Global Payments Inc, a leading global provider of payment technology and software solutions, announced its financial results for the third quarter of 2023 on 31st October 2023. Global Payments’ Q3 2023 Financial Update reveals the results via live audio webcast, which was hosted by Global Payments’ management at 8:00 AM (EDT) on the same day to discuss these results. The company’s quarterly earnings stood at $2.75 per share, which exceeded the Zacks Consensus Estimate of $2.71 per share. This marks a growth from the earnings of $2.48 per share YOY.

The Global Payments’ Q3 2023 Financial Update revealed an earnings surprise of 1.48%. During the last quarter, market analysts predicted that this digital payment company would report earnings of about $2.58 per share. However, they pleasantly surprised everyone by delivering earnings of $2.62, increasing by 1.55%. It’s worth noting that Global Payments has surpassed the consensus EPS estimates on many occasions over the four quarters.

Key Takeaways:

- Earnings Surpass Estimates: Global Payments has reported more than expected earnings for Q3 2023, with earnings per share at $2.75 compared to the estimated $2.71 per share. This indicates a 1.48% surprise earnings, highlighting the company’s resilience and strong financial management.

- Robust Financial Growth: Despite the tough macroeconomic conditions, Global Payments has demonstrated impressive financial performance. The company experienced an 8.3% increase in GAAP revenues, an 8.5% rise in adjusted revenues, and an 11% growth in adjusted EPS compared to the year prior, showcasing significant year-on-year growth.

- Operational Success: Global Payments achieved notable success, demonstrating a rise of 9.6% year-over-year increase in adjusted operating earnings. Additionally, they effectively managed costs and improved their operating margin by 50 basis points, highlighting their commitment to operational efficiency as well.

- Positive Outlook and Future Projections: CEO Josh Whipple expressed confidence in the company’s outlook. He anticipates a growth rate of 7% to 8% in revenue for the year ahead and expects an expansion of up to 120 basis points in the adjusted operating margins. Furthermore, the company projects an 11% to 12% growth in adjusted EPS compared to the last year.

Image source: Global Payments

Global Payments’ Q3 2023 Earnings Show Strong Growth Amid Economic Uncertainty

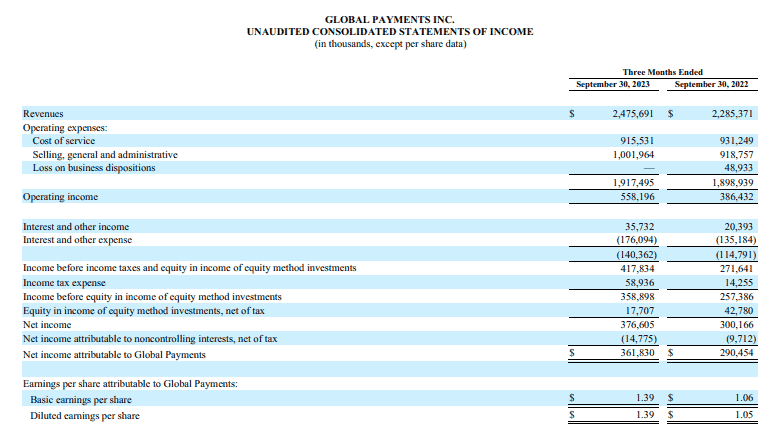

Global Payments’ Q3 2023 Financial Update on October 31st, 2023, surpassed expectations despite the macroeconomic environment. The company reported a net income of $361.83 million or $1.39 per share, showing a significant increase compared to the third quarter of the previous year when it was $290.45 million or $1.05 per share.

In terms of revenue, Global Payments recorded $2.48 billion in GAAP revenues for the quarter, marking an 8.3% rise from the period in 2022 when it was $2.29 billion. Adjusted EPS also experienced an uptick, climbing by 11% to reach $2.75 compared to $2.48 in 2022.

Furthermore, adjusted net revenues showed a growth of 8.5% YOY, reaching $2,232.4 million. The company’s operating margin also improved significantly, rising from 16.9% in the year before 22.5%. Adjusted net revenues witnessed an increase as well, reaching $2.23 billion compared to $2.06 billion in 2022. Moreover, the adjusted operating margin expanded by 50 basis points.

Furthermore, adjusted net revenues reached $2,232.4 million, demonstrating an 8.5% increase from the same period last year. Notably, the company’s operating margin improved, rising to 22.5% from 16.9% in the previous year. Adjusted net revenues witnessed a substantial uptick, reaching $2.23 billion compared to $2.06 billion in 2022. The adjusted operating margin expanded by 50 basis points to 45.7%.

As Global Payments’ Q3 2023 Financial Update, the President, Cameron Bready, expressed satisfaction with their strong third-quarter performance, which exceeded their expectations despite the ongoing uncertain macroeconomic climate. He emphasized the resilience of their business model and their ability to execute consistently across various market cycles, which solidifies their confidence in their strategic approach and the positive outcomes it yields.

Bready also highlighted the significant strides they’ve made in integrating with EVO Payments, anticipating approximately $135 million in yearly synergies resulting from this integration. He conveyed optimism about the future in collaboration with EVO Payments, emphasizing their collective strengthening of competitive advantages and leadership in the payments industry.

