Introduction

Marcus Invest is a dedicated robo-advisor platform that is part of Marcus by Goldman Sachs. It offers users a convenient and straightforward way to make diversified investments in ETFs or exchange-traded funds.

Whether it’s automated investing, diversified portfolios, tax-loss harvesting, or low fees, Marcus Invest stands out. Marcus Invest is a cost-effective, robust, and automated investment solution that is an attractive option for both beginner and experienced investors to build their wealth.

In this review of Marcus Invest, you’ll learn about Marcus Invest fundamentals, how it works, its pros and cons, and how it compares to other robo-advisor solutions.

Mechanics of Marcus Invest

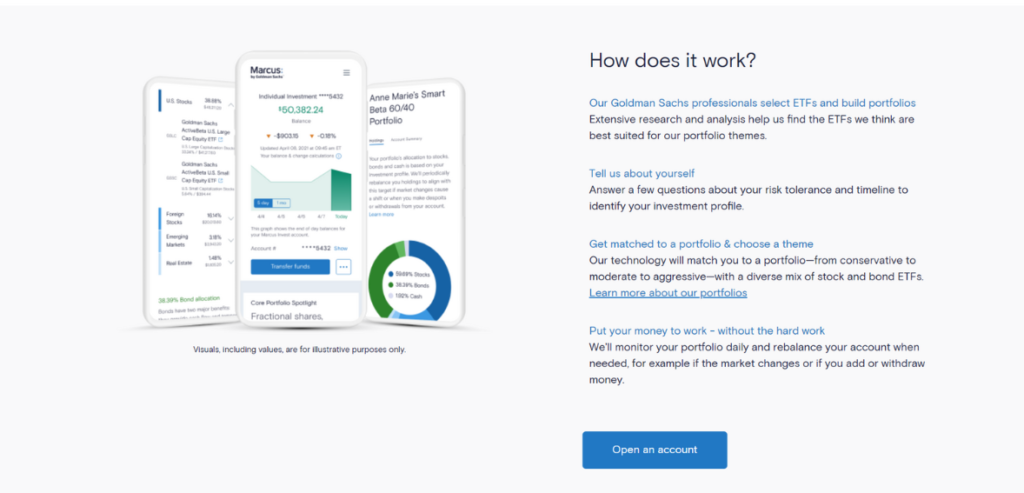

Marcus Invest works like modern-day robo-advisors. It attracts new users through an introductory questionnaire, which helps determine what type of account each user needs and how they see their future investments.

The same introductory questionnaire also determines whether users are willing to take potential investment risks. In addition to joint and multiple taxable investment accounts, Marcus Invest offers conventional IRAs, including SEP IRAs and traditional IRAs.

One of the unique aspects of the Marcus Invest introductory questionnaire is that it reviews your saving tactics and whether or not you have a dedicated emergency fund. It influences and propels beginner investors to have an emergency fund that ordinarily may not have money management goals.

Once you fill out the questionnaire, you can select one of three investment strategies: Impact, Smart Beta, or Core. The portfolio users get recommended by Marcus Invest is based on their answered questions. It is up to new users to opt for a conservative or aggressive investment portfolio.

Benefits of Marcus Invest

One of Marcus Invest’s benefits is that it offers multiple investment strategies. You can opt for a Smart Beta, Impact, or Core portfolio that fits your investment requirements. Marcus Invest Reviews show that it offers a high yield on its savings account. You can expect to get as high as a 3.30% APY rate paired with attractive features.

With standard robo-advisors, users can leverage Marcus Invest for automated rebalancing. This feature is triggered when a user’s asset allocation moves away from its predetermined benchmarks.

The Robo algorithm notifies investors about rebalancing and making suitable trades. Ultimately, human advisors assess recommended trades and approve them. Another advantage of Marcus Invest is that it allows users to invest as little as $5.

Marcus also reduced its minimum account requirement to $0 to compete with close competitors and set a new standard in the market. Marcus Invest is easy to navigate and features a clean and attractive layout. On the dashboard, it is easy for users to check their balance and link their target portfolio.

Users can also check every investment’s cost. The dashboard simplifies and centralizes the most relevant investment-related information and helps users make quick decisions. You can also use the dashboard to check performance details and see how each one of your portfolios is performing.

Limitations of Marcus Invest

Some of Marcus Invest’s drawbacks include no human advisor, nonexistent tax strategies, and a lack of integrated tools. The main downside for users is that Marcus Invest usually fails to offer tax-loss harvesting, which has become a standard practice. Most robo-advisors offer this to decrease capital gains on taxes across taxable accounts.

Marcus Invest also charges a higher-than-average management fee. Similarly, the lack of tools in Marcus Invest makes it difficult for users to make logical and calculated financial decisions and create a holistic view of their finances.

