RealReal, a platform for luxury resale, said in an SEC filing that it fired 230 workers and shut down four locations last year in an effort to cut costs. This amounted to 7% of its personnel being laid off. Along with two more locations in Atlanta and Austin, the flagship stores in San Francisco and Chicago were among the ones to close. In addition, the business intends to reduce the size of its headquarters in New York City and San Francisco and close two consignment stores.

According to the filing, The RealReal will continue evaluating its real estate footprint to maximize efficiencies and react to macroeconomic and market developments.

Key Takeaways

- Strategic Streamlining: Recent measures by The RealReal point to a strategic reorganization intended to improve operational effectiveness and adjust to changing market circumstances. In an effort to better align its resources with market trends and maximize its real estate footprint, the company is realigning its workforce by 7% and closing four stores, including flagship locations in well-known cities like San Francisco and Chicago.

- Continuous Adaptation to Market Trends: The company’s resolve to be flexible and sensitive to shifting macroeconomic conditions and market conditions is demonstrated by its choice to evaluate and optimize its real estate holdings. This continuous assessment shows a proactive strategy to guarantee the business maintains its resilience and competitiveness in a changing business environment.

- Financial Performance and Growth Strategies: Even with obstacles, including constant losses and changes in leadership, RealReal’s financial performance has begun to improve. Generating positive adjusted EBITDA and free cash flow for the first time since going public shows how well the company’s strategic shift to growing the consignment business worked. The company has a defined growth strategy with sustained profitability in mind, as evidenced by its focus on margin enhancement and viable supply sources.

- Debt Management and Long-Term Viability: Recent private debt swap transactions show RealReal’s proactive attitude to managing its financial obligations and fortifying its balance sheet. The company is enhancing its long-term viability and financial stability by decreasing its overall debt and deferring the maturity of its obligations. This move positions the company for future growth and success in the luxury resale market.

A Strategic Restructuring: The RealReal’s Response to Market Shifts and Operational Optimization

The luxury resale platform revealed in an SEC filing last year that it would reduce staff by 230, or 7% of its total personnel, with most of the layoffs taking place in the first quarter. The business also intended to shrink its real estate holdings, including closing its local stores in Atlanta and Austin and its flagship locations in Chicago and San Francisco. There were also plans to close premium consignment offices in Miami and Washington, D.C. In addition, the corporation planned to reduce its office space in New York and San Francisco and leave its co-located logistical hubs.

The SEC filing also noted that the company will continue reassessing its real estate holdings to increase efficiency and respond to market and macroeconomic trends. This restructuring follows significant changes at The RealReal, which has been operational for 11 years. Founder Julie Wainwright departed in June, with John Koryl stepping in as her successor in January. More recently, the company announced that CEO Robert Julian will resign in October 2023, effective January 31, or upon the appointment of a new CFO, after a two-year tenure.

Notwithstanding these obstacles, The RealReal has seen a noticeable increase in sales, which can be attributed to consumers’ increased comfort level with used goods and their desire for sustainable purchase habits in the face of escalating climate change worries. Though it only marginally improved from the prior year, the corporation still struggles to profit, reporting losses of $151.2 million for the current year.

The RealReal, the biggest online marketplace for verified secondhand luxury items, also released its financial results for the fourth quarter and the full year 2023, which ends on December 31. In contrast to a $39 million loss during the same period in 2022, the company’s fourth-quarter 2023 net loss of $22 million represents an improvement. With a positive adjusted EBITDA of $1.4 million for the fourth quarter, it improved $22 million over the same period last year. The RealReal reported a net loss of $168 million for the entire year of 2023, down from a loss of $196 million in 2022, and an adjusted EBITDA of negative $55 million, up from a loss of negative $112 million the year before.

John Koryl, CEO of The RealReal, commented that the fourth quarter of 2023 saw the company achieving positive adjusted EBITDA and free cash flow for the first time since its IPO in 2019. He attributed these milestones to a strategic pivot towards enhancing the consignment business, significantly bolstering their financial results.

