With Square continuing to expand its payment acceptance capabilities, the company aims to provide flexible and affordable options for small businesses to accept credit and debit cards from their customers. Square now accepts several major credit and debit cards to support businesses in 2023 and beyond. Here is a complete review of credit cards accepted by Square in 2023 and other payment methods it accepts.

Without any hidden fees or long-term contracts, Square’s payment processing solutions offer an easy way for merchants of any size to get paid through digital and in-person transactions.

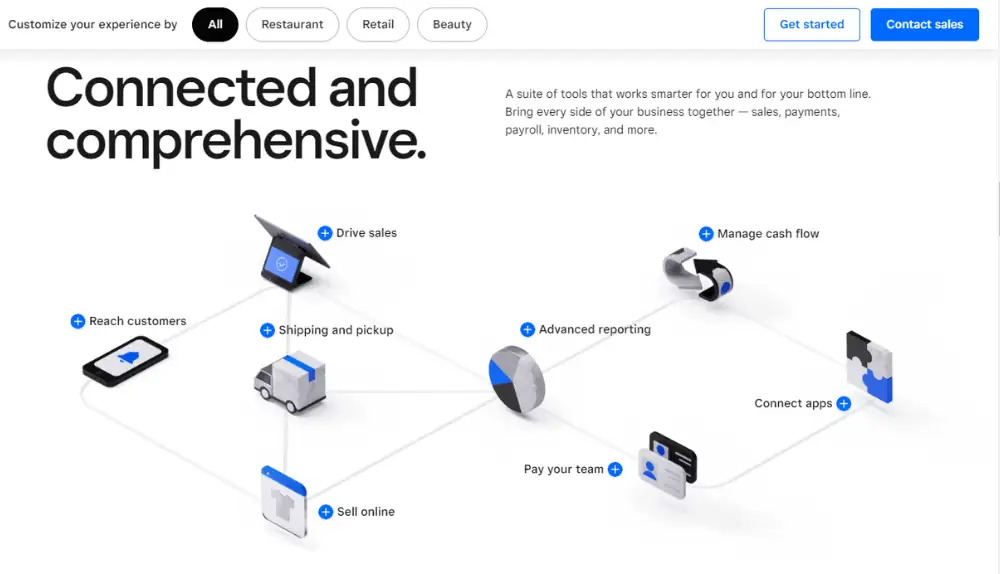

Square accepts Visa, Mastercard, American Express, Discover cards, Visa debit cards, and Mastercard debit cards. They can be used for purchases made at retail locations, for services, or through a business’s website and mobile apps. Square Stand, the company’s countertop POS terminal, allows businesses to accept magstripe cards, EMV chip cards, contactless payments like Apple Pay and Google Pay, and more using the same device. Through integrations with payment gateways, Square merchants can also process transactions from additional card types such as UnionPay, JCB, Diners Club International, and Carte Blanche.

With fraud detection tools, transaction dispute mediation, chargebacks management, and global payout capabilities, Square aims to handle the complexity of payment processing so merchants can stay focused on growing their business. Square continues to expand acceptance to more card brands and link additional payment methods to provide more ways for customers to pay for goods and services. With affordable pricing, no long-term commitments, and responsive support, Square gives businesses to control and flexibility over how they accept and manage payments.

Credit Cards Accepted By Square In 2023

Square enables businesses to accept a wide range of credit, debit, gift, and other card payments using the same simple and affordable platform. This includes standard cards, prepaid cards, health savings accounts, employee reimbursement cards, and unemployment benefit cards – all with the same transparent pricing.

Payments are processed instantly and settlements are deposited directly into a business’s bank account, with Square’s fees deducted upfront from each transaction. There are no surprise charges or hidden fees – merchants only pay Square’s standard processing rate for each payment, regardless of the card type. Square’s fee schedule is clearly listed on their website, providing full details on rates by payment method.

With Square, businesses maintain flexibility and control over their payments. There are no long-term contracts, minimums or early termination fees. Merchants can accept cards in-person, online, or through a mobile app – and can switch processing hosts at any time if they find a better solution. All transactions also benefit from Square’s robust fraud detection and dispute resolution services to give businesses more confidence in each sale.

