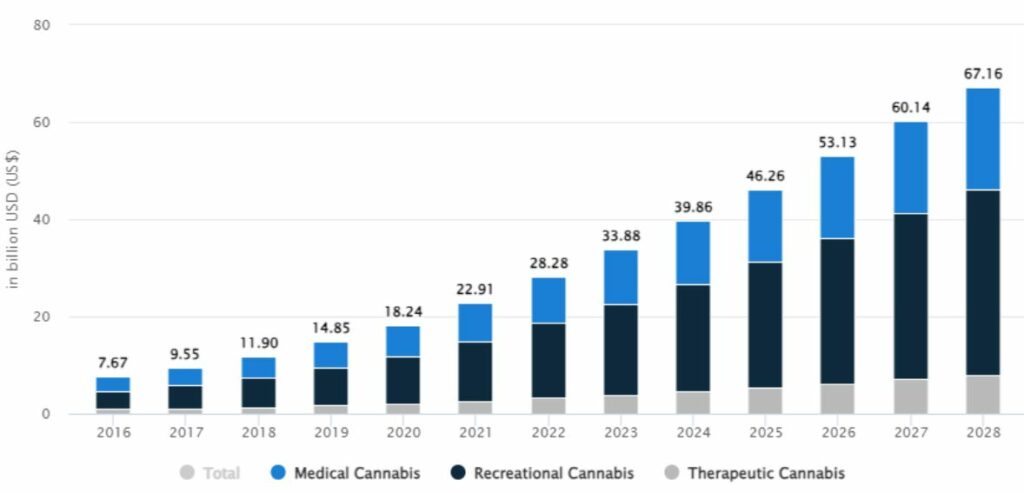

As you are reading this article the chances are you are a cannabis business owner seeking funding to kickstart or expand your venture. Despite the hurdles of obtaining loans in this industry, specialized lenders are catering to cannabis business loans. With the marijuana sector poised to contribute nearly $33.82 billion to the US economy in 2023 and adult-use cannabis now legal in 24 states, there’s a golden opportunity to explore financing strategies that can propel your cannabis business forward. With 89% of adults supporting cannabis legalization, mastering the art of securing financing for growth and streamlining your finances is crucial to staying competitive in this rapidly growing and widely embraced industry.

Source: Statista – Cannabis revenue growth in the US

This blog post will walk you through the process of finding a qualified lender, preparing your loan application, securing collateral, and completing the loan closure. Follow these tips to boost your chances of securing approval for a cannabis business loan.

