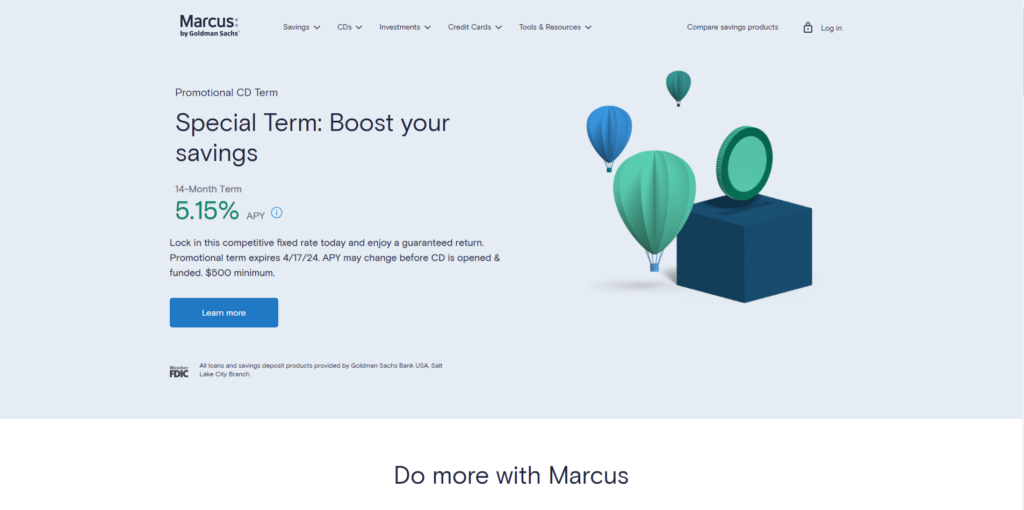

Marcus by Goldman Sachs is a dedicated online banking arm of Goldman Sachs. It provides high-return savings accounts, no-fee personal loans, and penalty-free high-yield CDs.

With top CD rates and high APY, it was only a matter of time before Marcus’s value-added approach got the attention of a wide audience. What’s interesting about Marcus’ savings account is that it does not have minimum deposit requirements and doesn’t charge monthly fees. Marcus is ideal for savers who want to leverage competitive CDs.

You need a simplified review of Marcus by Goldman Sachs rather than getting lost in technical information to see if it works for you. In this Goldman Sachs Marcus review, you’ll get an objective look at Marcus and whether or not it caters to your financial needs.

Let’s touch on the Marcus by Goldman Sachs pros and cons, savings account details, and what customers can overall expect from it.

Benefits of and Limitations of Marcus

Image source

Benefits

- The saving account doesn’t charge a service fee every month

- There is no minimum balance requirement

- CDs’ balance requirements are low

- Offers 24/7 customer service for account holders, which makes it easier for customers to get in touch with a customer representative at any day and time

Limitations

- Account holders have no choice but to make automated deposits or electronic transfers.

- Doesn’t support ATM-based or debit transactions, which makes it hard to access funds

- Lack of financial products

What Makes Marcus Attractive?

One of the main reasons “Marcus by Goldman Sachs” stands out is that it is designed to serve customers looking for highly competitive rates. Marcus is an all-around great choice for customers who don’t want to deal with a traditional bank account.

Many customers use Marcus because it is from a highly reputable financial institution like Goldman Sachs. It gives customers a sense of assurance that they’re getting something from one of the top international investment banks that offer impressive financial services.

Marcus by Goldman Sachs is also ideal for customers who want added flexibility across CDs. For customers who want a personal loan without a fixed rate and fee favor, Marcus by Goldman Sachs. Marcus is also perfect for customers who prefer higher-than-average CD rates and savings.

Sure, Marcus doesn’t offer a long list of financial products like most online banks, but it is a top-tier financial solution. In terms of ranking, if you look at Marcus by Goldman Sachs through the lens of the digital age – it’ll make a lot of sense. It is no wonder Marcus is on top of the list among many satisfied customers.

What Can You Expect from Marcus

Marcus revolves around two options:

- a certificate of deposit (CD)

- an online account

It is up to the customers whether they want to open both or just one of the accounts. The best part is that there’s no unexpected or hidden requirement targeted at the client on both accounts. It all depends on if it is the right fit for your current financial needs.

Marcus features a wide range of sub-offerings on its online savings account and a certificate of deposit.

Instead of rolling out many financial product offerings, Marcus by Goldman Sachs prioritizes quality and making sure each offering works in the best interest of the customers.

