Nuvei Corporation has rolled out its card-issuing solution in 30 countries worldwide. This means Nuvei’s clients can now provide their customers or staff with physical and digital white-label cards. By combining this new feature with its existing payment services, Nuvei offers itself and its clients a unique advantage.

This dual capability brings several advantages, such as same-day funding, streamlined processing, optimized interchange fees, and real-time transaction updates. Currently, the service covers 30 countries in the European Economic Area (EEA), with plans to expand to the US, Latin America, and the UK in 2024. Businesses can use these cards for various purposes, including virtual cards for B2B transactions with suppliers.

Key Takeaways:

- Global Expansion: Nuvei Corporation has significantly expanded its global presence by introducing its card-issuing solution in 30 countries within the European Economic Area (EEA), with future plans to expand into the US, Latin America, and the UK in 2024. This move underscores Nuvei’s commitment to serving diverse markets and enhancing its global reach.

- Enhanced Financial Operations: The introduction of Nuvei’s card solution offers businesses improved working capital efficiency and better transaction approval rates. This enables businesses to access funds promptly, streamline payouts, and increase the likelihood of transaction approvals, which is particularly beneficial in retail scenarios.

- Innovative Payment Solutions: Nuvei’s collaboration with Curve and Microsoft showcases its dedication to fostering technological advancements in the payment industry. By partnering with leading platforms, Nuvei aims to optimize card transactions, offer new payment options, and provide localized payment solutions tailored to specific markets.

- Client-Centric Approach: Nuvei’s Wallet-as-a-Service option and focus on custom-branded cards highlight its commitment to delivering tailored solutions for clients. By offering seamless integration, cost-effective distribution of funds, and opportunities for customer loyalty programs, Nuvei empowers businesses to enhance customer relationships and drive growth.

Nuvei Corporation Expands Global Reach with Innovative Card-Issuing Service

Nuvei Corporation, a leading Canadian FinTech firm, has introduced its card issuing service in 30 countries across EEA. This feature empowers Nuvei’s clients to furnish their customers, staff, or contractors with custom-branded digital and physical cards. The expansions to the US, Latin America, and the UK are also on the horizon.

Philip Fayer, Nuvei’s Chair and CEO, expressed excitement about this addition to their tech platform. He emphasized that this launch underscores their commitment to innovating for their clients across various sectors while expanding their market reach. A standout benefit of Nuvei’s cards is enhanced working capital efficiency. With virtual cards, businesses can promptly access and use funds from their customers, supporting their financial operations.

Nuvei’s card solution offers several advantages, including better transaction approval rates. When merchants issue refunds using Nuvei’s cards for physical and online purchases, the chances of transactions getting approved increase. This is especially useful in retail, where customers can conveniently spend their refunded money in the same store.

The system also streamlines payouts, making them both easy and cost-effective. Whether it’s physical or virtual cards, Nuvei’s solution allows quick distribution of funds to customers or employees, often at a lower cost than traditional methods. This feature can be particularly handy for scenarios like insurance payouts, online gaming, government benefits, or payments in the gig economy. Furthermore, merchant-branded cards can boost customer loyalty. By linking card usage with reward programs, businesses can incentivize repeat purchases and foster a stronger customer connection.

They also provide a Wallet-as-a-Service option, handling everything from start to finish for their clients. So, as soon as a transaction is completed, businesses can instantly create virtual cards to pay employees, suppliers, or other clients.

This capability finds a practical application in the retail sector, especially when merchants refund their customers using virtual or physical cards, and these customers subsequently utilize the refunded amount within the same store. Utilizing the same payment processor for card issuance and transactions enhances approval rates. The process is not only seamless but also cost-effective, as virtual and physical cards can be swiftly issued.

Businesses benefit from these cards by efficiently disbursing funds to their customers or workforce rapidly, often at a lower cost than traditional payouts to existing cards or bank accounts. The immediate usability of virtual cards adds value in scenarios where businesses or governments need to pay for segments of the population without access to traditional banking services.

Nuvei’s Partnership With Curve

In a recent development, Nuvei partnered with Curve, a banking platform, to make digital wallet payments smoother. This alliance aims to improve card transactions and bring new payment options to Curve’s platform. Using Nuvei’s technology, Curve can efficiently process VISA and Mastercard payments, ensuring transactions are approved more often while keeping costs in check.

Additionally, Nuvei has expanded its footprint by opening an office in China. This strategic move reflects Nuvei’s goal to support online businesses in the Asian-Pacific market. They’re committed to helping e-commerce companies in the region grow internationally by offering both global reach and local market know-how.

Montreal’s fintech company, Nuvei, also teamed up with Microsoft. This partnership aims to use Nuvei’s flexible payment technology in the Middle East and Africa. Microsoft plans to tap into Nuvei’s expertise in local markets to enhance payments for subscription services and individual purchases, including their popular Xbox and Office products.

Ajith Thekadath, Microsoft’s Vice President of Global Payments, highlighted the importance of smooth transactions for their customers, whether making a one-time purchase, subscribing to software, or buying in-game items. He expressed enthusiasm about expanding their payment solutions to Africa and the Middle East by collaborating with Nuvei, making payments more accessible and convenient for users.