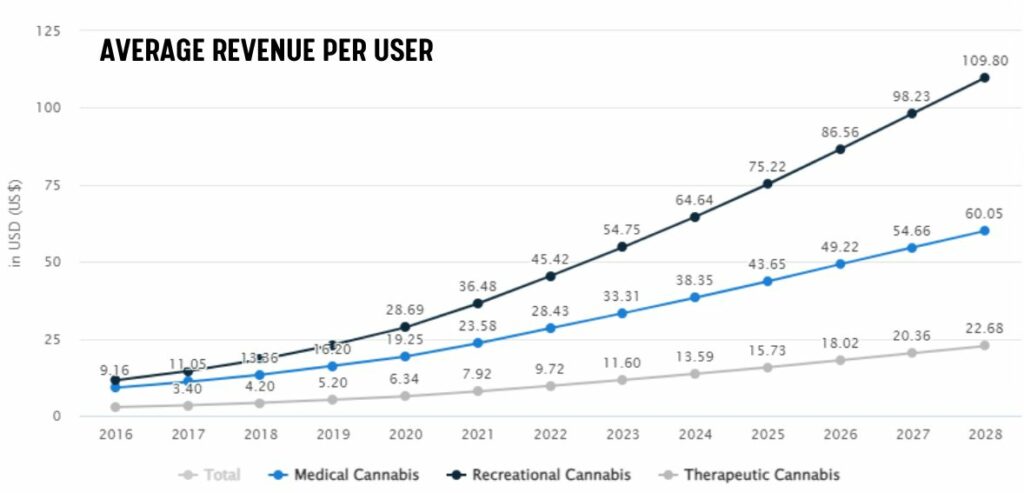

Source: Statista – Cannabis revenue growth in the US

Understanding Cannabis Business Loans

The rapid expansion of the cannabis industry, fueled by recent increases in recreational and medical marijuana legalization, has created a thriving landscape. With numerous states embracing marijuana legalization, the industry is witnessing a surge, leading to the establishment of more businesses to meet the escalating demand. In this diverse sector, cannabis businesses encompass everything from cultivation facilities and dispensaries to ancillary companies supporting the entire cannabis supply chain.

Financing is a common necessity for most businesses, irrespective of their industry. Given the novelty of the legal cannabis market, entrepreneurs in this field often seek working capital loans to ensure smooth operations.

While various small business loans cater to different industries, the cannabis sector’s uniqueness demands equally distinctive loan structures. Typically, cannabis companies seeking financing find themselves relying on alternative business loans to meet their specific needs.

Why Is Obtaining Cannabis Loans For Business Such A Challenge?

Despite the growing acceptance of recreational marijuana in 24 states and medical marijuana in 38 states, eager entrepreneurs aiming to tap into this expanding market face hurdles in securing funding. You might assume that with the momentum favoring decriminalization, obtaining funding would be straightforward as long as cannabis is legal in your state. However, that’s not the case.

Bank doors are closing on prospective entrepreneurs, limiting their financing options. Many marijuana businesses encounter difficulties in establishing a bank account with a credit union or federal bank. The federal illegality of cannabis creates a significant obstacle to obtaining financing through small business loans, as banking institutions are prohibited from handling funds related to cannabis.

While there are still ways to navigate toward financial success in the cannabis industry, it requires more than a simple visit to your bank for a business loan. Financing options exist, but business owners must exercise caution to avoid attracting unwanted attention from the federal government.

Most Common Reasons For Rejections For Cannabis Business Loans

Here are some primary reasons a lender might decline your business loan:

- Poor Credit:

Every financial move you make, from credit and debit card transactions to utility payments, contributes to your credit history. Missing a single loan payment can leave a lasting mark on your credit report. Late payments, credit defaults, or an excessively high debt-to-credit ratio can damage your credit score, making you a risky borrower.

- Excessive Debt:

This aligns with poor credit, but even if you’re diligent about timely bill payments, a lender might view a significant amount of outstanding debt as a warning sign. While secured debt like a mortgage can be advantageous, having too much unsecured debt from sources like student loans, personal loans, or credit cards could make banks wary of financing your business. Keeping these amounts in check is crucial.

- Unclear Business Plan:

Presenting a new business plan to a lender without demonstrating its profitability is a sure path to rejection. Similarly, approaching a lender with a shaky business plan lacking clarity won’t yield positive results. For those seeking expansion funding for an existing business, showcasing its growth is vital. Provide bank statements, ledgers, and evidence of responsible business ownership.

If you’re in the early stages of starting a business, meticulous planning is crucial. Outline your supply sources, anticipated costs, shipping and sales strategies, and any other details that prove your business acumen. This thorough approach significantly improves your chances of securing financing.

- Insufficient Collateral:

Even with a moderate or poor credit history, having collateral strengthens your loan application. Whether it’s property ownership like a home or another business, or maintaining a consistent savings account balance, these assets assure the bank of your financial reliability.

Having a co-signer with a longer, better credit history and established collateral is an alternative strategy to overcome this hurdle and enhance your loan eligibility.

Exploring Optimal Cannabis Financing Choices

When considering loans for your cannabis businesses, it’s crucial to identify the most fitting solutions for your specific needs.

