Have you ever tried to swipe, tap, or chip-read your American Express card only to receive an error message that says “sorry, American Express not accepted”? Have you ever wondered, “Is American Express accepted everywhere?” For the past few decades, Amex was not accepted at many stores, while Visa and MasterCard were welcomed. So, why is Amex not accepted everywhere? More specifically, where is Amex not accepted in the USA and internationally?

Store owners want to retain maximum profits from each sale. American Express, however, has historically been perceived to charge higher fees transactions. While each credit card company charges transaction fees, other card brands have been viewed as lower cost compared to Amex card processing charges. To maximize profits and reduce costs on card processing fees, many small businesses accept only Visa, MasterCard, and to a lesser extent Discover. While American Express has been gaining in acceptance, the perception of high fees is a major reason American Express is not accepted everywhere. This is such a widely discussed topic, there is a Reddit dedicated to the question “Is American Express accepted everywhere?”

The rates Amex charges depend on business type, the number of transactions processed annually, and the size of each transaction. The company charged significantly higher transaction fees and discount rates than Visa and MasterCard in 2017, with some businesses reporting nearly twice costs – one of the clear reasons some retailers do not accept Amex for retail, virtual or contactless payments. Of course, every retailer wants to retain maximum profits while paying the lowest possible fees to credit card companies. This is especially true for the small businesses selling products and services with thinner profit margins.

It should be noted that American Express has made gains in acceptance recently, and has offered a fee structure more in line with other card brands through the introduction of the American Express Opt Blue program. With recent changes, many cardholders may wonder when there will be an affirmative answer to the question “is American Express accepted everywhere?”

There are different types of Amex cards, each offering different benefits suitable for different individuals. These cards have varying fees, benefits and rewards structures. So, selecting the card depends on your financial situation and what you aim to achieve with your rewards. Opting for a card with a low yearly fee can save you money initially but it is important to note that these cards often provide fewer benefits and protections as well.

Benefits Of Using Amex

American Express may not be accepted everywhere. Anyhow, it remains popular with customers for many reasons. One of the advantages of having an Amex credit card is the rewards it offers. Not only can you earn points but you can also redeem those points for fantastic rewards. These rewards can be beneficial while booking flights and hotels. Sometimes you get them free. If you spend more your far more returns than what you spend on the annual fee. Although we always advice you to spend and use your credit card wisely.

As far as the merchants are concerned, American Express charge high fee. So merchants might not see it an as attractive option. Many merchants do not find using it because more people use Visa and MasterCard. Furthermore, many merchants do not find the benefits associated with American Express exiting enough. Many merchants do not find using Amex profitable.

Although, some businesses can benefit substantially if they accept Amex cards. It all depends on what type of products, price structure and clients you have. As a merchant it may still be worth considering running some calculations. Even conducting a trial period and check if there is any benefit using Amex cards.

Every American Express card comes with its set of benefits which vary depending on the specific card you choose.

A survey conducted in 2022 revealed that 70% of millennials and Gen Zers who have American Express cards stated that they planned to use their Amex cards for travel expenses during the summer.

In 2023 a majority of respondents (70%) expressed their intention to utilize credit card points as a means of saving money during their trips. This indicates that a significant number of Amex cardholders value the travel benefits associated with their cards. However, it’s worth noting that the benefits provided by Amex extend, beyond travel perks.

Different Cards Different Benefits

Platinum Card

- You can earn upto 80,000 Membership Rewards Points by spending $8,000 on purchases using the card within the first 6 months of your membership.

- 5 points per dollar for hotel bookings made via American Express Travel and 1 point per dollar for eligible purchases.

- Receive 5 Membership Rewards Points for every dollar spent on flights booked directly with airlines or, through American Express Travel (up to $500,000 per calendar year)

- Enjoy airline credit worth $200 annually.

- Access to numerous airport lounges.

Blue Cash Everyday

- No Annual fee.

- Earn 3% cash back when shopping at U.S. Supermarkets, U.S. Gas stations.

- Making purchases, in the U.S. (up to $6,000 per year in each category then 1%).

- Receive 1% cash back on all purchases. The cash back comes in the form of Reward Dollars that can be easily redeemed for statement credits.

Airline And Hotel Specific Cards

Delta SkyMiles Gold

- Save 15% on award travel through Delta airline.

Marriot Bonvoy Bevy Card

- Earn 6 Marriot Bonvoy points per dollar (only for eligible purchases) at hotels under Marriot Bonvoy

- Earn 4 points per dollar at US supermarkets as well as restaurants worldwide.

- Earn 2 points for every dollar you spend on all other types of purchases (eligible purchases only) .

How Big Is the American Express Credit Card Network?

As per a Nilson report of 2022 Amex is widely accepted in the US. 99% merchants that use credit cards to take payment also accept Amex.

Find a store near you that accepts Amex by using American Express’s Find Store And Retailers.

Source : American Express – Find A Store Or Retailer

So Is American Express Accepted Everywhere?

