Financial technology companies develop an extensive range of complex and innovative algorithms and software. These are developed with the intention to simplify and support economic activities. The growth of these companies is essential for the growth of the economy. Top fintech trends in 2022 will decide the future of the market. Each trend will have its own contribution to the exponential growth that we will witness in the year 2022 in the fintech businesses.

What is Fintech

The word Fintech has two words in it. It is a combination of the terms Finance and Technology. So, Fintech is the process of using technology to promote and increase transactions, company’s business, automate its everyday work, and ensure fraud protection.

It seems pretty straightforward. But the important thing is that the financial tech needs continuous modifications of the software. This is to ensure that these services are accessible and secure for the end-users.

The use of Fintech has increased drastically in recent years. It has also become an essential part of consumers’ financial lives. Especially after the post COVID19 period fintech has become a part of everyday life for merchants and customers alike. Therefore, any disruption in the top fintech trends in the coming years can have a great impact on every sector of the economy. It can impact people from all sections of society.

Research conducted by Fintech Adoption Index concluded that more than 2/3rd of consumers worldwide have at least used two or more fintech-based services. They also said that this trend would further increase in the coming years. This article will discuss some of the fintech trends that have already been a great success and are predicted to rise sharply in the near future.

Top Fintech Trends to Watch in 2022

Fintech services are multi-dimenssional. There are various trends at different levels that determine the position and the trajectory of the market. Anyhow, there are a few top fintech trends that you should watch to understand the future. These top fintech trends can have a major impact on the global economy.

#1- Digital All-In-One Banking -#1 of the Top Fintech Trends in 2022

Banks are extensively using fintech services. They have tried to include the advantages of the global economy and cryptocurrency and make an all-in-one banking service for their customers. The banking consumers get the luxury of peer-to-peer transfers, zero MasterCard transaction fees, and quick payments to any global company without the need for heavy paperwork. All this can be done without going to the bank.

Global Market Insight showed that with the increase of fintech services in banks, there had been a decrease of about 36% in the physical branch visits. The trend is becoming more common and with AI and automation, the visit to a bank will be history soon.

In 2015, a startup named Monzo was founded in the UK. It was a digital-only banking company that became hugely popular. It got more than 42,45,063 domestic accounts with over $356 million funding in a short span of time. This shows how fast fintech services are being accepted by people and businesses alike.

#2 AI-based Technology

Right from the beginning, the computer has revolutionized banking. It automated millions of simplistic tasks and performed complicated transactions within seconds. Fintech AI has great potential in the finance industry. The AI factor is considered to be a major player in the top fintech trends in 2022 and beyond. The year 2022 will be just the beginning of the fintech AI growth story.

AI forms the backbone of all digital transactions for any business, protects it from fraud, and predicts the investment avenues with solid analysis. With all these robust features, AI will soon become an integral part of every business that wants to grow. Some financial analysts have predicted that AI Fintech will gather a net worth of more than $8.9B in the next four years. This will be possible as a lot of investment will take place in AI-powered finance companies.

An innovative startup by the name of Parashift began its work on a machine learning platform that attracted the attention of the industry. This startup was called the swiss army knife of the finance industry. They had developed a platform that could read all credit card receipts, cash receipts, and invoices with unparalleled accuracy. All these processes could happen autonomously without any human intervention. The company was backed by an experienced team that also founded the popular swiss bookkeeping platform called Accounto.io. This team created a startup in 2018, and in the same year, they received funding of 1 million Swiss Francs.

#3 Innovative Payment Methods

Any modern business transaction has some base elements like a Mobile wallet system, Contactless payments, ID verifications, and security of transactions based on fintech. In 2020 PaymentsJournal noted that by 2022, the value of consumer shift to online purchases is expected to be over $2.7 billion. There is every possibility that this value can go more than $5.4 trillion by the year 2025. A fantastic example of this is a new startup called Flutterwave. They launched their startup in Lagos, Nigeria, in 2016. Flutterwave is a fintech company that now operates globally and growing fast. Their tried and tested payment system helped Uber enter the African market and accept payments in local currency. Many other companies depend on Flutterwave APIs to make their financial transactions easy.

