Are you tired of encountering the frustrating Error Code 12 – Invalid Transaction when trying to complete a simple task on your computer or while navigating your favorite software? Don’t worry, you’re not alone! In this comprehensive guide, we’ll uncover the Error Code 12 and equip you with a range of effective solutions to get you back on track.

What Does Error Code 12 Mean?

Error Code 12 is a common issue encountered in various computer systems and software applications. It typically points to an “Invalid Transaction” error, indicating that a requested operation or transaction failed due to inconsistency or error in the process. The error message can vary depending on the context in which it occurs, but its core meaning remains consistent – something went wrong during the transaction, rendering it invalid and unable to proceed.

The causes of Error Code 12 can be diverse, ranging from corrupt system files, software conflicts, inadequate permissions, hardware issues, or even transient glitches. Resolving this error requires a systematic approach involving troubleshooting, diagnosing the underlying problem, and applying specific fixes accordingly. Users may need to delve into system logs, update drivers, repair software installations, or utilize built-in troubleshooting tools to pinpoint and resolve the root cause.

Addressing Error Code 12 is crucial to restoring normal functionality and preventing potential data loss or system instability. Understanding the meaning of this error code is the first step towards finding an effective solution and ensuring a smoother computing experience.

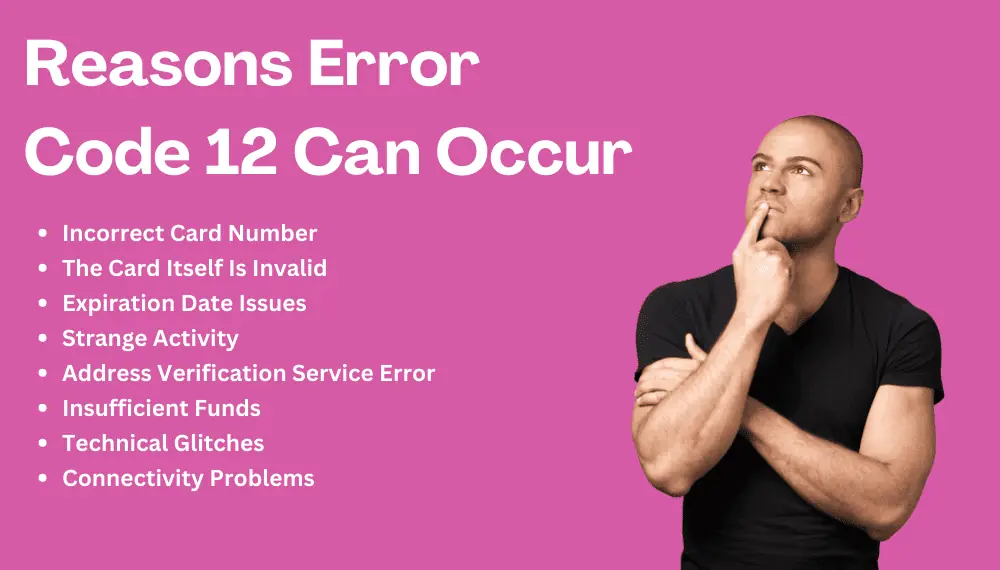

Reasons Error Code 12 Can Occur

Error Code 12, often associated with the message “Invalid Transaction,” is a common occurrence in the world of credit card transactions and online payments. It can be quite frustrating for both consumers and merchants, as it hinders the seamless processing of transactions. Several factors can contribute to the emergence of Error Code 12. Let’s explore some of the key reasons below:

Incorrect Card Number

One of the primary culprits behind Error Code 12 is an incorrect or mistyped card number. A small typo or transposed digits during the entry of the credit card details can render the transaction invalid, leading to an error message.

The Card Itself Is Invalid

Error Code 12 may also arise if the credit card itself is invalid or expired. This could be due to a canceled or closed account, an expired card, or a card that has not been activated for online transactions.

Expiration Date Issues

When the expiration date of the credit card provided during the transaction is either missing or incorrectly entered, the transaction can be flagged as invalid, resulting in Error Code 12.

Strange Activity

Financial institutions and credit card companies employ sophisticated fraud detection systems to protect users from unauthorized transactions. If a transaction appears suspicious or deviates from the cardholder’s regular spending patterns, it might be deemed invalid, triggering Error Code 12 as a security measure.

Address Verification Service Error

The Address Verification Service (AVS) is used to compare the address provided by the customer during the transaction with the billing address on record with the card issuer. If there’s a discrepancy between the two, the transaction may be marked as invalid, resulting in Error Code 12.

Insufficient Funds

A common reason for Error Code 12 in debit card transactions is insufficient funds in the account. If the available balance in the linked bank account is not enough to cover the transaction amount, it will be considered invalid, and the error will be displayed.

Technical Glitches

At times, technical issues within the payment gateway, the merchant’s website, or the card processing network can lead to Error Code 12. These glitches may interrupt the transaction flow and result in an invalid transaction status.