Furthermore, Microsoft will benefit from Nuvei’s global payment capabilities, which include better transaction approval rates and effective risk management to reduce payment errors. Additionally, Nuvei’s system allows Microsoft to offer local payment options specific to each market, all through a single integration.

About Nuvei Corporation

All images source: Nuvie

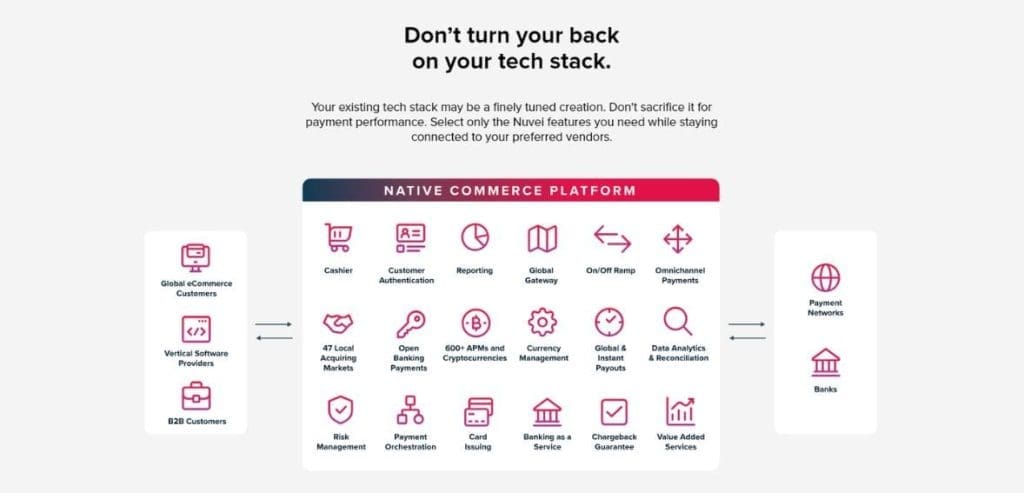

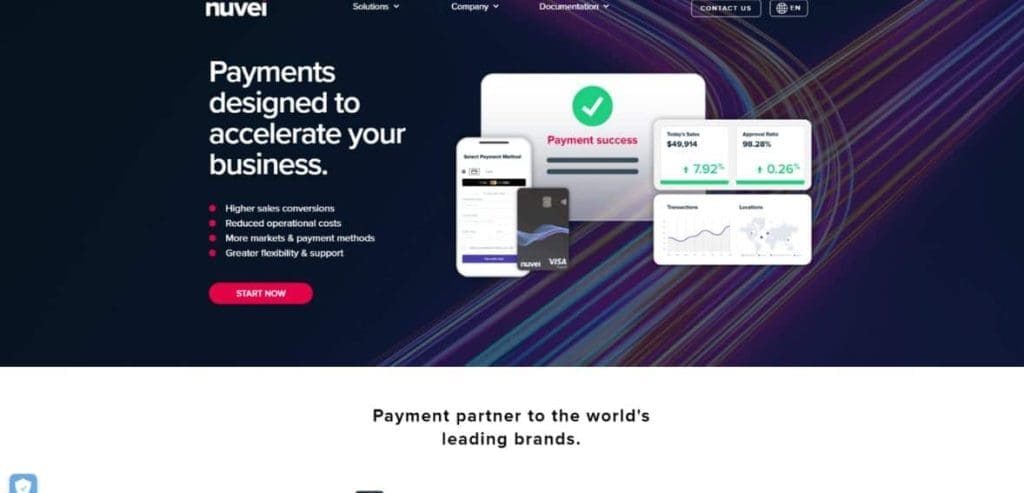

Established in 2003, Nuvei Corporation stands as a global leader in providing cutting-edge payment technology solutions. With a widespread presence across Europe, North America, Africa, the Middle East, Asia Pacific, and Latin America, Nuvei’s mission is to empower merchants and partners with seamless payment experiences. At the core of Nuvei’s offerings is a robust platform that transcends geographical boundaries, allowing customers to effortlessly make or accept payments irrespective of their device, preferred payment method, or location.

Nuvei goes beyond conventional payment solutions by offering a turnkey system designed to deliver frictionless payment experiences. In addition to its innovative payment technologies, Nuvei provides a diverse suite of data-driven business intelligence tools and risk management services.

The company’s go-to-market strategy involves the distribution of its solutions through both indirect and direct sales channels. Nuvei tailors its offerings to meet the needs of Small and Medium-sized Businesses (SMBs) and collaborates with eCommerce resellers to extend its reach and impact. Headquartered in Montreal, Canada, Nuvei Corporation operates with a commitment to excellence and a vision to redefine the landscape of payment technology.

Conclusion

Nuvei Corporation’s introduction of its card-issuing solution marks a significant stride in the FinTech industry, amplifying its global footprint and bolstering its comprehensive payment offerings. The dual capability of physical and digital white-label cards promises enhanced financial flexibility and efficiency for businesses across various sectors.

As Nuvei continues to expand its reach into new markets and forge strategic partnerships with industry leaders like Curve and Microsoft, it underscores its commitment to innovation and client-centric solutions. By seamlessly integrating advanced payment technologies with data-driven insights and risk management services, Nuvei remains poised to shape the future of frictionless payment experiences worldwide.