#4 Blockchain

Blockchain and Fintech are a perfect match for each other. They are helpful in many areas, but their best usage is seen in the supply chain management system. Blockchain can give a cheap, fast, and reliable payment processing system with added security. When this system gets added advantage of foolproof auditing, accounting, and record-keeping, it can give the old, traditional, and less reliable system a run for its money. These old systems have slowed down the progress of the financial industry for a long time. A startup named Synaps was started as a collaborative work of two companies, Symbiont and Ipreo. This new startup was focused on smart contracts. They used the foundation of blockchain with the automation of the global loan monopolistic market. These startups are worth millions now.

#5 Online Shopping Security

It can be a profitable business by automating the day-to-day activities of a company by adding AI capabilities. This can separate genuine customers from fraudulent ones easily. Every bank or company needs this as it is the need of the hour. Adding this capability to any business can be very complicated. Fintech solutions are spreading their reach everywhere including the risk management section. This is an integral part of any industry because it decides the future.

Creating a risk management system with AI was the next obvious need for the industry. There are a few startups that have tried to capture this new market. One of them is a New York-based startup called Riskified. This company offers many different tools to eCommerce ventures, including dynamic checkout, chargeback guarantee, and alternative payment processing. It uses an innovative verification process based on a machine learning platform that gives more security to the customers with a simplified transaction process.

The Future of the Global Fintech Market

The scope of innovation using financial technologies is virtually limitless. If you have a vision and the required talent, you can create wonders and capture a major share of this big-value industry. Companies and big institutions now see more enormous possibilities in Fintech and this is a positive change. A study done by Medium in the year 2020 showed that the investments made in robotic automation of banking processes started to get back returns in about 3 to 8 months. In 2019, the market share of the top 48 fintech unicorn companies (whose value was over $1 billion) was a little more than 1%. This share has been continuously increasing.