1. Working Capital:

| Requirements | Details |

| Loan Range | $250,000 to $1.5 million or even higher (depending on the scale) |

| Loan Duration | 6 to 48 months |

| Applicant’s Revenue | $100,000 or plus (annually) |

| Credit Score | 560+ |

Any company, even one in the cannabis sector, needs working capital to survive. It represents the amount of money that is available to pay for regular operating costs. When it comes to financing cannabis businesses, working capital credits are essential for keeping things running smoothly because they cover expenses like rent, inventory, and payroll.

Qualification Criteria:

While requirements vary among lenders, a credit score of 670 or higher is typically needed to secure the best working capital rates for your marijuana business. However, certain online lenders extend working capital to individuals with scores as low as 500.

To be eligible, your company must demonstrate its financials, which should include stable income sources, a healthy cash flow, and a detailed plan explaining the capital usage plans. Lenders could also take into account the regulatory environment in your location and your credit history.

Features of Working Capital:

- Fast Approval: Given that working capital is designed to cover daily operational expenses, lenders prioritize swift approval and funding timelines.

- Relaxed Eligibility Requirements: Most lenders, especially online ones, maintain relaxed eligibility criteria for these short-term loans.

- Bridge Financial Gaps: Working capital proves instrumental in bridging financial gaps that arise in seasonal fluctuations.

2. Inventory Financing

| Requirements | Details |

| Loan Range | The amount can exceed $5 million for a piece of machinery. |

| Loan Duration | 1 to 10 years |

| Applicant’s Revenue | $250,000 or plus (annually) |

| Credit Score | 600+ |

Inventory financing entails a short-term loan or a revolving line of credit utilized by cannabis companies to procure products for future sale. This financial solution proves invaluable for dispensaries that need to settle payments with suppliers for an inventory stock stored and used on demand.

The collateral for this financing is the very inventory it aims to purchase. While beneficial, especially for newer businesses or those currently in debt, it can introduce added stress due to increased indebtedness. Notable examples of financing options in the cannabis industry include Bespoke and Leaflink Financial.

Qualification Criteria:

Financial assistance for equipment eligibility frequently depends on the equipment’s worth. The machinery itself or an initial deposit may be required by the financial institution as collateral. Financial standing and company viability are taken into account during the approval procedure.

Features of Inventory Financing:

- Preservation of Working Capital: Makes it possible to keep cash on hand for additional operational requirements.

- Access to Cutting-Edge Equipment: Makes the latest technology available..

- Potential Tax Benefits: Depreciation provides a possible tax benefit.

3. Term Loan

| Requirements | Details |

| Loan Range | $10k to $5 million |

| Loan Duration | 3 months to as long as 5 years |

| Applicant’s Revenue | $75,000 or plus (annually) |

| Credit Score | 550+ |

A term loan offers upfront lump sum funding to cannabis business borrowers, contingent on specific borrowing terms. Borrowers commit to repaying the loan, including interest, within a specified period, often accompanied by an initial down payment to lower the overall loan cost.

Term loans prove beneficial for well-established small cannabis businesses requiring extra capital, especially for expansions.

Qualification Criteria:

In securing any term business loan, the pivotal factors during the underwriting process are your use of funds and credit history. Cannabis lenders typically scrutinize your credit report before granting financing. Businesses in the marijuana industry must ensure the logical application of funds before seeking term financing options. Lenders often require a detailed breakdown of how the funds will be utilized, dollar for dollar, before considering the application.

Features of Term Loan:

- Interest Rates: Term loans come with either fixed or variable interest rates. The repayment schedule can also be quarterly or monthly, aligning with a set maturity date.

- Negotiable Terms: Before the loan is granted, the duration, amount, and interest rate are subject to negotiation.

- Extended Repayment Tenures: Term loans offer longer repayment tenures, with a minimum of 3 years.

