In the fast-paced world of modern commerce, electronic transactions have become the lifeblood of businesses, offering convenience and efficiency like never before. Among the various electronic payment methods, the Automated Clearing House (ACH) system stands tall as a reliable and widely used mechanism for fund transfers.

In this guide, we unveil the secrets to effectively ways to handle ACH disputes, claims, and chargebacks, equipping you with the knowledge and strategies necessary to handle difficult situations related to ACH.

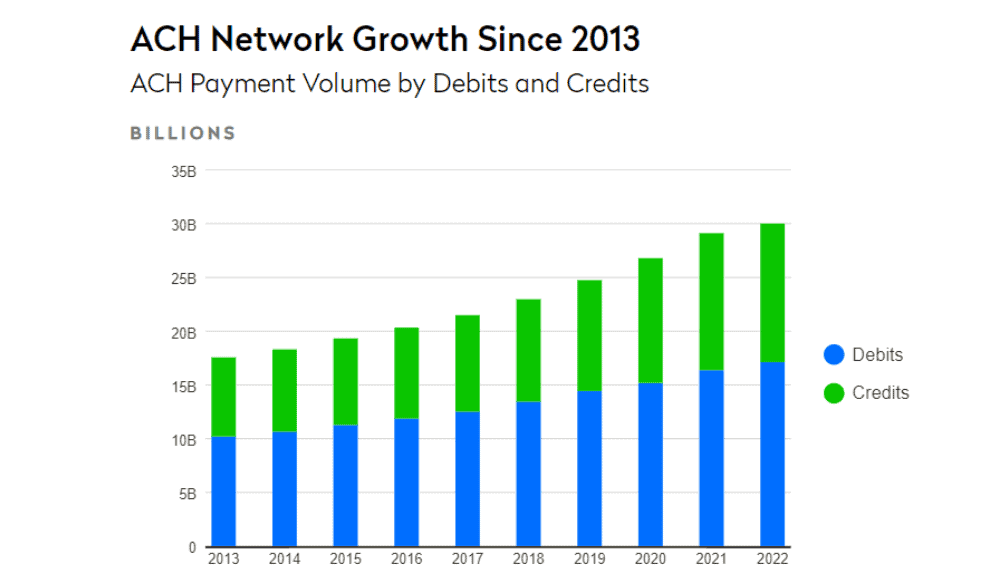

YoY Growth:

Payments: 3.0%

Dollars: 5.6%

Total Payments: 30.00 billion

Debits: 17.12 billion

Credits: 12.88 billion

Total Dollars Transferred:$72.62 trillion

What is an ACH Dispute or Claim?

An ACH dispute or claim refers to a situation in which a customer challenges a transaction processed through the Automated Clearing House (ACH) network. The ACH system is a secure and efficient method for electronically transferring funds between financial institutions, often used for various transactions such as direct deposits, bill payments, and recurring payments. However, despite its reliability, discrepancies can arise, leading to customers questioning the legitimacy or accuracy of a particular ACH transaction.

ACH disputes or claims typically occur when a customer notices an unauthorized or erroneous charge on their bank statement or believes a transaction was mishandled. It could be due to an overcharged amount, a duplicate entry, a canceled service still being billed, or any other billing error.

To initiate an ACH dispute, the customer contacts their bank or financial institution, which then investigates the matter. If the bank determines the dispute is valid, they will proceed with the dispute process, working with the receiving bank to resolve the issue. This might involve reversing the transaction, refunding the customer’s account, or providing evidence to support the legitimacy of the transaction.

As a business owner, understanding ACH disputes and claims is crucial to effectively handling customer concerns, maintaining a positive reputation, and ensuring smooth financial operations. Proactively addressing such disputes with transparency and efficiency can strengthen customer trust and loyalty, ultimately benefiting both your business and its clientele.

What is an ACH Chargeback?

An ACH chargeback is a process through which a customer disputes a transaction processed through the Automated Clearing House (ACH) network and seeks a reversal of funds directly from their financial institution. Similar to chargebacks in credit card transactions, an ACH chargeback allows customers to request refunds or claim unauthorized or fraudulent charges, but it specifically applies to payments made through the ACH system.

