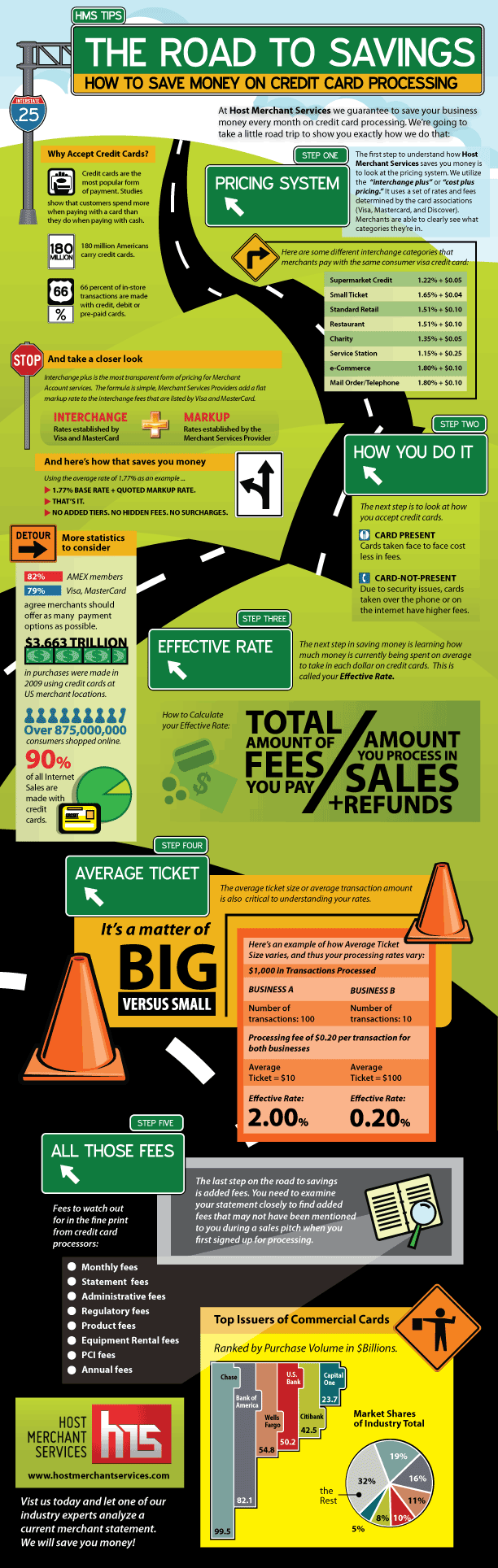

Host Merchant Services is able to guarantee its customers savings and the lowest rates possible. Take a trip with us on the road to savings and learn how you can save money on your credit card processing fees:

Frequently Asked Questions

Why is saving money important?

Saving money is important for several reasons. It provides financial security and a safety net for unexpected expenses or emergencies. Saving also allows individuals to achieve their long-term goals, such as buying a house, starting a business, or retiring comfortably. It helps to avoid excessive debt and interest payments and provides peace of mind and freedom from financial stress. By saving, individuals can build wealth over time and have the means to pursue opportunities or weather financial downturns.

How can I start saving money if I don't have much to spare?

Starting to save money, even with limited funds, is still possible. The key is to establish a budget and identify areas where expenses can be reduced. Small changes like cutting back on discretionary spending, finding cheaper alternatives, or negotiating better deals can free up some funds to put towards savings. It's also important to prioritize saving by setting specific savings goals and automating regular contributions to a separate savings account. Over time, these small savings can add up and create a solid financial foundation.

What are some effective strategies for saving money?

There are several effective strategies for saving money. One approach is the “pay yourself first” method, where a portion of each paycheck is automatically deposited into a savings account before spending on other expenses. Another strategy is the envelope system, where money is allocated into different envelopes for specific purposes, such as bills, groceries, and savings. Cutting back on non-essential expenses, negotiating better deals on regular bills, and avoiding impulsive purchases are also effective ways to save money.

How can I stay motivated to save money?

Staying motivated to save money can be challenging, but there are ways to keep yourself on track. Setting specific savings goals can provide a sense of purpose and motivation. Breaking down larger goals into smaller, achievable milestones can make the process more manageable and rewarding. Celebrating milestones along the way can also help to maintain motivation. Finding an accountability partner, such as a friend or family member, can provide support and encouragement. Additionally, regularly reviewing your progress and visualizing the benefits of saving can reinforce your motivation.

How can I make saving money a habit?

To make saving money a habit, it's important to integrate it into your daily routine. Automating savings contributions can make it easier to stick to the habit consistently. Creating reminders or using budgeting apps can help keep saving top of mind. Surrounding yourself with a community or online groups that share similar financial goals can provide inspiration and accountability. Rewarding yourself occasionally for meeting savings targets can also reinforce the habit. With consistent effort, saving money can become a natural and ingrained part of your financial routine.