You might have heard that flat-rate credit card processing is the best option for handling cashless transactions for your small business. However, having an account with a payment processor might be more expensive than most business owners anticipate because credit card processing is also a tricky and complicated subject.

This article will detail everything you need to know about flat rate credit card processing and how it differs from other available subscription models on the market.

What is Flat Rate Credit Card Processing?

Today’s credit card-driven economy has seen a rise in the use of flat rate credit card processing. This pricing structure, also known as flat-rate merchant processing, charges a specified percentage, or rate, based on the volume of credit cards you accept, which contrasts with Interchange Plus pricing, where you pay a separate price for each transaction.

When new businesses seek an entry-level solution, flat rate credit card processing is usually the first choice. Without a merchant account, aggregators like Stripe, Paypal, and Square provide flat-rate processing. Going with an aggregator may be their only option since many new or small businesses cannot meet the underwriting standards for a merchant account.

Flat-rate processing is still an option for companies eligible for merchant accounts. They could favor paying a flat rate because of its ease and security.

How Flat Rate Credit Card Processing Services Works

To comprehend flat-rate credit card processing, you need to be familiar with a few aspects of credit card transactions. The following are the costs associated with processing credit cards:

- An interchange fee

- An assessment fee

- A markup

Interchange Fee

Interchange fees, which credit card issuers collect, account for the most significant portion of the cost of credit card processing. These fees are widely recognized as a certain percentage plus an extra fixed sum. Several factors, including the credit card network (such as Mastercard or Visa), how the payment is handled, whether the card is a debit or credit card, and the merchant category code, all significantly impact interchange fees.

Assessment Fee For Flat Rate Credit Card Processing

You pay the assessment fee directly to the card network, which is a significantly lower credit card processing price. Due to the specific nature of a transaction, additional fees, including foreign transaction fees, may apply. In addition, various factors that vary from network to network will affect these fees. When using a credit card instead of a debit card, certain networks would charge higher rates, while others might do the same if there are more transactions.

Markup

Markup is a fee that varies from one flat rate credit card processor to the next and is paid to the merchant service provider. No matter your processor’s pricing structure, you will always have to pay something, even if you have no idea what it will be.

