

Limited Buyer and Seller Protection

While Venmo offers some buyer protection in cases of disputes or undelivered goods, it may not provide the same level of protection as traditional payment processors. Businesses may need to be cautious when dealing with customers, as Venmo’s dispute resolution process may not offer the same level of coverage as other payment platforms.

Privacy Concerns

Using Venmo as a business might raise privacy concerns. Since Venmo’s standard accounts are designed for personal use, using them for business transactions could inadvertently expose personal information to customers and create potential privacy risks.

Restricted Business Types

Venmo’s terms and conditions may restrict certain types of businesses from using the platform. For instance, some high-risk businesses or industries with strict regulatory requirements might not be eligible to use Venmo for payments.

Instant Transfers Fee

While Venmo offers instant transfers for businesses to access funds immediately, it comes with a fee. This cost could be a consideration for businesses looking to manage their expenses effectively.

Understanding Venmo Scams

Venmo scams refer to fraudulent activities and deceptive schemes that target users of the Venmo platform to steal money or personal information. Scammers use various tactics to trick users into sending money or divulging sensitive details. It’s essential for Venmo users to be aware of these scams to protect themselves from falling victim to such fraudulent schemes. Here are some common Venmo scams:

Payment Request Scams

Scammers create fake payment requests, often posing as friends or acquaintances, asking for money for a fictitious reason. They may use stolen identities or create convincing profiles to deceive users into making payments.

Overpayment Scams

In this scam, a scammer pretends to pay more than the agreed-upon amount for an item or service, requesting the seller to refund the excess amount. However, the initial payment is fraudulent, and the seller ends up losing both the product and the refund.

Phishing Scams

Phishing scams involve sending users fraudulent emails, messages, or links that appear to be from Venmo or a legitimate source. These messages request users to log in or provide personal information, which scammers then use to gain unauthorized access to accounts.

QR Code Scams

Scammers may create fake QR codes, which, when scanned by unsuspecting users, lead to unauthorized payment requests or redirect them to malicious websites.

![]() Also read: Privacy while using QR codes

Also read: Privacy while using QR codes

Ticket or Event Scams

Scammers may offer tickets, or event passes for sale, asking buyers to pay through Venmo. However, after receiving the payment, they never deliver the promised tickets.

Fake Charitable Donations

Scammers may create fake charity profiles, asking users to donate money for a good cause. However, these funds are misappropriated, and the donations never reach any legitimate charity.

How to Stay Safe While Using Venmo?

Staying safe while using Venmo involves adopting a proactive approach and being aware of potential risks and security measures. Here are some essential tips to ensure a secure experience on the platform:

- Enable Two-Factor Authentication (2FA) : Activate Venmo’s two-factor authentication (2FA) feature. This adds an extra layer of security, requiring a one-time code sent to your registered phone number or email during login, in addition to your password.

- Use a Strong and Unique Password: Choose a strong, unique password for your Venmo account. Avoid using easily guessable information and refrain from reusing passwords across multiple accounts.

- Verify Payment Requests: Before making any payments, verify the recipient’s information and the payment request details to ensure it’s legitimate. Contact the person directly using a trusted means of communication if you have any doubts.

- Keep Your App and Device Updated: Regularly update your Venmo app and the operating system of your device to ensure you have the latest security patches and enhancements.

- Avoid Public Wi-Fi for Sensitive Transactions: Avoid conducting financial transactions on Venmo while using public Wi-Fi networks, as they may be more susceptible to potential security breaches.

- Set Privacy Settings: Adjust your privacy settings to control who can view your transactions and who can send you payment requests. It’s a good practice to keep your payments private.

- Link a Bank Account or Credit Card: Link your Venmo account to a bank account or credit card rather than using a debit card. Credit cards typically offer more fraud protection than debit cards.

- Be Cautious with QR Codes: Only scan QR codes from trusted sources, such as official business websites or verified payment requests.

- Use Business Profile for Business Transactions: If you conduct business transactions, consider upgrading to a Venmo Business Profile. This provides additional security features tailored for business use.

- Report Suspicious Activity: If you notice any suspicious or unauthorized activity on your Venmo account, report it immediately to Venmo’s support team and change your password.

- Educate Yourself about Scams: Stay informed about common Venmo scams and other types of fraudulent activities to recognize warning signs and avoid falling victim to scams.

- Regularly Review Transactions: Regularly review your transaction history and account activity to identify any suspicious or unauthorized transactions promptly.

By following these safety tips and being vigilant, you can significantly reduce the risk of security breaches and enjoy a secure and hassle-free experience while using Venmo for your financial transactions. Remember that your awareness and caution are essential in safeguarding your personal and financial information on any digital platform.

Conclusion

Venmo has revolutionized the world of mobile payments, offering users a convenient and efficient platform to exchange money seamlessly. As with any digital payment system, it comes with its own set of benefits and potential risks.

While Venmo has implemented various security measures, users should be aware of the limitations and stay vigilant to protect themselves from scams and fraud. For businesses, upgrading to a Venmo Business Profile can offer higher transaction limits and additional security features.

To ensure a safe experience on Venmo, users should enable two-factor authentication, use strong passwords, verify payment requests, and be cautious with QR codes and public Wi-Fi. By staying informed, adopting best practices, and being proactive in safeguarding their personal and financial information, users can confidently utilize Venmo as a reliable and secure payment solution in the ever-evolving digital landscape.

Frequently Asked Questions (FAQs)

Is Venmo safe to use?

Venmo has implemented various security measures, such as encryption, two-factor authentication, and biometric login options, to protect user data and financial information. While it is considered safe, users should remain cautious and follow security best practices to enhance their safety.

Can I use Venmo for business transactions?

Yes, Venmo offers a feature called “Venmo for Business,” allowing merchants to accept payments from customers and clients. However, businesses are encouraged to upgrade to a Venmo Business Profile to access higher transaction limits and additional security features.

Are there any fees for using Venmo?

Venmo charges a fee for instant transfers to a bank account, but standard bank transfers are usually free. Sending money using a credit card may also incur a fee. Personal payments between friends and family are typically fee-free.

How do I protect myself from Venmo scams?

To stay safe from scams, users should enable two-factor authentication, use strong and unique passwords, verify payment requests, be cautious with QR codes and public Wi-Fi, and stay informed about common scams and security best practices.

Is Venmo a secure platform for businesses?

Venmo can be secure for businesses if they upgrade to a Venmo Business Profile. Business owners gain access to higher transaction limits and additional security features, making it a safer option for conducting business transactions.

Can I reverse a payment on Venmo?

Venmo does not offer a built-in feature to reverse payments once they are sent. If you encounter an issue with a payment, you can try contacting the recipient and request a refund. However, Venmo's buyer protection policy may offer assistance in certain cases.