If you’re a frequent shopper on T.J.Maxx or its affiliated stores like HomeGoods, Sierra, or Marshalls, you may be curious about whether the T J Maxx Credit Card is worth considering. The card is often promoted in-store and on their website, so it’s natural to wonder if it offers good value.

You get rewards for shopping at your favorite stores, so why not? Before you apply for this credit card, you should understand its specifications and features. There are two options available with TJ Maxx cards – the Rewards MasterCard (Platinum) that you can use anywhere and the Rewards cards specifically for in-store purchases.

Before you apply for this credit card, here’s everything you must know.

What is the T J Maxx Credit Card?

T J Maxx is a known retailer that offers discounted clothing items across the United States. They have their brand of stores as well as partner labels. Among all the store credit cards in the market, the T J Maxx Credit Card, also known as the TJX Rewards credit card, is the better option.

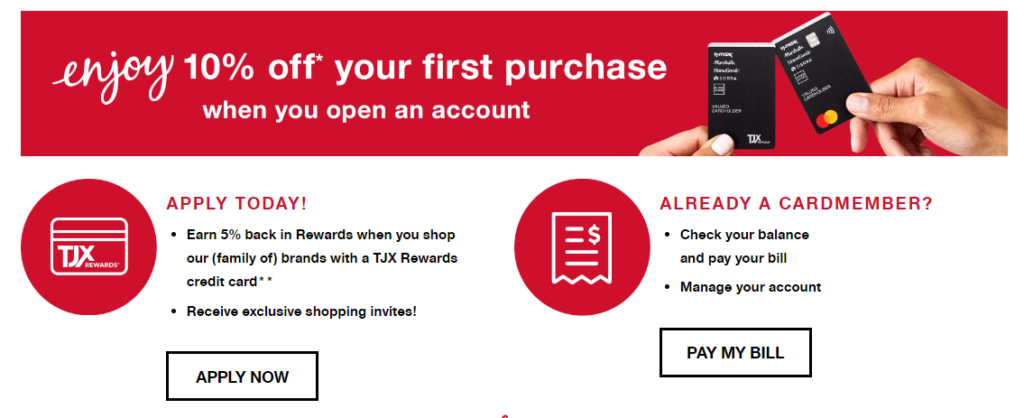

The TJ Maxx Cards, by Synchrony Bank, is a MasterCard that provides an opportunity to earn rewards. While you use this card for purchases at any of the T.J.Maxx family of stores, you can earn 5% back in rewards. Additionally, after you open your account with this card, you’ll receive a 10% discount on your purchase.

There are two versions of the TJX Cards;

- 1. TJX Rewards: This card is exclusively for use at their stores and affiliated locations. It does not bear any payment network logo like Mastercard or Visa.

- 2. TJ Platinum Mastercard Rewards: This card differs from the in-store version as it is linked to Mastercard, allowing you to use it not only at T.J.Maxx but at any other store that accepts Mastercard payments. This feature makes it a flexible choice for customers.

How TJ Maxx Cards Work?

The TJX rewards credit cards work on a simple points system. Whenever you shop at TJ Maxx, HomeGoods, Marshalls, HomeSense, or Sierra and spend a dollar, you earn five points. To get started with the card, you’ll need to create an account first with TJ Maxx. Once your card is linked to this account, you’ll start earning Rewards Certificates when you reach purchase milestones. These rewards will be available to use in under 48 hours from your transaction.

When it comes to using your Rewards Certificates, you have two options: Have them automatically redeemed during checkout or manually enter the CSC of the Certificates you wish to use. As a welcome bonus, once your application is approved, you’ll receive a 10% discount on your purchase. It’s worth noting that this discount only applies if you’ve applied for the credit card online and are making transactions on the TJ Maxx website.

Apart from this welcoming perk, there are benefits associated with the card as well. These include access to discounts, exclusive events, and markdowns on selected items. You’ll be notified about these perks through invitations sent specifically for shopping purposes.

Where can you use It?

You can use the T.J. Maxx credit card anywhere they accept Mastercard. You’ll get the most rewards if you use it at T.J. Maxx branded stores, though. You can buy anything at the TJX stores and earn higher rewards than anywhere else.

