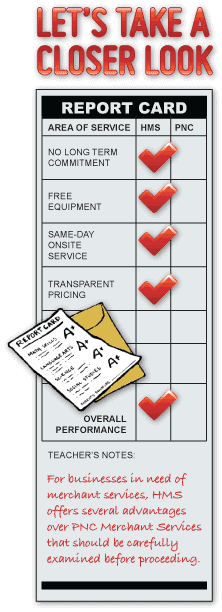

Host Merchant Services vs. PNC Merchant Services

Businesses today need every advantage they can get, especially when it comes to accepting credit card payments. There are a variety of services to choose from, with Host Merchant Services and PNC Merchant Services being two of the most popular. Today, more businesses are beginning to turn to Host Merchant Services as a superior solution for their credit card processing needs.

Long-Term Commitment

While PNC Merchant Services typically requires long-term commitments and charges early termination fees of as much as $500 to get out of the contract, Host Merchant Services does not. With no hidden banking fees, no monthly minimums and no early termination fees Host Merchant Services give their clients no surprises, only results. Monthly statements are sent promptly and are easy to read, making the entire experience hassle-free.

Free Equipment

A major stumbling block for many businesses is the cost of the credit card processing equipment. PNC Merchant Services usually expect customers to sign long-term leases for their equipment, often costing the business thousands of dollars for equipment that may actually cost only a few hundred. It’s also likely they will be charged upfront fees for the equipment, which can cost $400 to $750 or more. Host Merchant Services, however, provides clients with a free terminal and free supplies (receipt paper, etc), keeping the focus on customers rather than contracts and fees.

Premium, Same-Day Service

Any business knows that eventually equipment will break down, and when it does prompt service is a premium. While PNC Merchant Services requires terminals to be shipped for repair, costing a business time and money when it cannot process credit card payments, Host Merchant Services offers 24/7 on-site service and customer support. HMS offers its customers same-day service, repairing or replacing terminals on the spot rather than wasting time and money shipping equipment back and forth.

Transparent Pricing

One of the biggest areas of difference between the two services is pricing. PNC Merchant Services often has many pricing schemes, many including surcharges and hidden fees, along with a tiered pricing scale that winds up costing clients hundreds of dollars in unnecessary charges. Frequently PNC Merchant Services disguises high credit card processing rates by charging other excessive banking fees. Host Merchant Services, however, has an interchange plus pricing plan that provides a competitive rate that’s locked in and never increases. By offering this type of pricing plan, HMS gives its customers peace of mind while making it easier for them to concentrate on customer service. For businesses in need of merchant services, HMS offers several advantages over PNC Merchant Services that should be carefully examined before proceeding.