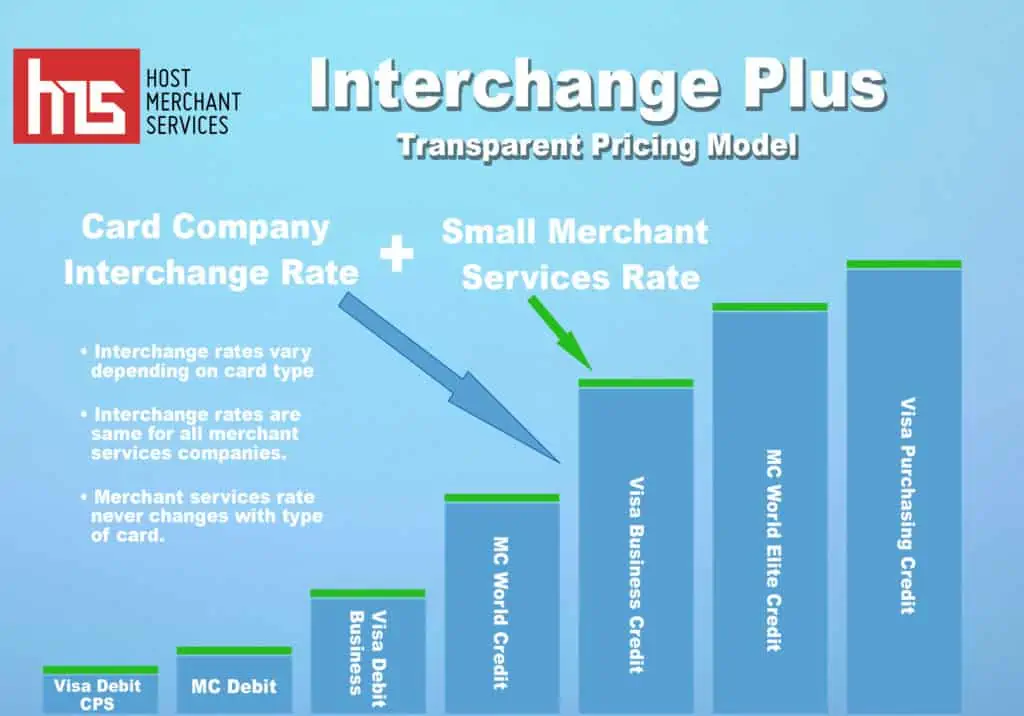

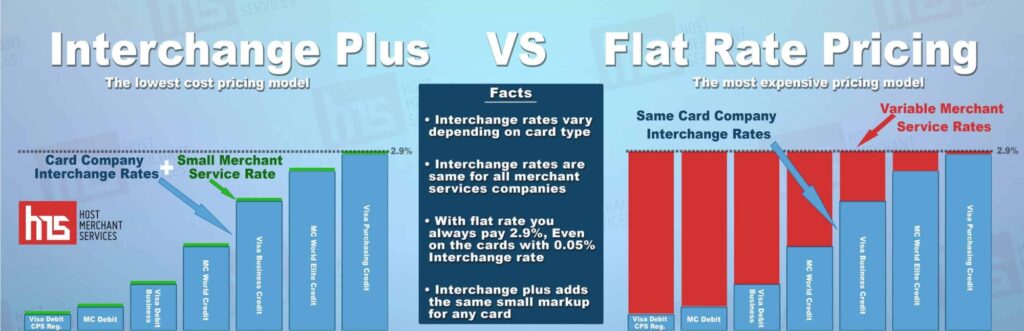

Flat Rate vs. Interchange Plus

Every credit card transaction is subject to interchange. It is how credit card companies make the majority of their revenue. The credit card company levies an interchange fee for each swipe or insertion of a card into a terminal. A model with interchange plus has two components: The “interchange” is determined by the credit card networks, and the “plus” is the markup fee your processor levies.

Any flat rate credit card processing pricing plan includes interchange fees as part of the standard 2.75% to 2.90% price. However, the interchange fee‘s set rate for various card brands and types differs. Flat-rate credit card processing has grown in popularity because of this.

For instance, the interchange fee for a debit card typically ranges between 0.005% and 2.00% for every transaction, while it is often around 0.005% for a credit card. A modest amount, typically less than 0.5%, or roughly 20 cents per transaction, is added on top of the interchange fee. The credit card company determines these rates.

An interchange-plus strategy may appear to cost more than flat-rate processing at first glance. However, paying per transaction rather than all at once might be a better option if you process many cards.

Other Processing Pricing Models

Fees from payment processors are added to those from the credit card network. In general, processors impose fees using one of the below-discussed pricing models.

Tiered Pricing

In the United States, tier pricing is the most prevalent pricing model. With tiered pricing, the rate model is split into tiers, typically with a lower-priced tier known as “qualified” and higher-priced tiers known as “non-qualified” or “mid.” The low qualifying rate is a standard draw for merchants. However, most transactions fall into higher categories, making it only apply to a small number of transactions.

However, businesses need to be aware of the possible drawbacks. One drawback is that your lower qualified rate might only apply to a specific card or transaction type. You may be responsible for paying the higher fees if your clients use cards or make transactions that aren’t covered.

Membership/Subscription Pricing

Every transaction is subject to a monthly fee under membership or subscription pricing. The overall costs may be cheaper because the processor does not include a fixed percentage fee in this pricing structure.

While the fees might be lower, many criteria, such as the volume of business and the number of transactions, determine whether or not they are. You will still pay the membership fee even if the processor doesn’t receive a predetermined markup from you. As a result, you’ll need to do the math to determine whether this pricing structure benefits you.

