Payment fraud poses a significant threat across industries, with pharmaceuticals, manufacturing, and finance being particularly susceptible. It is imperative for leaders in information technology and cybersecurity, including managers and team leaders, Heads of the ITs, CISOs, and IT managers, to stay informed about the current market of payment fraud, its associated costs, and the effective prevention strategies to comply with their existing fraud management strategies.

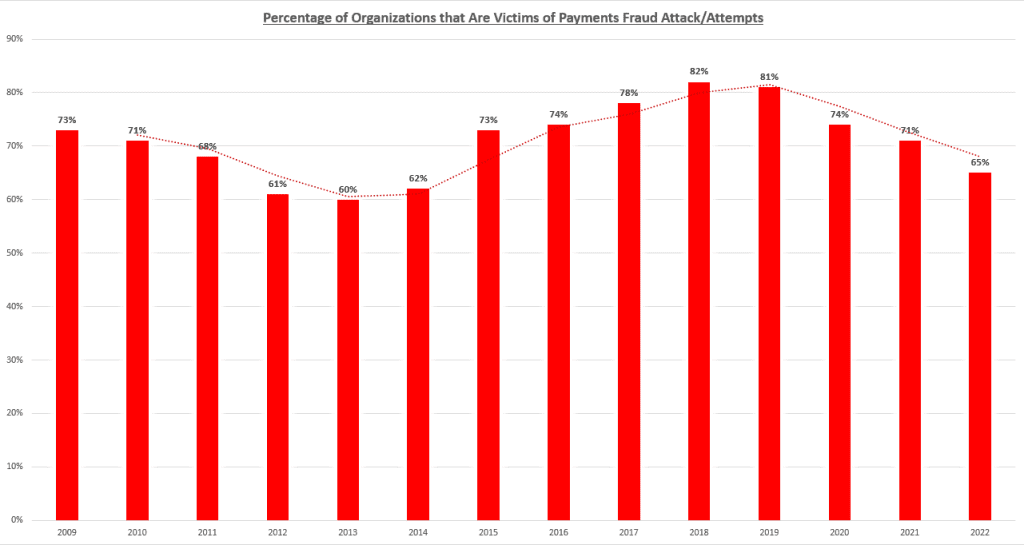

The AFP Payments 2023 Survey reveals a concerning trend, indicating that 65% of organizations fell victim to payment fraud in 2022. What’s even more alarming is that nearly half of these organizations (about 44%) were unsuccessful in recovering any of the pilfered funds.

Source: 2023 AFP Payments Fraud and Control Survey

Fraud management today is one of the most important aspects for businesses that are connected online and aiming to get rid of payment frauds effectively. Small and large businesses use specialized tools to prevent payment fraud and practice some important precautions and protocols for safety. These specialized tools and practices are crafted to proactively prevent, detect, and mitigate fraudulent activities. In this article, we will thoroughly discuss the core concepts of fraud management, explore the prevailing fraud management trends in 2024, and provide valuable insights to equip businesses in their battle against payment fraud.

What Exactly Is Fraud Management?

Businesses and organizations face diverse forms of fraud, perpetrated by employees, customers, third parties, vendors, and other entities like hackers. Annually, companies incur substantial financial losses amounting to billions of dollars due to fraudulent activities. The proliferation of online channels has particularly heightened the risk, impacting sectors such as e-commerce, banks, airlines, pharmaceuticals, and manufacturing. In response to these challenges, fraud management emerges as a systematic approach to handle fraud effectively within an organization or a company. Effectively reducing fraud requires early detection. It also requires a proactive method widely adopted by using analytics models with predictive capabilities to identify vulnerable transactions.

Providers specializing in fraud protection, whether high risk merchant account providers, payment service providers or dedicated fraud prevention software providers play a crucial role in preventing fraudulent behavior. They stay abreast of the latest fraud trends, employ AVS (Address verification), implement anti-fraud tools, and meticulously manage and analyze transactions, utilizing a combination of automated and manual order screening. Early detection of fraud not only minimizes revenue loss but also enhances customer satisfaction and retention. This multifaceted approach is essential for businesses fighting fraud.