In addition, Bready emphasized their unwavering commitment to enhancing the commerce experience for their customers worldwide as the Global Payments’ Q3 2023 Financial Update. He underscored their distinct technology-driven strategies, continual execution, and focused approach, all of which contribute to sustainable growth and the creation of substantial value for all stakeholders.

Dividend And Other Financial Summary

As the Global Payments’ Q3 2023 Results Beats the Estimates, The Board has approved a dividend of $0.25 per share, scheduled to be paid on December 29, 2023, to shareholders of record as of December 15, 2023.

In Q3 2023, the company’s consolidated income statements reflect a net income of $376.6 million, marking a 25.5% increase from the $300.2 million reported in the third quarter of 2022. The financial measures (excluding GAAP) table indicates an 8.5% rise in adjusted net revenue, reaching $2.23 billion, compared to $2.06 billion in the third quarter of 2022.

Operational Gains

Global Payments’ Q3 2023 Financial Update shows a 9.6% YOY growth in adjusted operating earnings, reaching around $1,019.5 million. The adjusted margin for operations stood at 45.7%, marking a 50 BPS improvement from the year prior.

Total operating costs rose by 1% YOY, totaling $1,917.5 million. This increase was driven by higher selling, general, and administrative expenses during the quarter. Interest and other expenses amounted to $176.1 million, displaying a 30.3% increase YOY.

Global Payments’ Performance By Segment

- Merchant Solutions:

The segment’s adjusted revenues reached a solid $1,728 million, marking a notable 19.2% increase YOY in Q3. This growth was attributed to a 33% surge in new integrated partners, a 20% rise in POS services, and robust expansion in Spain and Central Europe, showing mid-teens growth.

The segment’s adjusted operating income stood at a solid $847.7 million, demonstrating a solid 17% improvement YOY.

- Issuer Solutions:

Adjusted revenues for the segment amounted to $519.7 million, displaying a 6.3% YOY increase in the quarter. This growth was driven by core issuer constant-currency expansion and a rise in traditional accounts.

Adjusted operating income for the segment totaled $246.6 million, indicating an 8.7% increase YOY.

Future Outlook

CEO Josh Whipple expressed satisfaction with the company’s robust financial performance throughout the third quarter and YTD period. He highlighted the achievement of a solid growth of 9% in net adjusted revenue, alongside a notable expansion in adjusted operational margins and an impressive 11% increase in adjusted EPS compared to the corresponding period in 2022.

Whipple emphasized the company’s positive outlook, citing promising trends within the business despite prevailing macroeconomic fluctuations and concerns in Forex rates. The company maintains its projection of net adjusted revenue ranging from around $8.6 billion to $8.7 billion, indicating a 7% to up to 8% growth YOY. Additionally, they anticipate an expansion of up to 120 BPS in adjusted operating margin for the year 2023. The CEO also forecasted adjusted EPS to fall within the range of $10.39 to around $10.45, reflecting an 11% – 12% growth compared to 2022 or roughly 17% excluding dispositions.

Whipple concluded by stating that the company’s 2023 outlook remains optimistic, taking into account the sustained momentum within the business, while also considering the potential impact of a more cautious economic environment amidst the ongoing uncertainty.

About Global Payments

Image source: Global Payments

Global Payments Inc. is a company that specializes in providing software solutions and payment technology. Its operations are divided into several segments, including Issuer Solutions, Merchant Solutions, and Consumer and Business Solutions. For Merchants, Global Payments offers global customers software solutions and cutting-edge payment technology. It also delivers a range of value-added services such as specialty POS solutions, engagement, and analytic tools, as well as reporting and payroll services, all designed to boost customer demand.

The Issuer segment focuses on providing financial institutions and other service providers with solutions to streamline their card portfolios and reduce technical complexity and overhead. This segment also prioritizes delivering a seamless experience for cardholders in a unified platform, along with commercial payments and е-Payables solutions that facilitate B2B payment processes for governments and businesses.

Under its Consumer and Business Solutions segment, Global Payments offers various financial services, including general-purpose reloadable payroll cards, prepaid debit cards, and DD accounts. These services are tailored to support underbanked individuals and businesses in the United States, operating primarily under the branding of Netspend. Established on January 31st, 2001, Global Payments is situated in Atlanta, GA.

Conclusion

Global Payments’ impressive performance in Q3 results 2023 reflects the company’s resilience and strategic process in the face of an uncertain macroeconomic climate. With its earnings surpassing estimates and strong financial growth evidenced through increased revenues and margins, the company has demonstrated its ability to navigate challenging market conditions effectively.

The integration with EVO Payments has resulted in significant synergies, further strengthening their competitive position and industry leadership. Additionally, the company’s commitment to enhancing the commerce experience for customers worldwide underscores its dedication to providing innovative and customer-centric solutions.

Moreover, the company’s positive outlook, as highlighted by CEO Josh Whipple, indicates a strong trajectory for future success and growth. With promising projections for net adjusted revenue, operational margin expansion, and adjusted EPS, Global Payments remains well-positioned for sustained momentum and continued value creation for its stakeholders.

Overall, Global Payments’ consistent focus on technological innovation and customer-centric strategies positions it as a key player in the evolving landscape of payment technology and software solutions, solidifying its role as a leading global provider in the industry.