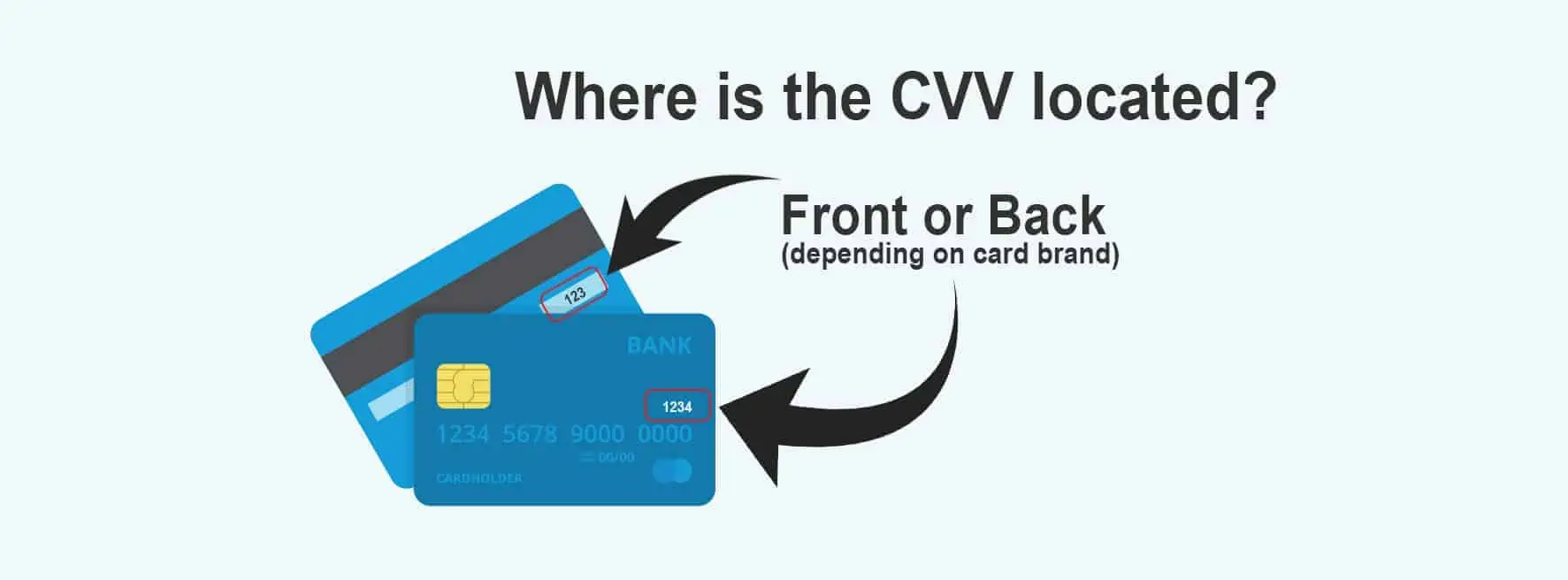

A card’s CVV, which stands for “Card Verification Value”, is a special code printed on credit and debit cards. This code is used as an extra layer of security and protects against fraud and is usually a 3 digit code printed on the back of the card next to the signature strip. Though the CVV is usually located on the back of the card, it is not always. American Express® cards generally have the CVV in the form of a 4 digit number on the front of the card just above and to the right of the card account number. No matter what card you have the CVV will be in one of these locations. The graphic below shows both for visual reference.

Now that you understand the basics let’s get more technical. It is important to understand that the CVV number that is physically printed on a card is technically called a “CVV2”. There is a code called a “CVV1”, but that code is not accessible by the cardholder. The CVV1 is a security code that is encoded in the second track of the magnetic strip on the back of the card. The purpose of the two different CVVs is the same – to add an extra layer of security – but the use is different. The CVV1 that is electronically encoded in the magstripe (magnetic strip) is read by credit card machines and swipers. That is the reason why you don’t have to type in the CVV when using your card at a terminal, the machine reads it for you. That being said, when the card isn’t being swiped, such as an online or over-the-phone payment, the cardholder is required to supply the CVV manually.

In conclusion, the CVV is usually a 3 digit number on the back of the card but in some instances is a 4 digit number on the front of the card. There is no difference in security or use of the CVVs.

Get Your FREE Merchant Services Account Review and Quote!

Or Call us! 877-517-HOST (4678)