Fiserv, a company that provides technology for payments and financial services, has introduced the Fiserv Small Business Index. This unique tool evaluates the performance of businesses in the United States based on state and industry factors. Unlike other indexes, this index stands out because it directly uses data from around 2 million businesses in the US to provide faster and more comprehensive insights.

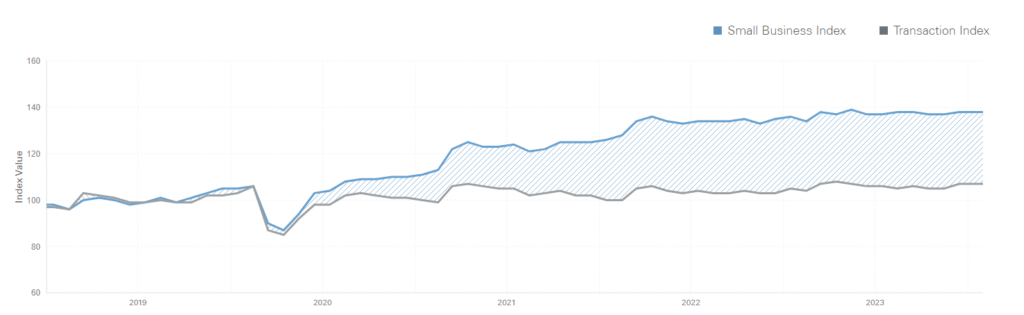

This index measures sales performance and customer traffic by analyzing point-of-sale transactions and assigns a value to consumer spending. According to the December 2023 index results, there has been an increase in business spending. Sectors such as Retail, Healthcare, and Food Services have shown growth. This Business Index has the potential to become a reference for understanding the current situation of small businesses.

Key Takeaways

- Comprehensive Small Business Insights: Fiserv’s Small Business Index, leveraging consumer spending data from 2 million small businesses, provides a unique and comprehensive view of small business performance. It stands out by directly utilizing transaction data, offering faster and more detailed insights than traditional methods, and contributing to a timely understanding of economic trends.

- Potential Standard Reference: The Small Business Index holds the potential to become a standard reference for assessing the state of small businesses. With monthly updates calibrated against 2019 data and covering 16 sectors and 34 sub-sectors, it offers a reliable and consistent measure of small business performance, even in industries dominated by larger enterprises.

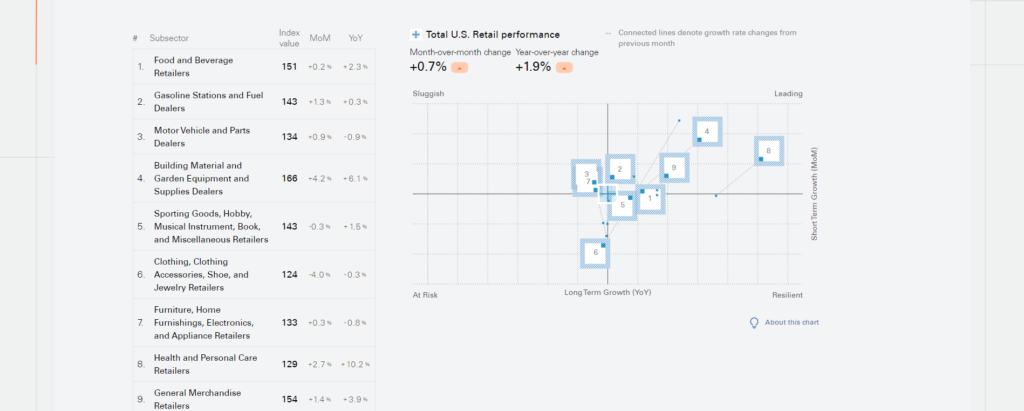

- December 2023 Highlights: The December 2023 index reveals a modest upswing in small business spending, particularly in sectors like Retail, Healthcare, and Food Services. Noteworthy improvements in consumer spending were observed in clothing, healthcare, and restaurant services, providing valuable signals about sector-specific trends.

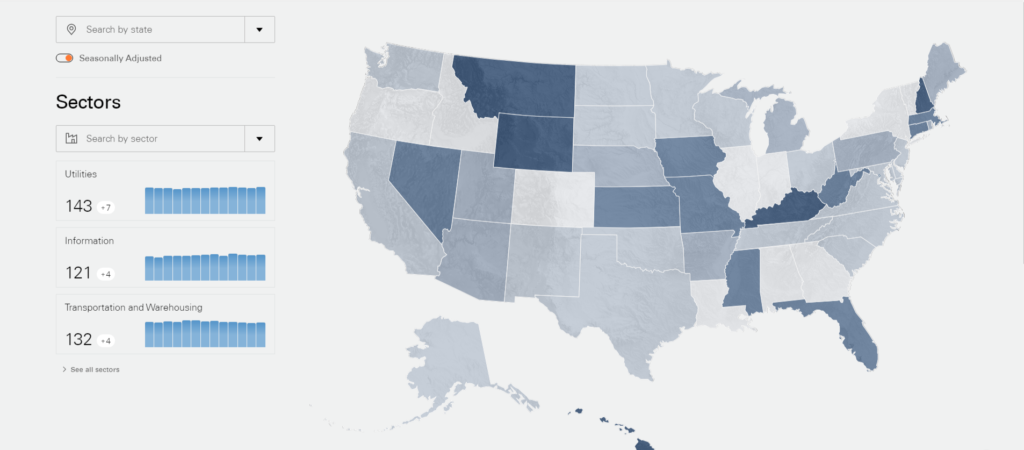

- User-Friendly Access: Fiserv’s commitment to empowering users is evident through the user-friendly interface of the Small Business Index, which is available on its website. Users can filter data by region, state, and business type, providing easy access for business owners, policymakers, lenders, analysts, economists, and investors to benchmark sales performance and make informed decisions based on timely insights.

