Despite the loom of recession in 2023, the year turned out to be unexpectedly better for all retailers across the US. In the forecasted recession, which never materialized, consumers remained resilient and continued spending, leading to a notable annual sales growth of 3.6%, or about $5.1 trillion. Looking ahead to 2024, US retail sales are anticipated to maintain an upward trajectory, although slightly slower than the previous year.

According to forecasts from the National Retail Federation (NRF), retail sales are projected to climb by 2.5% to 3.5% in 2024 to reach between $5.23 trillion and $5.28 trillion. The NRF shared these forecasts at its fourth State of Retail & the Consumer online event, which focused on evaluating the welfare of shoppers and the overall retail industry in the United States.

Key Takeaways

- Optimistic Growth Projections: The NRF is confident about sales growth in 2024, with a projected increase of 2.5% to 3.5%. This growth is expected to push revenues between $5.23 trillion and $5.28 trillion, building upon the solid sales performance in 2023.

- Diverse Sales Channels: The NRFs projections cover a variety of sales channels, including online sales and non-stores, which are expected to grow by 7% to 9% YOY. This reflects the trend of consumers shifting towards digital platforms and underscores the need for retailers to adjust their strategies to meet changing shopping patterns.

- Economic Impact of Retail: Retail has been and remains a cornerstone of the US economy, with over 4.6 million establishments supporting 55 million jobs and contributing around $5.3 trillion annually to the nation’s GDP. Matthew Shay, CEO and President of NRF, highlights how retailers drive growth and emphasize the importance of adapting to consumer preferences for expansion.

- Challenges and Opportunities Ahead: Despite signs of continued growth, such as consumer resilience and positive economic indicators, challenges like inflation pressures, labor market fluctuations, and increasing credit costs pose obstacles on the horizon. To thrive in the evolving world of retail in 2024, stores need to adapt to what customers want and provide flexible prices.

NRF’s Projections and Economic Insights for Retail Sales in 2024

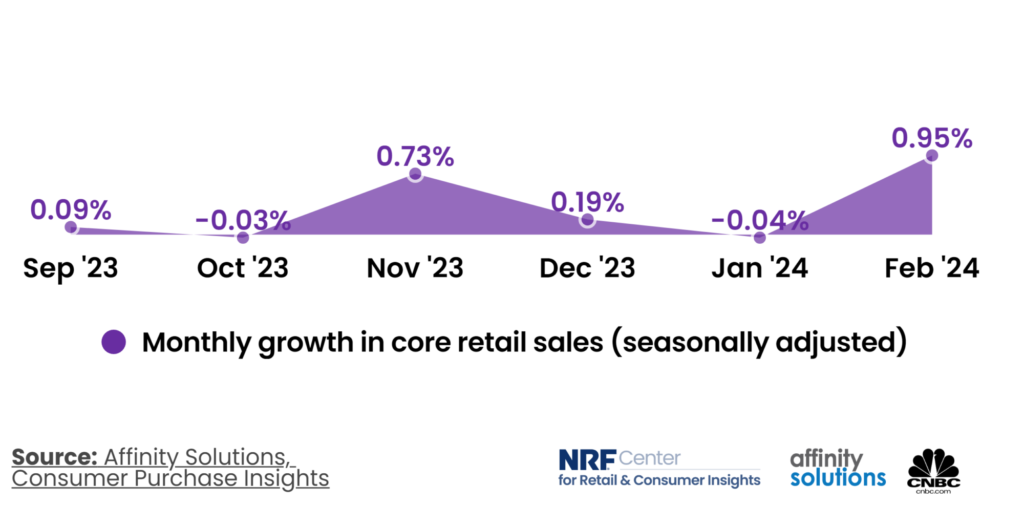

On March 20th, the National Retail Federation (NRF) released its projections for retail sales in 2024. According to the NRF, retail sales are anticipated to increase by 3.5% to reach $5.28 trillion. The forecast also includes online sales and non-stores, which are expected to grow by 7% to 9% YOY, totaling between $1.47 trillion and $1.5 trillion. This forecast for 2024 by NRF closely matches the sales growth of $5.1 trillion, which was recorded in 2023, or about a 3.6% yearly growth rate. Non-store and online sales reportedly amounted to $1.38 billion last year.

Source: Retail growth February 2024

The NRF’s retail sales projection for 2024 excludes automobile dealers, gasoline stations, and restaurants, focusing solely on the core retail sector. This forecast is derived from economic models that analyze various factors such as wages, employment rates, disposable income, consumer confidence, past retail sales data, weather patterns, and consumer credit trends.

A robust job market and increasing wages have bolstered household spending. However, retail sales have experienced fluctuations due to rising credit expenses and persistently high prices. Additionally, consumer spending patterns have shifted towards services, following a period of heightened focus on purchasing goods during the pandemic’s peak when people were predominantly staying at home.

Matthew Shay, CEO and President of the NRF, expressed confidence in American consumers’ resilience, stating that they continue to drive the economy forward. He emphasized the importance of retailers meeting consumer preferences by providing products and services conveniently and at competitive prices, which ultimately fosters steady growth throughout the year.

Shay further emphasized the significant impact of the retail industry on the economy, noting its vast scale, with over 4.6 million establishments supporting 55 million jobs in America. This makes retail the largest private sector employer, constituting more than one-fourth of all jobs and contributes approximately $5.3 trillion annually to the nation’s GDP. NRF’s prediction suggests that retail sales will return to more sustainable levels in 2023, with another promising holiday season anticipated.