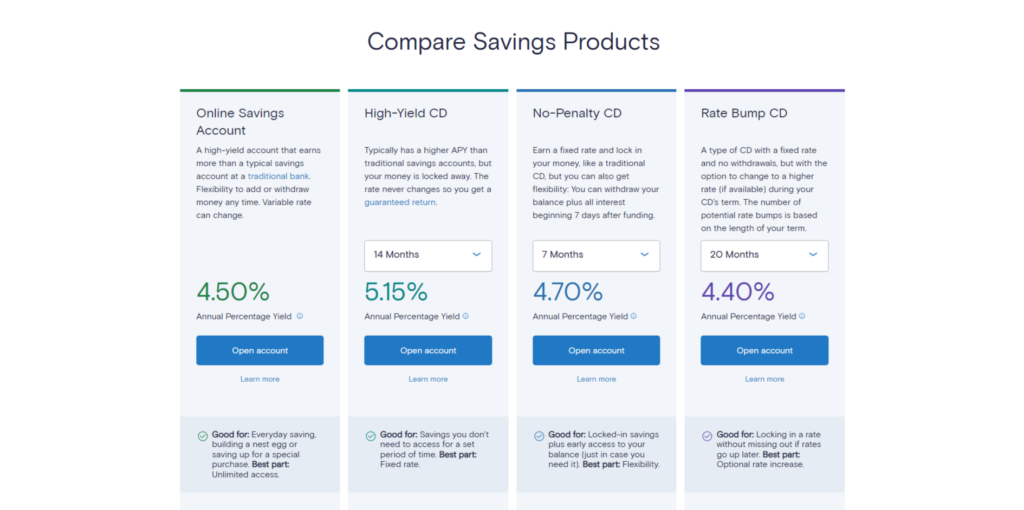

Marcus Online Savings Account

The only conventional bank offering of Marcus is its high-yield savings account. What makes it stand out? It doesn’t have minimum deposit requirements. It also doesn’t charge monthly maintenance charges for the account.

And with a 3.30% APY, it is perfectly structured for customers to get the most value out of their savings account. In terms of security, Marcus’s online savings account comes with FDIC insurance that supports more than the maximum limit set by the law.

CDs

In Marcus, customers can get two kinds of CDs:

- No-Penalty CD

- High-Yield CD

The high-yield option features additional term options. This option can range from 6 months to 72 months. But whether it’s a high-yield CD or a no-penalty CD, both options come with a minimum deposit requirement of $500.

In the high-yield CD option, customers can get a ten-day rate guarantee. It means you can open a new CD and put a minimum of $500 in the account within ten days. The same rules will apply if the CD rate goes up in the same ten-day time window.

If the rate increases, customers can leverage the highest available during the ten-day slot. On the other hand, high-yield CDs get 30 days after opening a new account to get fully funded. So, if customers want to access their money from a high-yield CD account before the maturity date, they will need to pay the penalty for making an early withdrawal.

The good news is that customers won’t have to pay any penalty if they take out the money after 90 days. But the interest varies for 180 days, 12 months or less, 270 days, and five years for CDs. In no-penalty CDs, customers will find different rates than high-yield CDs. And that’s because customers can take out their full balance and cross out no-penalty CDs without compromising interest.

But this work is based on the assumption that CDs are fully funded for the whole week. Still, users cannot take out a partial withdrawal from their no-penalty CD. For security, CDs are protected by FDIC insurance that can support more than the maximum limit set by the law.

Current Rates and Terms for High-Yield CDs

9 Month – 3.95% APY

6 Month – 3.75% APY

5 Year – 3.80% APY

4 Year – 4.00% APY

3 Year – 4.00% APY

2 Year – 4.35% APY

18 Month – 4.75% APY

12 Month – 4.40% APY

Current Rates and Terms for No-Penalty CDs

13 Month – 3.85% APY

11 Month – 0.35% APY

7 Month – 0.45% APY

6 Year: 3.70% APY

A CD or certificate of deposit is a great way to save money. A certificate of deposit is a savings tool with low risk that increases the earned amount in interest. As a modern-day savings vehicle, it makes sure your funds are invested safely. It allows you to deposit money for a specific length with specific terms that customers choose.

If the deposited money stays in for a long time – it will render a higher interest rate. The major difference between Marcus’ savings account and CD comes down to the penalty on early withdrawal in CD. But the main benefit of a CD is that it gives you a better chance at earning a higher interest than a savings account. Not to mention, it is more highly stable than a savings account.

If you decide to opt for CD, you can leverage the ten-day guarantees of Marcus. So, if you open a new account at, say, one API and it decreases after seven days – you can still tap into the higher API, assuming you deposit the amount within ten days. What about the monthly interest you incur on a CD? Well, it’s added to the principal CD amount automatically. But users can decide to transfer this accrued interest to a different bank account without paying any fees.

![]() Recommendation: Use our CD calculator For Calculating Interest

Recommendation: Use our CD calculator For Calculating Interest

Marcus by Goldman Sachs: Positive User Reviews

“Not sure about the negative reviews but I’ve transferred funds several times and then deposited them into Marcus’ online savings account and it works like a charm. It also makes it easier to fund any new CD account through a site and then transfer the funds from Marcus’ online savings account to the new Marcus CD.”

“I like that the website is incredibly easy to use. It made it easier for me to manage my CD maturity plan for every CD right on the site. Rates are also solid and I keep my funds here and often make an external transfer to a full-service bank.”

“I’ve never felt the need to reach out to a customer service representative via chat or phone call. It has pretty much worked out for my specific needs.”

Wrap Up

Don’t think of Marcus as a new replacement for your traditional bank account since it doesn’t support ATMs, checking accounts, or retail locations. However, users can tap into the best aspects of Marcus by Goldman Sachs if they prefer online banking and want long-term savings.

Whether it’s minimum deposit limits on its accounts account or competitive rate, the benefits of Marcus by Goldman Sachs outweigh its limitations. Say you want to earn interest and save money through a less risky approach than buying stocks or other investments – you’ll find Marcus by Goldman highly attractive.

When it comes to choosing Marcus by Goldman Sachs, a lot depends on your financial situation. Since every customer has their own needs, it is better to be objective about Goldman Sachs by Marcus review. All in all, Marcus is a practical option for customers who want to keep an online savings account.