The use of cryptocurrencies has drastically increased over the years. But unfortunately, most blockchain networks can’t interact with each other because they have different protocols and features. Although it provides an excellent level of security, it creates problems with transferring data from one blockchain network to another.

However, the exchange of information is essential for the survival of decentralized finance (Defi). In this situation, the wrapped tokens appear to be a reasonable solution as they support the transfer of information without affecting the security of the blockchain network. Wrapped Bitcoin (WBTC) is one of the leading names in this category.

What is Wrapped Bitcoin?

Wrapped Bitcoin (WBTC) is an ERC-20 token designed to facilitate the Bitcoin holders who want to build or use decentralized finance (Defi) apps on Ethereum. Its value is equal to 1 Bitcoin because it represents Bitcoin on the Ethereum network. It was created by BitGo, Kyber, and Ren in 2019. And now, a group of 30 members (WBTC DAO) maintains this network.

Image source: WBTC

Wrapped Bitcoin enables Bitcoin holders to convert Bitcoin into a yield-bearing asset so they may take advantage of earning opportunities on different platforms.

How Does WBTC Work?

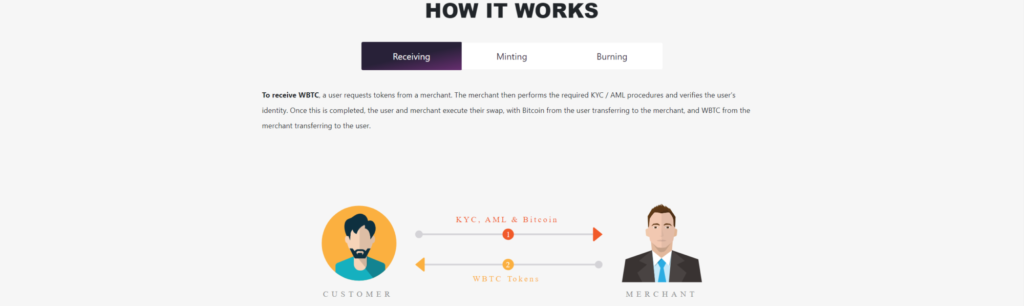

So far, the users can’t convert their Bitcoin into WBTC by themselves. They need to send their BTC tokens to a reliable merchant like Kyber Network, Ren, or DiversiFi. The merchant then transfers the BTC to a custodian (BitGo) to start the minting process. After the minting process, the WBTC is transferred to the Bitcoin holder subsequently.

The user can then use it on compatible platforms whenever he wants. And when he wants to redeem the BTC tokens, he needs to follow the same process again. The custodian will release the Original BTC tokens and the WBTC will be burned.

Wrapped Bitcoin vs. Bitcoin

WBTC is backed by BTC in a 1:1 fashion which means both the tokens have the same value.

Bitcoin is the leading cryptocurrency that paved the way for other cryptocurrencies. Hundreds of cryptocurrencies are launched over the years but Bitcoin has successfully maintained its reputation over the years.

With a circulating supply of 18.9 million tokens, Bitcoin has a market capitalization of $775 billion. It’s the leading cryptocurrency in terms of market cap. Bitcoin has a total supply of 21 million coins. The remaining 2.1 million coins will be launched over the next few years. These coins will be rewarded to the miners who are helping with keeping the network secured

Bitcoin incorporates the Proof-of-Work consensus protocol for validating transactions. The blockchain generates a mathematical equation whenever someone requests a transaction. The miners who have blockchain installed on their computers try to solve this equation. Whoever solves the equation earlier, wins the reward.

Although it has several complexities in its network, Bitcoin has successfully maintained its position over the years.

WBTC, on the other hand, has a circulating supply of 272 thousand tokens. It doesn’t have a maximum supply because it’s a wrapped version of Bitcoin. So, we can say that the maximum supply of WBTC is equal to the circulating supply of Bitcoin. With a market cap of $11 billion, WBTC is the 17th biggest cryptocurrency.

The reason why it has become so popular is that many Bitcoin holders wanted to take advantage of the Ethereum-based services. So, it appeared as a great solution for them.

WBTC isn’t the only version of Wrapped Bitcoin

As it’s mentioned above, WBTC is managed by WBTC DAO, a group of 30 members. There are several other organizations that provide a wrapped version of Bitcoin. For example, Huobi Global, a popular crypto exchange, has its own version of wrapped bitcoin known as HBTC (Huobi BTC).

The users can withdraw HBTC if they have a specific amount of BTC in their Huobi Global exchange account. Ren also launched a version of wrapped Bitcoin in 2020 which is more decentralized as compared to wBTC and HBTC. The users can mint renBTC by locking their BTC tokens in a smart contract.

Similarly, they can burn the renBTC tokens if they want to redeem their BTC holdings. There are several other versions of wrapped Bitcoin the Bitcoin investors can use according to their preferences:

- Tokelon’s imBTC

- pNetwork’s pBTC

- Synthetix’s sBTC

- BoringDAO’s oBTC

- Keep Network’s tBTC

There are some other forms of wrapped Bitcoin that are backed by a set of wrapped Bitcoins. acBTC is the most popular example that is backed by wBTC, imBTC, pBTC, and sBTC. Similarly, mStable’s mBTC and PieDAO’s BTC++ are other options that are backed by a set of wrapped Bitcoins.

Although wBTC isn’t the only version of wrapped Bitcoin, it dominates the market for wrapped tokens with an 81% share. renBTC is the second-largest token in this category with a market cap of $670 million.

Other Wrapped Tokens

There are several other wrapped tokens that are designed to exchange information between different blockchain networks. 0x Labs, Relay, and Airswap are some popular platforms that issue wrapped Ethereum in exchange for Ether (Ethereum) tokens because Ether isn’t compatible with Ethereum’s ERC-20 tokens.

The users need to lock their ETH tokens in a smart contract to obtain the wrapped Ethereum (wETH). They can get their ETH tokens back by returning the wETH.

Ren provides a wrapped version for several cryptocurrencies including:

- Terra (LUNA): renLUNA

- Zcash: renZEC

- Digibyte: renDGB

- Bitcoin Cash: renBCH

There are several other versions of wrapped tokens issued by other organizations:

- Wrapped Monero (wXMR)

- Wrapped Matic (wMATIC)

- Wrapped Filecoin (wFIL)

- Wrapped BNB (wBNB)

- Wrapped Celo (wCELO)

Wrapped Tokens aren’t the Only Solution

Although wrapped tokens are a great option for exchanging information between different blockchains, Bridging is another reliable solution for the problem. With this solution, the users don’t have to deal with a third party. They can transfer their assets from one network to another with a few simple steps.

Polygon, Optimism, and Arbitrum are some popular networks that enable users to transfer their assets from Ethereum to these networks.

Conclusion

Wrapped Bitcoin is designed to transfer information from Bitcoin to other cryptocurrency networks without compromising security. Similarly, there are other forms of wrapped tokens for different cryptocurrencies that are used to exchange information between different networks. If you need more information about Wrapped Bitcoin or other Wrapped Tokens, feel free to get in touch with us.