Credit cards have had a transformational impact on how humans transact, make purchases, and grow the global economy. However, not everyone is aware of how the roots of credit card processing and major payment networks such as American Express, Diners Club, Mastercard, and Visa took shape and what the industry has become today. Let us today unveil the fascinating history of credit card processing that changed the financial world drastically.

Interestingly, a half-century before credit card networks started taking form, Edward Bellamy published the novel Looking Backward in 1888, writing about the transformation of society witnessed by a person who wakes up after a 113-year sleep in the year 2000. The book speaks of people using a ‘credit card,’ but what the text refers to are debit cards today.

The First Credit Card

It wasn’t until 1914 that Western Union started issuing employee salaries in the form of non-cash payments via a metal plate card. Unfortunately, the card had a network limited to that of the company’s own stores and did not gain traction.

Image source: Wikipedia

It wasn’t until 1946 that the ‘Charg-it’ card was offered by John Biggins, which was a slightly more open card network. It allowed depositors at Biggins Bank to have a card that allowed them to purchase from their local retail stores. Those retail stores would then collect the bank’s charges, and the bank deducted the amount from their depositors’ accounts and a fee.

The first credit card came about when Frank McNamara, having left his wallet in another suit pocket and his wife having to foot the dinner bill, was forced to think of a payment process using a card that could be used to pay for these types of expenses while traveling. It’s a famous story that kicked off modern-day credit and non-cash payments with Frank developing the Diners Club travel and entertainment card within a year to return to the same restaurant in 1950 to pay for dinner with it.

How Credit Card Processing Began

Carte Blanche and American Express soon followed with their own travel and expense cards in the late ’50s. In 1958, Bank of America introduced the BankAmericard in California, an actual credit card by today’s standards as it had a revolving credit feature. By the 1960s, BankAmericard had developed into a payment network by licensing the credit card to be issued by other banks.

In 1966, a consortium of banks launched their own association called the Interbank Card Association (ICA). At ICA, independent committees developed the frameworks for credit authorization, clearing, and settlement, as well as handling matters of security, legal, and marketing.

In 1967, another group of banks in California formed the Western U.S. States Bankcard Association (WSBA) and introduced the alliance’s own credit card, the MasterCharge. WSBA quickly moved towards global expansion by targeting Mexico, Europe, and Japan.

By 1968, ICA and MasterCharge had effectively become one as ICA was given rights to use the MasterCharge name and logo, resulting in ICA changing the association’s name to MasterCharge.

BankAmericard had gone through a similar transformation, where Bank of America passed control of the payment network to an alliance of member banks issuing the credit card, called National BankAmericard, Inc. (NBI).

History Of Credit Card Processing – The Early Challenges

In the early ’70s, the threat of ongoing legal battles and warnings by the Justice Department of a loss at the Supreme Court, forced the industry’s hand towards duality, leading NBI and MasterCharge both to agree to let member banks become members of both associations. The 70s also ushered in technological advances for these payment associations when they implemented electronic credit authorization, clearing, and settlement replacing decades-old paper-based processes that required authorizations via phone and reducing both losses and overhead.

In 1976, BankAmericard was rebranded to Visa, with the thinking that it would be easier to pronounce and without the mention of ‘America’ in its name, would make it easier for the association to expand its footprint internationally. Following this step, MasterCharge changed its name to MasterCard International.

The Credit Card Industry – Technological Strides

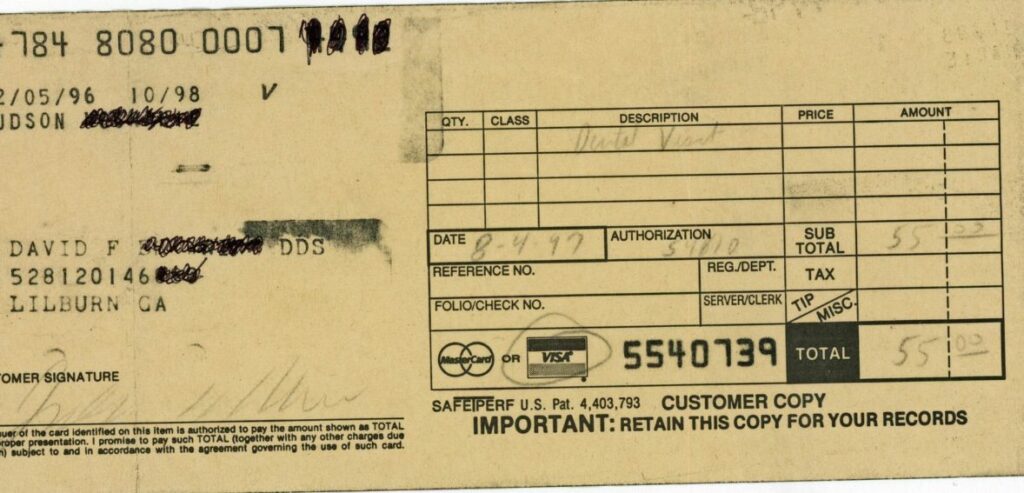

In the late ‘70s and early ‘80s, the credit card processing continued to make technological strides with the introduction and iteration of the Point of Sale (POS) system. The manual imprint device to capture credit card data was replaced by the magnetic stripe processor. In the ‘90s, the POS system was further refined with built-in wireless capabilities, as well as expansion of credit card usage due to ecommerce. Towards the end of the 2000s, the industry saw innovations such as the wireless card that allowed credit card transactions to be processed on the go.

That brings us to today. With the advent of the internet, smartphones, and pandemics, the credit card industry is quickly making a digital pivot with more and more transactions conducted on these payment networks’ infrastructure.

Today the technology isn’t just available for businesses to credit card transactions to take over for cash and checks. That automation process can easily be applied to other business operations, such as payroll processing. Businesses may not need to record hours, use Excel to calculate remuneration, and write out checks. The options are no longer just limited to third-party payroll services. It can be your merchant account provider as well, where the company’s employee management software can track hours, have data stored for pay and applicable tax rates, calculate and transfer salaries, and sync with accounting software to record the transactions.

The pandemic accelerated the progress in many areas regarding cashless transactions. Today credit card transactions top 82% of in-store transactions. The ongoing pandemic has accelerated growth in touchless transactions and moved up the pace of technology over the years. Al Kelly, CEO of Visa, says that “there’s plenty of opportunity at the ends of the curve. The high-ticket transactions and the low-ticket transactions are still a place where there’s cash on the low end, checks on the high end, where we have plenty of opportunities to grow.” He’s speaking of transactions too small to use a card for, i.e., a bagel, or too big, i.e., college tuition.

Bottomline

The credit card has a long history of human ingenuity that has made the world both smaller and safer. Today it continues to evolve through innovation with the introduction of numerous iterations such as e-commerce and mobile payment processing, digital wallets, and the introduction of pricing specifically for small-ticket items to capture a larger piece of the payment pie.