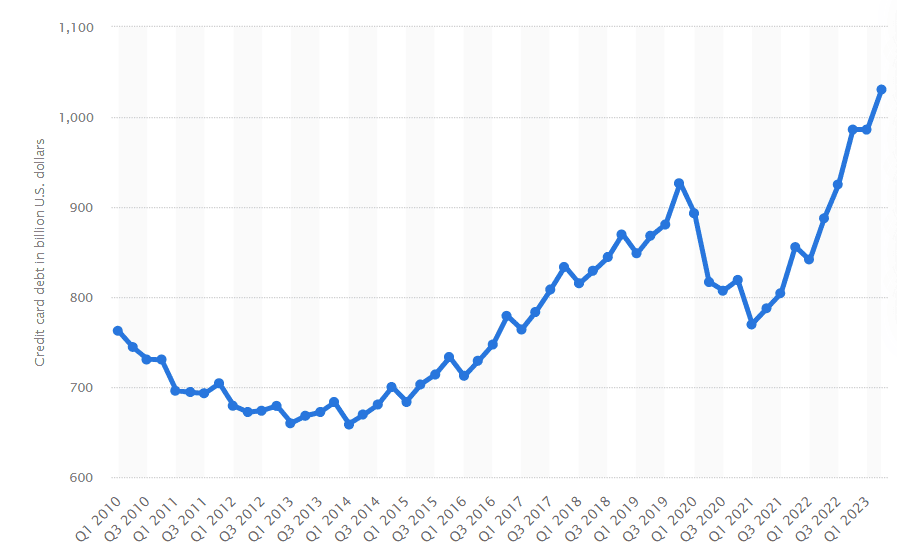

For businesses looking to broaden their customer base and increase sales, it is essential to provide various payment options, including credit card payments. Accepting credit cards for business as a payment method can potentially enhance sales by up to 40%. More and more people are using credit cards today to pay.

Source: Statista – Credit card debt in the United States

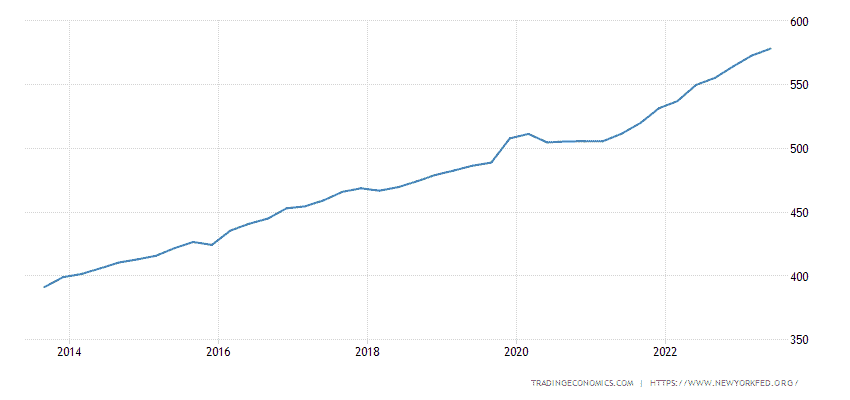

In today’s consumer landscape, credit cards have become a staple in wallets everywhere, and this trend is projected to persist. As the popularity of electronic payments continues to rise, credit cards are likely to remain a preferred choice for many years to come.

Source: Trading Economics – United States Credit Card Accounts

In this guide, we will walk you through the process of accepting credit card payments for your business. We will provide you with an overview of the procedure. Introduce you to different methods of processing payments.

What is Credit Card Payment Processing?

Before accepting credit cards for business you will require a payment processor. Credit card payment processing refers to the series of steps required to complete transactions using credit cards. This encompasses everything from when a customer chooses to pay with their card to the moment the transaction is authorized and finalized. Multiple methods are employed throughout this process including;

- Using Point of Sale (POS) Terminals

- Mobile POS Terminals

- Mobile Card Readers

- Mobile Apps

- Online Payment Gateways

Which Entities Play an Important Role in Credit Processing?

Some entities play key roles within the credit card processing system;

1. Merchant: The merchant refers to the service provider or retailer where the payment process begins.

2. Customer: The customer is the individual who holds a credit card and chooses to make a purchase using it.

3. Acquiring Bank: This is the bank that assists the merchant by enabling them to accept credit card payments through services and technology.

4. Issuing Bank: The issuing bank is responsible for providing customers with credit cards on behalf of the credit card networks. It serves as their bank in this context.

5. Payment Gateway: Acting as a link between the merchant’s website and payment processor, the payment gateway ensures the transmission of payment data.

6. Payment Processor: Responsible for handling payment data and facilitating transactions the payment processor connects with card networks to complete the payment process.

7. Card Network: Card networks are organizations such as VISA, MasterCard, RuPay, and others that operate credit card systems. They establish rules and standards, for credit card transactions.

Starting a Merchant Account

To get started with accepting credit and debit card payments, the first step is to set up a merchant account. Usually, you can do this at your bank. This merchant account acts as a channel that enables you to receive, process, and collect funds from payments made through credit and debit cards.

Whether it is for transactions or in-person purchases using a card machine, the merchant account ensures a transfer of funds from the customer’s card to your business account.

Choosing a Merchant Service Provider

When it comes to choosing a merchant service provider it’s essential to consider your options. Different providers offer a range of tools and solutions so it’s crucial to select the one that best aligns, with your business needs. It is equally important to assess the quality of customer support they provide. Make sure they offer assistance and clarify how their support is delivered whether through text, email, chat, online documentation, or other channels.