When a customer believes that a transaction is erroneous, unauthorized, or not in accordance with their agreement, they can contact their bank or financial institution to initiate the chargeback process. The bank will investigate the claim and, if found valid, will work with the receiving bank to recover the funds from the merchant’s account.

Common reasons for ACH chargebacks include billing errors, duplicate charges, goods or services not delivered as promised, or instances of fraud where the customer’s account information was used without their consent.

As a merchant, it’s essential to handle ACH chargebacks promptly and professionally. Disputes should be addressed with accurate records and evidence to support the legitimacy of the transaction, as chargebacks can lead to financial losses, additional fees, and potential damage to your business’s reputation. By proactively monitoring transactions and providing excellent customer service, merchants can reduce the occurrence of chargebacks and maintain a positive relationship with their customers.

Why Customers Need to Dispute an ACH Transaction?

Customers need to dispute ACH transactions to protect themselves from unauthorized activity, rectify billing errors, resolve issues with goods or services, address cancellation problems, and safeguard against fraud. By promptly addressing and resolving these disputes, businesses can demonstrate their commitment to customer satisfaction and maintain a positive reputation in the marketplace.

Unauthorized Transactions

One of the primary reasons customers need to dispute an ACH transaction is when they notice unauthorized activity on their bank account. If they identify a payment or withdrawal they did not authorize or recognize, it raises a red flag and prompts them to take action to protect their finances.

Billing Errors

Customers may also need to dispute ACH transactions due to billing errors. This could involve being charged the wrong amount, being double-billed for a single transaction, or experiencing discrepancies between the agreed-upon price and the actual charged amount.

Non-Receipt of Goods or Services

Another significant reason for ACH disputes is the non-receipt of goods or services. If customers paid for a product or service but did not receive what was promised or expected, they have a valid reason to initiate a dispute and seek a refund.

Dissatisfaction with Quality or Performance

Customers may dispute an ACH transaction when they are dissatisfied with the quality or performance of the received goods or services. If the purchased item is defective, subpar, or does not meet their expectations, they may request a chargeback to reclaim their funds.

Cancellation Issues

When customers cancel a subscription or service but continue to be charged, they may need to dispute the ACH transaction. In such cases, they would expect the recurring charges to stop after the cancellation, and any further deductions become grounds for a dispute.

Fraudulent Activity

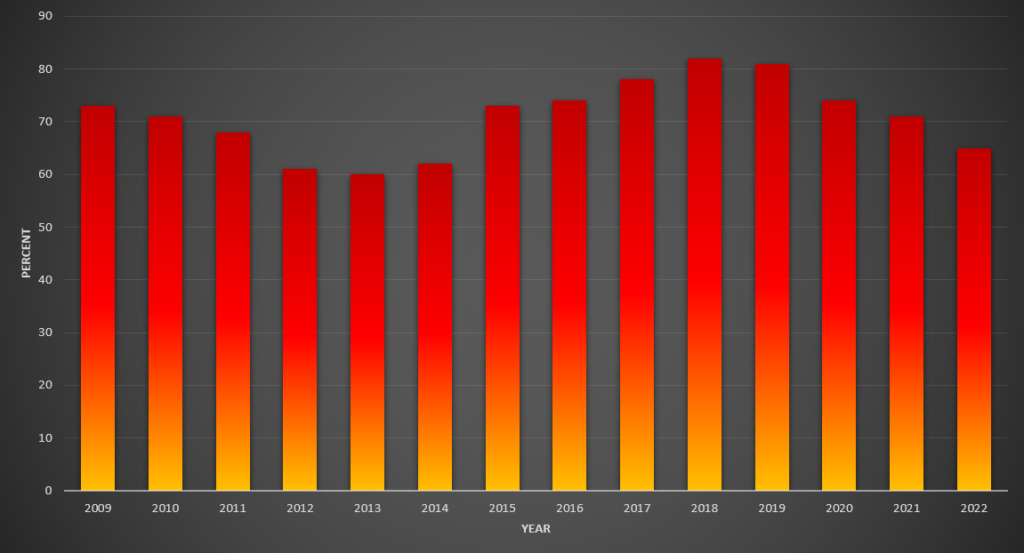

Organizations victims of payment fraud over the years (data 2009-2022)

Source: Afponline

Customers and organizations could encounter fraudulent ACH transactions if their bank account information is compromised or used without their consent. In these situations, they must dispute the unauthorized charges to recover their money and safeguard their account.

