Businesses accept credit cards and they must follow strict rules set by the Payment Card Industry (PCI) to keep transactions safe. If they don’t follow these rules, they can get in serious trouble and lose money and trust from customers.

This is where Approved Scanning Vendors (ASV) come in to help businesses. They assist businesses in following the PCI rules. But what exactly are these PCI compliance vendors, and how do they help businesses deal with the complicated PCI rules? In this article, we will explore ASV scanning and learn about the important role these vendors play. We will also find out how to choose the best ASV for your business to ensure a safe and smooth payment process.

What is an Approved Scanning Vendor (ASV)?

An Approved Scanning Vendor (ASV) is a crucial player in the world of cybersecurity and compliance with Payment Card Industry (PCI) standards. In simple terms, an ASV is a specialized company that helps other businesses ensure the security of their online payment systems. When a business accepts credit card payments, it must adhere to strict PCI standards to protect sensitive customer data from potential breaches and fraud.

ASVs are authorized by the PCI Security Standards Council to conduct security scans on these businesses’ networks and websites. These scans are thorough assessments that identify potential vulnerabilities and weaknesses in the systems. By pinpointing these weaknesses, businesses can take prompt action to fix them and improve their security measures, ultimately achieving and maintaining PCI compliance.

In essence, ASVs act as trustworthy guides, helping businesses navigate the complex world of cybersecurity and ensuring they meet the necessary standards to safeguard their customers’ data and maintain the trust of the wider online community.

What Does PCI ASV Mean?

Image source

PCI ASV stands for “Payment Card Industry Approved Scanning Vendor.” It refers to a specialized company that is authorized by the Payment Card Industry Security Standards Council (PCI SSC) to perform security scans on businesses’ networks and websites. The primary purpose of PCI ASVs is to assess the security of online payment systems and ensure compliance with the PCI DSS.

It is a set of comprehensive security standards designed to protect cardholders’ data and prevent fraud and data breaches. Any business that accepts credit card payments must comply with PCI DSS requirements to ensure the safety of sensitive customer information.

When businesses engage in a PCI ASV, the vendor conducts regular security scans to identify potential vulnerabilities and weaknesses in the payment system. By doing so, they help businesses address security issues promptly and enhance their overall data security posture. PCI ASVs play a crucial role in promoting a secure and trustworthy environment for online transactions, protecting both businesses and their customers from potential cyber threats.

Understanding How PCI Scans Work

PCI scans, or Payment Card Industry scans, are essential for businesses that handle credit card transactions. These scans help ensure that businesses comply with PCI DSS, a set of security standards designed to protect cardholder data and prevent data breaches. In this section, we’ll delve into how PCI scans work and their significance in maintaining a secure payment processing environment.

The Purpose of PCI Scans

The primary purpose of PCI scans is to assess the security of a business’s network and systems that handle credit card transactions. These scans are typically performed by Approved Scanning Vendors (ASVs) authorized by the PCI Security Standards Council. By conducting regular PCI scans, businesses can identify potential vulnerabilities and security weaknesses that could be exploited by cybercriminals.

Types of PCI Scans

There are two main types of PCI scans: external scans and internal scans.

- External Scans: External scans are conducted from outside the business’s network. The ASV sends simulated attacks to the business’s external-facing systems, such as web servers and firewalls. The purpose is to identify any vulnerabilities that an external attacker could exploit.

- Internal Scans: Internal scans, on the other hand, are conducted from within the business’s network. These scans identify vulnerabilities that may be present on internal systems and devices, providing insight into potential risks within the network.

Vulnerability Assessment

During a PCI scan, the ASV performs a vulnerability assessment by using specialized scanning tools. These tools check for common security weaknesses, such as outdated software, misconfigurations, and known vulnerabilities. The scan evaluates the business’s compliance with specific PCI DSS requirements related to network security.

Penetration Testing

In addition to vulnerability assessments, some PCI scans include penetration testing. Penetration testing, also known as ethical hacking, involves a controlled attempt to exploit vulnerabilities in the system. This testing goes beyond identifying weaknesses and aims to demonstrate the potential impact of an actual cyber attack.