What Rewards does the T.J. Maxx Credit Card Offer?

With TJ Maxx, you get incredible discounts and rewards at popular retailers like TJ Maxx, Marshall’s, HomeGoods, Sierra, and Homesense with the TJX Rewards Platinum Mastercard. Experience the perks of being a cardholder and enjoy exclusive benefits from these beloved stores, all under the TJX parent company.

As a new cardholder, you can take advantage of a special offer – enjoy 10% off your first purchase when you approve the card. This adds a bonus to your shopping experience. Plus, this card has no annual fee or foreign transaction fees, making it even more appealing. (Terms and conditions apply).

Earn rewards effortlessly as you shop – 5% back in rewards on eligible purchases within TJX stores and 1% back on purchases beyond the TJX, excluding returned orders, gift cards, and cash advances. You can amass points for both in-store and online transactions, paving the way for more rewarding shopping adventures.

Furthermore, for every 1,000 points you accumulate, you’ll receive a $10 rewards certificate, valid at any of the five TJX brands. Just keep in mind that these certificates have a validity period of two years and can only be issued in increments of $10 or $20. Although, for example, the estimated rewards might amount to $395.03, the redemption system allows you to cash out with a value of $390, giving a boost to your savings and shopping skills.

Make sure you stay well informed about the card’s specifics, including the APR of 31.74% and the basic benefits that come with being a Platinum card holder. Don’t miss out on this chance to enhance your shopping experience with the TJX Rewards Platinum Mastercard.

What are T.J. Maxx Rewards?

T.J. Maxx rewards are certificates you can use at any T.J. Maxx, HomeGoods, Sierra, or Marshalls. You can use them like a coupon or gift certificate toward your purchase. For example, if you have a $10 certificate and your total is $20, you’d only pay $10 out of pocket using your certificate.

How do you Redeem your Rewards?

You must earn 1,000 points to redeem them for a $10 T.J. Maxx reward. 1,000 points is equal to $1,000 in ‘regular’ purchases or $200 in purchases at T.J. Maxx or one of its affiliates. You can see how much more beneficial it is to use the card at T.J. Maxx versus anywhere else.

Is there a Bonus Offer?

Many rewards credit cards offer enticing bonus offers, such as a $150 statement credit if you spend $1,000 within the first 90 days. However, the TJ Maxx card takes a unique approach. Rather than a traditional bonus offer, it provides customers with a 10% discount on their initial in-store or online purchase at any of the TJX stores.

When you spend $200, you’ll receive a $20 discount on your order. At the same time, this may not seem like a substantial benefit compared to the typical sign-up bonuses offered by reward credit cards.

Pros and Cons of the T.J. Maxx Credit Card

It’s always important to weigh the pros and cons of any credit card before you apply for it. Here are the good and bad about the T.J. Maxx credit card.

Pros Of TJ Maxx Credit Card

If you shop at T.J. Maxx and its affiliate stores, you can get a $10 reward for every $200 you spend

You can earn points shopping anywhere else at a rate of a $10 reward for every $1,000 you spend

T.J. Maxx credit cardholders get access to exclusive deals and sales

Your T.J. Maxx rewards points never expire

The T.J. Maxx certificates are good for 2 years

You can use your reward certificates online or in-store

Cons Of TJ Maxx Credit Card

You can only use your welcome bonus at the store you applied for the card at if you shop online, but you can use it at any TJX store in person

Most reward credit cards pay much more than 1 point per $1 spent

The card carries a high APR compared to other cards

Who Should use the T.J. Maxx Credit Card?

If you’re a T.J. Maxx fanatic, then the T.J. Maxx credit card makes sense. If you shop there often and will use the rewards, it can be a great secondary rewards credit card.

No one should use it as their primary rewards credit card, though. Many other credit cards offer much higher rewards for general purchases, and some even pay higher rewards for restaurant, grocery, and gas purchases.

It doesn’t hurt to have the T.J. Maxx card in your wallet, reserving it for when you shop at T.J. Maxx stores but don’t use it for general purchases if you have access to a higher paying rewards credit card.

How To Apply For The TJ Maxx Card?