Connectivity Problems

In online transactions, connectivity problems can occur between the merchant’s server and the payment processor. If the connection is disrupted during the transaction process, it can lead to an incomplete transaction, triggering Error Code 12.

Error Code 12 – Invalid Transaction, while frustrating, serves as an essential security measure and ensures the safety of users’ financial information. Understanding the various reasons behind this error can help consumers and merchants troubleshoot and address the issues promptly. By double-checking card details, staying vigilant against fraud, and ensuring a seamless payment process, the chances of encountering Error Code 12 can be significantly reduced.

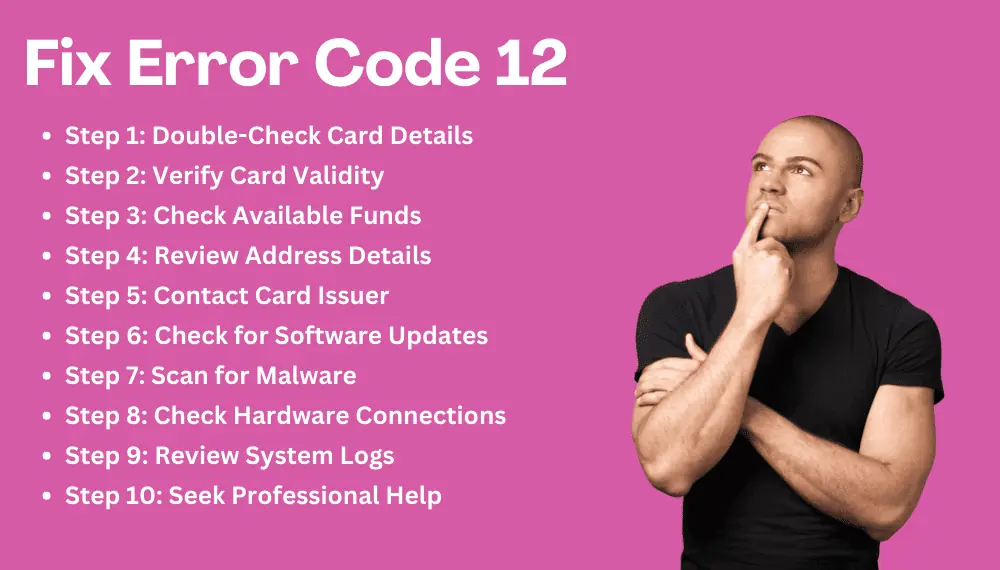

Steps to Fix Error Code 12

Fixing Error Code 12 – Invalid Transaction requires a systematic approach to identify and address the underlying issue. Below are the steps you can follow to troubleshoot and resolve Error Code 12:

Step 1: Double-Check Card Details

If you encounter Error Code 12 during a credit card transaction, ensure that you have entered the card number, expiration date, and CVV (Card Verification Value) correctly. Even a small typo in the card details can cause the transaction to be flagged as invalid.

Step 2: Verify Card Validity

Confirm that the credit card being used is valid and not expired. Check the expiration date on the card and verify that the card is still active and authorized for online transactions.

Step 3: Check Available Funds

In the case of debit card transactions, ensure that there are sufficient funds available in the linked bank account to cover the transaction amount. Insufficient funds can lead to an invalid transaction and trigger Error Code 12.

Step 4: Review Address Details

For transactions that involve Address Verification Service (AVS), review the address details provided during the transaction. Ensure that the billing address entered matches the address on record with the card issuer to avoid potential AVS errors.

Step 5: Contact Card Issuer

If you’ve confirmed that the card details are correct and there are sufficient funds, but the error persists, contact the card issuer or bank. They can provide insights into any issues with the card or transaction and help resolve the problem.

Step 6: Check for Software Updates

If the error occurs while using specific software, check for updates or patches for that application. Software updates often include bug fixes that may resolve known issues, including Error Code 12.

Step 7: Scan for Malware

To see if any malicious software is interfering with your transactions, run a full malware scan on your computer. Malware can interfere with system performance and result in issues like Error Code 12.

Step 8: Check Hardware Connections

If you encounter Error Code 12 in hardware-related scenarios, such as with graphics cards or network cards, ensure that all hardware components are properly connected. Re-seat the hardware if necessary, and ensure that drivers are up-to-date.

Step 9: Review System Logs

Check system logs and error messages for any relevant information about the cause of Error Code 12. System logs can offer valuable insights into potential issues that may not be apparent on the surface.

Step 10: Seek Professional Help

If you’ve exhausted all troubleshooting options and the error persists, consider seeking help from technical support or IT professionals. They can conduct more in-depth diagnostics and provide tailored solutions for your specific situation.

By following these steps and being patient during the troubleshooting process, you can increase the chances of identifying and resolving the underlying cause of Error Code 12 – Invalid Transaction, allowing you to proceed with your transactions smoothly.