Who is the Target Market for Marcus Invest?

Marcus Invest is ideal for socially responsible, hands-off investors searching for high-yield online savings accounts. If you’re a Marcus customer, you can leverage the value-added and streamlined financial user experience of Marcus Invest.

If you’re not a Marcus customer and looking for automated investment portfolio management, you’ll find Marcus Invest an attractive platform. You can choose from multiple investment strategies and take advantage of Marcus Invest’s Smart Beta portfolios and impact investing.

You can apply Smart Beta investment portfolios for active management and passive robo-advisor investment portfolios. It is the best approach to take up potentially high-risk investments that offer higher returns. If you are in the market for automated investment portfolio management advice, you may want to look for another option since Marcus Invest doesn’t provide direct access to advisors.

How Your Money Gets Invested through Marcus Invests

Marcus Invest invests your money based on the choices you make in the questionnaire. Marcus Invest focuses on a singular strategy to invest your funds. You can expect different balances in each investment portfolio depending on the investment time horizon and risk tolerance.

Core Strategy

With the Core strategy, users are placed in a low-tier fee portfolio. It is a diversified portfolio similar to standard robo-advisor portfolios. Small cash allocation is one of the 12 featured funds. While twelve different funds is a competitive number most robo-advisors offer, you can diversify with fewer funds.

Marcus Invest’s portfolio revolves around value allocations and small-cap equity funds. In the long run, these historically core portfolio elements outperform other funds.

Impact Strategy

Impact invests funds based on a score determined by third-party reviewers that focuses on environmental, social, and governance metrics. The idea is to select enterprises that continue to impact the environment and society in a socially conscious manner.

With this style of investment strategy, you’ll need to avoid industries like tobacco, firearms, and coal. Plus, ESG funds involve more research and management than standard funds, which is the main reason ESG funds come with higher expense ratios.

But most investors don’t mind paying a higher fee in the hopes of doing social good. In a critical sense, the ESG investing approach has had its fair share of criticism. While ESG funds are progressive, they often don’t align with most companies’ values.

Smart Beta Strategy

This type of investment strategy involves a proprietary methodology. It scores enterprises based on their technical and annual performance metrics and determines whether they can outperform in a competitive market. This investing style is suitable for aggressive investors who are willing to take high-potential risks on their investments.

The Smart Beta portfolio under Marcus Invest features active ETFs and passive funds. Marcus Invest also offers account holders credit based on incurred expense ratios when selecting Goldman Sachs funds for a portfolio.

What are Marcus Invest Expense Ratios?

Every ETF you purchase comes with an expense ratio, a fee that gets deducted from your savings account. Marcus Invest has a fee structure similar to most robo-advisor service solutions. Whether Core, Smart Beta or Impact, Marcus Invest charges an additional cost and shows the average range of expenses users would need to pay for different strategies.

Impact

0.11% – 0.19%

Core

0.05% – 0.16%

Smart Beta

0.15% – 0.17%

Why does the cost change in each strategy? Well, it comes down to the combination of funds you choose. One strategy may cost more than others, depending on the risk tolerance and time horizon. Still, the average cost ratio is slightly higher than the offered ETFs at the usual robo-advisors.

The difference is just a couple of dollars on $10,000 invested. Depending on the combination of funds you’ve invested in, you would probably pay less in Marcus.

What Else Can You Expect from Marcus Invest?

Marcus Invest falls under the umbrella of Marcus by Goldman Sachs products. This line of products caters to young people who are less affluent than Goldman Sachs’s usual high-net-worth clients.

Marcus Invest doesn’t provide financial advisors – it directs customers to a robo-advisor to get the best investment advice on their portfolio based on answered questions.

However, Goldman Sachs offers its clientele wealth management and financial advisors. Through Marcus by Goldman Sachs, users of Marcus Invest can access personal loans, CDs, savings accounts, and money management.

Mobile App

Users can get the Marcus mobile app on their iOS or Android devices and centralize all Marcus, like Marcus Invest. You can also link external accounts to get automated insights through Marcus Insights. It will help you learn how to utilize your money across different accounts based on availed services.

Customer Service

Marcus customers get standard customer service via phone from Monday to Friday. Marcus Invest also features email support for customers. You can find email support with integrated links in account services. On the downside, Marcus Invest doesn’t feature live chat customer service.

Final Verdict

In a competitive marketplace, Marcus Invest offers a cost-effective robo-advisor solution. Marcus Invest focuses on value-added types of investment portfolios. Whether it’s an expansion from a bank, centralization of finances, or maintaining solid banking relationships, Marcus Invest works wonders for existing Marcus customers – it offers heightened service features within the same digital hub.