By providing a seamless experience for customers and merchants alike, Square aims to make it effortless to accept more types of payments and grow revenue through fair, transparent fees and partnerships. Square continues expanding acceptance of additional cards, gift cards, installment payments, and more – all to give businesses more opportunities to get paid in the way that suits them best.

What Payments Can I Take With Square?

Online

Square provides simple and affordable solutions for businesses to accept payments both in person and online with no coding required. Their eCommerce integrations allow merchants to sell digital and physical goods through a website or mobile app while still using Square as their payment processor. These integrations are designed to be plug-and-play, often taking just a few clicks to set up with the most popular eCommerce platforms.

Square integrates with WooCommerce, Magento, BigCommerce, Wix, and more. Merchants can start accepting payments on their site immediately using the payment forms and API provided by Square. Buyers can then pay through any major credit or debit card, digital wallet like Apple Pay or Samsung Pay, or alternative payment method that Square accepts. Transactions are processed instantly and settled funds are deposited directly into the merchant’s bank account, with Square’s transparent fees deducted upfront from each sale.

Checkout Links

Once integrated with Square, businesses can easily generate payment links to send customers for purchasing goods or services online. These links can be used in email marketing campaigns, social media promotions, blog posts, or other digital marketing efforts – at no extra cost beyond standard transaction fees.

Square payment links allow merchants to drive more sales through their website or mobile app. Customers simply click the link to begin the checkout process and can then pay using any of the major cards or payment methods that Square accepts. Transactions process instantly and funds are deposited directly into the merchant’s account, with Square’s fees deducted automatically from each sale.

In-Person

Square is best known for providing affordable yet robust payment processing solutions for in-person businesses. Their portfolio includes a range of hardware options from simple card readers that plug into a smartphone up to full point-of-sale terminals – offering flexibility and features at every price point.

For merchants just getting started, Square offers a free card reader that plugs into the headphone jack of an iPhone or Android phone. This allows for basic taps-and-swipes card payments right away using an existing mobile device. For those needing more, Square also provides affordable countertop POS systems that can handle magstripe, EMV chip, contactless and mobile payments.

Invoices

Square provides an simple yet powerful invoicing solution for businesses of all types in paragraph form. Using the Square Invoices feature, merchants can send professional invoices to clients, offer payment plan options like Afterpay or Klarna, and give customers more flexibility and control over paying for goods and services.

Invoices integrates right into the Square Point of Sale app and dashboard, allowing for easy setup. Creating and sending invoices only takes a few taps. Square offers hundreds of custom template options with images and layouts to choose from, making invoices more branded and professional.

Virtual Terminal

Square provides a virtual terminal solution for businesses that need the ability to process payments remotely in paragraph form. Their virtual terminal turns any compatible computer into a virtual card terminal, allowing merchants to accept credit card payments over the phone, via email or through mobile-friendly payment links.

A Square virtual terminal is ideal for remotely billing customers or taking credit card payments over the phone. It essentially transforms any computer into a full-featured register capable of processing split payments as well as accepting and recording cash, checks, Square gift cards, and other forms of payment. Merchants can also text customers a secure payment link so they can pay via credit card from anywhere.

Does Square Take American Express And Does It Cost More?

Square charges merchant processing fees for enabling customer payments through Point of Sale terminals, checkout links and other means. Fees aim to provide affordable yet comprehensive payment and accounting services with transparent pricing rather than hidden charges. Rates apply equally regardless of card type, including American Express, covering services like instant funds, fraud prevention, chargeback handling and global payouts.

In-person card payments at Point of Sale terminals incur 2.6% of the transaction amount plus $0.10 per swipe. Card-not-present payments through checkout links cost 3.5% plus $0.15 per transaction. While rates may differ versus larger merchant accounts, Square targets businesses of any size with fair, visible pricing. Additional fees for online payments account for complexities in routing and verifying remote transactions.