Top 5 Principals Of Fraud Management

- Analyzing frauds

- Creating effective fraud management governance policy

- Proactive fraud prevention

- Fraud detection

- Monitor and report

- Analyzing Frauds

Before rolling out an anti-fraud program, a crucial step involves assessing the organization’s vulnerabilities and pinpointing areas susceptible to fraudulent activities. A thorough risk assessment and analysis provide valuable insights into the organization’s weak points. Moreover, it digs deeper into the core to understand the likelihood, nature, and associated costs of potentially fraudulent activities.

Based on the assessment results, a risk-tolerance limit can be established to align with the organization’s specific needs. This approach proves beneficial by quantifying the risk assessment and enabling the company to concentrate its efforts on addressing more impactful and damaging instances of fraud.

Creating Effective Fraud Management Governance Policy

Fraud management governance forms the framework of rules, practices, and processes dedicated to fraud management within a company. A robust and transparent fraud management governance policy serves as a deterrent to potential fraudsters, highlighting C-level commitment to minimizing and controlling fraud. Key elements of a comprehensive fraud management governance policy include:

● Promoting a culture of increased awareness among employees regarding fraud.

● Upholding the quality of each practice, risk, and rule process employed within the organization.

● Implementing ongoing surveillance for identifying and handling potential frauds.

● Conducting research on market trends in fraud prevention and mitigation technology.

● Providing clear descriptions of the process involved in investigating instances of fraud.

Aligned with the principles of good governance, each facet of a fraud management governance policy should be well-documented, appropriately delegated and designated, and easily accessible. Ideally, an individual within the organization should take the lead in spearheading the efforts related to fraud management governance. This comprehensive approach ensures a proactive stance in managing and mitigating fraud within the company.

Proactive Fraud Prevention

You’ve likely heard the age-old phrase, “prevention is always better than the cure,” and in fraud management, this saying holds true. Once a comprehensive fraud management plan is in place, and you’ve identified and assessed potential risks within your organization, the next crucial step is the implementation of controls, policies, procedures, and software. The primary aim is to prevent or significantly reduce the likelihood of fraud. Direct your efforts toward mitigating all three components of the fraud triangle:

● Understand the financial incentives that might drive individuals to commit fraud.

● Explore ways in which someone could rationalize committing fraud against your company.

● Assess and address the ease with which someone could commit fraud and go unnoticed.

By focusing on these key aspects, your organization can actively reduce the risk of fraud and fortify its defenses against potential threats. This proactive approach aligns with the wisdom encapsulated in the age-old saying, fostering a culture of vigilance and resilience in the face of fraud risk.

Fraud Detection

The efficacy of an organization in detecting fraud hinges on the proficient implementation of Reporting and Controls. These two strategies not only serve as preventive measures but also play a pivotal role in detecting fraudulent activities.

Controls, essentially tools, act as early warning systems for employees, signaling potential fraudulent behaviors. Deployment of these controls across various organizational layers is vital. However, employers must be well-versed in understanding how these controls operate and when to evaluate them.

On the other hand, Reporting stands as a critical facet of fraud detection. When correctly implemented, reporting mechanisms can identify and report fraudulent activities, safeguarding organizations from compromising sensitive information. The reports should encompass all essential details, including date and time stamps. This dual approach of controls and reporting forms a robust foundation for organizations aiming to enhance their fraud detection capabilities.

Monitor and Report

The effectiveness of an organization’s fraud management strategy significantly influences its overall success. Achieving this efficiency requires regular reviews and monitoring to ensure that the policies and practices within the fraud management strategy seamlessly align with the company’s vision and remain updated.

Additionally, a crucial step involves actively reporting any identified fraudulent activities to someone capable of addressing the issue promptly. This proactive reporting mechanism catalyzes timely action, preventing organizations from incurring substantial losses.

By adhering to these five stages during the implementation of the organization’s fraud management program, businesses can enhance their capabilities to detect and prevent suspected fraud, both internally and externally.

