Imagine a world where paper checks zip through a digital highway, reaching their destinations faster than ever while leaving a minimal environmental footprint. Welcome to the realm of check truncation, where cutting-edge technology is fused with traditional banking processes to create a seamless, efficient, and eco-friendly experience.

At the heart of this revolution lies the term ‘truncation,’ which refers to the act of shortening or cutting something. In the context of check processing, truncation signifies the transformation of a paper check into an electronic image, expediting the clearing process and bringing a plethora of benefits to businesses and consumers alike. So, keep on reading to dive deep into the fascinating world of check truncation, exploring its intricacies, advantages, potential drawbacks, and impact on the banking landscape.

What is Check Truncation?

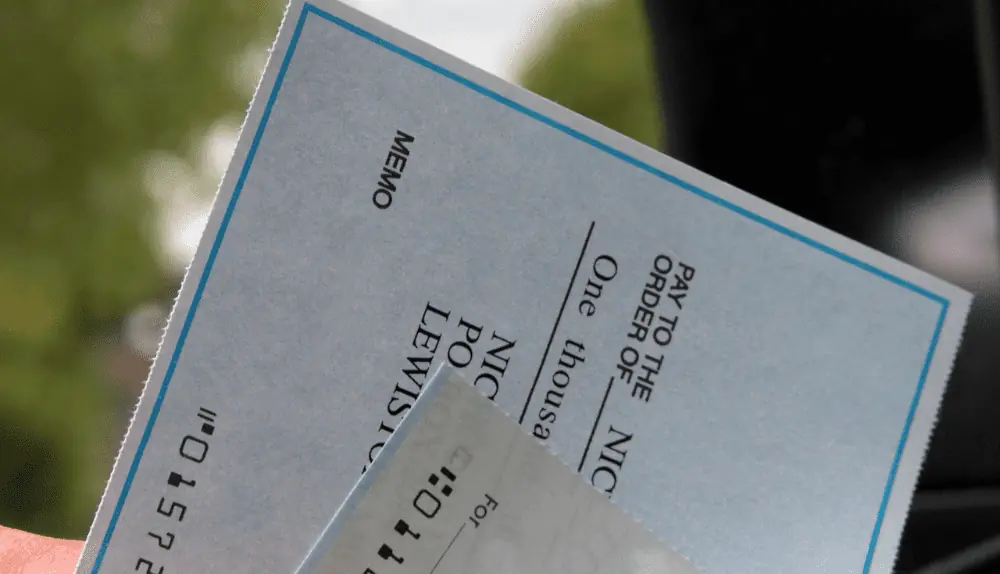

Check truncation is a process in the banking industry that converts paper checks into electronic images or substitute checks during the clearing and settlement process. Instead of physically transporting the original paper checks from the bank where they were deposited to the paying bank for clearing, electronic images of the checks are transmitted between banks.

This digital transformation allows for more efficient and secure processing and faster clearing times. The electronic image or substitute check, considered the legal equivalent of the original check, carries all the essential information, such as the payee’s name, amount, and signature.

Once the electronic image is created and transmitted, the original paper check is typically destroyed or securely stored, eliminating the need for further handling or transportation of the physical check. This streamlined process has revolutionized how banks and financial institutions manage paper checks, providing numerous benefits for businesses and consumers.

The Evolution of Check Truncation

The journey towards check truncation has been driven by the need to improve the efficiency and security of check processing in the banking industry. Let’s take a look at the key milestones and developments that have shaped the evolution of check truncation.

Traditional Check Processing

In the past, paper checks were physically transported from the bank, where they were deposited to the paying bank for clearing. This process was labor-intensive, time-consuming, and prone to errors. As the volume of checks processed each year grew, banks and financial institutions sought more efficient methods to handle these transactions.

Technological Advancements

The introduction of advanced technology provided the foundation for check truncation. High-speed scanners, image processing software, and secure data transmission methods allowed banks to create and transmit electronic images of checks, paving the way for a more efficient clearing process.