Although American Express (AmEx) has made progress in terms of acceptance, within the United States it is still quite common to encounter acceptance issues from merchants in different countries. This might be a problem for frequently travelers outside the US.

In the US, retailers like Costco do no accept American Express cards.

And all this comes down to one particular reason. American Express charges higher merchant fees than other cards. Other networks, especially Visa or Mastercard, charge low fee which is beneficial for merchants dealing in competitive segments or dealing with products where the profit margin is low.

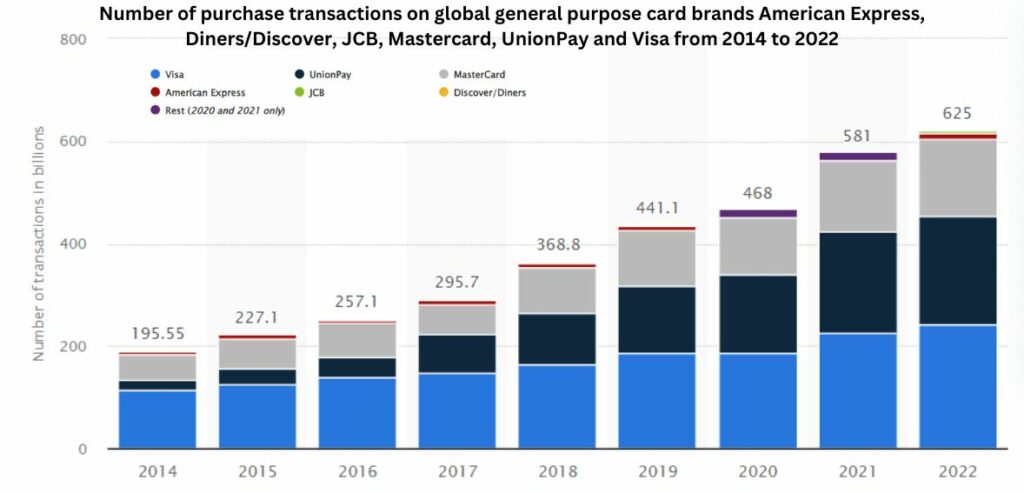

Visa credit cards top the market. Visa transaction volume share is more than 38% of the global market. MasterCard ranks second with 24%. Compared to these two giants American Express only consists of 4.61% of all the transactions globally.

So if you are a frequent travel to other countries and want to spend with your credit card on hotels and flights, then Amex is the best option.

Reason Behind Retailers No Accepting American Express?

When a merchant accepts a credit card for transaction, the merchant pays a certain percentage or amount of fee to the credit card company. As more and more people use credit cards to pay, merchants have no other choice but to accept credit cards.

When you pay with a Visa or MasterCard, the merchant is charged anywhere between 1.15% to 2.5% of the total transaction. But, for the same amount of transaction the merchant might have to pay anywhere between 1.43% to 3.3% if you use an American Express credit card.

Imaging a merchant sells thousands of small products, with very low profit margins, against credit card payments made through Amex cards, he might lose a substantial part of profit due to high fee. If they increase the price to compensate the fee, the competitors only accepting Visa and MasterCard get the edge to win.

Why Does American Express Not Lower It Fees?

American Express’s business model is different from Visa and Mastercard’s. Both these companies have substantial revenues from interest. But Amex do not have many products to generate this type of revenue. The card holders of Amex have to pay the full balance at the end of the month.

At the same time to keep up the revenue stream, American Express charge a higher annual fee that others. And therefore, most of the customers are of high income group. And this is also the reason why merchants dealing in high cost products or luxury products accept American Express credit cards.

Accepting an Amex Credit Card – How Much Does it Cost?

Credit card companies make profits through interest and annual fees charged to the customers. But that isn’t the only source of revenue for these companies. The merchant is also charged a small portion of the fee on every transaction made through the credit card. For example, every time a user swipes the Visa or Discover card at the retail POS, a 1.5% to 3.5% of the amount of the transaction goes to the credit card company.

Source: Statista – Number of purchase transactions on global general purpose card brands American Express, Diners/Discover, JCB, Mastercard, UnionPay and Visa from 2014 to 2022

As mentioned earlier, the transaction fees depend on a few factors, but historically has ranged from 2.5% to 3.5% for those using Amex cards for payments. The good news, however, is that the company has recently announced a reduction in its fee structure by 2.37% internationally,

According to a 2018 report by the Financial Times, American Express did announce it’s largest fee reduction in two decades. This announcement stated that Amex fees would decrease by five to six basis points, to an average transaction cost of 2.37%. In 2018, it was estimated that 1.3 million locations do not accept American Express compared to Visa and MasterCard, so this rate cut was designed to increase adoption.

With these recent measures, it may be unclear as to why some places do not take Amex. But despite recent efforts, the historical perception of higher fees still persists with many merchants, fueling the trend that American Express is not accepted everywhere.

How Does Fee Structure Impact Amex Acceptance?

In the past, American Express lost merchants (especially small business owners) because of high fees. They charged a higher fee because their structure is completely different from that of the Visa and Mastercard’s business model. American Express advertises a premium card brand targeted at affluent buyers.