4. Cash Advance

| Requirements | Details |

| Loan Range | $1k to around $1 million |

| Loan Duration | 3 months to as long as 2 years |

| Applicant’s Revenue | $120,000 or plus (annually) |

| Credit Score | 550+ |

A merchant cash advance serves as an alternative to traditional bank loans, tailored specifically for small businesses. In this arrangement, the business owner receives an upfront lump sum from a cash advance provider, which is then repaid with a percentage of the business’s sales. While these loans offer accessibility and flexibility without stringent credit or collateral requirements, it’s important to note that merchant cash advances can be costly and potentially disrupt business operations.

Qualification Criteria:

Qualifying criteria can vary; some lenders might stipulate maintaining a minimum of $2,500 in monthly credit card transactions, while others may require $5,000. Business tenure is a factor, with most lenders preferring at least a year of operation, though some might consider applicants with less than six months in business.

Features of Merchant Cash Advance:

- Repayment Structure: Repaid through a percentage of future sales, aligning with the business’s revenue.

- Cash Availability: Borrowers can receive cash or a cash equivalent, typically up to 20% to 30% of the available credit limit on the card.

- Usage Flexibility: No restrictions on the use of the loan, offering versatility to businesses.

Step By Step Process Of Applying For Cannabis Loan

Navigating the Alternative Business Lending Application Process for Your Cannabis Company

Step 1: Consider Your Needs

Before diving into the application process, assess whether alternative business lending aligns with your unique requirements. Ensure the capital can be effectively used for your intended purposes, evaluate if the repayment structure suits your cash flow, and determine the precise amount of funding needed. Addressing these considerations upfront streamlines the entire process.

Step 2: Gather Your Documents

Documentation requirements vary based on the type of loan sought. For instance, a merchant cash advance necessitates bank statements reflecting all transactions. General document categories include:

- Financial Statements (Balance Sheets and P&L)

- Tax returns

- Five-year P&L statement (Pro Forma)

- Six Months’ bank statements

- Personal statement for the business owners

- Corporate structure, capitalization table, and operating agreement

- List of assets and equipment

- Licenses

Collecting these documents promptly facilitates a smoother application process.

Step 3: Complete the Application

Initiate the application process by either calling your nearest bank or online lenders by filling out online forms. In either case, you’ll need to provide the information outlined in the previous section, along with specifying your desired loan amount.

Numerous online platforms facilitate the application process. Once you submit your application, a representative will reach out to guide you through the interest rates, the eligible terms, and the repayment terms. This ensures transparency, eliminating any surprises or hidden fees during the repayment phase.

Step 4: Secure Approval

Upon approval, anticipate the funds reflected in your bank account within 1-10 business days, depending on your specific loan type.

Conclusion

Understanding the complex landscape of cannabis business loans requires a strategic approach. Despite industry challenges, specialized lenders cater to the unique needs of cannabis entrepreneurs. As the cannabis sector continues its exponential growth, with a projected contribution of nearly $33.82 billion to the US economy in 2023, exploring tailored financing strategies becomes pivotal.

Whether seeking working capital, inventory financing, term loans, or lines of credit, understanding eligibility criteria and document requirements is crucial. By mastering the intricacies of alternative business lending, cannabis businesses can secure the funds needed for growth and maintain a competitive edge in this dynamic industry.

Frequently Asked Questions

Which country boasts the largest cannabis market?

The United States expanded its cannabis landscape in 2021, introducing new state markets. Notably, New York is anticipated to rank second in market size, with California holding the title of the world's largest cannabis market, surpassing even the entire country of Canada.

Which state leads in cannabis consumption?

In 2020, California topped the charts with the highest number of cannabis consumers in the United States, totaling around 6.7 million. Florida followed with approximately 2.8 million cannabis consumers.

What documents are required for obtaining a cannabis business loan in the US?

To prepare for a cannabis business loan application, you'll need a thorough business plan, accurate financial statements, your personal credit report, and collateral information. Lenders will carefully review these documents before approving your loan request.

What is the cost of opening a Marijuana dispensary in Florida in 2023?

For those looking to open a dispensary in Florida in 2023, the Department of Health outlines rules and regulations, including an initial application fee of $60,063.