Koryl noted that the company has refined its growth model to emphasize profitable supply sources and has substantially improved its margin structure. He expressed intentions to maintain these improved margins as the company aims to accelerate its growth moving forward.

Additionally, The RealReal disclosed that it has engaged in private debt exchange transactions with certain creditors holding more than $145 million in total principal of its 3.00% Convertible Senior Notes due in 2025 and over $6 million of its 1.00% Convertible Senior Notes due in 2028. As part of the agreement, these creditors swapped their existing notes for $135 million in principal of new 4.25%/8.75% PIK/Cash Senior Secured Notes maturing in 2029.

Additionally, they received warrants to buy up to 7,894,737 shares of the company’s common stock at a strike price of $1.71, equivalent to the stock’s closing price on February 28, 2024, along with accrued and unpaid interest. This strategic move allowed The RealReal to reduce its total debt by over $17 million and effectively extend the maturity of a substantial portion of its obligations originally due in 2025.

About RealReal

Image source

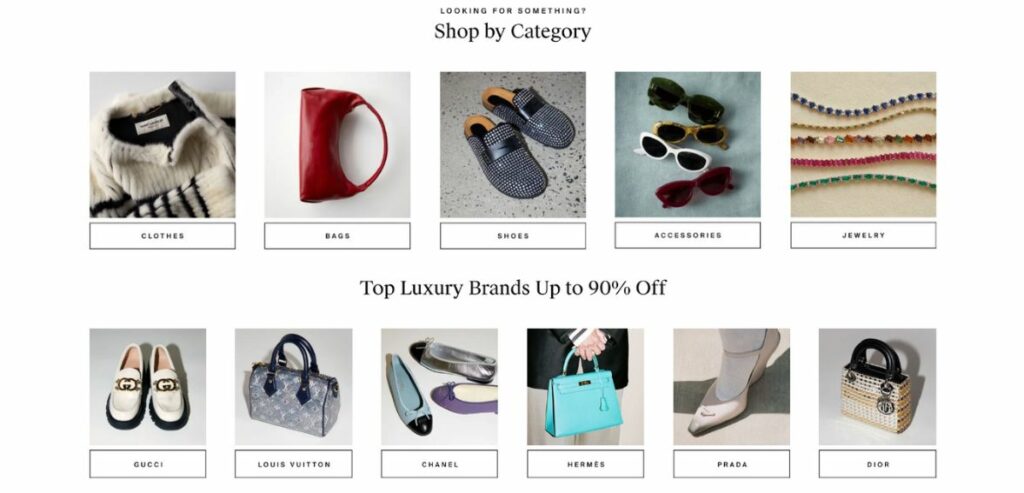

The RealReal, Inc. is a leading online marketplace for reselling luxury goods in the United States. The platform features a wide range of product categories such as women’s and men’s fashion, jewelry, and watches. As of September 30, 2023, it boasts over 34 million members and has facilitated the sale of nearly 36 million items.

The RealReal operates both online and through physical retail stores, offering a secure and dependable environment for buying and selling high-end items. Additionally, the company promotes sustainability in the fashion industry by revitalizing pieces from hundreds of distinguished brands, including Gucci and Cartier. Founded in 2011, The RealReal is based in San Francisco, California.

Conclusion

The RealReal’s strategic restructuring, including store closures and workforce reductions, reflects its commitment to cost-saving measures amidst a shifting market landscape. These adjustments, outlined in an SEC filing, signify the company’s proactive response to economic challenges and its dedication to operational efficiency. Despite leadership changes and financial losses, The RealReal remains resilient, buoyed by increasing consumer interest in sustainable luxury consumption.

The recent disclosure of improved financial performance, marked by positive adjusted EBITDA and reduced debt, underscores the effectiveness of its strategic pivots. As the company continues to refine its growth model and capitalize on profitable supply sources, it positions itself for sustained success in the competitive luxury resale market.