In the world of e-commerce and online retail, businesses need to be constantly adapting to the changes that are happening in real time. There are constantly new innovations being made in the world of payments that typically take the market by the storm. In addition, users are demanding more than ever, and as each day passes, consumers are spending more and more time on their mobile devices and less time on desktop computers.

Customers’ digital transformation is now seen very clearly in many sectors. In terms of how they pay for goods and services, same-day delivery services, virtual fitting rooms for online shopping, and AI-based suggestions while purchasing to gain more information during the buying process.

In this article, we’ll cover the top payment processing trends that will take shape in 2023. Continue on to learn more about what you can do to improve your business today.

Payment Processing Trends That are Taking Shape for 2023

Virtual Assistants

Virtual assistants are already commonplace on smartphones and smart speakers. They are intelligent computer programs that can perform tasks for you and assist with minor things in terms of appointment setting, scheduling on calendars, and automating messages. In the next 5 years, virtual assistants will be able to assist with online purchasing and payment. One of the biggest payment trends that will take place in 2023 is the growing popularity of virtual assistants.

Consumers will continue using voice assistants such as Amazon Alexa and Google Assistant to shop and pay for goods. This will be done by linking your bank account with your virtual assistant. It is believed that when this happens, virtual assistants will assist you to make purchases with only a few words.

Additionally, payment information will be stored on the device itself in order to prevent data breaches and identity theft. Virtual assistants are expected to become more useful as AI technologies advance but currently, they are only used to answer questions, provide relevant information, and even assist with daily tasks.

Biometric Identification

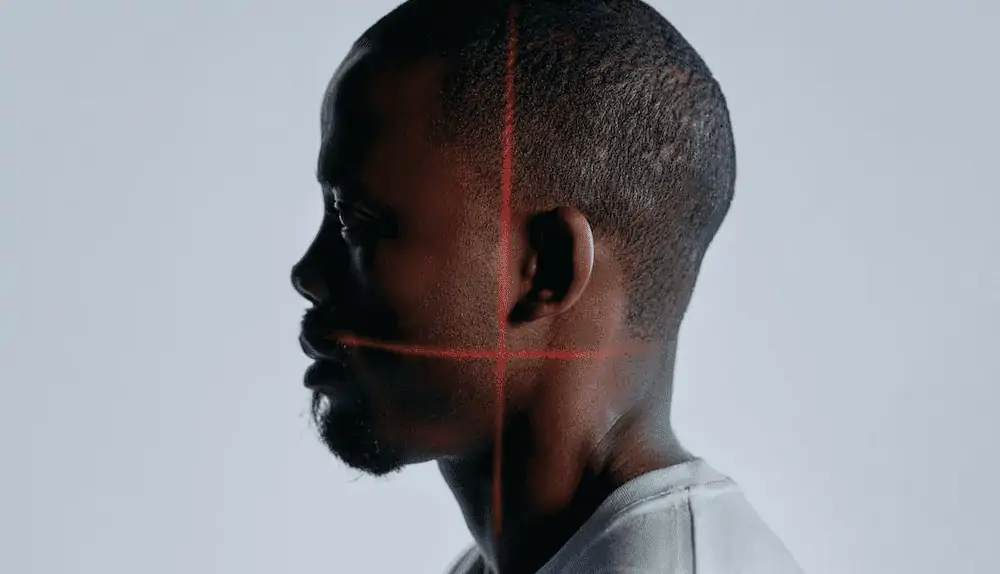

Biometrics is the use of biological traits to identify a specific person. Fingerprints have been used for many years to identify people. However, retinal scans, earlobe geometry, and hand geometry are other biometric identification technologies that have recently been introduced.

Biometric technology uses fingerprints, facial scans, or other biological markers to identify people. This technology is used in payment authentication to replace passwords and paper-based ID cards. As of 2020, one-third of enterprises had adopted biometric authentication and this trend will continue further.