Square charges the same rates for all card types to avoid discouraging use of any particular card. Fees cover value-added services rather than simply processing charges, providing tools for fraud detection, dispute handling, sending payments worldwide and instant deposit of funds. Rates aim to balance affordability for volume businesses and small sellers with comprehensive service. Robust yet transparent pricing intends to prevent dissatisfaction from hidden surcharges or discouraging certain cards.

A comparison of Square versus traditional merchant accounts helps determine if Square adequately and affordably meets a business’s needs. Square targets companies wanting payment and accounting services with no long-term contracts, simplifying setup and management with an all-in-one solution. Rates cover more than just card processing for instant access to earnings, fraud prevention resources and streamlined accounting.

How to Accept EBT, SNAP and WIC Payments With Square?

Square itself does not currently support processing government benefits like SNAP, WIC or EBT payments directly. However, integrated third-party solutions provide the means for accepting these types of transactions affordably and responsibly through Square according to regulation. Partners like Totilpay offer EBT software and hardware enabling government benefits acceptance at Square Point of Sale terminals if fees are accounted for in addition to standard Square rates.

Monthly Totilpay fees range from $19.99 to $29.95 depending on a business and its transaction volume. While fees apply on top of Square’s standard card processing rates, integrated solutions aim to provide comprehensive service affordably for the types of businesses accepting government benefits. Totilpay seamlessly connects its EBT software with any Square POS hardware, covering capabilities, regulations and requirements for this particular transaction type.

Though Square does not accept benefits directly, the platform otherwise provides robust payment processing for all major credit and debit cards with fair, transparent pricing. Card-present rates are 2.6% of the transaction amount plus $0.10 per tap, dip or swipe at a Square terminal. Online payments incur 3.5% plus $0.15 per transaction. Integrated EBT partners like Totilpay, associated guidelines andSquare’s standard rates together aim to make acceptance of government benefits affordable and compliant for merchants.

Resources covering EBT payments, regulations and alternatives help determine if Square’s integrated solutions suit a particular business’s needs for accepting government benefits legitimately and cost-effectively. Comparisons of Square versus platforms like Shopify that do support direct EBT acceptance provide impartial guidance on which partner provides the responsible and budget-friendly approach. Though Square does not handle benefits directly, the resources, partners and rates combine to enable compliant acceptance for many types of merchants.

Square Now Accepts Cash App Pay

Though simple to integrate, Cash App Pay only works with select Square hardware and software solutions currently. However, Square enables Cash App as an additional payment method at no extra cost or complex setup. Resources also cover implementation guidance, fees and alternatives to determine if Cash App meets a particular business’s needs affordably and without hidden costs or difficult integration.

Sellers generate a QR code at checkout linking customer payments to their Cash App account. In-person, a QR code displays on a mobile POS device for customers to scan, connecting payment to Cash App. Online, tapping “Cash App Pay” or scanning a page QR code links the transaction. Though supported solutions are limited currently, offering Cash App provides another payment option without fees.

At Square signup, no extra steps or charges are required to accept Cash App Pay. However, the feature only works with Square Register, Square Stand, Square Terminal, Square Online and the Square Point of Sale mobile app for iOS and Android currently. Unsure of setup or any Cash App fees? Guidance covers creating a business Cash App account and rates. Comparing Square and Stripe also provides an overview if more online selling before choosing a payment partner.

Cash App Pay aims to provide an easy additional payment method with no setup complexity or charges. By generating a linking QR code at checkout and taping “Cash App Pay” or scanning an interface QR code, customers can pay using their Cash App balance or linked funding sources without impacting the seller. No extra Square fees result from accepting Cash App.

Though supported solutions are limited currently, offering Cash App as an option expands the usefulness of Square for no cost and without difficult integration. Other resources on fees, guidelines and alternatives determine if the feature meets a business’s needs affordably and legally or if a different partner may suit particular goals better despite simple Cash App Pay implementation.

What is Cash App Pay?

Sellers provide a QR code at checkout linking customer payments to their Cash App account, enabling Cash App balances and linked funds as payment options. Customers scan the QR code to complete the transaction through Cash App. Online stores offer “Cash App Pay” on websites or mobile apps for convenient Cash App payments without impacting the checkout experience or fees.

