As a savvy entrepreneur, you are likely delving into the various “buy now, pay later” solutions available in today’s marketplace, with Perpay being one of the choices on your radar.

While these services can offer merchants a wealth of advantages, such as reducing abandoned carts, elevating sales, and strengthening customer devotion, it is crucial to be aware that there are also potential drawbacks to be taken into account.

Before committing to any “buy now pay later” program, it’s advisable to weigh the outcomes and assess all aspects thoroughly. In this article, you’ll discover more about it, what is Perpay, and how it works.

What is Perpay and How Does it Work?

What is Perpay?

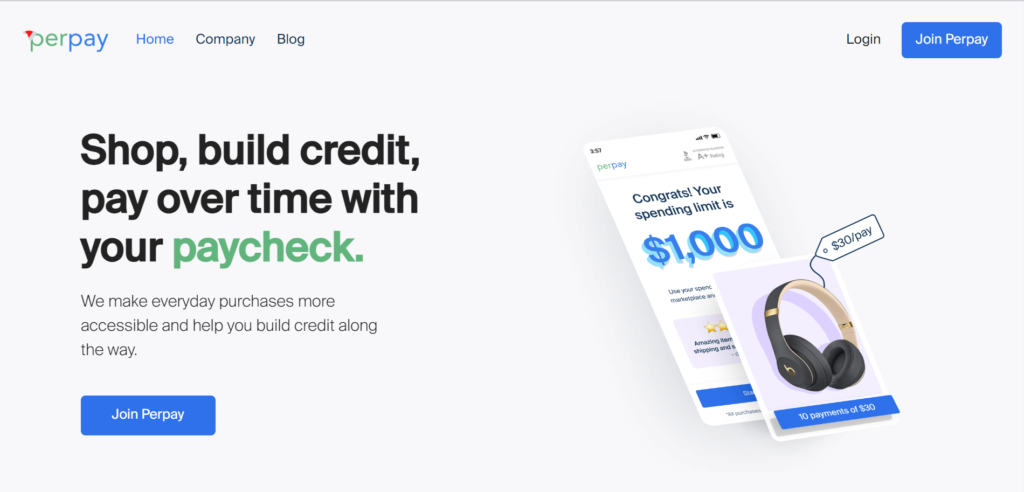

Perpay revolutionizes the way people pay for their shopping. As a fintech firm, it offers a cutting-edge alternative to traditional payment methods. With its “buy now, pay later” option, Perpay empowers consumers to divide the cost of their purchases into manageable chunks spread out over a while, with no interest or extra charges to worry about.

Image source: Perpay

The Perpay platform makes it easy for customers to make payments in installments, providing a stress-free experience and peace of mind. No more hidden fees or sky-high interest rates, just a convenient and flexible solution allowing individuals to take control of their finances and confidently make their purchases.

How does Perpay work?

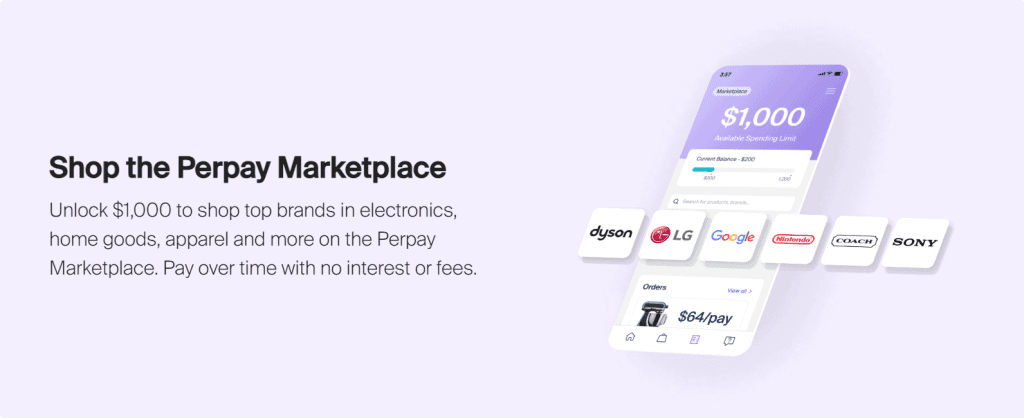

With Perpay, you can turn your big-ticket purchase dreams into a reality without financial stress. The company offers a 12-month payment plan without any extra interest charges. Signing up is easy and only requires your latest pay stub to determine your spending limit.

