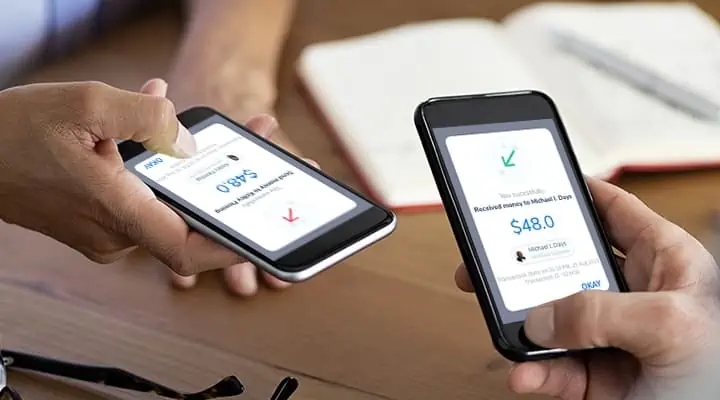

Today, several customers and businesses have started embracing peer-to-peer payment technologies. The popularity of P2P payments has been on the rise since the year of the pandemic. As the pandemic has disrupted different services, it has encouraged customers to find digital solutions for transactions. The value of P2P payments is increasing, as many businesses have started resuming their normal operations. Using P2P platforms, customers can find it easy to make payments from their smartphones.

The latest trends of using P2P payment platforms

One of the major advantages is that P2P ensures better control of the in-person fund transfer process. It is also a great option when you have time sensitive transactions. P2P platforms are accessible anytime and from any place. The technology ensures minimal friction with the digital transaction process. More than 30% of Americans have started using at least one peer-to-peer payment platform. P2P should gain universal acceptance within a few years.

According to the latest survey, 70% of adults signed up with P2P platforms at the end of 2020. It indicates faster adoption of P2P technology. It also enables us to predict long-term trends in the digital transaction market.

A study from Mercator Advisory Group revealed that there was a slight decline in the frequency of P2P transactions in 2020. However, the number of platforms is increasing..

Credit Unions have found it easy to provide P2P services to their members. There is a rise in the number of co-branded P2P networks and non-bank apps. Credit Union leadership is trying to increase digital engagement. It likes to know how the use of P2P will benefit them. Signing up with a P2P network helps in promoting security around transactions. The credentials of the member will be linked with the institutional security already used by credit union.

P2P and security standards

Unfortunately, P2P has become one of the new targets of cybercriminals. In the past year, there has been an increase in cases of P2P account fraud. However, the rate of other identity fraud has decreased by 21%. Thus, security should be the major concern for P2P users. Interestingly, the increasing usage of RFID, NFC, and other similar technologies in P2P payments will present several opportunities in the future.

P2P is useful for something more than check-splitting. You may notice the recent trend of using P2P for small payments. However, the CEO of Zelle’s parent company found that the average amount of Zelle transactions is about $250.

With the growth of P2P platforms, businesses will choose peer-to-peer platforms for both receiving and sending money.

From these trends, it can be said that P2P will be acceptable to businesses for payment disbursements. They will also use it for settling issues with other organizations. It will enable businesses to settle obligations within a very short time. There will be a minimal risk of verification delays, which are common in ACH transactions.

Mobile P2P apps and their growing transactions

The mobile P2P sector has been gaining popularity in recent years. The key players in the market have seen considerable growth and an increase in the payment transaction value. They have attracted more users in the past few years.

At present, Cash App, Zelle, and Venmo are enjoying unparalleled growth, especially during the pandemic. These companies have continued innovating their platforms to attract new users and retain loyal ones. To have a clear understanding of how these mobile P2P apps are transforming the industry, you can check out some statistical data.

- Cash App

Almost 30% of US-based users of P2P mobile payment platforms have chosen Cash App. In the last months of 2020, the estimated balance of Cash App was around $2 billion. The company has gained a big share of its revenues from Bitcoin transactions.

It indicates that the P2P platform is following the trend of shifting towards cryptocurrency. Especially, the instant deposit cash card is highly advantageous, as it helps in using the funds in-store. It covers a bigger part of the profits of the company.

According to the latest predictions, by 2022, there will be a transaction of $128 billion via Cash App. By 2025, the number will cross the $200 billion.

- Zelle

Zelle is steadily growing its user base, and within a few years, it will reach 48.2 million in the US. To say clearly, it is about 18.5% of the US population. This growth rate will continue for a number of years. By 2025, Zelle’s service will be available to more than 60 million users.

In the present P2P market, Zelle has gained a strong position. 7 large US banks, including Wells Fargo, Bank of America, and JPMorgan Chase, have partnered with Zelle. The network of partners is growing, as the company will tie-up with several other banks.

In the past year, Zelle added more than 450 financial institutions to make its network bigger. The network also comprises several credit unions and small banks.

Consumers prefer Zelle to pay bills and make bigger transactions. Several small businesses rely on Zelle for bill payments and contractors’ payments. Some businesses also like to use the invoicing feature of the product.

According to a rough estimation, Zelle transacted $272 billion via a mobile app. By 2022, it will get doubled and cross $500.82 billion.

- Venmo

Venmo has gained recognition for easier and safer social payments. Its target audience is mainly millennials, and it focuses more on peer-to-merchant transactions. In the US, the number of Venmo users will be more than 77.8 million. The user base is growing consistently, and it will be 100 million by 2024. Venmo has a chance of grabbing a significant share of the P2P market. Overall, we can say that the transaction amount of these popular mobile P2P apps will cross $1.152 trillion in the future. Modern P2P payments are on track to replace traditional funds transfers.