Scan Results and Remediation

Once the PCI scan is completed, the ASV provides a detailed report of the findings. This report includes information on identified vulnerabilities and their severity level. The business then uses this information to prioritize and address the vulnerabilities based on their criticality. Implementing the necessary security measures is crucial to achieving and maintaining PCI compliance.

Rescanning for Compliance

After addressing the vulnerabilities, the business may need to undergo a re-scan to ensure the necessary fixes have been applied successfully. Rescans are essential to demonstrate compliance with PCI DSS requirements and verify that the business’s systems are adequately secured.

PCI scans play a vital role in securing payment card data and protecting businesses and customers from potential data breaches and fraud. By identifying vulnerabilities and weaknesses, businesses can take proactive steps to enhance their security measures and ensure compliance with PCI DSS standards. Regular PCI scans and prompt remediation contribute to creating a safer payment processing environment and maintaining trust with customers.

ASV Scanning and PCI Compliance

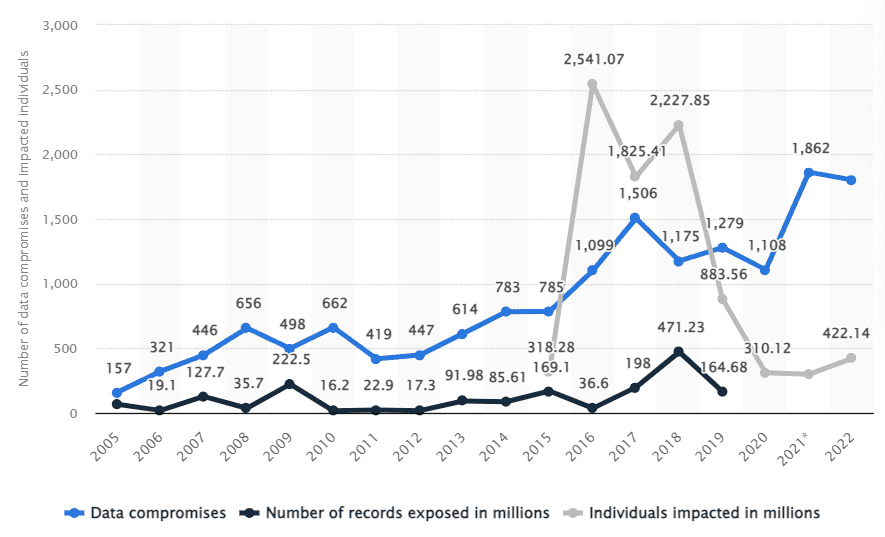

ASV scanning plays a crucial role in helping businesses achieve and maintain PCI compliance, which is essential in safeguarding sensitive consumer data from the rising threat of data theft and breaches. With the alarming increase in consumer data theft incidents over the years, adhering to PCI DSS has become more critical than ever.

Data theft incidents over the years – Source Statista

In 2021, a staggering 1,862 data compromises were reported by the Identity Theft Resource Center, surpassing the previous record set in 2017 with 1,506 breaches.

This alarming surge in data breaches highlights the pressing need for robust security measures to protect valuable cardholder information. PCI compliance is designed to establish a strong defense against cyber threats, ensuring that businesses handle payment card data securely and responsibly.

Approved Scanning Vendors (ASVs) are instrumental in this process, as they conduct thorough security scans on businesses’ networks and systems. These scans help identify potential vulnerabilities and weaknesses that malicious actors could exploit to gain unauthorized access to sensitive data. By promptly addressing these weaknesses, businesses can enhance their security posture, reducing the risk of data breaches and staying in compliance with PCI DSS requirements.

Overall, the significance of ASV scanning in achieving PCI compliance cannot be overstated. By proactively safeguarding consumer data, businesses can not only protect their reputation and customer trust but also contribute to the broader effort of combatting the escalating threat of data theft in the digital age.