Fiserv Introduces Small Business Index To Comprehensively Gauge Small Business Performance

Fiserv facilitates payments for over six million merchants globally and maintains a presence in nearly every ZIP code in the US. Leveraging this extensive reach, the company introduces the Small Business Index, aiming to benefit reporters, analysts, and, most popularly, small businesses.

This Small Business Index is an interactive tool meticulously crafted to provide swift and accessible access to comprehensive small business performance data. Drawing data from millions of small businesses situated in the US, it enables users to get a deeper, more comprehensive understanding of the industry, state, and national performance metrics. This updated monthly index sheds light on consumer spending patterns across 2 million small businesses in the States.

It’s a direct compilation of consumer spending data from various transactions, encompassing cash, checks, and card payments, both online and in physical stores. Comparing this strategy to sentiment-based indices or traditional surveys provides a more accurate and instantaneous picture of small company activity. This special Index, scheduled for release during the first week of the month, offers deeper insights faster than other measures, enabling users to react quickly to new trends.

As the backbone of the US economy, small businesses account for nearly half of the jobs within the nation and provide 44% of the GDP, according to Frank Bisignano, President, Chairman, and CEO of Fiserv. The organization provides timely, thorough, and useful information based on consumer spending behavior through the Index. This index functions as a trustworthy new metric, providing insightful indications regarding the state of small enterprises in the US.

The Smaller Business Index seeks to provide data and insights useful to investors, policymakers, lenders, analysts, economists, and business owners. Its goal is to provide quick insights into the trends of particular industries within the ecosystem of small businesses, allowing users to gauge sales performance, make wise choices, and adjust to the changing market environment every month.

Source: Fiserv – Consumer Spending February 2024

The index, which measures consumer expenditure numerically and includes a transaction index that tracks customer traffic, is calibrated using data from 2019. The NAICS System allows users to filter this data easily by state, region, and business type. The index, which calculates a monthly score for 16 industries and 34 subsectors, is expected to establish itself as a standard tool for evaluating the situation of small enterprises. Even in markets where big enterprises dominate, it provides a timely, accurate, and consistent assessment of small business performance.

December 2023 Insights: Small Business Spending Trends and Sectoral Highlights

In December last year, the index pointed towards a slight uptick in consumer spending at small businesses. The index reached 138, indicating a modest 0.6% month-on-month and 2.6% yearly increase in spending. Noteworthy improvements were observed in clothing, healthcare, and restaurant services.

Prasanna Dhore, Chief Data Officer at Fiserv, highlighted that the uptick in small business sales during December mirrored consumers’ priorities as the year concluded, with a focus on food and drink, healthcare, and retail. Notably, the most significant gains in small business expenditure were observed in clothing, restaurants, and other accessories.

Source: Fiserv – Retail spotlight

The Drinking Places and Food Services category showcased robust performance in December, registering a six-point surge from November to reach an index of 128. This reflects a 4.9% monthly and 3.1% annual growth in sales. Additionally, customer visits exhibited an approximate 2.0% increase in both MOM and YOY.

The national retail index held steady at 142, with a marginal 0.3% dip in sales from November but a positive 1.6% increase compared to the previous year. Notably, the Accessories, Clothing, Jewelry, and Shoes sub-sector witnessed a noteworthy 6.1% surge in sales from November and a 5% uptick from December of the preceding year.

For easy access and analysis, the index by Fiserv is available on the company’s website, offering users a user-friendly interface to explore the data.

About Fiserv

Fiserv, Inc. is a company specializing in financial services technology. It operates across four main segments: Financial, Corporate, Payments, and Other. In the Payments segment, the focus is on delivering e-bill presentment and payment services, mobile and internet banking services and software, A2A transfers, credit and debit card processing services, P2P payment services, and various other electronic payment services and software solutions.

The Financial segment offers financial institutions source capture and item processing services, account processing services, servicing products, loan origination, consulting, cash management services, and other products supporting diverse financial transactions. The Corporate and Other segment includes intercompany eliminations, amortization of acquisition-related intangible assets, unallocated corporate expenses, and activities not factored into segment performance evaluations, like gains on sales of businesses and associated transition services. The company is headquartered in Wisconsin, founded in 1984 by George D. Dalton and Leslie M. Muma.

Conclusion

Fiserv’s launch of the Small Business Index marks a significant stride in providing timely and comprehensive insights into the performance of small businesses in the United States. This monthly index, utilizing direct consumer spending data from millions of small businesses, offers a nuanced understanding of industry, state, and national metrics. The December 2023 index indicated a modest uptick in small business spending, particularly in retail, healthcare, and food services.

With a commitment to delivering actionable insights, Fiserv aims to empower lenders, business owners, economists, policymakers, investors, and analysts to face the unprecedented market overview. The Small Business Index stands poised to become a standard reference for assessing the state of small businesses, offering a reliable measure even in industries dominated by larger enterprises.