Fintech Growth Prediction for 2025

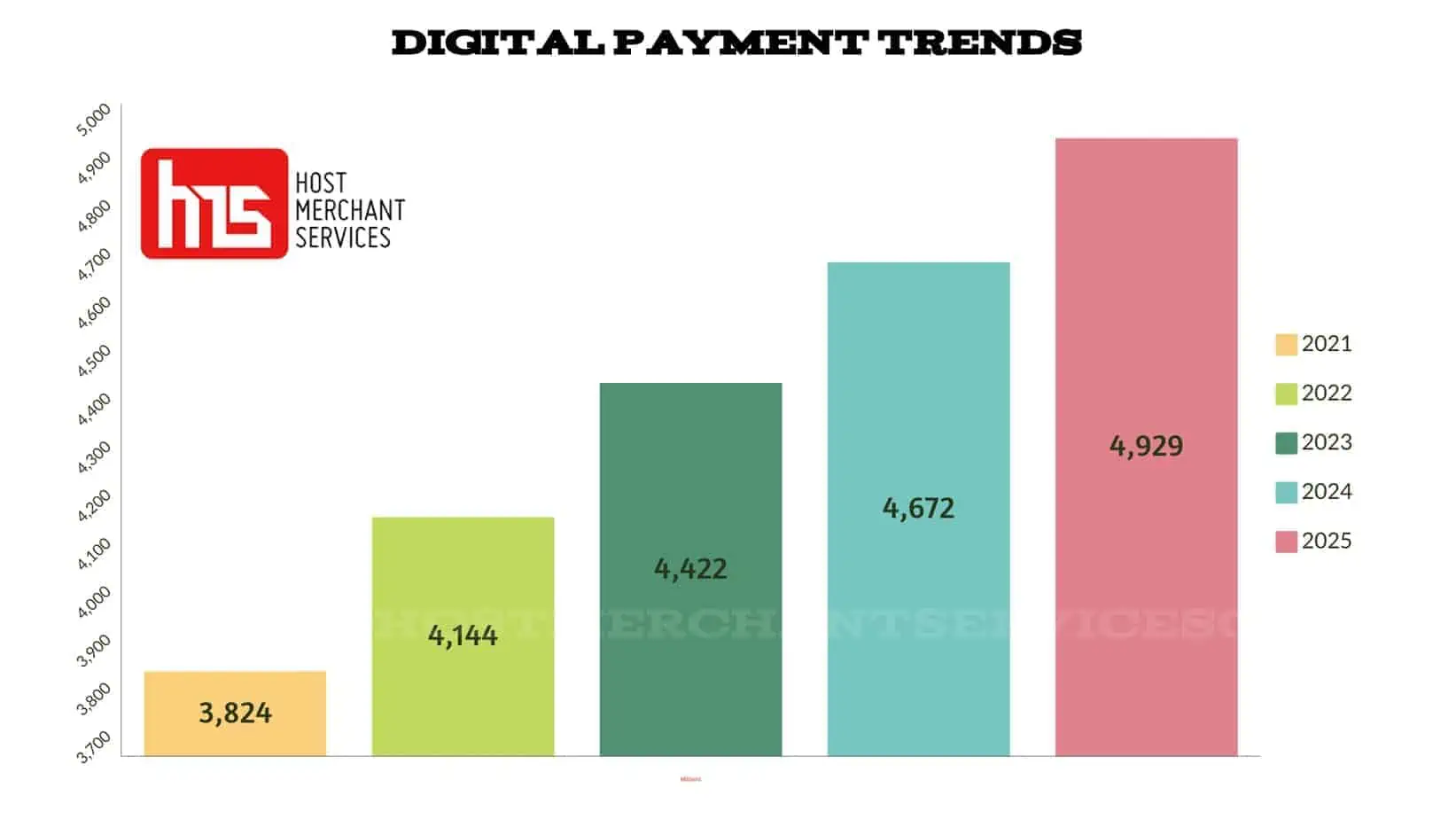

With more and more use of advanced technology, the growth predictions of this industry are even more exciting. It is predicted that the expected CAGR will be 23.5% by the year 2025.

Fintech strives to remove complications from financial jobs and reduce overall business and consumer costs without compromising safety and security. With new innovations, various business models have become complex and vulnerable to delays at any level. Fintech can save them. The future of fintech is bright.

Frequently Asked Questions

What are some emerging trends in the fintech industry that I should keep an eye on?

Discover the latest developments such as decentralized finance (DeFi), artificial intelligence (AI) in financial services, open banking, blockchain applications, and digital currencies.

How is the use of artificial intelligence (AI) shaping the future of fintech?

AI is revolutionizing fintech by enabling personalized financial recommendations, fraud detection, risk assessment, and automated customer service. It enhances efficiency, improves accuracy, and provides better user experiences.

What is decentralized finance (DeFi) and why is it gaining traction in the fintech space?

DeFi refers to financial applications built on blockchain networks, offering decentralized alternatives to traditional financial intermediaries. It enables peer-to-peer lending, decentralized exchanges, and other services, providing greater accessibility, transparency, and financial inclusion.

What is open banking and how does it impact the fintech landscape?

Open banking allows third-party developers to access financial data through APIs, fostering innovation and competition in the financial sector. It enables customers to securely share their financial information with multiple service providers, resulting in more tailored products and services.

How are digital currencies reshaping the fintech industry?

Digital currencies, such as cryptocurrencies and central bank digital currencies (CBDCs), are revolutionizing the way we transact and store value. They offer faster, more secure, and cost-effective cross-border transactions, while also providing opportunities for financial inclusion and new business models.