Moreover, by 2023, biometric authentication is expected to be commonplace in financial transactions. This is because biometric authentication is highly secure and convenient and it does not rely on static passwords that can be stolen, shared, or forgotten. Instead, it uses unique physical traits that cannot be replicated from one person to another.

Artificial Intelligence and Machine Learning

Artificial intelligence (AI) is a technology that enables computers to think and act like humans. AI has been around for a long time in various forms and there is growing interest in machine learning, which is a subset of AI.

Machine learning is a form of AI that enables computers to learn without being explicitly programmed. It is a technique used in computer systems that teach computers to employ algorithms to change their behavior based on new data that they gather. There are many ways in which machine learning can be applied to payments.

With machine learning, you can create payment flows that take a complete 360-degree view of your customers. This allows your business to understand customer preferences and requirements better. With the help of machine learning, businesses can create payment processes that are adaptive, easy to use, and scalable.

Same-day Delivery Services

The popularity of same-day delivery services is expected to increase in the coming decade. Same-day delivery services have already taken over the grocery sector and are growing in the retail industry. With the growing use of AI and robotics, same-day delivery services are expected to become even more common.

On the other hand, consumers are becoming increasingly impatient with waiting for goods to arrive. They want their orders to be delivered quickly, within hours. By 2023, more businesses are expected to offer same-day delivery services and this growth can be attributed to the increasing use of AI and the IoT in supply chains.

In the case of online retail, same-day delivery is possible if the supplier is nearby, however ensuring these services are also dependent on the shipping carrier. Typically for same day delivery, customers can receive products immediately if they are willing to pay a premium.

Real-time Payments

Real-time payments have been around for some time now, however, they are expected to become even more commonplace in the next few years. Real-time payments rely on a system that settles transactions instantly rather that authorizing a card.

This means that the funds are transferred between the two parties instantaneously. Real-time payments are advantageous because they prevent fraud and are highly secure. Real-time payments can be used in a variety of situations and typically can be used for person-to-person, online, or card-present transactions. These payments are made using APIs or sophisticated software systems. Furthermore, with the advancement of AI and blockchain technologies, real-time payments are expected to become even more common among larger and smaller institutions.

Augmented Reality and Virtual Reality Shopping

Virtual and augmented reality technologies will evolve in the next few years and will enable shoppers to virtually try on clothes, view furniture in their homes, and interact with products like never before.

This technology is already present in the gaming industry, however, it is now being explored by the retail industry. For example, a retailer could allow customers to try on certain styles of jeans or dresses in a virtual dressing room. This is expected to be convenient and time-saving for shoppers. Additionally, retailers can obtain valuable insights about their products and services to make changes based on real data for their shoppers.

This will let them tailor their offerings and improve their customer experience. Retailers can also integrate augmented reality or virtual reality technology into their websites. This will let customers experience their products as if they were holding them in their hands.

Blockchain Technology

Blockchain technology is expected to become mainstream in the next five years. The financial sector has already embraced this technology and now, it is slowly making its way into the retail industry. The blockchain is a publicly distributed ledger that allows transactions to be recorded and verified anonymously.

This works through peer-to-peer networks, where each computer acts as a node and these nodes are then linked together to create a chain. This technology offers several benefits to the retail industry because it is secure, scalable, and inexpensive, and at the same time offers a high degree of functionality. Moreover, blockchain technology can track goods through the supply chain and verify their authenticity. This is expected to be especially helpful for companies selling luxury goods. Additionally, blockchain technology can let customers pay for goods without needing a third party to process the transaction.

Conclusion

As you can see, e-commerce is not slowing down anytime soon, and payment innovation will continue to drive much of the industry’s growth. In order to keep up with the ever-changing trends and demands, businesses must constantly test new things.

With the advent of AI and machine learning, businesses can make their payment processes more efficient and secure. It is important for business owners to explore news ways to engage with customers, and doing so can help business owners gain a significant competitive advantage.