ACH Errors or Processing Delays

Occasionally, ACH transactions may experience errors or processing delays. This can result in unintended consequences, such as payments not going through on time or being processed incorrectly, leading customers to dispute the transactions to rectify the situation.

How to Handle ACH Disputes And Chargeback?

Handling an ACH chargeback requires a prompt and systematic approach to address the customer’s concerns and provide evidence to support the legitimacy of the transaction. Below are the steps to effectively handle an ACH chargeback:

Review the Chargeback Notice

When you receive a chargeback notice from your bank or payment processor, carefully review the details of the dispute. Understand the reason for the chargeback and gather all relevant transaction information, such as the date, amount, and customer details.

Communicate with the Customer

Reach out to the customer as soon as possible to understand their reason for initiating the chargeback. Maintaining open lines of communication can help resolve the issue quickly and prevent further escalations.

Gather Supporting Documentation

Compile all documentation related to the transaction in question. This could include purchase receipts, shipping and delivery confirmations, customer agreements, and any other evidence that proves the validity of the transaction.

Verify the Transaction

Thoroughly examine the transaction to ensure it was indeed legitimate and complied with the agreed-upon terms. Verify whether the product or service was delivered as promised and that the customer authorized the payment.

Respond to the Chargeback

Prepare a detailed and persuasive response to the chargeback. Provide clear evidence, including documentation and communication records, to demonstrate the validity of the transaction. Present your case concisely and professionally.

Submit the Response

Submit your response to the chargeback within the specified timeframe (typically within a few days to a few weeks). Missing the deadline could result in a default win for the customer, and the funds will be permanently deducted from your account.

Work with Your Bank/Processor

Cooperate with your bank or payment processor during the chargeback process. Be proactive in providing requested information and updates. They will act as an intermediary between you and the customer’s bank.

Be Prepared for Arbitration

In some cases, chargebacks may proceed to arbitration if the dispute remains unresolved. Be prepared to present your case in front of a third-party mediator should the situation escalate to this stage.

Analyze and Prevent Future Chargebacks

Take the opportunity to analyze the reasons behind the chargeback and identify any patterns or recurring issues. Implement measures to prevent similar chargebacks in the future, such as improving communication, refining billing processes, or enhancing customer service.

Remember, successfully handling ACH chargebacks requires a customer-focused approach, clear documentation, and proactive communication. Resolving disputes efficiently can help maintain positive relationships with customers and minimize the financial impact on your business.

ACH Dispute Remediation Tips

When faced with ACH disputes, implementing effective remediation strategies is crucial to efficiently resolve issues and maintain positive relationships with customers. Here are some tips to guide you through the ACH dispute remediation process:

Act Promptly

Address ACH disputes as soon as they arise. Prompt action shows customers that you take their concerns seriously and are committed to resolving the matter quickly.

Communicate Clearly

Maintain open and transparent communication with the customer throughout the dispute resolution process. Keep them informed about the progress and expected timelines.

Gather Evidence

Collect and organize all relevant documentation related to the disputed transaction. This may include transaction records, receipts, delivery confirmations, customer communication, and any other evidence supporting the validity of the transaction.

Verify Transaction Validity

Thoroughly investigate the disputed transaction to ensure its legitimacy. Double-check customer authorization, service or product delivery, and adherence to agreed-upon terms.

Be Customer-Focused

Prioritize customer satisfaction and aim to find a fair resolution that meets their needs. A customer-centric approach can help retain their loyalty and positive perception of your business.

Provide Refunds or Replacements

When appropriate, consider offering refunds or replacements for products or services that were not delivered as promised. This gesture can help defuse the dispute and rebuild customer trust.

Improve Communication Channels

Enhance your customer support and communication channels to make it easier for customers to reach out with questions or concerns. A responsive support team can help resolve issues before they escalate into disputes.

Review Internal Processes

Analyze the root causes of ACH disputes and identify any internal processes that may contribute to them. Implement necessary changes to prevent similar issues in the future.

Train Staff

Ensure your staff, particularly those handling customer interactions and payment processing, are well-trained in dispute resolution and customer service best practices.

