Buy Now/Pay Later loans have become a very popular option for big-ticket purchases thanks to their zero-interest rates and reasonable repayment rates. Afterpay BNPL provides a great no-interest option for shoppers while allowing you to pay in multiple ways. But how does their BNPL work? Read on to find out.

In this article, you’ll learn everything you need to know about Afterpay BNPL’s offering, including how it works, its advantages and disadvantages, and how to determine whether it’s the right choice for you.

Overview of Afterpay BNPL

You can use Afterpay to pay for online and in-store purchases from many major retailers, such as Bed Bath & Beyond, Old Navy, and Nordstrom.

It’s a financing option similar to other BNPL providers, like Klarna and Affirm, allowing you to split your purchase into smaller installments with no interest.

While a cash payment is generally the best way to make a purchase, BNPL payment plans are an option if you need to break up a big-ticket purchase. However, you will need to be able to pay each payment on time in order to avoid any issues.

Additional Afterpay Services

There are no other products available through Afterpay besides pay-in-four loans.

How Does Afterpay BNPL Work?

A pay-in-four payment plan from Afterpay BNPL lets shoppers pay in four equal installments, each due every two weeks, with the first payment due at checkout.

As an example, if your purchase costs $200, you would pay $50 at checkout. Once you have paid off the $200, you will have to make three more $50 payments every two weeks.

You can use your debit card, credit card, or bank account to make payments. Your first payment might be higher than the rest of the installment if what you are buying is particularly expensive, though Afterpay will show you the full breakdown before you pay.

Afterpay also incentivizes paying in time by improving your terms the more you use the service. If you’ve been using Afterpay BNPL for a while and you have been punctual, you may be allowed to pay the first installment in 2 weeks instead of right away, giving you a longer repayment plan.

Afterpay does not charge interest on its plan, so if you pay on time, you can basically take advantage of it for free. If you fail to pay ten days after the initial deadline, you will be charged an $8 late fee. Furthermore, your account will be paused if you miss a payment, in which case you can’t use the service until the payment has been made.

Approval Process

Afterpay accounts are easy to set up and do not require credit checks. In order to complete the application, you need to provide your name, email address, phone number, home address, date of birth, and payment method (debit or credit card).

You are approved for lower limits as a new customer that gradually increase based on how you use the account and whether you pay on time.

Interest Rates and Fees

The loans offered by Afterpay BNPL are interest-free. You only pay 25% upfront and 25% every two weeks until the loan is paid in full.

As long as you pay on time, there are no fees for Afterpay loans. In the event that you do pay late, the penalties are fixed, capped, and do not accrue over time. The customer pays a $10 late fee, plus an additional $7 if their payment is not current after seven days. With late fees capped at 25% of the original purchase amount, small purchases won’t get overwhelmed by fees that end up costing more than the purchase itself.

Customers who fall behind on their payments won’t be able to make additional purchases until their accounts are brought current. However, delinquent payments will not be reported to the credit bureaus.

Credit Checks

You may receive a soft credit check from Afterpay, which does not negatively impact your credit score. Afterpay does not specify its minimum credit score requirement, and borrowers with bad credit or no credit are likely to qualify for its payment plan.

Customer Service

Customers can contact Afterpay customer service seven days a week by email, so they are available 24/7. You can reach our customer support team by calling 855-289-6014 from Monday through Saturday if you prefer to talk to someone. Support is available Monday through Friday from 7 a.m. until 7 p.m. Central Standard Time and from 9 a.m. until 6 p.m. Central Standard Time on Saturdays.

App Functionality

Shoppers can use the Afterpay mobile app or shop online. You can download the app for Apple and Android devices, and it has a very high rating from users. More than 23,000 retail partners are available in North America, and more than 85,000 retailers are available worldwide. Among the most popular brands are American Eagle, Banana Republic, Clinique, Puma, and Old Navy.

You can buy through Afterpay’s mobile app and pay in four installments. 25% of the total is due right away through your debit or credit card on file, and the rest is paid in three payments every two weeks.

In addition to browsing and shopping, you can view previous orders, make payments on open loans, and customize your experience. Through the app, you can also change your payment method and track your deliveries.

Pros and Cons of Afterpay BNPL

The decision to use Afterpay could have both pros and cons, just like every other BNPL service. As for their BNPL offering, they have the following pros and cons:

Pros

- Late fees are capped at 25% of the purchase amount: If you have trouble paying your account on time, late fees can quickly add up. You will never pay more than 25% of your original purchase amount for late fees with Afterpay.

- Charges no interest: You won’t be charged any interest for purchases made with Afterpay’s pay-in-four financing. You pay in four installments, with 25% due in advance. The remaining 75% will be paid in equal installments every two weeks over the next six weeks.