Responsibilities of Approved Scanning Vendors (ASVs)

- Security Scanning

- ASVs are responsible for conducting thorough security scans on the networks and systems of businesses that handle credit card transactions. These scans aim to identify potential vulnerabilities and weaknesses that could be exploited by cybercriminals.

- Vulnerability Assessment

- ASVs perform comprehensive vulnerability assessments using specialized scanning tools. They check for outdated software, misconfigurations, and known security flaws to ensure compliance with Payment Card Industry Data Security Standard (PCI DSS) requirements.

- Penetration Testing

- Some ASVs also conduct penetration testing, where they simulate controlled cyber attacks to demonstrate the impact of potential real-world threats. This helps businesses understand the actual risks and take appropriate measures to strengthen their defenses.

- Reporting and Documentation

- After completing the scans, ASVs provide detailed reports of their findings to the businesses. These reports include identified vulnerabilities, their severity levels, and recommendations for remediation.

- Remediation Guidance

- ASVs offer guidance to businesses on how to address the identified vulnerabilities effectively. They assist in developing remediation strategies and ensuring that security measures are appropriately implemented.

- Compliance Verification

- ASVs play a vital role in verifying a business’s compliance with PCI DSS requirements. They help ensure that the business’s systems meet the necessary security standards.

Qualifications of Approved Scanning Vendors (ASVs)

PCI Security Standards Council Authorization

ASVs must be authorized by the PCI Security Standards Council to perform security scans and assessments. This authorization ensures that ASVs meet specific industry standards and adhere to best practices.

Technical Expertise

ASVs are required to have a team of skilled and knowledgeable cybersecurity professionals. They should possess expertise in conducting vulnerability assessments, penetration testing, and understanding various network configurations.

Experience and Track Record

A reputable ASV should have a proven track record of successfully performing security scans for a range of businesses. Experience in the field demonstrates their ability to handle diverse scenarios and challenges.

Up-to-Date Tools and Techniques

ASVs need to use the latest scanning tools and methodologies to conduct comprehensive assessments. Staying updated with the evolving cybersecurity landscape is vital for delivering accurate results.

Objectivity and Impartiality

ASVs should maintain objectivity and impartiality during the scanning process. They must provide unbiased reports and recommendations without favoring any particular vendor or technology.

Clear Communication Skills

Effective communication is essential for ASVs to convey their findings and remediation guidance to businesses in a clear and understandable manner. They should be able to articulate technical concepts to non-technical stakeholders.

![]() Recommended reading: Four Levels of PCI Compliance

Recommended reading: Four Levels of PCI Compliance

How Often Do You Need ASV Scanning?

The frequency of ASV scanning is primarily governed by the Payment Card Industry Data Security Standard (PCI DSS) requirements. According to PCI DSS, merchants are required to conduct an ASV scan at least once every 90 days. This quarterly scanning ensures that businesses regularly assess the security of their payment systems and identify any potential vulnerabilities.

However, it’s essential to note that the 90-day interval is a minimum requirement. If any significant changes are made to the payment system or network infrastructure, it is highly recommended to conduct an ASV scan sooner.

Changes to the system, such as updates, new hardware or software installations, or modifications to network configurations, can impact the security posture. In such cases, performing a scan promptly after the changes can help identify and address any emerging security risks.

While quarterly scanning is standard practice, staying proactive and vigilant about security is crucial for protecting sensitive cardholder data.

Engaging with an Approved Scanning Vendor (ASV) and adhering to the recommended scanning frequency can aid businesses in maintaining a robust security framework, ensuring compliance with PCI DSS standards, and safeguarding against potential data breaches and cyber threats.

Things to Look for in an ASV

When choosing an Approved Scanning Vendor (ASV) for your business, there are several essential factors to consider to ensure you partner with a reputable and capable provider. Here are some things to look for in an ASV:

PCI SSC Authorization

Verify that the ASV is authorized by the Payment Card Industry Security Standards Council (PCI SSC). This authorization ensures that the vendor meets the necessary standards and qualifications to perform PCI scans.

