If you and your team handle patient payments as part of your dental practice then everybody in the team doesn’t need to understand the intricacies of the transaction process. While some patients fully settle their bills during their appointments, others may opt for a dental payment plan due to financial constraints. Creating a system to accommodate these situations is essential, allowing patients to manage their balances through regular, manageable payments instead of a lump sum.

Choosing the right payment plan is not just about facilitating transactions; it also influences default pricing for treatment plans and provides valuable data for reporting purposes, such as patient numbers and recalls. This article will guide you through the process of creating effective dental payment plans to serve your patients better.

Understanding Dental Payment Plans

A dental payment plan is like a financial arrangement offered by dentists. It allows patients to handle the cost of expensive dental work by breaking it down into manageable payments. This plan has a clear agreement outlining how much your patient owes, the size and frequency of payments, and any additional fees or interest. Plus, these dental payment plans offer almost all the needed services like Crowns, Fillings, Braces, Dentures, Restorations, Extractions, Cosmetic Work, X-rays, Periodontal therapy, or Replacements.

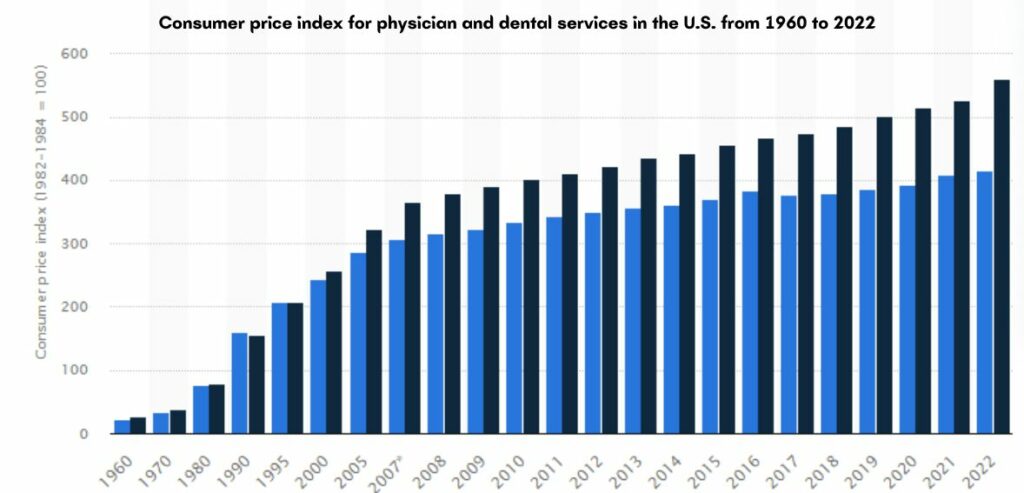

Source: Statista

This option is particularly useful if a patient lacks dental insurance or your current plan doesn’t cover certain treatments. Depending on the plan, your patient might make a monthly or weekly payment. Some plans even offer a period with no interest, although this can vary. To set up these payment plans, dentists often partner with finance companies. While many dentists work with specific finance providers, patients may be able to arrange their own financing.

Different Types Of Dental Plans

Dental payment plans can seem complicated, but knowing the basics can guide you in making better choices for your oral health. Let’s dive into the three main types of dental payment plans you’re likely to encounter:

1. Preferred Provider Organization Dental Plan

A PPO dental plan offers flexibility, letting your patient pick a dentist from a broad network. Dentists usually agree to a preset rate for their services with the insurance companies, which is usually discounted. So, instead of the full price, the patient pays this discounted rate, and the insurance covers the rest. Generally, the patient’s share of the cost is reasonable, varying by the type of dental work your patient needs. That’s why PPO plans often mean lower expenses for your patients.

Before signing up for a PPO, it’s smart to check which dentists are in the network. This helps your patient select a dentist they are comfortable with or one conveniently located for them. PPO dental insurance often pays for the basics like:

- Regular cleanings once or twice a year

- X-rays for check-ups

- Protective sealants

- Fluoride treatments to keep teeth strong

When it comes to common dental procedures, PPO plans usually cover a part of the costs. Specifically, preventive care like cleanings, X-rays, and sealants are often fully covered, meaning you might not have any out-of-pocket costs. Some PPO plans might also offer coverage for specialized treatments like braces, gum treatments, and replacement teeth like dentures or bridges.

2. Discount Medical Plan

A Discount Medical Plan Organization (DMPO), known as a dental discount plan, also provides patients with reduced rates for healthcare services. This happens because a dental practice and the plan’s organization agree to lower the costs of certain treatments.

A DMPO can help your patient save money on services that your patient’s regular health insurance might not fully cover. State departments like the Department of Insurance or Commerce usually oversee these plans. They’ve been a reliable option for years and are often run by insurance companies.