- No hard credit checks: You do not need to provide your Social Security number when opening an account with Afterpay, and there are no hard inquiries on your credit report. Therefore, those with bad credit or little credit history won’t be affected by their low credit score.

Cons

- Limited financing options: The only financing option available through Afterpay is pay-in-four, so if you require more time to pay off your purchase, you should consider other BNPL apps.

- Late fees: You will be charged a late fee of $10 if you fail to make your payment on time. Payments not received within seven days of the due date will be charged an additional $7. These fees can add up but will not exceed 25% of the original purchase price.

- Your purchase may be declined by Afterpay: On average, 90% of customers’ purchases are approved by Afterpay. However, one transaction in ten is declined.

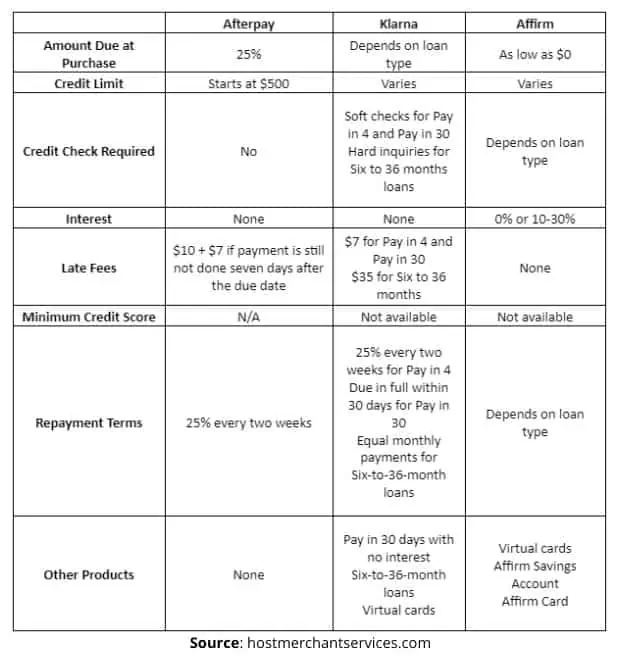

Afterpay Compared to Other BNPL Options

Below is a table comparing the terms and fees of Afterpay and two other of the most popular BNPL options available:

Should You Use Afterpay BNPL?

A BNPL loan from Afterpay is reputable, and you are relatively risk-free if you pay on time. BNPL plans, however, can lead to overspending, so it’s recommended to only use them for necessary expenses. Before agreeing to the loan, read the Afterpay terms thoroughly.

Choose Afterpay if…

- You are comfortable with automatic payments: Afterpay recommends that you set up automatic payments to ensure that you don’t fall behind on your payments by accident. As long as you have enough money in your account, your payment method will automatically be charged on each due date. A reminder will be sent before each payment is due.

- You want a simple plan: Afterpay offers a single, zero-interest payment plan to all shoppers, in contrast to other BNPL providers that have multiple financing options. Some BNPL companies, like Affirm, negotiate their underwriting criteria with individual merchants, which means the interest rate and repayment terms may vary according to where you shop.

- You want a BNPL with a rewards program: As a BNPL provider, Afterpay’s Pulse Rewards program is unique. By making on-time payments, you earn points for being responsible for your repayments. You can eventually exchange your points for more flexible payment options (such as delaying your payment by up to seven days), exclusive discounts, or gift cards. Only Afterpay app users have access to Pulse.

Avoid Afterpay if…

- You tend to overspend: If you have a habit of overspending, Afterpay will likely increase your credit limit as you successfully pay off more purchases. It may be tempting to overspend or fall behind on other financial goals if you have difficulty building an emergency fund or paying down other debts.

- You don’t always pay on time: In case of missed payments, Afterpay charges a late fee after a 10-day grace period, something that not all BNPL providers do. Although Afterpay only charges $8 per installment, and late fees are capped at 25% of the order value, this can increase your purchase price significantly.

- You want to build your credit score: Even though many BNPL companies do not report on-time payments, some companies opt-in to report to the credit bureaus and will report if certain loans are made. Afterpay doesn’t report your payment history, so you can’t build credit. A good credit score increases your chances of qualifying for other financing products such as credit cards or loans.

Final Thoughts

Afterpay’s BNPL loan program is excellent for people that want a pay-in-four financing option with no interest. Their inclusion of a rewards program for purchases made through them sets them above the traditional BNPL providers, and their single loan plan makes them a very straightforward choice. If you pay on time, you shouldn’t have any issues with them, and even if you don’t, the late fees won’t exceed 25% of the product.

However, their single financing option might be limited for people looking for more flexible repayment terms, and they aren’t a great choice if you are looking for a provider that can help you build up your credit score.