Legal Framework

In the United States, the Check Clearing for the 21st Century Act (Check 21) was passed in 2004, providing the legal framework for check truncation. This legislation allowed banks to create and transmit electronic images of checks, known as substitute checks, considered the legal equivalent of the original check. This legal recognition enabled banks to embrace check truncation without fear of non-compliance or legal challenges.

Widespread Adoption

As the benefits of check truncation became apparent, more banks and financial institutions began to adopt the process. Faster clearing times, reduced operational costs, and enhanced security made it an attractive option for the banking industry. Today, check truncation is widely used in countries such as the United States, Canada, India, and several European nations, with more countries considering its implementation.

Mobile Banking and Remote Deposit Capture

The continued advancement of technology has further streamlined the check-clearing process. The widespread adoption of mobile banking and remote deposit capture allows consumers and businesses to deposit checks by simply taking pictures with their smartphones. This eliminates the need for physical transportation of checks and further reduces the time required for clearing and settlement.

As technology continues to progress, check truncation will likely evolve to keep pace with the changing landscape of banking and financial transactions. The future of check truncation may involve more efficient cross-border check processing, improved fraud detection systems, and greater integration with other digital payment methods.

How Does the Process of Check Truncation Work?

The process of check truncation involves several steps, which enable banks and financial institutions to convert paper checks into electronic images or substitute checks for efficient clearing and settlement. Here’s a step-by-step overview of how the check truncation process works, incorporating data from the sources provided:

Check Deposit

A customer deposits a paper check at their bank, either in-person, via an ATM, or through a mobile banking app using remote deposit capture. This step remains unchanged in the check truncation process compared to traditional check processing.

Image Capture

The bank where the check is deposited (called the depositary bank) captures an image of the front and back of the check using a high-speed scanner or a smartphone camera (in the case of remote deposit capture). Capturing the check images is a crucial step in the check truncation process.

Data Extraction

Essential information from the check, such as the account number, check number, routing number, payee’s name, and the amount, is extracted from the check image using optical character recognition (OCR) or magnetic ink character recognition (MICR) technology. Data extraction is an important aspect of the check truncation process to ensure accurate and efficient processing.

Creation of Substitute Check or Electronic File

The depositary bank creates a substitute check or an electronic file containing the check image and the extracted data. A substitute check is a high-quality printout of the electronic image that bears a legend stating that it is the legal equivalent of the original check.

Transmission to Paying Bank

The depositary bank securely transmits the substitute check or electronic file to the paying bank (the bank on which the check is drawn) via a clearing house or a direct exchange between the banks. The electronic transmission of check images significantly speeds up the clearing process, reducing the time and resources required for check processing.

Check Verification and Clearing

The paying bank verifies the check details, ensures sufficient funds are in the payer’s account, and clears the check. If the check is found to be fraudulent, altered, or insufficient funds, the check is returned to the depositary bank electronically, further expediting the resolution process.

Storage or Destruction of Original Check

After the check has been processed electronically, the original paper check is either securely stored or destroyed, depending on the bank’s policies and applicable regulations. This eliminates the need for further handling or transportation of the physical check, making the process more efficient and secure.

Benefits of Check Truncation

Faster Clearing Times

One of the most significant benefits of check truncation is the reduction in clearing times for checks, as electronic images or substitute checks can be transmitted between banks more quickly than physical checks, providing businesses and consumers with faster access to their funds. Transporting physical checks between banks could take several days, delaying the availability of funds for the payee.

Reduced Operational Costs

Check truncation also leads to reduced operational costs for banks and financial institutions. The process of physically handling, transporting, and storing paper checks requires significant resources and personnel. Eliminating physical transportation and handling checks reduces costs associated with courier services, labor, and storage, allowing banks to save money and allocate resources more efficiently.