What Are the Pros of Flat Rate Credit Card Processing?

The easiest pricing model to grasp is flat-rate processing. Every card swipe incurs a flat fee, and this pricing model offers several benefits.

Simple Statement Processing

Your monthly processing statements are one aspect of flat-rate processing that is made simpler. For instance, businesses that use interchange-plus pricing can send lengthy bills with various fees based on the interchange rate for each transaction.

With flat-rate processing, the tricky math involved in figuring out interchange fees is eliminated, and you know precisely how much you’ll be spending for each transaction.

No Monthly Charges

Most businesses with a flat processing fee don’t send monthly service invoices. Due to irregular credit card transactions, small businesses may find this extremely welcome news.

It’s possible that the core of your company’s strategy is to close a significant deal every few months. When you don’t even use the service monthly, paying a monthly processing fee makes no sense.

Seasonal businesses also experience this. A year-long contract is typically required of merchants by businesses that don’t offer flat-rate credit card processing. So seasonal businesses would ultimately have to pay for processing during the off-season.

Transparent Pricing

Speaking of knowing exactly what you’ll be paying, flat-rate processing also tends to combine your expenses into one simple charge. Other processing businesses could tack on extra fees, such as compliance fees, or charge more for using their point-of-sale system.

However, some businesses are skilled at consolidating numerous features and services into a single processing rate.

What Are the Cons of Flat Rate Credit Card Processing?

Although flat-rate processing often makes sense, there are some drawbacks to consider when researching flat-rate service providers.

More Expensive

Compared to interchange-plus processing fees, flat-rate processing fees are typically more expensive because interchange-plus pricing typically results in lower transaction costs overall.

Any item, regardless of weight, would be subject to a flat rate processing fee. However, interchange-plus pricing is comparable to buying something based on its weight. When a credit card is processed, hundreds of interchange fees may be charged, and the weight in this example symbolizes those fees.

The pricing threshold that will generate a profit even if every transaction utilizes the highest interchange rate is determined by processing businesses to establish flat rates, which implies that businesses that use flat-rate processing will ultimately pay more for transactions with lower interchange rates.

Not Suitable for Routine, High-Volume Processing

Since flat-rate processing costs more per transaction than interchange-plus pricing, the more volume you sell will result in higher flat-rate processing premium costs.

Although this downside might appear to raise the cost of flat-rate processing, most companies that use interchange-plus pricing likewise charge a monthly fee. As a result, to adopt an interchange-plus model and save money, your company must process at a regular and respectably high monthly volume.

Therefore, flat-rate processing is probably more expensive for your company than interchange-plus pricing if your organization does make consistent monthly transactions.

Lack of Custom Pricing

The absence of personalized pricing is another factor that could increase the price of flat-rate processing. As their merchants process higher amounts of transactions, many processing firms that employ the interchange-plus pricing model will offer lower processing rates. Consequently, these rates can significantly affect costs as the business expands.

Costs of Flat Rate Credit Card Processing

You might be curious about how much you will pay for flat-rate credit card processing, including the interchange fee, assessment, and markup.

Flat rate credit card processing typically costs between 20 to 30 cents or 2.75% to 2.90% per transaction. And the interchange fee is incorporated into the flat rate to simplify the price structure. Although this pricing model simplifies costs and makes them easier to grasp, it usually costs more than other models.

Calculating your costs is not too difficult when using flat rates. Simply multiply your gross sales by the processor’s rate to get the pricing for credit card volume.

Can You Save Some Money with Flat Rate Processing?

Yes, in some cases. Flat-rate processing will probably result in financial savings if you process irregularly or in low volumes.

Additionally, utilizing flat-rate credit card processing with point-of-sale features could result in cost savings. This is only possible if you require point-of-sale features and the providers you’ve researched also charge extra for those features.