Though Cash App Pay integrates seamlessly with Square, the payment platforms operate independently. Square charges standard processing rates on all transactions completed through any payment method, including Cash App, currently 2.6% plus $0.10 for in-person card payments or 3.5% plus $0.15 for card-not-present. Accepting Cash App Pay does not incur any additional Cash App transaction fees.

Cash App Payment offers value as another payment choice without increasing costs or complexity. Sellers can quickly enable Cash App as an option but continue paying standard Square rates on every transaction, no matter the payment method used. Cash App, card or cash all process at the listed Square rates, and Cash App Pay provides an easy way to accept another payment method affordably.

Does Square Accept Apple Pay, Google Pay and Other NFC?

Sellers can accept contactless tenders including near-field communication (NFC) transactions by enabling contactless payment methods such as Apple Pay, Google Pay, Samsung Pay or other tap-to-pay options within their Square account. Contactless payments process at Square’s standard credit card rates, currently 2.6% plus $0.10 for in-person contactless payments or 3.5% plus $0.15 for contactless online transactions. No additional fees apply specifically for accepting contactless forms of payment.

To accept contactless payments in-person, merchants must purchase a Square chip and tap reader as a magstripe or chip reader alone cannot read contactless signals. Square charges the same rates on all payments, including contactless, completed at a Square terminal. Contactless payments incur no supplementary fees beyond standard processing charges.

For online selling, simply enabling contactless payment methods in Square Online account settings allows contactless payments. Customers pay by logging into the associated payment service account, such as Apple, Google or Samsung Pay. Like in-person contactless, Square charges regular online processing rates with no extra contactless payment fees. Contactless provides another easy and affordable payment choice without hidden costs.

Contactless payments offer more ways for customers to complete sales through methods they use most frequently. Enabling contactless acceptance helps minimize friction, optimize experiences and gain customer preference legitimately without complexity or excessive fees. Sellers accept contactless both in-store and online, offering flexibility and choice responsibly while continuing standard Square rates on all transactions, regardless of payment method.

Conclusion

While Square accepts more credit cards than ever before, the platform continues evolving to support new forms of payment in 2023 and beyond. By partnering with leaders in payments, Square provides access to innovative tools helping merchants thrive affordably through the options fueling their business.

Continual progress in features, reporting, fraud prevention, payouts and integrations aim to minimize complexity so sellers can focus on success. Fair, transparent pricing combined with exceptional service also gives more businesses opportunities to prosper by accepting all payments that power their growth without constraint.

Through scalable solutions and optimizations based on feedback, Square expands acceptance of cash, credit, debit, mobile wallets, contactless payments and beyond. New partnerships may bring acceptance of additional niche or international payment types, providing more flexibility and choice. The goal remains empowering merchants by offering affordable access to the options their customers want to use.

By evaluating capabilities and demand regularly, Square determines the best path forward for expanding tools that simplify getting paid without penalty. No long-term contracts, setup fees or hidden charges mean switching providers remains an easy choice if another solution better suits a business’s evolving needs at any stage. Square provides affordable access to innovative payment technology and support so businesses can focus on their craft, not administrative overhead.

Whether selling locally, nationally or globally, Square ensures fast, low-cost and seamless payment acceptance. 24/7 fraud monitoring, chargeback management and international payout capabilities in over 40 currencies also provide exceptional service at every step. Square evolves continually to meet the changing payments landscape head-on while keeping the complexities at bay for merchants.

The payments accepted by Square in 2023 and beyond aim to facilitate business opportunities and success affordably with minimal constraints. By remaining dedicated to innovative yet easy-to-use solutions, fair pricing and outstanding support, Square gives more merchants the tools and freedom to achieve prosperity on their terms. What credit cards are accepted continues expanding so merchants can get paid through all the options fueling their growth journey without compromise.

Square provides access to accepted payments, features, reports, integrations and insights helping businesses make more informed decisions and better serve their customers each day. Payment innovation is how Square builds tools for success tailored to the evolving needs of merchants at every stage. And the journey is only just beginning. What credit cards are accepted by Square in 2023 and beyond? The possibilities are endless.