Upon approval of your application, you’ll have access to Perpay’s diverse marketplace, featuring top brands such as Ashley HomeStore and Nintendo. Conveniently, your payment installments can be automatically deducted from your chosen pay cycle (biweekly, weekly, or monthly), giving you one less thing to worry about. You also have the option to make additional payments with your card, giving you complete control over your finances.

Image source: Perpay

Perpay’s payment plan provides a stress-free and flexible solution for those seeking to make big-ticket purchases without the burden of high-interest rates or sneaky fees. With Perpay, you can confidently manage your finances and make purchases easily.

How Does Perpay Make Money?

Perpay is a one-of-a-kind retail platform that offers a revolutionary way of shopping and managing personal finances. Unlike traditional retail stores, Perpay does not impose any membership or late fees on its customers. In addition, the installments made by customers are not subject to interest, providing a worry-free shopping experience.

Many customers may wonder how Perpay generates revenue, but the answer is quite simple. Perpay obtains products at wholesale prices, then sells them to customers at a higher price after adding a markup. Although this may cause some products to be pricier compared to other retailers, Perpay provides customers with the benefit of paying for their purchases in installments and the chance to improve their credit.

Advantages and Disadvantages of Perpay

Advantages

Perpay provides a seamless shopping journey by letting you pay for your purchases through manageable installments without harming your credit standing. The spending limit is set based on your income, and you can choose the number of payments that best suits you, which will be automatically deducted from each paycheck after you order the item.

You can opt to spread the payments over a maximum of 6 months, and rest assured that there are no added interest costs or penalties for late or missed payments. The mobile app is user-friendly and highly rated on both Google Play and Apple stores, allowing you to manage expenses and explore a diverse range of products from different brands available in the Perpay platform.

To enhance your credit profile, sign up for Perpay+ and have your payments reported to the three major credit bureaus, Experian, Equifax, and TransUnion. However, making timely and dependable payments is crucial to make the most of this add-on service.

Disadvantages

One of the negatives of using Perpay is the limited shopping options. Unlike other BNPL companies that enable their customers to shop at various retailers or in-person locations, Perpay restricts its customers to purchasing only items available on its website or mobile app.

Additionally, the payment structure of Perpay requires customers to pay off their purchases through automatic deductions from their paychecks, limiting the flexibility in payment options.

Is Perpay Safe?

Perpay is dedicated to ensuring the privacy and security of its customers. They understand that personal information is valuable and must be protected. They have established strict policies to protect your data from unauthorized access, use, or disclosure.

Perpay will not share your personal information with any third parties except when required by law enforcement. This means that you can trust that your information will only be used for the purpose it was collected. Additionally, if you sign up for Perpay+, credit bureaus may share your data to help build your credit history.

The company implements industry-standard security measures to enhance your data’s protection further. This includes off-site storage, where your information is stored in secure locations, and SSL certificate technology encrypts your information as it is transmitted over the internet. These measures are designed to ensure that your personal information remains confidential and secure.

Who can Become a Perpay Shopper?

Several eligibility requirements must be met to become a Perpay shopper and secure approval. Firstly, it is essential to have a steady and reliable job that provides a consistent source of income. This helps the shopper make timely payments and fulfill their financial obligations.

Secondly, it is necessary to have an annual earning that exceeds $15,000. This requirement is in place to ensure that the shopper has sufficient funds to make purchases and manage their finances effectively.

Thirdly, a good cell phone plan is also a must. This is because Perpay uses cutting-edge technology to manage transactions and communicate with shoppers, and a cell phone plan is necessary to take advantage of these features.

Finally, the shopper must not be currently undergoing any ongoing bankruptcy proceedings. This ensures that the shopper is financially stable and can manage their finances effectively.

Final Thoughts

To answer your question on what is Perpay and how it works, Perpay stands out as a top-notch financial technology company that presents a fresh perspective on financing. Unlike traditional methods, where individuals must borrow from banks or other lenders, Perpay allows customers to finance their purchases over an extended period.

Image source: Perpay

This provides a convenient way for them to make purchases and opens up the door for them to enhance their credit scores and sidestep the high-interest rates and additional fees typically associated with conventional forms of credit.

Perpay’s innovative approach to financing is a pivotal moment in the financial industry, providing a novel and adaptable option for individuals seeking to take control of their finances.

The company aims to offer its customers a valuable and practical solution for their financial needs. By bringing a unique spin to financing, Perpay empowers individuals to make confident purchases and manage them quickly and efficiently.