What Is Splitit Payments?

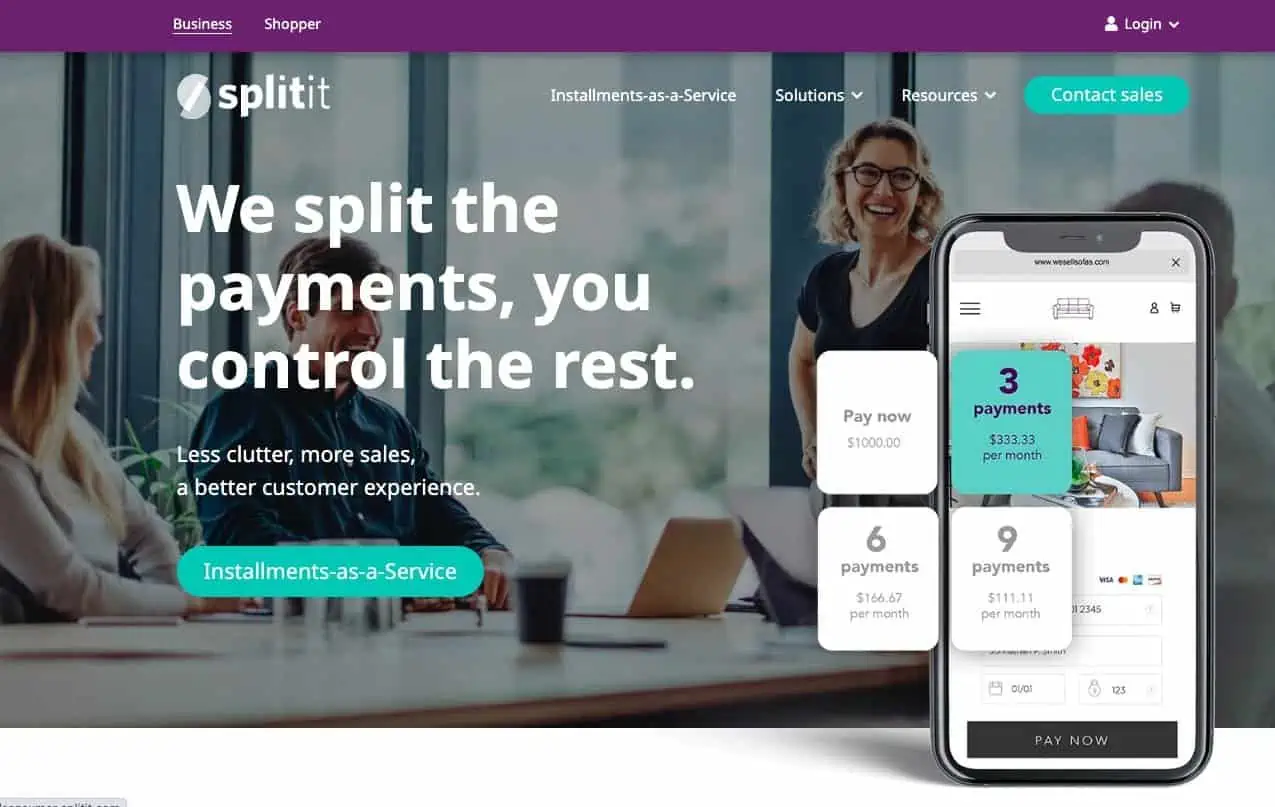

Splitit Payments is a solution that allows consumers to pay for their purchases in installments, with no interest or fees added. Splitit provides an easy way to manage monthly payments with flexible plans and secure platforms for both online and in-store payments.

This review will examine the features, benefits, and drawbacks of Splitit Payment’s services.

This review will explain what makes Splitit Payments stand out from other payment platforms and how customers can benefit from this innovative checkout solution. We’ll also discuss Splitit’s fees, customer support, and more so you can decide if it’s right for your business. At the end of this review, you’ll have all the information required to determine whether Splitit is the best choice for your needs. So let’s jump right into it!

How to Use Splitit

Splitit Payments allows customers to split the purchase cost over several months without having to pay any interest or fees.

- To use Splitit, customers must select the installment option at checkout and follow the instructions.

- After that, enter their credit or debit card information into the system. Once this information has been entered and approved, customers can divide their purchases into flexible monthly payments over a period without any added interest or fees.

- The payments will be securely processed on the customer’s existing credit account. They can be easily managed from the customer’s online dashboard after logging in with credentials which means that Splitit will automatically deduct each installment from the customer’s account until the total cost of the purchase has been paid off.

Key Features of Splitit

Splitit is a new payment solution that allows users to pay for large purchases over time with no interest or additional fees. This review will outline all the key features of Splitit, so you can decide whether it’s the right payment solution for you.

- For starters, Splitit payments offer an interest-free installment plan that can span up to 36 months, depending on the retailer’s discretion. There are no hidden costs or fees involved in using the service, making it an attractive option for those who want to spread out their payments without worrying about additional burdens.

