Home renovations cost a pretty penny and sometimes you don’t want to use up your savings. A credit card means paying interest, but there are ways around it, especially if you’ll shop at Home Depot.

The Home Depot credit card makes it easy to afford your home renovations and offers the option to avoid interest. Here’s everything you must know.

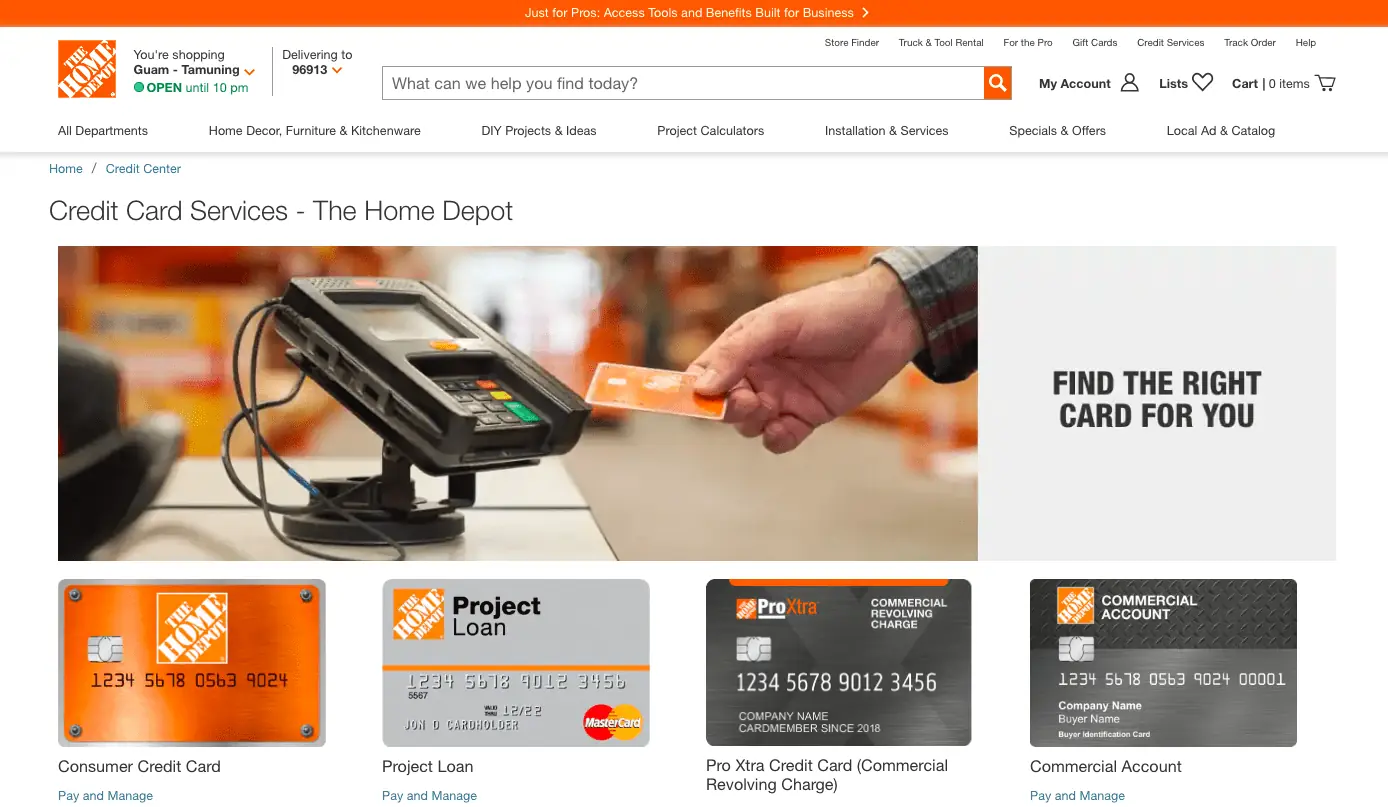

What is the Home Depot Credit Card?