A reputable service provider will also assist you in meeting and maintaining the security standards set by the Payment Card Industry (PCI) which governs payment-related activities globally. Lastly, pay attention to how the provider charges for credit card usage. The common pricing models, for merchant service providers are tiered pricing and interchange plus pricing.

Now that you have an understanding of setting up a merchant account and selecting the provider let’s explore how online payments are facilitated.

Accepting Credit Cards for Business

Allowing credit card transactions is a straightforward process that can be applied to various types of businesses, whether it’s online or at the counter. Here are the fundamental steps involved in credit card processing, regardless of the payment method:

Customer Input: The customer either swipes, inserts, taps their card or puts in their card number on a website or app to provide their payment details to the processor.

Communication with Issuing Bank: The payment processor then connects with the customer’s bank (the issuing bank) to check for available funds or limits and to detect any potential fraud.

Transaction Approval: The transaction is approved by the bank, the payment processor gets that amount from the customer’s account and it is then transferred to your merchant account.

The main difference in the payment process of the credit card lies in how you input the card information initially.

Payments Made in-Store

To enable the use of credit cards, for purchases made in-store you’ll need a point of sale system commonly known as a POS system. This system allows your customers to conveniently pay for their purchases using their credit cards. However, it provides more than the ability to accept cashless payments.

With a POS system, you can also effectively manage your inventory handle staff management seamlessly integrate your in-store and online sales, and perform tasks related to the backend operations of your business. To set up this credit card system you’ll need a card machine. This equipment is vital in ensuring an efficient payment process, for both you and your customers.

Online Payments

To facilitate online credit payments effectively, you’ll need a secure e-commerce platform with a robust checkout system and a dependable payment gateway channel. There are numerous service providers that offer comprehensive solutions covering both the e-commerce platform and the payment gateway.

Here’s how it works:

- Your e-commerce platform creates a safe and easy-to-use space for customers to browse and buy products. It guarantees a smooth online shopping journey, from product selection to the final checkout process.

- Securing your clients’ credit card information is of utmost importance, and that’s where the payment gateway comes in. This essential component encrypts sensitive data and ensures its secure transmission over the internet for your approval. Once you give the green light, the transaction is complete, and the funds are usually deposited into your merchant account within 1 or 2 days.

While online sales offer convenience, it’s important to consider that they come with higher security risks. Verifying identities and assessing payment gateways increases the fees associated with processing credit card transactions online compared to in-person transactions. However, these costs are necessary to implement robust security measures that protect both you and your customers during online transactions.

You’ll require an account with PSP like PayPal or Stripe. You can connect this PSP to your eCommerce store online, which is usually a simple process if you’re using the right website builder. Many contemporary website builders and online shops are designed to facilitate online payments and seamlessly integrate it with your payment processors.

As many website builders have a secure sockets layer (SSL) certificate for customer security, you might need a standalone service if you want to accept payments online. If your existing website doesn’t integrate well and causes problems in successful payments, you might need to direct customers to a third-party payment site, such as PayPal, for transactions.

Payment Processing Through Mobile

To enable credit cards through your mobile device, you’ll need to set up a mobile credit card reader on your smartphone or tablet. Additionally, it’s essential to ensure that your chosen merchant account is configured to handle mobile payments effectively.

The mobile credit card reader serves as the bridge between your mobile device and your merchant account. It empowers you to accept various types of credit cards, whether they use chips, magnetic strips that require swiping, e-wallets, or contactless cards. One notable advantage of processing payments through mobile devices is the reduced risk of fraud since you can visually verify the cardholder’s identity along with the physical card or their information. Consequently, this added security helps lower the overall cost of maintaining mobile payment services.

There are many user-friendly mobile payment processor, like Square, Clover Go, and Paypal Zettle, that offers a small card reader that connects to your smartphone’s headphone jack (including Lightning connectors). With these apps, you can enter the customer’s order or total and swipe the card to complete the transaction, similar to an in-store POS. Customers can also sign to authorize the transaction directly on the screen if necessary.

Credit Card Processing Fees

When credit cards or debit cards are used to make purchases, you’ll encounter a set of common charges:

Interchange Rate: This is a percentage of the sale amount; credit card companies like Visa and others charge it. Interchange rates can be anywhere from 1.5% – 3.5%, and they tend to be higher for premium cards with added benefits.

Transaction Fee: Some payment processors charge a common rate per transaction that covers both their fee and interchange fee. Others use interchange-plus, which means you’re charged the interchange fees including a varying fee imposed by the processor.

Service Fee: Depending on your provider, you might have to pay yearly charges to use their services. However, many small-business payment service providers, such as PayPal, do not charge this fee. Instead, they opt for flat charges, making it easier for businesses to budget without worrying about additional subscription costs.

Conslusion

Fortunately, the world of payments has seen advancements that have made it incredibly convenient for business owners to access the tools for processing credit card payments. As a business owner, you now have the freedom to choose between a payment system or an integrated one.

Obtaining online or mobile payment solutions for your business has become a straightforward process. All you need to do is find a reputable provider that offers services and is known for their reliability. Armed with this knowledge, you can take your business to heights by enabling credit card acceptance. It’s a move that brings convenience to your customers and opens up possibilities for growth in your enterprise.