When individuals experience financial difficulties, credit repair companies are invaluable resources for getting back on their feet. In the present day and age, they serve an important purpose. Despite the critical nature of such services, banks have historically been hesitant to grant merchant accounts to credit repair organizations.

Credit repair company owners may find it challenging to continue operations as usual in light of this general guideline. If you run a credit repair firm, having a dependable payment processor is crucial to your company’s success and the continued provision of your services to the general public. Nearly all credit repair businesses use card-not-present invoicing as their primary method of accepting payments.

Credit Repair is Regarded as a High-Risk Venture

It is rare for a credit repair business to be granted a merchant account by a credit card processor. This is partly attributable to the high-risk nature of the credit-repair business. A large number of chargebacks, as well as the risk to processors’ and sponsors’ reputations, are two of the main reasons this industry is considered risky. Due to the lengthy deletion and removal processes, chargebacks are more common in this sector of business. Some clients may challenge the credit repair transaction several months later due to the fact that some removed items can be placed back on their credit report.

Customers may initiate a charge-back when they suspect that their credit card was used fraudulently by a credit repair company. Typically, having too many chargebacks will cause a processor to suspend or even cancel a merchant’s account.

Payment processing alternatives like PayPal are used by many businesses that don’t have access to traditional merchant accounts. However, credit repair businesses are unable to accept payments through PayPal or similar services since doing so is against their terms of service.

Tips on Finding a Reliable Payment Processor for Your Credit Repair Company

Due to the high-risk nature of the credit repair industry, most merchant service providers will automatically label you as such.

Look for businesses that have developed processes to meet the specific requirements of the credit repair industry, such as a method of verifying the identity of buyers and their authorization of recurring charges.

When dealing with payments around something as delicate as credit repair services, making sure that the aforementioned methods of verification are in place is crucial. This will safeguard both your and the payment processor’s interests and perhaps lower the likelihood of chargebacks and disputes.

Host Merchant Services for Credit Repair Companies

High-risk merchants can make use of Host Merchant Services, a conventional merchant account provider, for credit card processing at low-cost interchange-plus rates. Hosts can open merchant accounts for numerous companies that other processors will not touch. We pride ourselves on assisting anyone who is not “selling anything that borders’ on unlawful.”

We simplify the process with transparent pricing, a flat monthly rate, and no surprise charges. It’s important to us that we are open and honest within the payment processing marketing, where typically companies can charge a number of hidden fees and have other wrongful practices.

There is a concerning lack of transparency regarding fees charged by merchant services providers and the agents that sell these services. PCI costs, AVS fees, batch fees, monthly minimum fees, termination fees, and many others are all included in this category. Your bottom line might take a hit if the true cost of processing is more than expected due to hidden fees. For this reason, it is crucial that you study merchant account agreements thoroughly before signing anything.

Before you make a commitment to a merchant services provider, whether with Host Merchant Services or another processor, be sure you have all of the facts.

Products and Services

We offer a wide range of products and services, ranging from credit card terminals, point of sale systems, and online payment gateways. Among the brands that you’ll find here are Clover, Bonzai, Pax, Valor, Ingenico, Dejavoo, Vital, and more.

We also offer cash discount programs, gift cards, loyalty programs, and programs for both low and high-value items, in addition to standard credit and debit card processing.