- Splitit works by dividing payments into smaller installments over time. You don’t have to apply for a new loan or sign up for an account; select Splitit as your payment method at checkout, and you’re ready to go. Plus, you won’t be charged any interest on your purchase, as Splitit only charges late fees if payments fall behind schedule. If you want to make larger purchases without breaking the bank, Splitit is worth considering.

- One of the key features that sets Splitit apart from other payment options is its compatibility with major credit cards such as Visa, Mastercard, American Express, and Discover. Customers can use Splitit with their existing card to pay for larger purchases over time without incurring interest or fees. The platform also supports international transactions and provides an easy way for customers to manage recurring payments online.

- Splitit’s key features include zero interest, no hidden fees, and an easy-to-use checkout process that makes shopping more user-friendly. Businesses can decide how many installments they want their customers to pay over what time, giving them the flexibility they need when setting up payment plans for their products or services.

Pros & Cons of Splitit

The convenience of using Splitit to make purchases makes it a popular choice for many shoppers, but there are pros and cons when deciding if this is the correct payment method.

Pros:

- Quick and Easy to Use

It’s straightforward to use; users select the item they wish to purchase, enter their details on the checkout page and then select Splitit as their payment method. The quick setup process allows customers to enter their credit card information quickly and begin using the service immediately. Once registered, users can shop online with Splitit’s participating merchants.

- No Interest Payments

One of the main benefits of Splitit is that there are no interest payments involved. Customers can spread payments over an extended period at no extra cost if they make them on time. Not only does this eliminate potentially high-interest charges associated with other installment plans, but it also ensures that your monthly payments remain affordable.

- No Hidden Fees

There are no hidden fees associated with Splitit Payments. Customers do not have to worry about being charged additional costs on top of the purchase price they agreed upon before completing their purchase.

- No Credit Checks

The most apparent benefit of Splitit Payments is that it allows customers to purchase items with no credit checks. This makes it an ideal option for those with limited or bad credit, as they can still make their desired purchases without worrying about being rejected due to their financial situation. Additionally, since there’s no need for a credit check, customers can enjoy faster checkout times when using Splitit payments.

- Security and Safety Feature

One of the most significant benefits of using Splitit is its enhanced security and safety features. The company utilizes advanced encryption technology to protect credit card details, ensuring that all data remains secure throughout each transaction. Furthermore, Splitit’s fraud protection system monitors every stage of the checkout process. It automatically flags any suspicious activity to provide buyers with total peace of mind when they use their service.

- Customer Service

Splitit Payments offers 24 hr customer service so customers can get help when needed. This gives users the peace of mind of knowing that if they have any questions or issues, they can receive assistance at any time of day without waiting on hold or having to make a call during business hours.

Cons:

- Splitit payments require customers to have a credit card to use them. This means those without access to a credit card cannot take advantage of splitit payments.

- Some customers may need clarification on signing up and making their first payment, which could prevent them from using this payment system.

FAQs

Q. How Do I Create a Splitit Payment Account?

First, you’ll want to visit the official website at splitit.com and click the “Sign Up” button at the top of the page. You can create your account with your name, address, and phone number. You will then be asked to verify your identity by providing additional information, such as a valid photo ID or passport number. Once this step is complete, you’re ready to start using your new Splitit account!

Q. Why Should I Use Splitit Payments?

So why should I use Splitit Payments? Well, not only does it provide an affordable way to pay for your goods and services without having to worry about high-interest rates but it also offers an easy payment process – all you have to do is choose how many installments you want and when they are due.

Q. What Are the Eligibility Criteria for Splitit Payments?

A customer must have a valid credit card. The card must also be issued by a major credit provider such as Visa or Mastercard. Additionally, the customer must be 18 years or older and have a valid email address to create an account with Splitit.

Q. Does Using Splitit Affect Your Credit Score?

The short answer is no. Using Splitit will not affect your credit score. That’s because when you use Splitit, the transaction takes place between you and the merchant rather than between you and a lender. The credit bureaus don’t track this transaction, so that it won’t appear in your reports. This means that while it won’t help build up a good credit history either, it won’t hurt it either by appearing negative on any reports or scores.

Q. What Are the Different Types of Splitit Payments?

Splitit offers three payment options: purchase-based installment payments, subscription-based installment plans, and interest-free loan options. With purchase-based split payments, customers can divide their total purchase amount into multiple installments over time. Subscription-based installment plans allow customers to make recurring monthly payments for a set period of time. Interest-free loan options are available for larger purchases where the customer pays back the total amount over time.

Q. Are Splitit Payments Safe?

Splitit uses advanced encryption technology to protect customer data from fraud or identity theft. This means that your personal information is completely secure when you use Splitit. Furthermore, the company has fraud prevention measures to ensure your financial details remain private and secure while making purchases online.

Conclusion: Smart Payment Option

Splitit Payments is an excellent solution for those looking to pay in installments without paying interest. It’s easy to use, secure, and consumer friendly. Compared to other payment solutions, the fees are low, and customers won’t have to worry about hidden or additional fees. The integration process is easy and quick, so businesses can start offering Splitit payments immediately without any hassle or delay.