However, businesses that consistently generate more monthly revenue than their processing provider charges would benefit financially from interchange-plus pricing.

What is the Cheapest Method of Processing Credit Cards?

This largely depends on the nature of your business. Flat-rate processing will likely be the least expensive for you if you’re starting and don’t handle many monthly transactions.

In reality, a flat-rate pricing structure can be an effective method to learn about processing and increase your sales volume for companies searching for their very first processing solution. You can switch to an interchange-plus pricing model once you’ve generated a respectable amount of sales because there is no contract, so you won’t have to pay a cancellation fee.

Who Benefits More from Flat Rate Pricing?

The short answer is that small and new businesses that don’t handle many monthly transactions and don’t want to be burdened by extra account fees benefit the most from flat-rate pricing. Flat-rate pricing makes it simple to accept credit and debit cards without the obligation and charges of a full-service merchant account, whether you’re starting out or your business is a side hustle that isn’t expected to grow considerably over the years.

Yes, the cost of processing credit cards is higher for each transaction. However, you won’t be bound to a lengthy agreement or be required to pay all the extra costs usually associated with a legitimate merchant account. Through the elimination of most, if not all, of these extra costs, flat-rate pricing can help you save money overall. When the moment is right, switching to a full-service merchant account is simple and uncomplicated due to the absence of a long-term contract.

Is Flat Rate Credit Card Processing Right for You?

Let’s break down this pricing structure so you can decide if it suits you. There are two pricing options for flat fee credit card processing: flat rate percentage pricing and flat rate subscription fees. As previously discussed, flat rate processing can also be an appealing choice for new businesses that don’t meet the requirements for a merchant account because it has a low entrance barrier.

However, merchants ultimately pay more because all transactions are combined into a single cost under flat-rate pricing. Additionally, since flat fee payments don’t disclose detailed information on your bill, businesses may find it challenging to keep track of the preferred payment methods your customers use, such as gift cards, credit cards, and debit cards.

Flat rate processing is simple to understand and has predictable costs. Just keep in mind that flat-rate processing is not without cost. It’s crucial to pick the best pricing structure.

Determining Your Alternatives – Flat rate credit card processor

The flat-rate credit card processing model is popular among business owners because it is easy and convenient. However, this payment processing model could be expensive if you process any credit card transactions. In this scenario, you will typically have to pay more than the specified interchange cost.

You know that the interchange rate is constant irrespective of the payment processor. However, the payment processor may not always be transparent about the interchange cost if you select flat rate processing. This is because they are paying it on the merchant’s behalf. When it comes to credit card processing, there is not much regulation; thus, this price might be increased. You would have to check the interchange fees to determine whether there was “padding” or an additional expense.

The possibility that you will pay the fee at cost exists even though you do not pay interchange directly. The processor is free to impose any percentage fee and keep any excess revenue earned as compensation for the convenience of the service.

If you’re unsure whether the flat rate processing option is the best fit for you and the type of business you run, here are two more options that can provide you with the best processing rate possible.

- Interchange Plus: Some businesses refer to this option as pass-through pricing (also known as interchange pass-through). This particular payment processing model contains a minimal additional markup in addition to the fundamental interchange fee. Its key advantage is that the interchange portion of the costs and the markup are clearly distinguished.

- Cash Discounting: This is primarily utilized in businesses that produce expensive goods, like the piano or auto industries. The cost of accepting cards is passed on to cardholders by merchants under this program. To inform all prospective customers that paying with credit cards will result in additional service charges (roughly 4%), the merchant will place a notice in front of the desk and in front of the store to that effect.

Final Thoughts

Whatever flat-rate credit card processing option you use, know that convenience isn’t cheap. Due diligence is required in light of this. Select the most appropriate pricing model that focuses on the demands of your business, the kind of transactions you often handle, and other factors.

Understanding what you need will enable you to weigh the costs and rewards of the providers you are considering and ultimately help you can identify the ideal provider for your business.