Source: Prosper Insights and Infogram

The NRF anticipates full-year GDP growth of approximately 2.3%, a slightly slower pace than the 2.5% seen in 2023. However, this growth rate is deemed strong enough to support job creation. Inflation is also projected to ease to 2.2% YOY, attributed to factors such as a stabilizing economy, better alignment between product and labor markets, and decreasing housing expenses.

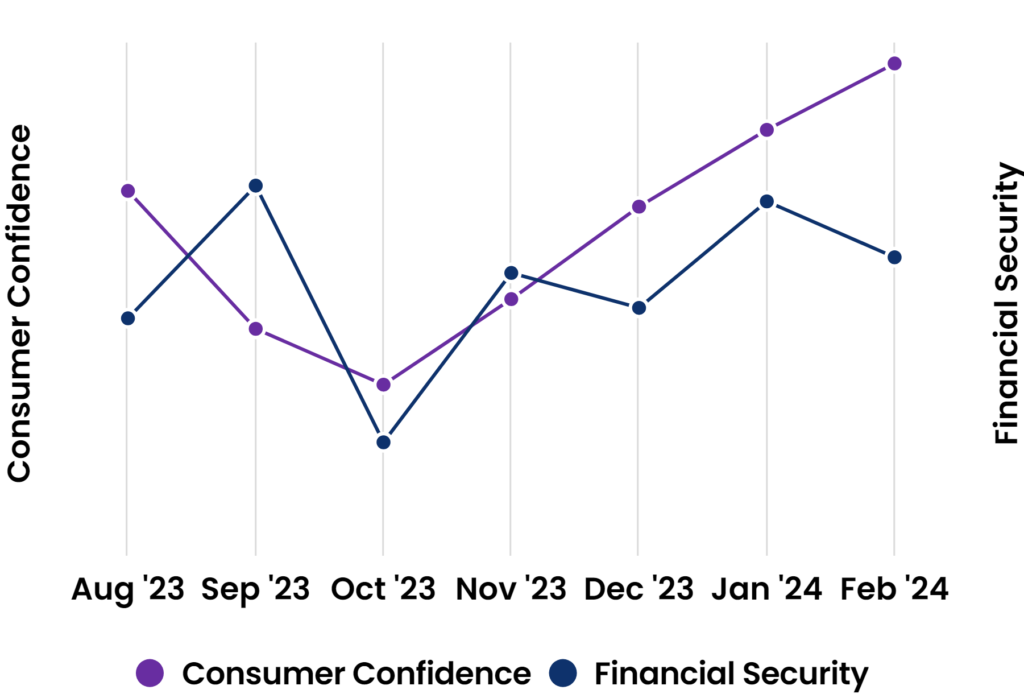

According to Jack Kleinhenz, Chief Economist at NRF, the economy relies heavily on consumers, who have demonstrated greater resilience than anticipated. It’s challenging to have a pessimistic outlook on consumer behavior. Looking ahead to 2024, the critical question is whether consumer spending will maintain its resilience.

Kleinhenz also observed that consumers’ financial positions and ability to manage debt remain strong. The uptick in home and stock prices in 2023 likely encouraged higher consumer spending through the “wealth effect,” a trend expected to continue in 2024. Various surveys indicate that consumers maintain a positive outlook, which should bolster their willingness to spend. However, many consumers feel the strain of tighter credit conditions and inflation.

The labor market is also anticipated to ease up in 2024, slowing down the robust job growth and wage increases that have been driving consumer spending. The NRF predicts that the economy will see approximately 100,000 fewer jobs per month on average compared to 2023, with an expected unemployment rate of around 4% for the entire year.

This projection from the retail group coincides with a slight uptick in consumer spending observed in February, following a pullback the previous month. However, the increase of 0.6% last month was weaker than anticipated, and January’s decline was revised downward even further, indicating a growing sense of caution among consumers regarding their spending habits. Many retailers are responding by ramping up promotions as they enter the spring sales season while also introducing new loyalty programs—some free, others fee-based—to encourage shoppers to return more frequently.

About NRF

Image source

The National Retail Federation (NRF) is the world’s largest retail trade association, championing initiatives, policies, and concepts to advance the retail sector. Through its lobbying division, the NRF actively promotes legislation and shapes labor, commerce, healthcare, and workforce development agendas. Moreover, the NRF operates a philanthropic arm known as the NRF Foundation, which focuses on enabling connections between the industry and job seekers by providing educational opportunities, training, scholarships, and immersive experiences.

Established in 1911, the NRF boasts a diverse membership base encompassing all retail landscape facets, from department stores and restaurants to grocery outlets and multi-level marketing enterprises. Serving as the preeminent private-sector industry body in the United States, the NRF represents a staggering network of over 3.8 million retail establishments and employs over 52 million individuals.

Conclusion

The retail industry is poised for continued growth in 2024, with projections from the NRF indicating an anticipated uptick in sales. Despite economic uncertainties and evolving consumer behavior, the resilience demonstrated by consumers in recent years remains a driving force behind this growth. While the pace of expansion may moderate slightly compared to previous years, factors such as a robust job market, increasing wages, and consumer confidence are expected to sustain momentum.

However, challenges such as rising credit expenses and inflationary pressures warrant careful attention from retailers. By aligning with consumer preferences, offering competitive pricing, and embracing innovative strategies, retailers can navigate these challenges and contribute to the industry’s ongoing success. As the NRF continues to advocate for the retail sector’s interests and foster connections within the industry, it remains poised to support retailers in adapting to evolving market dynamics and seizing growth opportunities.