Discount plans offer reduced rates for various healthcare services, such as:

- Doctor’s visits

- Specialized treatments

- Hospital care

- Prescription drugs

- Apart from Dental care, it is also used for eye care.

While these plans are more affordable than traditional health insurance, it’s essential to note that they don’t offer the same level of coverage or protection.

3. DHMO/Capitation Plan

Dentists receive a monthly fee for each patient under their care in a DHMO or capitation plan. This covers certain treatments at either no cost or a reduced rate for the patient. Patients usually need to visit a dentist within the plan’s network to get the most from this plan.

Here are some services often included in a DHMO plan:

- Check-ups and cleanings

- X-rays

- Fillings

- Crowns

- Root canals

With DHMO plans, patients can expect lower costs and possibly no copayments when they see an in-network dentist. It’s important to note that DHMO plans have more restrictions compared to PPO plans. Typically, patients must visit a specific dentist within the network they’ve chosen and enrolled with to receive coverage. This means coverage usually isn’t available for out-of-network providers or even other in-network dentists they haven’t officially selected.

4. Dental Preferred Provider Organization Plan

With DPPOs, patients usually have an annual deductible and coinsurance. After they’ve paid their deductible, the plan will start sharing the costs with the patient, but only up to a yearly limit. Most basic dental check-ups, like cleanings and X-rays, are fully covered if your patient sticks to in-network dentists. However, your patient might have to chip in some money for other treatments.

Choosing a DPPO can be a smart move to save on dental care, especially if your patient is okay with staying within the network. It’s a pretty popular choice for many people because it often covers 100% of preventive care. This includes things like

- Teeth Cleanings,

- Oral Check-Ups,

- X-rays,

- Fluoride Treatments,

- Sealants.

5. Indemnity Dental Plans

Indemnity plans, often called “traditional insurance,” typically cover a portion of the Usual Customary Reasonable (UCR) fee. It’s essential to check for specifics like deductibles, waiting periods, maximum limits, and other details, which can usually be found through phone calls, faxes, or online portals.

Sometimes, the insurance company pays you directly after the patient assigns their benefits to the plan. However, in other instances, the patient receives the payment. Patients often have the freedom to choose any dentist, although some plans may have agreements with specific PPO networks.

Generally, these plans cover preventive and diagnostic procedures at 100% of the UCR. Basic treatments are typically covered at 80%, and major services at 50%. Remember that deductibles apply to basic and major treatments, and there’s usually an annual maximum limit. Since each plan has its specifics, it’s crucial to input these details into your PMS software accurately.

A Step-by-Step Process To Create A Dental Plan

Designing a payment plan for patients is a straightforward task that demands careful consideration, clear communication, and compliance with regulations. To streamline this process, here’s a breakdown of the stages involved:

- Step 1: Assess Patient Needs

Start by gaining an understanding of the situations of every patient. Certain individuals may find it advantageous to opt for a payment plan with a short duration, while others might need a longer timeframe to manage their expenses effectively.

Adapting the payment plan to suit each patient’s requirements promotes fairness and enhances the chances of successfully completing the plan.

- Step 2: Define Terms and Conditions

It is important to communicate the specifics of the payment arrangement, including information such as the total amount due, how long the plan will last, how often payments should be made, and any additional charges or interest.

By providing transparent details from the start, it helps establish a connection and trust between the dental office and the patient.

- Step 3: Communicate Effectively with Patients

Present the proposed payment plan to the patient in a clear and transparent manner. Take the time to explain their obligations thoroughly and offer a written agreement for their review. Effective communication ensures that patients are well-informed and comfortable with the proposed terms.

- Step 4: Create the Payment Plan

You must integrate several Dental Plans into your payment processing system to make the process straightforward. To begin creating a payment plan for the selected patient, you can use the Accounts module in your facility’s software. First, go to the “Billing and Payment Plan” section.

Choose the type of billing you prefer. Then, specify the payment interval you want and provide any information like late charges or interest rates. Next, decide how you would like payments to be processed manually, automatically, or through a third-party service. And adjust the plan details accordingly.

- Step 5: Document the Agreement

Maintain comprehensive records of the payment plan agreement, capturing essential information such as payment schedules, amounts paid, and any communication with the patient regarding the plan.

Documentation serves as a crucial reference point and supports compliance with regulatory requirements.

- Step 6: Monitor and Follow-Up

Regularly review the status of each payment plan to ensure adherence to the agreed-upon terms. If a patient misses a payment or falls behind, initiate timely follow-up to address any concerns and collaboratively explore potential solutions. Proactive monitoring demonstrates commitment to patient care and financial responsibility.

What If Your Patient Has A Bad Credit Score?

Financial constraints should not deter individuals from seeking essential dental care. Fortunately, various financing avenues are available for patients who may not have a robust credit history. Many lenders specialize in offering loans specifically designed for dental procedures, often with lenient credit score requirements. Here’s what you can do:

- Assess Funding Needs: The first step for patients is to determine the total amount of funds required for their dental treatment. This includes considering the cost of the procedure, additional services, and any associated fees.