Monitor and Analyze Trends

Regularly monitor dispute trends and patterns to identify potential issues or recurring problems. Use this data to proactively address areas of concern and improve your business operations.

Work Closely with Banks and Processors

Maintain a good working relationship with your banks and payment processors. They can assist you in navigating the dispute process and provide valuable insights into resolving issues.

Document Everything

Keep comprehensive records of all communications, actions taken, and resolutions offered during the dispute remediation process. This documentation can be useful in the event of arbitration or further escalations.

By following these tips, you can effectively handle ACH disputes, minimize financial losses, and maintain a positive reputation for your business in the eyes of your customers. Remember that dispute resolution is an opportunity to showcase your commitment to customer satisfaction and build lasting relationships.

How to Handle Fraudulent ACH Returns

Handling fraudulent ACH returns requires swift action and careful attention to protect your business from financial losses and reputational damage. Here’s a step-by-step guide on how to handle fraudulent ACH returns effectively:

Identify Fraudulent ACH Returns

Monitor your transaction records regularly to identify any suspicious or unauthorized ACH returns. Look for unusual patterns, unfamiliar customer names, or unexpected return reasons.

Gather Transaction Information

Collect all relevant transaction information related to the fraudulent ACH return. This includes the date, amount, customer details, and any supporting documentation associated with the original transaction.

Contact Your Bank or Payment Processor

Notify your bank or payment processor immediately after detecting the fraudulent ACH return. They will guide you through the next steps and initiate the dispute process with the receiving bank.

Initiate the Dispute Process

Provide all the necessary documentation and evidence to support the legitimacy of the original transaction and demonstrate that it was not fraudulent. Your bank will use this information to challenge the return on your behalf.

Communicate with the Customer

Reach out to the customer involved in the disputed transaction to confirm their identity and inquire about the situation. It’s possible that the customer may not be aware of the fraudulent return, or they may be a victim of identity theft.

Offer Refunds or Replacements (if applicable)

If the customer was indeed a victim of fraud, offer refunds or replacements for any products or services that were not delivered as promised. This shows goodwill and helps resolve the issue amicably.

Improve Security Measures

Assess your business’s security measures and implement necessary improvements to prevent future fraudulent ACH returns. This may include enhancing customer authentication protocols, using encryption, or investing in fraud detection tools.

Report to Authorities

If you suspect criminal activity or deliberate fraud, report the incident to the appropriate authorities, such as law enforcement agencies or your local banking regulatory body.

Cooperate with Investigations

Cooperate fully with your bank, law enforcement agencies, or any other entities conducting investigations into fraudulent activity. Providing any requested information promptly can help expedite the resolution process.

Educate Staff and Customers

Train your staff to recognize signs of potential fraud and establish protocols for handling suspicious transactions. Educate your customers about the importance of safeguarding their account information and being vigilant against phishing attempts and scams.

Document Everything

Maintain comprehensive records of all actions taken during the handling of fraudulent ACH returns. This documentation can be valuable in case of future disputes or legal proceedings.

Remember, taking proactive measures to prevent fraud and promptly addressing any fraudulent ACH returns is essential to safeguard your business and maintain customer trust. Regularly review your security practices and stay informed about the latest fraud prevention strategies to stay one step ahead of potential threats.

How to Prevent ACH Chargebacks and Returns

Preventing ACH chargebacks and returns requires a proactive approach and the implementation of effective strategies to minimize the occurrence of disputes. Here are some essential tips to help prevent ACH chargebacks and returns:

Clear and Transparent Billing

Ensure your billing statements and invoices are clear, detailed, and transparent. Provide customers with accurate descriptions of the goods or services they are being billed for, including the amount and date of the transaction.

Obtain Proper Authorization

Always obtain proper authorization from customers before processing ACH transactions. This could be in the form of written consent, an electronic signature, or a recorded phone call. Retain proof of authorization in case of disputes.

Use Descriptive Billing Descriptors

Use easily recognizable and descriptive billing descriptors that customers can identify on their bank statements. This reduces the likelihood of customers disputing a charge due to confusion over the origin of the transaction.

Provide Excellent Customer Service

Offer excellent customer service and be responsive to customer inquiries and concerns. A positive customer experience can reduce the likelihood of customers seeking chargebacks as a means to resolve issues.

