Introduction

In a saturated financial market like we have today, there are many cards to compare when looking for the best cash back credit cards. Typically, cash-back credit cards are a great option to earn rewards on everyday purchases. Whether it’s groceries, gas, travel, or dining, many credit cards now offer cash-back rewards on a wide range of spending categories.

If you can track value points and redemption points, you can earn high returns through cash back credit card rewards. When it comes to earnings from using a credit card, most people want to get rewards in the form of dollars. Most rewards cardholders agree that they prefer cash back rewards and returns over different redemption options.

Cash Back Credit Card

Credit cards for cash back revolve around rewards on eligible purchases. These cards give cardholders a percentage reward based on their purchase price. For instance, if the cash back rate is 2%, it means the cardholder can earn 3 cents back on each dollar spent.

So, if you buy groceries worth $5,000, earning 3% would mean getting $150 in cash back rewards. You can see cash back through the lens that you would look at a discount. This means the payoff works around redeeming rewards rather than getting an upfront discount at the time of checkout.

Best Cash Back Credit Cards of 2023

Now, to help you get started, let’s look at the best cash back credit cards in 2023:

Discover it Cash Back Card

It is ideal for rotating categories of cash back. With the Discover it Cash Back Card, you get 5% in cash back rewards with $1,500 in spending on rotating categories every quarter. It is highly rewarding for credit cardholders who tend to flex their overall spending and want to get a boost in reward categories in different quarters.

Discover it Cash Back Card is great for individuals who adjust their total spending to maximize their cash back earnings in different categories. But if you don’t like the idea of enrolling for new categories every quarter, then you should probably look for a cash back credit card that offers value on consistent purchases throughout the year.

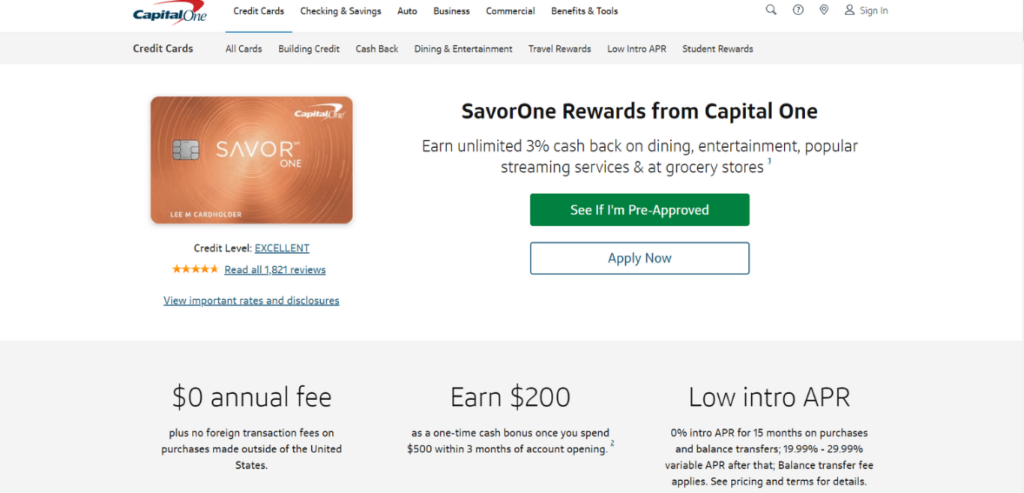

Capital One SavorOne

This cash back credit card is perfect for restaurants and grocery shoppers. One of the highlights of the Capital One SavorOne card is that it features a dedicated entertainment category. It covers a wide range of eligible purchases, like tickets to movies, concerts, theme parks, tourist attractions, and sporting events. All these purchases allow cardholders to earn 1% back in cash.

Citi Double Cash Card

Citi Double Cash Card is great for cardholders who want straightforward cash back rewards without an annual fee and tracking of categories. One of the stand-out elements of the Citi Double Cash Card is that it features an impressive reward structure that incentivizes you to keep up with your payments.

After payments, you can only earn 2% in full cash back rewards on eligible purchases. In short, you earn 1% cash back at the time of purchase and 1% “after” you pay off your purchases.

If you plan to make large purchases and need time to save money on different interest charges, then you’ll fare well with Wells Fargo Active Card. And that’s because it also earns a similar flat rate on eligible purchases and features an extended APR offer on balance transfers and purchases.