Their sales strategy to merchants is based on that, promising an influx of well heeled buyers to encourage businesses to accept American Express. Amex acceptance does indeed bring more buyers and a higher average transaction size than other card brands, resulting in more fees but also more sales for merchants.

Despite this premium positioning, today American Express has also adjusted their rates to be more in line with other card brands and their fees are now more comparable to their competitors. As a result, Amex acceptance has greatly increased and it is now accepted in over 99% of merchants. That still leaves millions of merchants who do not accept Amex, but the American Express has made a concerted effort to take steps to increase acceptance.

While Visa and MasterCard consist of a mix of credit cards and debit cards, most Amex credit cards are charge cards with a 0% APR. While the cards must be paid off monthly, it also means customers are not charged any interest on the amount they charge. Since they company is earning less from the interest, they need to charge merchants more to maintain profits. Other credit card companies generate a major portion of their revenues from the interest income. Amex customers often use the card for perks and rewards, further necessitating fees to merchants to pay for these programs, and resulting in higher fees.

Where is American Express not Accepted?

There are a number of places that don’t accept Amex, especially very small retailers and other independent businesses due to the perception of higher fees, even if this is less of an issue in reality today. Now more than ever, merchants accept Amex at their restaurants, cafes, hotels, and other stores of all sizes. In the past, higher fees restricted which business were able to accept American Express for transactions.

Some low margin businesses still do not accept American Express in an attempt to reduce costs. In particular, wholesalers, contractors, parking meters, government payments, and independent restaurants are more likely to not accept American Express. In addition, one notable major retailer does not accept American Express – Costco. Costco previously exclusively accepted American Express, but ended their relationship with the company and stopped accepting Amex in 2016 (now they only accept Visa).

Stores selling expensive and luxurious items have usually accepted American Express. Is American Express accepted everywhere luxury goods are sold? It may seem like it. In addition, businesses that report a large number of transactions annually are likely to accept Amex cards.

The larger the business, the more payment methods it accepts. These stores are may be willing to pay a higher transaction fee if it means more customers. In the past, independent business owners and international brands did not accept American Express. Other large organizations allow Amex payments, however one exception is Costco that accepts Visa only.

Why You Should Use American Express?

Despite the fact that it has a lower acceptance rate, many people prefer to use American Express since it offers great rewards and the brand is well regarded for providing excellent customer service. Many cardholders prefer Amex because there are no interest fees on their charge card products. American Express is also famous for their Membership Rewards program, where cardholders earn points on every purchase. While this program isn’t always the most compelling card rewards program today, the perception of American Express as a leader in cardholder rewards still persists. You can redeem Membership Rewards points for free hotel stays, free flight tickets, and purchases at Amex partner companies.

For most people, the annual fee of American Express is not excessive compared to the volume of transactions they process on their Amex cards. So now is American Express accepted everywhere? In a word, no. Some merchants may still resist incorporating American Express into their payment systems, but the new pricing structure has made it much more attractive. For other businesses, accepting Amex cards is a must. Businesses that sell luxury items, cater to high end customers, or process a high volume of transactions annually generally see the value and choose to accept American Express credit and charge cards.

Where Is Amex Not Accepted In USA. What To Do If A Store Doesn’t Accept American Express Credit Card?

Even though American Express has taken measures to improve its services and lower its fees, chances are you may run into a store that does not accept Amex payments. If you have wondered “is American Express accepted everywhere,” it is better to ask ahead, especially if you are making a big purchase. Ask the company whether they accept Amex cards to make your shopping easier and hassle-free.

This is especially important for customers who only carry an American Express card. Whether you are going grocery shopping or buying the latest fashions, ask about the payment methods the retailer accepts so you can plan your shopping accordingly.

In addition, you should carry a backup card if possible, although that is becoming less necessary with rising American Express acceptance rates. Visa and MasterCard are good options since they still have the highest acceptance rates of all card brands. The best thing you can do is research the retailers that accept American Express before heading out for shopping. You could also try American Express Virtual Credit Card for online purchases and services. The card is accepted by Netflix, Amazon Prime, and other subscription-based services.

How Can Your Business Accept American Express?

Maybe you have been frustrated trying to use your American Express card only to be rebuffed by an establishment you are trying to patronize. Or possibly you’re a merchant who has held out due to the perception of higher fees, but is now considering accepting Amex as a way to attract more customers. If your favorite business does’t yet accept the American Express card, suggest they talk to a specialist at Host Merchant Services who can introduce them to new the new Opt Blue and help their business add Amex acceptance without hurting their bottom line.

If you’re a merchant on the fence, the time is now to accept all cards because the fees for accepting American Express are now in line with other card brands like Visa, MasterCard, and Discover. If you’re paying higher merchant fees with another provider, we can confidently add American Express processing and lower your overall costs by reducing the mark-up on your processing. Call us or chat with us today to connect with a specialist. If you prefer, you can also use our online form to start getting better service and lower rates for credit card processing, point of sale, and more.