Set Realistic Delivery Expectations

If your business involves delivering goods or services, set realistic expectations for delivery times. Provide tracking information, if applicable, so customers can anticipate when to expect their order.

Implement a Clear Refund Policy

Establish a clear and easy-to-understand refund policy and communicate it to customers. Make it simple for customers to request refunds or returns if they are dissatisfied with their purchase.

Monitor ACH Transactions Regularly

Monitor ACH transactions regularly to detect and address potential issues or errors promptly. Early intervention can prevent chargebacks from escalating.

Address Customer Complaints Promptly

Respond to customer complaints and inquiries as soon as possible. Addressing issues proactively can often prevent them from escalating to chargebacks.

Strengthen Security Measures

Implement robust security measures to safeguard customer data and prevent unauthorized access. Use encryption and multi-factor authentication to protect sensitive information.

Verify Recurring Payment Authorizations

For recurring ACH payments, regularly verify customer authorizations to ensure they still wish to continue the service. Notify customers before processing recurring payments to minimize surprises.

Train Staff in Dispute Resolution

Train your staff in effective dispute resolution techniques and ensure they are well-versed in handling customer concerns professionally and empathetically.

Monitor Dispute Trends

Keep track of ACH dispute trends to identify recurring issues. Analyze the root causes and take proactive steps to address these issues to prevent future disputes.

By implementing these preventive measures, you can significantly reduce the likelihood of ACH chargebacks and returns, improve customer satisfaction, and maintain a smooth payment process for your business.

Final Words

Handling ACH disputes, claims, chargebacks, and fraudulent returns requires a comprehensive and customer-centric approach. Being well-prepared to navigate these complex situations is essential for any business to maintain its financial stability and reputation.

By promptly addressing customer concerns, gathering supporting documentation, and cooperating with banks and payment processors, businesses can effectively resolve disputes and build stronger relationships with their clientele. Moreover, taking proactive measures to prevent ACH chargebacks and returns, such as transparent billing, obtaining proper authorization, and offering excellent customer service, can significantly reduce the likelihood of disputes arising in the first place.

Continuous monitoring, analysis, and improvement of internal processes are vital for enhancing security and minimizing fraudulent activities. As businesses prioritize customer satisfaction and implement robust dispute resolution strategies, they can thrive in the fast-paced world of electronic transactions, foster trust with their customers, and ensure a prosperous and resilient future.

Frequently Asked Questions (FAQs)

What should I do if I notice an unauthorized ACH transaction on my bank statement?

If you identify an unauthorized ACH transaction on your bank statement, act promptly. Contact your bank immediately to report the unauthorized activity and initiate an ACH dispute. Your bank will investigate the matter and work towards resolving the issue.

What are common reasons for ACH chargebacks?

Common reasons for ACH chargebacks include billing errors, non-receipt of goods or services, dissatisfaction with product quality, unauthorized transactions, cancellation issues, and fraudulent activity.

Can I get a refund through an ACH chargeback?

Yes, if you successfully dispute a transaction through an ACH chargeback and the bank determines it is valid, you may receive a refund for the disputed amount.

How long does it take to resolve an ACH dispute?

The time it takes to resolve an ACH dispute can vary depending on the complexity of the case and the responsiveness of the involved parties. In general, it may take a few days to several weeks for the dispute to be resolved.

How can I prevent ACH chargebacks and returns in my business?

To prevent ACH chargebacks and returns, focus on clear communication with customers, obtain proper authorization for transactions, offer excellent customer service, and establish a transparent refund policy. Regularly monitor transactions and address customer concerns promptly to reduce the likelihood of disputes.

What can I do to protect my business from fraudulent ACH returns?

To protect your business from fraudulent ACH returns, implement robust security measures such as encryption, multi-factor authentication, and regular verification of customer authorizations. Educate your staff and customers about the importance of security and vigilant against phishing attempts and scams.

Can I appeal an ACH chargeback decision?

Yes, if your ACH chargeback is not resolved in your favor, you may have the option to appeal the decision. Check with your bank or payment processor about their specific appeal process and requirements.

What are the potential consequences of excessive ACH disputes for my business?

Excessive ACH disputes can have negative consequences for your business, including financial losses, increased processing fees, and damage to your reputation. Payment processors and banks may also impose penalties or restrictions on businesses with high dispute rates.