You are able to apply for TJ Maxx cards online or in-store at any of the stores. Just tell the cashier you want to apply for the card, and they’ll walk you through the steps. It takes only a few minutes to apply. Everyone can access and manage their account online, but you can also choose to receive paper statements if you prefer.

![]() For online T J Maxx Credit Card visit here

For online T J Maxx Credit Card visit here

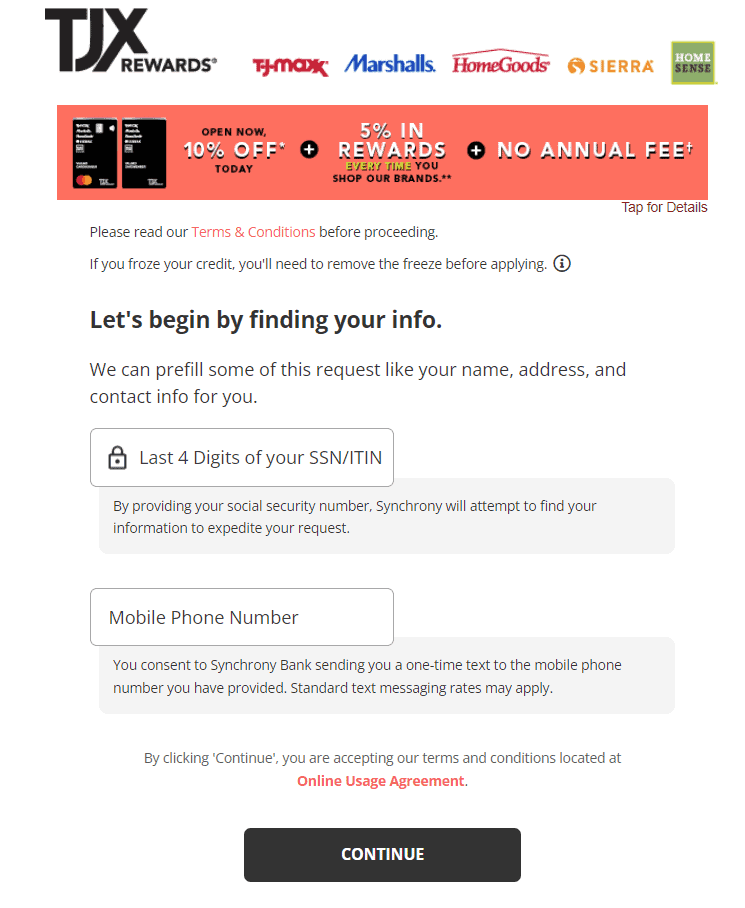

Registering your account for the TJX Rewards cards is a simple process. Here’s a step-by-step process:

- Visit Synchrony Bank’s online account registration page designed for the TJX Rewards cards.

- Enter your credit card account number and the corresponding billing ZIP code.

- Click on the “Continue” button.

- Follow the on-screen instructions to complete the registration.

How To Get Your TJ Maxx Rewards?

Redeeming your TJX Rewards is a straightforward process that offers you Reward Certificates. These certificates work as vouchers, making them perfect for those who frequently shop at TJX but may not be as valuable for others. Here’s what you need to know:

- You can find your Reward Certificates via the portal of Synchrony Bank or choose to enroll in the statements online to receive your rewards through email.

- These certificates are used both in-store and online to lower your total price at checkout. However, they cannot be enforced toward the statement balance and cannot be used for purchasing gift cards.

- Any remaining amount of the Reward Certificate will stay valid or may be issued to you as store credit for future purchases.

- It’s essential to note that these certificates expire two years after the certificate is issued. Keeping an eye on your account regularly can help ensure you don’t miss out on using your rewards. Notably, points themselves do not expire, which is beneficial for occasional shoppers, giving them more time to accumulate points.

Conclusion

Is the T.J. Maxx credit card worth it?

It depends on where you like to shop. If you frequent the TJX stores in person or online, then it’s a great way to earn money back toward your purchases fast. If you don’t, though, you won’t earn rewards fast and even if you do, the rewards are only redeemable at TJX stores.

The T.J. Maxx rewards credit card is a great option to have in your wallet for when you shop there because why not get the points, right? But don’t forgo it for another credit card that may pay higher rewards for general purchases.