American Express SafeKey is an innovative fraud prevention tool that provides an extra layer of security for businesses and their customers. By using one-time use codes as a second factor of authentication, SafeKey helps verify identities and reduces unauthorized transactions, helping businesses minimize chargebacks and fraud.

Fraud is an ongoing challenge and threat to businesses, costing hundreds of billions each year in fraud losses and compromised revenue. SafeKey offers an easy solution to help gain back control and fight fraud. It requires would-be fraudsters to not just possess a stolen card number, but also obtain a dynamic, unique code sent directly to the legitimate cardholder.

With SafeKey, businesses can enhance trust in digital payments, strengthen customer confidence, and boost loyalty through a seamless user experience. At the same time, they benefit from lower fraud rates, decreased chargebacks, and increased fraud cost savings. SafeKey provides advanced yet easy-to-implement anti-fraud protection that’s universally accepted and flexible enough to work across all major cards and payment methods.

American Express created SafeKey as an innovative fraud prevention service for businesses and their valued customers. By verifying identities through a multi-factor authentication process, SafeKey helps prevent fraud before it happens and ensures that only authorized users can make purchases. Together, businesses and their customers can fight fraud, build trust in payments, and feel safe sending and receiving money in today’s digital world.

SafeKey offers simple, comprehensive fraud protection with the advanced security and peace of mind that comes with American Express. It’s a fraud prevention solution tailored to meet the unique needs of businesses and the diverse payment experiences of their customers. With SafeKey, fraud fear need not hold you back from accepting new payments or reaching new heights of business success.

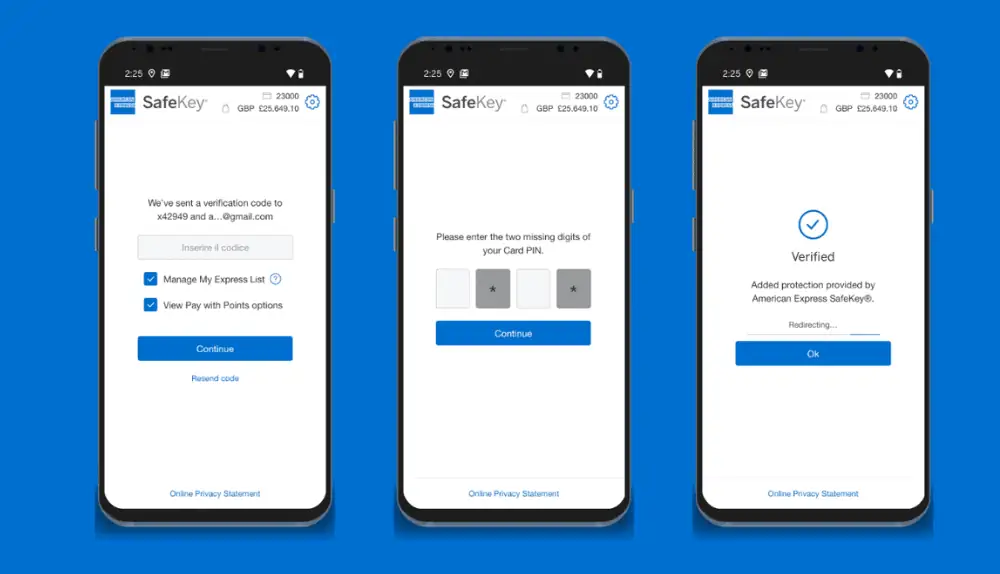

How American Express SafeKey Works

SafeKey provides fraud prevention through multi-factor authentication that requires not just a card number, but also a dynamic one-time code. This code is sent via text message to the mobile number on file for the cardholder’s account. By entering this code in addition to the card details, SafeKey confirms the legitimate customer is the one attempting to complete the transaction before approving the payment.

This two-step verification process makes it significantly harder for fraudsters to make unauthorized purchases or hijack accounts. They would need both the stolen card information as well as the validation code sent to the actual cardholder, which is nearly impossible to obtain. SafeKey thus helps block fake transactions and prevent account takeovers, from fraud.

Image source

SafeKey works for all online and mobile payments, including website purchases, app payments, contactless interactions, and more. It provides an extra layer of security and fraud checking for any digital transaction where only a card number may be entered. By requiring the dynamic code, SafeKey ensures the right customer is authorizing the right payment at the right time.