Benefits Of Effective Fraud Management Plans

● Safeguarding Against Severe Losses

Instances of fraud leading to substantial losses, which can jeopardize a company’s very existence, are fortunately rare but not unheard of. Whether it’s financial setbacks or the erosion of trust, the aftermath of such fraud leaves lasting scars.

The encouraging news is that the overall cost of implementing a fraud management strategy is not exorbitant, providing a shield against potential future losses.

● Gaining Valuable Insights

A well-structured fraud management strategy, when put into practice, offers valuable insights into an organization’s vulnerabilities. It serves as a beacon, illuminating both strengths and weaknesses that require attention. Armed with this knowledge, organizations can construct a more effective and efficient fraud management program, mitigating risks and fostering resilience.

● Instills Confidence and Attracts Opportunities

A well-executed fraud management strategy not only enhances control over an organization’s destiny but also instills a heightened sense of confidence. This increased confidence makes the organization more appealing to investors, business partners, and other potential opportunities.

Top Fraud Management Trends And Insights 2024

Scam Blocking Techniques and Tools Are Getting Attention

The need for a systematic approach to address the prevalence and complexity of scam trends is crucial. Relying solely on old security measures proves insufficient against the ever-evolving tactics employed by scammers. Businesses must acknowledge the significance of multi-layered strategies integrated with necessary tools and services to effectively safeguard against various types of scams.

A multi-layered fraud management approach integrates multiple security measures, each serving as a line of defense against different facets of fraudulent activities. This approach provides a comprehensive defense strategy that is not only more robust but also adaptable, thereby mitigating the risks posed by sophisticated phone scams.

To optimize efforts in preventing fraud, businesses and organizations must efficiently coordinate diverse risk signals, customer information, and data points. Through the consolidation and analysis of this information, organizations can devise a unified and well-rounded response. This approach aims to minimize risk, reduce customer friction, and mitigate the associated costs of prevention.

AIT SMS Fraud on the Rise

AIT, or A2P or International Traffic, represents a pervasive form of SMS fraud that orchestrates a surge in fake traffic through mobile applications or websites. Recent insights identify AIT as a prominent threat that individuals covering fraud prevention should be aware of, as projections are indicating its further escalation in 2024.

Here’s a common AIT scenario:

- A fraudster makes a bot designed to generate fake accounts.

- The bot initiates the delivery of OTP SMS to various mobile numbers.

- The fraudster collaborates with a rogue entity to intercept the inflated traffic, avoiding actual message delivery to end users.

- Together, they lay claim to the revenue generated, sharing the ill-gotten profits.

- This cycle repeats, inflating revenues and manipulating conversion statistics.

As the application owner, you may find yourself burdened with the bill, even though the messages were technically delivered by the fraudsters. Fraudsters often target long-distance locations, as international destinations with higher delivery costs offer the most lucrative returns. Recent data reveals that over 43% of businesses have encountered AIT in recent years, with 60% of business owners seeing a noticeable acceleration in this threat.

To steer clear of AIT scams, businesses should opt for a trustworthy communication platform equipped with effective fraud prevention tools. One such tool is the Verify API, which allows you to enforce Two-Factor Authentication (2FA) for all A2P messages containing sensitive information. This proactive measure enhances security and safeguards your communication channels from fraudulent activities.

Escalation of Wire Frauds

Among the concerns that keep certified fraud examiners and anti-fraud professionals up at night, wire fraud stands out as a formidable adversary. Unlike schemes centered around credit lines and gift cards, wire fraud perpetrators are now setting their sights on the real estate market, participating in escrow closings.

Examining the losses, particularly in real estate, reveals a staggering 700% growth in wire frauds in the last five years, according to recent FBI data. Wire fraud poses a unique challenge because while institutions gather ample information about the payers initiating transactions, they possess scant details about the payees receiving the funds.

This gap in knowledge prompts fraud risk experts to explore improved methods for gaining insights into entire payee ecosystems. To safeguard against wire transfer fraud, it’s advisable to verify each transaction meticulously before releasing funds. Avoid contacting numbers provided in emails or on websites for verification. Instead, rely on the initial transaction information you received—trusted numbers that have been used in previous interactions before discussing financial matters. This practice enhances security and reduces the risk of falling victim to fraudulent activities.

