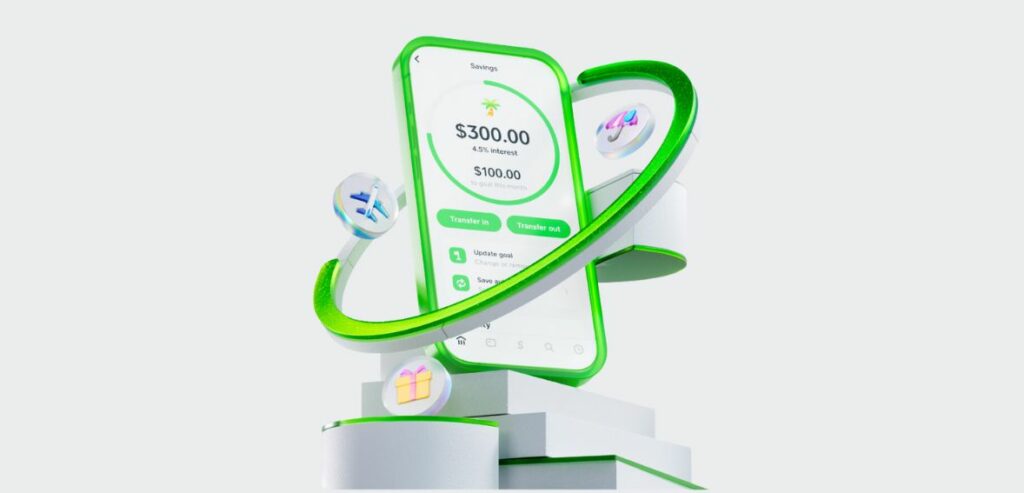

Cash App Launches 4.5% Interest on Savings

Cash App rolled out high-yield saving deposits for its Cash Card users. Per their announcement on X last month, the user can earn up to 4.50% interest. With an option to earn 4.50% interest, they are now directly competing with Apple. Apple recently increased its interest rates. The user must fulfill some essential conditions to […]

Cash App Launches 4.5% Interest on Savings Read More »