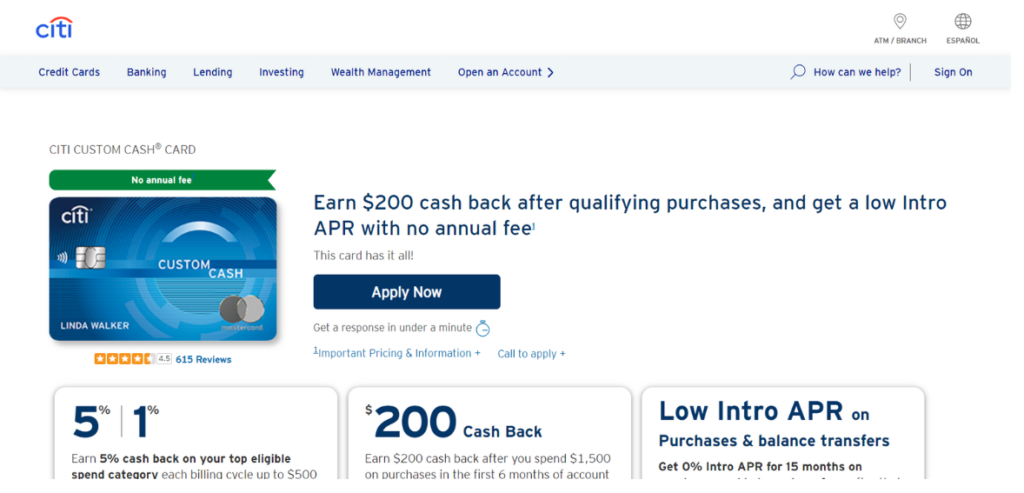

Citi Custom Cash Card

If you want a high rate on cash back and don’t want to constantly remember to activate your bonus categories, then the Citi Custom Cash Card is for you. It features ten automated bonus categories that would fit with your rewards or cash back strategy. With Citi Custom Cash Card, you can earn 5% back that round up to $500 in cash rewards. You will need to supplement your Citi Custom Cash Card if you plan to spend big on more categories.

Wells Fargo Active Card

This cash card is ideal for earning 2% cash rewards. On top of the impeccable rewards rate, one of the highlights of the Wells Fargo Active card is its cell phone protection. In fact, you can get more than $600 in protection against theft or damage. It is no wonder many people now pay their monthly phone charges with this card.

Wells Fargo Active is ideal for people who plan to make a significant purchase. Wells Fargo Active Cash Card comes with an APR offer that allows cardholders to minimize their interest charges on eligible purchases and earn consistent cash rewards.

Blue Cash Preferred Card

If you’re searching for compact cash back credit card that offers rewards on grocery purchases, you’ll find the Blue Cash Preferred Card a solid option. Blue Cash Preferred Card offers a whopping 6% high rate in cash back reward categories across U.S. supermarkets.

You can get 6% cash back rewards on purchases across American supermarkets a year. Blue Cash Preferred Card is suitable for individuals who make moderate to large grocery purchases and don’t want their budget to be offset by an annual fee. With Blue Cash Preferred Card, you can earn a good chunk of cash back amount.

Capital One Quicksilver Card

If you’re new to cash back rewards, then this is the card for you. It offers a flat rate and doesn’t charge an annual fee. The card is also low-maintenance and is perfect for people who are new to earning cash back rewards. With the Capital One Quicksilver Cash Rewards Credit Card, you can earn 1.5% in cash back rewards.

Capital One Quicksilver offers all-around protection on travel accident insurance, extended warranty protection, and 24-hour travel services. If you spend a lot on standard purchases like gas and groceries, then you will earn higher cash back rewards in different categories.

Chase Freedom Unlimited

This cash back credit card is great for the sign-up bonus. Chase Freedom Unlimited is designed for individuals who tend to stick with their everyday rewards and travel regularly. It is also ideal for people who don’t want to deal with annual fees and high-rate rewards on rental car bookings, hotel stays, and airline bookings.

One of the highlights of the Chase Freedom Unlimited cash back credit card is that it offers more impressive bonus rewards on travel-based purchases than standard cash back credit cards. The Chase Freedom Unlimited credit card offers 1.5% cash back on purchases in different bonus categories. It also features impressive sign-up bonuses. Chase Freedom Unlimited credit cardholders soon notice that they can maximize the value of their rewards.

Bank of America Custom Card

This cash back credit card allows you to choose from six different bonus categories. It also allows cardholders to change their selection every month so that they can match their spending habits. If you’re looking for the most flexible cash back credit card, then you can’t go wrong with the Bank of America Custom Cash Credit Card.

It is an excellent option for people who want to change their category of bonus rewards every month. On the downside, this custom cash credit card has cash back limits. Still, heavy spenders can benefit from this card and earn a flat rate on different purchases.

Alliant Cashback Visa Card

This credit card offers 2.5% in cash back rewards. If you want to boost your rewards, you’ll find the Alliant Cashback Visa Signature Credit Card more practical than many cash back credit cards available in the market.

You just need to be part of the Alliant Credit Union and maintain a daily average balance of $1,000 in your checking account each month to get 2.5% in cash back rewards. With the Alliant Cashback Visa credit card, you can earn over $10,000 on eligible purchases for every billing cycle.

Amazon Prime Rewards Card

If you love to shop online, you’ll find the Amazon Prime Rewards Visa an attractive option. This Visa Signature card features great features and benefits for cardholders. Typically, retail cards are not famous for their benefits or sign-up bonuses. With Amazon Prime Rewards, you can get a $150 Amazon gift card after approval and without any spending requirement.

You can also get coverage for your purchases via purchase protection and an extended warranty. Amazon Prime Rewards is ideal for Amazon Prime members and whole foods shoppers. You can earn 5% in cash back rewards for all online purchases, including groceries. It is an all-around great card for people who want to save more money.

Final Thoughts

You’ll find plenty of solid cash back credit cards in the financial market. When picking one of these credit cards, you should pick one based on your spending priorities and habits. You can get a simple or all-purpose rewards credit card that comes with cash back bonuses in different categories.

Like any other type of credit, you have to responsibly use the card and pay off your balance every month in full to avoid potential interest fees and charges. In hindsight, take your time and review the top-tier cash back credit cards and select the one that meets your financial needs.