Fleet cards are an excellent way to provide flexibility to your fleet while on the road while also having better control over your fuel costs. When looking through the different available providers, you probably considered Fuelman’s fleet cards.

But how can you know whether they are the right provider for your business? Read along to find out.

This article will discuss the Fuelman fleet card, including its different types, pros and cons, and who the card works best for.

The Fuelman Fleet Card

The Fuelman fleet cards enable fleet managers to reduce costs, increase security, and manage their drivers, vehicles, and fuel usage by offering four cards.

Fuelman’s network (also known as the Fuelman Discount Network) consists of 20,000 maintenance facilities and 50,000 gas stations that accept the Fuelman fleet card. These Fuelman sites offer fuel, maintenance, and repair services and discounts on Fuelman’s fleet cards.

Image source: Fuelman

With a Fuelman fleet card, you can pay for gas, repair services, and other supplies at gas stations and convenience stores across the country. Using a Fuelman card, you can set customizable spending limits and access controls and top it up with regular money. Fuelman cards are ideal for fleets pumping between 1,000 and 5,000 gallons per month.

Fleet cards offered by other providers, however, have broader network coverage. For example, WEX cards are accepted at more than 95% of gas stations in the US, plus 45,000 service locations, while Comdata’s fleet card also enjoys a high level of acceptance.

What Are the Rates of the Fuelman Fleet Card?

Fuelman doesn’t publicly advertise its exact rates, like most other fleet card suppliers. You may pay anywhere from $0 to $10 per card per month, plus interest – usually between 15% and 20% APR (annual percentage rate). Late fees may also apply if you don’t make repayments on time.

While this is a general rate, you can expect to pay similar charges across various fleet cards.

Types of Fuelman Cards

Fuelman offers many different fleet cards to meet different needs. Let’s take a look at five types offered on their website:

- Simple Saver: Ideal for interstate freight businesses, especially those with heavy fleets pumping diesel at truck stops. Pilot, Speedway, and Kwik Trip customers can save 10 cents on purchases, while other customers can save 2 cents.

- Deep Saver Fleet Card: The Deep Saver Fleet Card is an excellent choice for mixed fleets that operate in metro areas. Consumers who pump at any of the 40,000 Fuelman’s Discount Network locations save 8 cents on diesel and 5 cents on unleaded.

- Universal Premium Mastercard: Suitable for businesses that need a fuel card that is universally accepted. The Mastercard card can be used everywhere. Mastercard is accepted-roughly 160,000 stations nationwide.

- Public Sector Fleet Card: This is the best option for non-profit fleets and businesses in the government sector. This card comes with rebates, increased control for fuel spending, special tax reporting, and simplified accounting. Up to five cents per gallon will be credited to your account based on how many gallons you pump per month.

- Fuelman Clean Advantage: If you care about the environmental impact of your fleet, the Fuelman Clean Advantage allows you to neutralize your carbon emissions for $0.05 per gallon, thanks to certified carbon offset projects.

Fuelman Pros and Cons

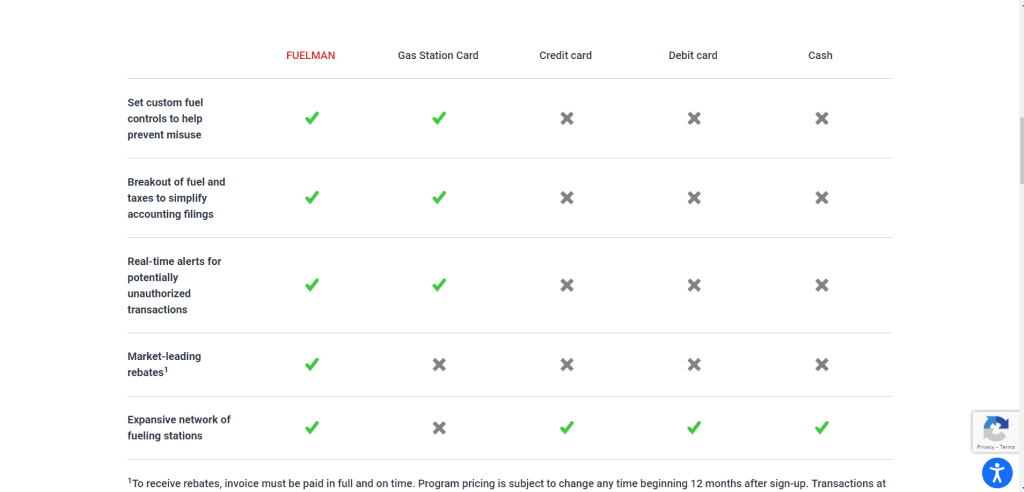

Like any fuel card in the market, there are benefits and drawbacks to using a Fuelman fleet card. They have multiple options, good savings on refuels, and excellent rebates for nonprofits and government fleets, but they have a more limited network than other options. Let’s take a look at all their upsides and downsides:

Pros

- With Fuelman, you can customize your cards to only be used when, where, how, and for what you desire.

- Fuelman offers several fueling cards to meet every need a company could have.

- Fuelman’s billing cycle calls for weekly or bi-weekly payments, but for a fee, payments can be extended to monthly if desired.

- An employer can use a fuel card to ensure company funds are properly utilized by providing purchasing flexibility. Fuel cards, in most cases, can only be used to buy fuel and nothing else. These controls are mainly ineffective for companies with multiple costs, as they require credit cards or cash to purchase products other than fuel. Nevertheless, Fuelman expands the program by allowing additional supply purchases to be made with particular cards.