The Home Depot credit card is a store-branded credit card for use can be used only at Home Depot. It offers 0% interest for six months on projects over $299 and offers credit limits up to $55,000 for those who qualify.

It can be a great credit card for your home improvement needs, but it helps to understand how it works.

How Does it Work?

The Home Depot credit card is unsecured. You don’t need collateral to get it, but you must have the right credit score and income to qualify for it.

If approved, you get a credit line you can use like any other credit card to pay for your home renovation needs. There isn’t an annual fee, which is nice, but the interest rate can be high (7.42% – 26.99%).

Like most credit cards, you’ll pay interest on any balances you carry and when you pay off your balance, you can reuse the credit line for future products. However, Home Depot does offer deferred interest, which can be deceiving, so read on to learn how it works.

Understanding Deferred Interest

Home Depot offers a 0% APR for six months on purchases over $299. It sounds great at first but look at the fine print.

You must pay the balance off in full within 6 months to pay no interest. If you don’t, you’ll pay interest starting back at day one. In other words, interest accrues the entire time, but if you pay the balance off before the six-month expiration date, they’ll waive it.

So, it’s not the same as 0% interest. It’s only 0% if you pay the balance off in time otherwise it’s just deferred interest that you pay at a later time.

Home Depot Credit Card Features

Besides the 0% APR on orders over $299, the Home Depot card offers other benefits including the following.

No Annual Fee

The Home Depot card doesn’t have an annual fee and it includes many nice features. Typically, credit cards with any out of the ordinary features charge an annual fee. On the flip side, though, the Home Depot card doesn’t pay any cashback or store rewards, so it’s a tradeoff.

One-Year for Returns

Any purchases made with the Home Depot credit card can be returned for 365 days. That’s a much longer time than most stores allow, which is a nice benefit.

Discounts on your First Purchase

When you open a Home Depot card, you can get the following discounts:

- $25 off purchases $25 to $299

- $50 off purchases $300 to $999

- $100 off purchases $1,000 or more

Opportunities for Special Promotions

Periodically Home Depot also offers special promotional periods allowing you to spread out your 0% APR for as long as 24 months.

No Liability for Unauthorized Charges

Home Depot has your back if someone steals or hacks your credit card. Report unauthorized charges right away and you won’t be liable for them.

How to Apply for the Home Depot Credit Card

It’s easy to apply for the Home Depot card. You can apply online or in-store at any register. Typically, you’ll receive an answer instantly unless they need more information from you. If you’re declined, they will mail you the reason and you’ll have the right to request the credit report they used to make their decision.

Alternatives to the Home Depot Credit Card

If you’re doing major home renovations, you have a few other options to compare the Home Depot credit card to, including the following.

Home Equity Line of Credit

If you have equity in your home, you can borrow against it with a HELOC. This is a line of credit, like a credit card, against your home. If you don’t make your payments, you risk your home, but you might be able to borrow more than you would with a Home Depot card.

A HELOC has a variable interest rate, and you can draw funds for up to 10 years. You only owe interest payments on the funds you withdrew. You can pay the principal back if you want, but it’s not required until the draw period ends, and the repayment period begins after 10 years.

Cash-Out Refinance

A cash-out refinance is a first mortgage. You pay off your first mortgage and take a larger loan amount, taking the difference to renovate your home.

The cash-out refinance has lower interest rates than a HELOC and the rates are fixed, which is nice. However, your home is the collateral so only use this option if you know you can afford the payments.

Reward Credit Card

Home Depot accepts most major credit cards. If you have a reward credit card that pays a decent percentage back for home improvement stores, you might make a decent amount of money back.

To determine if it’s better than the Home Depot card, look at the interest charges. If you can pay your Home Depot bill off in 6 months, you’ll pay no interest. Compare the interest savings to the rewards you could earn to see which is better.

Final Thoughts

The Home Depot credit card is great for people with less than perfect credit and who know they can pay off the amount they’ll charge within 6 months. Use the card right and you’ll save a significant amount of money.

Use it wrong, though, and you could get in over your head in debt. Just like any credit card, make sure you understand the fine print and how to make the most out of your Home Depot credit card and home renovations.