- Evaluate Credit Score: While some lenders may have minimal credit score requirements, it’s essential for patients to know where they stand. Checking their credit score beforehand can help set realistic expectations and identify suitable loan options.

- Seek Pre-Qualification: Patients can benefit from seeking pre-qualification before diving into the loan application process. This preliminary step gives an indication of the loan amount and terms they may qualify for without affecting their credit score. You can apply for pre-qualification with different banks for better chances of loan approval.

- Compare Terms and Rates: It’s advisable for patients to explore multiple lenders and compare the terms and interest rates offered. This comparison allows them to find a loan that aligns best with their financial situation and repayment capabilities.

- Finalize Application and Proceed with Treatment: Patients can complete the application process once a suitable loan option is identified. Upon approval, they can undergo the necessary dental treatment, ensuring their oral health is cared for without undue financial stress.

Things To Consider When Selecting The Right Payment Plans

When exploring dental payment plans, it’s essential to understand that finance companies aim to generate profits. While some companies may solely rely on fees from dentists, many also intend to profit from patients. Before committing to a payment plan provider, carefully review the terms and conditions, focusing on the following aspects:

- Interest Rates

Interest serves as a primary revenue source for finance companies. While some plans advertise 0% interest, especially for a specific period, others might impose rates higher than typical credit cards. Always scrutinize the interest rate offered and compare it with alternative financing options.

- Interest Rates on Payments:

Is there a set amount the finance firm charges to set up your payment schedule? Make sure to check since these may be tucked away in the periodic repayments.

This rate will determine the overall cost of the loan for the patient. It’s important to assess whether the interest rate is competitive and aligns with industry standards, ensuring affordability for patients while covering the financing costs for your practice.

- Administration and Application Fees:

Some finance companies may impose fees for setting up and administering the payment plan. These fees can vary significantly between providers.

It’s advisable to scrutinize these charges carefully to understand their impact on the overall cost for patients and the financial implications for your practice.

- Early Repayment Penalties:

Patients who wish to repay their loan ahead of schedule should be aware of any early repayment penalties that may apply.

These penalties can deter patients from settling their dues early and may affect their overall satisfaction with the payment plan. Evaluating the terms related to early repayment can help design a more flexible and patient-friendly arrangement.

- Late Payment Penalties:

Delinquent payments can pose challenges for both the patient and your practice. Finance companies may levy penalties for late payments, which can add to the financial burden for patients.

It’s essential to understand the terms governing late payments and communicate these clearly to patients to avoid misunderstandings and foster timely repayments.

Conclusion

Establishing an effective dental payment plan is a strategic endeavor that requires careful planning, transparent communication, and adherence to regulatory guidelines. By understanding the various types of payment plans available, such as PPOs, DMPOs, and DHMOs, dental practices can tailor their offerings to meet the diverse needs of patients.

Additionally, the step-by-step process outlined ensures that the creation and management of payment plans are executed seamlessly. It’s crucial to consider the financial implications, including interest rates and fees, to balance patient affordability and dental practice sustainability. Ultimately, a well-designed payment plan facilitates access to essential dental care and strengthens the trust and rapport between healthcare providers and patients.

Frequently Asked Questions

Do Dentists Invoice Patients at a Later Date?

The timing of dental service charges depends on several factors, such as the patient's insurance coverage, specific payment terms, and the chosen dental financing method. Patients without dental insurance may settle the bill immediately after the appointment. For those with insurance or financing, the process typically involves:

– Gathering credit or debit card details during the visit

– Confirming insurance details

– Documenting the provided dental services

– Processing insurance claims and addressing any denials.Is it Possible to Finance Dental Treatments?

Absolutely, many healthcare providers offer various financing options to help manage the costs of dental treatments. Third-party financing solutions may provide interest-free repayment plans over a 12-month period. Alternatively, you can opt for extended repayment periods with interest-bearing loans.

How Can I Modify an Existing Payment Plan?

Adjusting an existing payment plan is generally straightforward across most payment processing systems. Simply locate the plan you wish to modify and select the 'Edit' option. A dialog box will appear, allowing you to update the relevant information. During this process, you can deactivate the plan if it's no longer required or adjust fee amounts to reflect changes in your pricing structure.

What Constitutes an Emergency Dental Plan?

Unexpected dental emergencies can result in substantial costs for patients. While routine cleanings might fit into a budget, unforeseen dental issues like severe pain, broken fillings, or dislodged braces can strain finances.

Emergency dental plans are designed to assist patients with such unexpected expenses. These plans can be obtained through a specialized insurance provider or your dental practice. It's advisable to guide patients toward policies that meet their state's minimum coverage criteria to avoid potential tax penalties.