Cons

- Unfortunately, there are fees associated with the Fuelman Fuel card. There are the monthly program fees, late payment fees, and finance charges. You can check out their prices. Some customers have complained about Fuelman’s fees and terms not being apparent.

- Only 50,000 stations accept the Fuelman Fuel Card, marked by a small Fuelman Flag, which is significantly less than other universal cards. Despite this, Fuelman is also accepted at some 20,000 maintenance stations, a characteristic that most other fuel cards lack.

- Their app feels dated and unintuitive.

Fuelman Card Reviews

This review would not be complete without looking at the opinions of people who use Fuelman cards, either positively or negatively.

So, what do Fuelman’s customers think about the company?

Well, there is a low level of satisfaction among Fuelman card users. There are far too many bad reviews on Fleetcor’s Trustpilot page, Fuelman’s parent company, and they are far from stellar.

The company currently has a 3.8/5 TrustScore, but most reviews are negative. There are 59% negative reviews, with many customers pointing out shady business practices. Complaints include that it’s impossible to reach a Fuelman agent by phone and that the company cancels credit cards without reason.

The company’s hidden fees, however, are the most egregious complaint. Fuelman, for example, charges a minimum quantity for “account maintenance” when gas prices fall below a certain amount, according to some reviewers. There is no mention of this fee when you sign up for the service, which shows a concerning lack of transparency on the company’s part.

There are 291 complaints on their Better Business Bureau page. Furthermore, Fleetcor has been sued for predatory fee practices, which raises major red flags.

Why Choose Fuelman?

Fuelman still offers some good features despite its low rating. Let’s take a look at some of the reasons why you should choose a Fuelman fleet card:

Savings and cost control

If you fill up at one of the 40,000+ locations in Fuelman’s Discount Network, you can save between 5 to 8 cents per gallon, depending on whether you use unleaded fuel or Diesel.

In addition, Fuelman fleet cards also enable you to set up purchase controls to lower your overall fleet management costs. Fuelman helps you limit the excesses of your drivers by providing some of the most vital purchasing controls on the market. You can easily restrict where, when, and how much your team can spend with a Fuelman fleet card!

Monitor for fraud

Fuel costs are so high that it is easy to burn through them quickly, which complicates budgeting for fuel costs. It’s even harder to stay within budget when drivers skim off the top or cook the books.

With Fuelman fleet cards, you can prevent driver theft and fraud by requiring your staff to enter their Driver’s Identification Number. Furthermore, Fuelman will send you an email or text alert at the first sign of suspicious activity, letting you know if any unauthorized activity occurs.

Flexibility for fleets

With Fuelman, you aren’t limited to a single type of fleet card. You can choose from various fleet cards to suit your unique business needs. Whether you need a mixed fuel card or a card for small fleets, Fuelman has a card to suit your needs.

However, the cards are still limited to the Fuelman network and come with monthly fees.

Reporting made simple

Fuelman also helps you save money by collecting the data you need to manage your fuel spending. In addition to streamlining your back-office processes, the mobile app makes keeping track of transactions a breeze, cutting out the administration of fuel spend analysis.

You’ll get everything all in one place, all digitized and ready to be interpreted, no more fumbling around with cash or worrying about lost receipts. However, it should be mentioned that the app does feel very dated by modern standards.

Who Is the Fuelman Fleet Card for?

While Fuelman boasts good coverage and a wide selection of fleet cards, it suffers from an outdated mobile app concerning customer reviews and a transparency issue regarding their fees. Which begs the question, who should go for a Fuelman Fleet card?

Fuelman Fleet’s card will suit your business if you fit one of the following criteria:

- You manage a mixed fleet in metro areas: Fuelman Deep Saver is the best option for mixed fleets. All Fuelman Network locations accept it, so it’s perfect for fleets in cities and densely populated areas. With the Deep Saver card, you save between 5 to 8 cents when refueling at any of Fuelman’s 40,000 discount sites. Anyone who pumps between 1,000 and 5,000 gallons per month can benefit from Fuelman fleet cards.

- Your company specializes in interstate freight: The Fuelman Simple Saver fleet card works excellent for fleets that move across state lines. This is a great option for heavy fleets, especially those pumping diesel at truck stops. You’ll save 10 cents when refilling at Kwik Trip, Speedway, or Pilot, and 2 cents anywhere else. Despite some gaps in coverage, it offers coast-to-coast coverage in the Lower 48.

- A universally accepted fuel card is essential: With the Universal Premium Fleet Card Mastercard, you can enjoy Fuelman’s benefits while getting a universal fleet card. As opposed to being limited to Fuelman’s Discount Network, this card is accepted anywhere Mastercard is taken, which is approximately 160,000 stations nationwide.

- The fleet you operate is non-profit: Public Sector fleet cards are designed specifically for businesses operating in non-profit and government sectors. In addition to rebates, this card offers tax reporting, simplified accounting, and fuel spending control.

You can go to Fuelman’s Site Locator to learn what services are available in your area. The tool also allows you to plan your trip by filtering stations by fuel type, state, facilities, and driver comforts.

Final Thoughts

Fuelman fleet cards offer various benefits and options, with excellent spending controls, purchasing flexibility, and reporting tools thanks to their app. However, the lack of transparency regarding all of their fees and considerably negative customer reviews make it difficult to recommend this option thoroughly. If you are interested in what they offer, inquire about all their fees as much as possible.