Enhanced Security

Electronic images of checks can be encrypted and transmitted securely, reducing the risk of theft or loss during transportation. Additionally, the electronic storage of check images allows banks to implement more stringent security measures, protecting sensitive customer information from potential breaches.

Environmentally Friendly

Check truncation reduces the consumption of paper, ink, and fuel associated with traditional check processing, making it a more environmentally friendly option. Furthermore, the eventual destruction or secure storage of original paper checks helps reduce paper waste, contributing to a more sustainable banking industry.

Streamlined Record-Keeping

Electronic images of checks can be easily stored, accessed, and retrieved, simplifying record-keeping and facilitating efficient auditing processes for both businesses and consumers.

Quicker Resolution of Returned Checks

If a check is found to be fraudulent, altered, or with insufficient funds, it can be returned electronically to the depositary bank, expediting the resolution process and reducing the time and resources spent on handling returned checks.

Remote Deposit Capture

Check truncation has enabled the development of remote deposit capture technology, allowing consumers and businesses to deposit checks using their smartphones, providing added convenience, and further streamlining the check-clearing process.

Cross-Border Efficiency

As more countries adopt check truncation systems, cross-border check processing may become more efficient, benefiting businesses and consumers engaged in international transactions.

Encourages Electronic Payments

The adoption of check truncation has contributed to the broader shift towards electronic payment methods, highlighting the advantages of digital transactions over paper-based methods. This shift can lead to even more efficient, secure, and cost-effective financial processes for banks, businesses, and consumers.

Drawbacks of Check Truncation

While check truncation offers numerous benefits, there are also some drawbacks and challenges to consider:

Privacy Concerns

The electronic transmission and storage of check images can raise privacy concerns for some customers. While banks are required to implement robust security measures to protect this sensitive data, the potential for breaches or unauthorized access to their personal information remains a concern for some.

Fraud and Security Risks

Although check truncation enhances security by reducing the risk of theft or loss during transportation, it also introduces new risks associated with electronic transactions. For example, criminals may attempt to manipulate check images or create counterfeit electronic checks, potentially leading to fraud. Banks must invest in advanced fraud detection and prevention technologies to combat these risks.

Initial Implementation Costs

The transition to a check truncation system may require a significant upfront investment for banks and financial institutions. This can include purchasing new equipment, such as check scanners and image processing software, employee training, and infrastructure upgrades. However, the long-term savings associated with reduced operational expenses often offset these initial costs.

Training and Adaptation

Employees at banks and financial institutions may require training to adapt to the new processes and technology involved in check truncation, which can be time-consuming and require additional resources.

Compatibility Issues

Different banks and countries may use varying technologies and standards for check truncation, which can lead to compatibility issues and hinder the efficiency of cross-border check processing.

Legal and Regulatory Challenges

The legal and regulatory frameworks surrounding check truncation may differ between countries, requiring banks to navigate complex compliance issues and adapt to different requirements when dealing with international transactions.

Reliability on Technology

The check truncation process relies heavily on technology, making it vulnerable to potential system failures, software glitches, or other technical issues that may disrupt the check-clearing process.

Final Words

Check truncation has revolutionized how banks and financial institutions handle check processing by converting paper checks into electronic images or substitute checks. This technology has led to numerous benefits, including faster clearing times, reduced operational costs, improved accuracy, enhanced security, and a more environmentally friendly banking system.

However, check truncation has drawbacks and challenges, such as initial implementation costs, privacy concerns, the potential for fraud, and reliance on technology. Despite these challenges, the overall impact of check truncation on businesses and consumers has been largely positive, streamlining the check-clearing process and offering greater convenience.

As the global financial landscape continues to evolve, with a growing shift towards electronic payment methods, businesses and consumers must adapt to these changes and take advantage of the benefits offered by technologies like check truncation. By understanding the implications of check truncation and addressing its challenges, banks, businesses, and consumers can work together to create a more efficient, secure, and sustainable financial system.