How Can Businesses Deal with Error Code 12

Dealing with Error Code 12 – Invalid Transaction is crucial for businesses that rely on smooth payment processing and seamless customer experiences. Addressing this error promptly can help prevent potential loss of sales and maintain customer trust. Here’s how businesses can effectively deal with Error Code 12:

Provide Clear Error Messages

Ensure your error messages are user-friendly and provide clear instructions on what might be causing the error. Avoid generic error messages and provide specific guidance on how users can rectify the issue, such as checking card details or contacting customer support.

Offer Multiple Payment Options

Diversify your payment options to accommodate various customers’ preferences. By offering multiple payment gateways and alternative payment methods, customers facing issues with one method can choose an alternative, reducing the impact of Error Code 12.

Implement Address Verification

Integrate Address Verification Service (AVS) into your payment processing system. AVS helps validate the cardholder’s address, reducing the likelihood of receiving Error Code 12 due to address discrepancies.

Ensure Secure Payment Processing

Invest in robust security measures to protect against fraud and ensure secure payment processing. Implement encryption, tokenization, and other security protocols to safeguard customer data and prevent unauthorized transactions that may trigger Error Code 12.

Monitor Transactions and Detect Anomalies

Use transaction monitoring tools and fraud detection systems to identify unusual or suspicious activities. By detecting potential fraud in real-time, businesses can prevent invalid transactions and potential Error Code 12 occurrences.

Train Customer Support Staff

Equip your customer support team with knowledge about Error Code 12 and its possible causes. Provide them with troubleshooting guidelines to help customers resolve the issue swiftly and efficiently.

Perform Regular Software Updates

Stay up-to-date with the latest software releases and security patches. Regularly update your payment processing systems, e-commerce platforms, and related software to fix known bugs and potential issues that may trigger Error Code 12.

Conduct Periodic System Audits

Conduct regular audits of your payment processing infrastructure and systems. Identify and resolve any vulnerabilities or inefficiencies that might lead to error occurrences.

Communicate with Payment Processors

Maintain open communication with your payment processors and acquirers. Inquire about any potential issues or updates that might affect your transactions and collaborate on resolving them effectively.

Offer Prompt Customer Support

Have a responsive and knowledgeable customer support team in place to assist customers facing Error Code 12. Promptly address customer inquiries and provide solutions to enhance the overall customer experience.

By implementing these strategies, businesses can effectively deal with Error Code 12, minimize its occurrence, and ensure a smooth payment processing experience for their customers. Proactive measures and customer-centric solutions can contribute significantly to maintaining customer loyalty and satisfaction.

Final Words

In conclusion, Error Code 12 – Invalid Transaction can be a frustrating hurdle for both individuals and businesses, but it is a common issue that can be addressed with the right approach. By understanding the potential causes of Error Code 12 and following the appropriate troubleshooting steps, users can resolve the error and continue their tasks with minimal disruption.

For businesses, dealing with Error Code 12 involves a combination of providing clear error messages, implementing security measures, offering multiple payment options, and ensuring proactive customer support. By prioritizing secure payment processing, staying updated with software, and monitoring transactions, businesses can minimize the occurrence of Error Code 12 and maintain a seamless payment experience for their customers.

Overall, taking the necessary steps to tackle Error Code 12 will lead to improved customer satisfaction, trust and ultimately, a smoother and more successful operation for both individuals and businesses alike.

Frequently Asked Questions (FAQs)

Why am I getting Error Code 12 during online transactions?

Error Code 12 during online transactions can occur due to various reasons, such as incorrect card details, invalid cards, expiration date issues, address verification errors, or suspicious activity on the account.

How can I fix Error Code 12 during credit card transactions?

To fix Error Code 12 during credit card transactions, ensure that you have entered the correct card details, verify that the card is valid and not expired, and check for sufficient funds in the linked bank account. Additionally, review the address details provided during the transaction for any discrepancies.

Why does Error Code 12 occur in hardware-related scenarios?

In hardware-related scenarios, Error Code 12 can occur due to faulty or poorly connected hardware components, outdated or incompatible drivers, or resource exhaustion leading to insufficient system resources for the transaction.

What should I do if Error Code 12 persists after troubleshooting?

If Error Code 12 continues to persist after trying the basic troubleshooting steps, consider contacting your card issuer or bank to verify the card's status. You may also seek assistance from technical support or IT professionals for more in-depth diagnostics and solutions.

Does Error Code 12 always indicate a problem with the user's card or account?

Not necessarily. While Error Code 12 can be related to issues with the card or account details, it can also be triggered by software conflicts, hardware problems, system issues, or temporary glitches in the transaction process.

Does Error Code 12 always indicate a problem with the user's card or account?

Not necessarily. While Error Code 12 can be related to issues with the card or account details, it can also be triggered by software conflicts, hardware problems, system issues, or temporary glitches in the transaction process.

How important is it for businesses to handle Error Code 12 promptly?

Handling Error Code 12 promptly is crucial for businesses to ensure a seamless customer experience, prevent loss of sales, and maintain customer trust. Prompt resolution can also contribute to enhanced security and fraud prevention in payment processing.