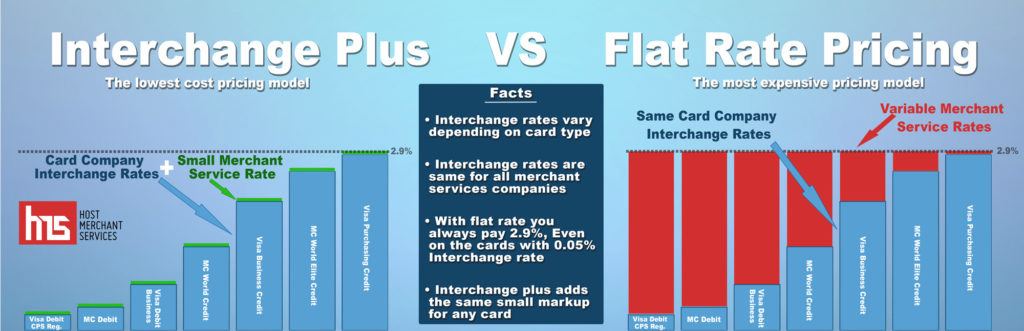

Interchange Plus vs Flat Rate Pricing

Two of the most common payment processing pricing models you will encounter today are flat rate pricing and interchange plus pricing. Here’s how they compare and why interchange plus pricing is the superior choice for most merchants. Choosing the right credit card processor can be a difficult task when you consider there are several types […]

Interchange Plus vs Flat Rate Pricing Read More »