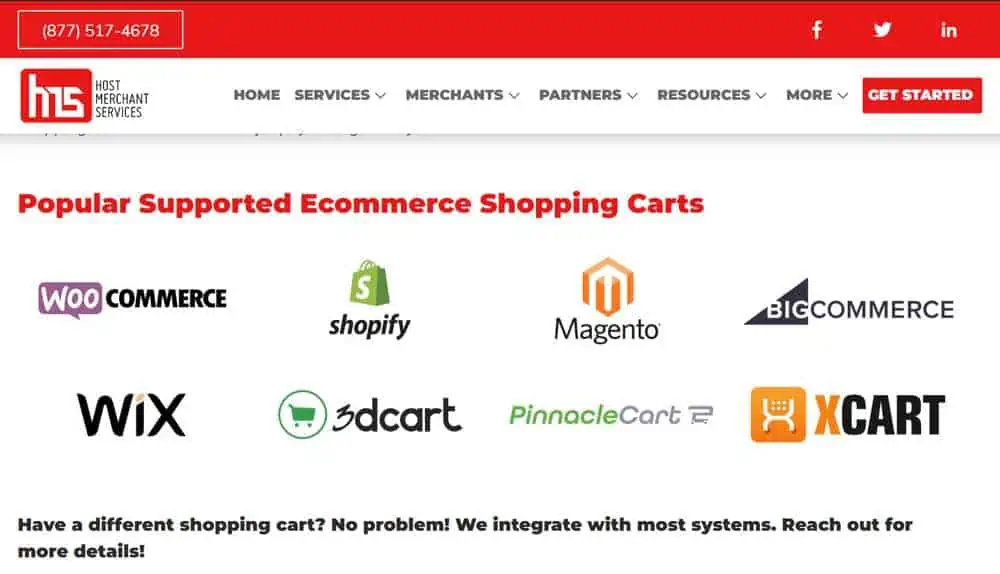

We understand that time is of the essence for online retailers. Thus, we provide comprehensive support to ensure smooth integration with our platforms. We are able to provide a customized eCommerce solutions for our merchants since our founder previously owned a successful web hosting firm.

Payment gateways, virtual terminals, online shopping cart interfaces, and mobile payment technologies are just some of the services that we provide for e-commerce.

Advertising & Sales

When it comes to its marketing, advertising, and sales methods, we have a long reputation for being honest and ethical among our consumers. We have inside sales associates as well as independent sales agents.

In comparison to most other processors, we like to provide as much information as we can on the cost of our products on our website. We are proud that we have no hidden costs, and we list the majority of our processing fees immediately on the pricing page of our website.

Pricing, Rates & Fees

When compared to other merchant service providers, HMS’ pricing is more clear and more straightforward.

Interchange plus price is listed on our website and is differentiated for three distinct markets (retail, dining, and online shopping). Pricing for brick-and-mortar stores is 0.25% + $0.10/transaction. The restaurant industry receives a discounted rate of 0.20% plus $0.09 for each transaction. Online stores should expect a processing fee of 0.35% plus $0.10 per sale.

Monthly fees, batch fees, gateway fees, and an annual charge are just some of the additional costs you may expect to incur while using our services; these costs, along with other costs, are spelled out in detail on the site. Advertised prices on our website serve as a starting point for custom pricing. Merchants of any volume can find a suitable credit card processing rate.

Each high-risk merchant is assessed separately. It is in the best interest of each merchant to engage with us on an individual basis due to the big range of high-risk enterprises. Variables like the underwriter and the platform on which the business is operating all affect the rates.

We currently are no complaints regarding hidden costs or misrepresentation of pricing in our ratings and reviews from merchants. Therefore, it seems safe to assume they are 99% of merchants are happy with our pricing and our services.

Setup & Support

Depending on the service that you are looking for will determine the specifics of the setup time of your merchant account. It could take a little bit of time for a merchant to receive their hardware, but once they do, all you need to do is turn it on and connect to your ethernet cable or Wi-Fi to being accepting payments.

The underwriting process might take up to a day, although low-risk businesses can often start accepting payments right away. The company’s internal team handles low-risk clients directly and works with other providers for high-risk merchants.

The typical underwriting period is 48 hours, but it can take up to seven days for high-risk accounts to be processed when a partner is involved.

Reviews

We are historically well-regarded by our clientele and have over 100 positive ratings. Many reviewers highlight the cost savings that resulted from moving to our services, as well as the quality of our customer care and its easy onboarding procedure.

Only a small number of reviews have small complaints, and those complaints have been addressed or seem to be outliers. We have received primarily positive feedback for the entire lifetime of our organization. While an HMS representative did respond to one complaint on the BBB page, it appears that they have tried to work things out with the store in question.

We also have received an “A+” from the BBB on their report card. We do not have any class action lawsuits pending against HMS or any complaints filed with the FTC.