Experience and Expertise

Look for an ASV with a track record of experience in conducting security scans for businesses similar to yours. Experience demonstrates their proficiency in handling various network configurations and identifying vulnerabilities effectively.

Comprehensive Scanning Services

Ensure the ASV offers both external and internal scanning services. External scans assess vulnerabilities from outside your network, while internal scans identify risks within your internal systems.

Penetration Testing

Check if the ASV includes penetration testing as part of their services. Penetration testing simulates real-world cyber attacks to assess the impact of potential security breaches.

Reporting and Remediation Guidance

Review sample reports from the ASV to understand the quality and clarity of their findings. The ASV should provide detailed reports with actionable recommendations for remediation.

Communication Skills

Choose an ASV that can effectively communicate technical information to non-technical stakeholders. Clear communication is essential for understanding scan results and implementing necessary security measures.

Up-to-Date Tools and Methodologies

Ensure the ASV uses the latest scanning tools and methodologies to stay current with evolving cyber threats and security best practices.

Customer Support and Responsiveness

Evaluate ASV’s customer support and responsiveness. A reliable ASV should be available to address any questions or concerns promptly.

Cost and Value

Compare the costs and value provided by different ASVs. While price is a consideration, prioritize the quality of service and the value it brings to your organization’s security posture.

Industry Reputation and Reviews

Research the ASV’s reputation and read reviews from other businesses that have used their services. Positive reviews and a strong industry reputation are indicators of a trustworthy and reliable ASV.

By carefully considering these factors, you can make an informed decision when selecting an ASV that aligns with your business’s security needs and helps you achieve and maintain PCI compliance. Choosing the right ASV is a crucial step in ensuring the safety and integrity of your payment card data and protecting your business and customers from potential cyber threats.

Conclusion

In conclusion, the role of an Approved Scanning Vendor (ASV) in achieving and maintaining Payment Card Industry (PCI) compliance cannot be underestimated. ASVs play a critical role in helping businesses protect sensitive payment card data, thwart cyber threats, and build trust with customers. By conducting regular security scans, vulnerability assessments, and penetration testing, ASVs assist businesses in identifying and addressing potential weaknesses in their systems.

Moreover, their expertise, up-to-date tools, and clear communication ensure that businesses receive comprehensive reports and actionable recommendations for remediation. When choosing the right ASV, factors such as PCI SSC authorization, experience, comprehensive services, communication skills, and customer support should be carefully considered.

Ultimately, partnering with a reputable and reliable ASV not only helps businesses adhere to PCI DSS requirements but also fortifies their security measures, safeguarding both the organization and its valued customers from the ever-evolving landscape of cyber threats. With ASVs as trusted allies, businesses can confidently navigate the complexities of cybersecurity and ensure a secure and seamless payment processing journey.

Frequently Asked Questions (FAQs)

Why do businesses need ASV scanning?

ASV scanning is necessary for businesses that handle credit card payments to assess the security of their systems. PCI DSS requires regular scanning to identify vulnerabilities and weaknesses that could be exploited by cybercriminals. By addressing these issues promptly, businesses can enhance their security posture and protect sensitive payment card data.

What is the difference between external and internal scanning?

External scanning assesses vulnerabilities from outside a business's network, focusing on external-facing systems like web servers. Internal scanning, on the other hand, identifies risks within the internal network and systems. Both types of scanning are essential for a comprehensive security assessment.

How do ASVs help with PCI compliance?

ASVs conduct security scans and assessments, identify vulnerabilities, and provide remediation guidance. By addressing these issues, businesses can meet PCI DSS requirements, demonstrating their commitment to protecting cardholder data and maintaining compliance.

Can ASVs prevent data breaches?

While ASVs play a crucial role in identifying vulnerabilities, they do not guarantee the complete prevention of data breaches. Implementing the recommended security measures based on ASV findings is essential to minimize the risk of breaches.

Can small businesses benefit from ASV scanning?

Yes, ASV scanning is beneficial for businesses of all sizes. Protecting payment card data is essential for all organizations, and ASVs can tailor their services to suit the specific needs and resources of small businesses.