Frauds Taking its Way Through ChatGPT

Fraud in the form of service is fueling the industrialization of fraudulent activities, posing a significant challenge to anti-fraud efforts. While cutting-edge technologies have been deployed to combat real-time transaction fraud and online scams, there’s been a concerning neglect of defenses against traditional, P2P, and physical frauds.

This neglect has given rise to a troubling trend where fraudsters are using modern tech integrated with older fraud schemes. Practices such as deposit and check fraud, and intercepting emails to pilfer information regarding your PII and credit cards also have become more sophisticated.

In some reported instances, criminals target unarmed mail carriers, they plunder for paper checks and items containing PII (Personally Identifiable Information), which are then sold in the black market, preferably the dark web. This results in exploitation for account takeovers, identity theft, and manipulation of checks by altering the amounts before depositing them into the mule accounts for laundering.

The integration of technologies like ChatGPT accelerates criminal activities. For example, a large-scale data breach at a retailer yields millions of card numbers, which fraudsters sell on the dark web, categorized by card type. The buyer of these card numbers can leverage ChatGPT to automate routines for swift and repetitive card-not-present attacks at an astonishing speed.

The key concept in understanding Fraud in the form of service is the division of labor among various players. With distinct groups involved in selling, exploiting, and buying PII, fraud transforms into a full-fledged industry. Fraudsters can navigate and operate within this industry more swiftly and easily than anti-fraud professionals can counteract. Countering industrialized fraud is poised to become a top priority for anti-fraud professionals in the upcoming year.

Phone Scammers Are Now Global

Phone scammers are adopting new tactics, using artificial identities to deceive individuals into thinking their calls are from reputable sources or friendly contacts. Employing urgency, fear, and empathy, scammers aim to manipulate emotions and gain unauthorized access to sensitive information through social engineering — sophisticated psychological attacks.

Expanding their reach globally, scammers now use local-number telecom technology, intended for global business-customer connections, to mimic phone numbers across different countries. This approach allows them to target a wider audience while remaining untraceable.

Businesses can leverage AI surveillance tools to identify and bar phone numbers associated with fraudulent activities, providing a proactive defense against evolving phone scam strategies.

Conclusion

As organizations grapple with the escalating threat of payment fraud, staying aware of the top fraud management trends in 2024 becomes imperative. The AFP Payments 2023 Survey underscores the alarming prevalence of payment fraud, emphasizing the urgency for robust fraud management strategies for 2024.

Through comprehensive governance policies, proactive prevention, vigilant detection, and strategic reporting, organizations can fortify their defenses. Embracing evolving trends such as scam-blocking techniques, addressing AIT SMS fraud, countering wire fraud escalation, and tackling fraud in the form of service will be crucial in navigating the evolving landscape of fraud prevention.

Frequently Asked Questions

What's the fastest-growing fraud in the US?

As the fastest-growing financial crime in the United States, synthetic identity fraud poses a significant threat, costing banks a staggering $6 billion. This type of fraud involves the creation of synthetic identities, often referred to as “Frankenstein IDs,” by combining real and fake information.

How can fraud in e-commerce be detected?

You can swiftly identify users by analyzing their email addresses or phone numbers through a process called data enrichment. For most online stores, transaction fraud typically manifests as low-value transactions, which fraudsters use to test the viability of stolen cards.

What techniques are employed in fraud monitoring?

Fraud monitoring utilizing machine learning involves the application of machine learning algorithms to detect and prevent fraud. Machine learning, a form of artificial intelligence, enables computers to learn from data without explicit programming, enhancing the ability to identify and thwart fraudulent activities.

What strategies are recommended for preventing fraud?

Establishing a code of ethics for both management and employees is crucial in shaping the organizational culture and setting expectations. Regular fraud risk assessments, coupled with the implementation of effective internal controls, play a key role in reducing the likelihood of fraud.