If unable to enter the correct code, the fraudulent transaction will be automatically declined, preventing unauthorized charges and limiting fraud exposure. SafeKey checks code validity in real-time, so legitimate customers experience no disruption to their shopping or payment experience. At the same time, SafeKey helps rule out fraud and maintain a seamless user journey.

Businesses can comfortably scale their digital operations without worrying about increased fraud risks. SafeKey provides advanced anti-fraud protection that grows with their business, all while keeping costs low and fraud at bay. By verifying identity through this multi-factor process, SafeKey essentially fraud-proofs payments and protects both businesses and cardholders from losses due to unauthorized use of accounts or stolen information. American Express SafeKey creates trust in the digital economy through simple, comprehensive fraud-fighting power.

Benefits of Using American Express SafeKey

Image source

American Express SafeKey provides numerous business benefits, including reduced fraud losses, fewer chargebacks, lowered costs, and increased customer confidence. By implementing SafeKey, businesses can lower their fraud rates by up to 95% and save thousands each year in fraud-related expenses.

Fewer chargebacks mean less time and money spent disputing claims and lower chargeback fees. SafeKey helps ensure that only authorized charges are approved, minimizing fraudulent transactions that lead to chargebacks. This results in significant cost savings and efficiently managed dispute processes.

SafeKey also improves the customer experience by adding an extra layer of security and fraud protection. Customers feel more at ease using their cards online or via mobile when SafeKey is in place, as it gives them peace of mind that their information and accounts are verified and safe. This leads to higher customer retention, loyalty, and lifetime value.

SafeKey supports businesses as they grow their digital operations without growing their fraud risk. It scales seamlessly to meet the evolving needs of fast-expanding companies and provides the advanced fraud prevention required for increasingly online customer journeys. SafeKey contains fraud costs even as payment volumes surge, allowing businesses to achieve more without compromise.

Integration of SafeKey is straightforward, with easy setup and minimal disruption to payment workflows or the user experience. It works with any major card network, acceptance method, or business size. SafeKey simply and seamlessly integrates into existing systems, protecting businesses from fraud quickly and cost-effectively.

SafeKey offers targeted, comprehensive fraud protection tailored to the unique risks and requirements of each business. Unlike broad, one-size-fits-all solutions, SafeKey provides the specific, advanced fraud prevention needed to support business growth and digital innovation safely. It helps create trust in payments and ensures a seamless user journey protected from fraud.

Overall, SafeKey delivers significant benefits through reduced fraud, lower costs, improved experience, seamless growth, and tailored fraud protection. By implementing SafeKey, businesses gain more control, reach new heights, and build trust in the digital economy. SafeKey makes fraud fear a thing of the past.

Conclusion

In summary, American Express SafeKey is an innovative fraud prevention solution that provides businesses and their customers an extra layer of protection against fraud. By using dynamic codes sent via text message as a second authentication factor, SafeKey helps verify identities before approving payments. This helps prevent unauthorized transactions, minimize chargebacks, and reduce fraud losses.

SafeKey offers simple yet advanced fraud prevention that fits seamlessly into existing payment workflows. It supports fraud-free growth by scaling according to business needs while containing costs. SafeKey provides the targeted, comprehensive fraud protection required to safely and confidently accelerate digital innovation.

Through SafeKey, businesses gain more control of their fraud risk, strengthen trust in payments, and enhance customer experience. They benefit from lower fraud rates, decreased chargebacks, reduced costs, and increased loyalty. SafeKey ensures only legitimate customers can make purchases, blocking fraud before it happens.

Customers feel their information and accounts are secure when using SafeKey, as an extra code is required to authorize charges. Their peace of mind increases confidence, satisfaction, and lifetime value. SafeKey fraud-proofs the journey from start to end, maintaining a seamless user experience built on trust.

Businesses and their customers can now transact digitally without fear of fraud or financial loss. By sending and receiving money with SafeKey, fraud fear is eliminated, new heights are reached, and success is optimized. SafeKey provides the advanced yet easy-to-use fraud prevention solution required to build trust, boost growth, and deliver digital innovation.

Overall, American Express SafeKey offers a promising path forward for businesses operating in the digital economy. Through partnerships built on integrated fraud prevention, businesses and customers alike benefit from innovation fueled by trust rather than stifled by fear. SafeKey makes fraud a concern of the past, unlocking new opportunities and securing progress for businesses today and tomorrow. SafeKey helps create a future of fraud-free digital progress and prosperity.