Sweden is known for its technological advancements and may soon become the first cashless society as 80% of all transactions involve credit card processing with many Swedes no longer carrying cash at all. Now, thousands of Swedes have taken technology one step further by implanting microchips under the skin to replace credit cards and even house keys, gym membership cards, and more.

The microchips are designed to improve convenience and make everyday activities faster and easier. Since 2015, over 4,000 Swedes have already had the small microchips implanted into their hands.

What is a Microchip?

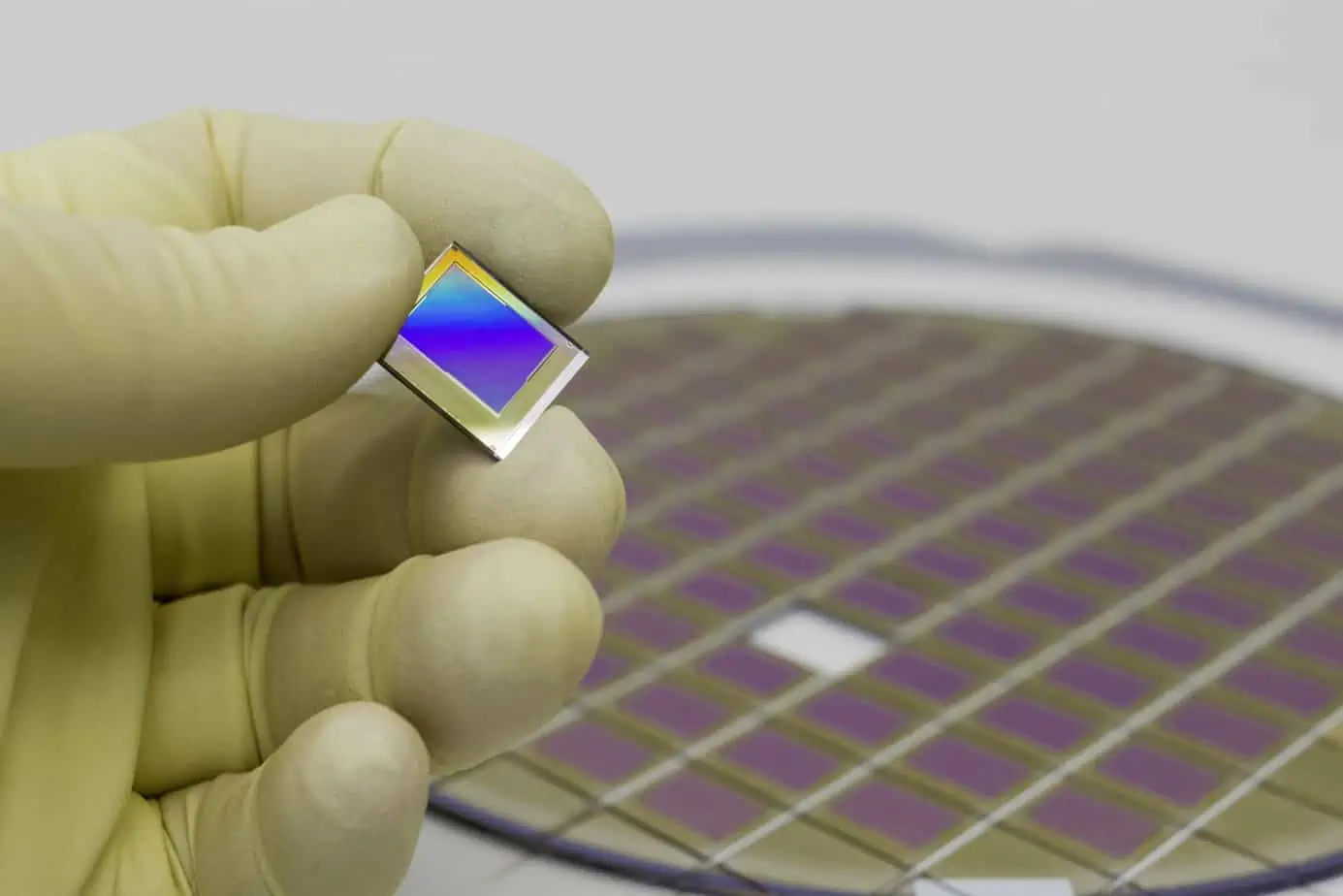

The microchips are about the size of a grain of rice and they’re implanted in the fleshy part of the hand between the forefinger and thumb. They work a lot like a smartwatch and digital wallet rolled into one. The chips can be used to monitor health vitals, replace keycards, and store credit card information.

Features of Microchip

The feature that has really helped the microchips take off is the ability to pay for goods in a store with a quick swipe of the hand (literally). In this way, the chips can be considered the ultimate type of mobile payment by skipping the smartphone entirely. The chips use near-field communication (NFC) technology that’s also used in contactless credit card processing and even pet tracking technology.

The microchips aren’t just for making payments; they can replace membership cards at the gym, passcards at the office, and house keys for a home equipped with a smart lock. The chips can store emergency contact information, event tickets, and even train tickets. Sweden’s SJ national railway company even supports the system with a microchip reservation service. Train conductors can scan a passenger’s hand after they buy a ticket online and register the ticket on their microchip.

Jowan Österlund, a former body piercer, pioneered the microchip technology and considers it safe and practical. The technology itself isn’t new, however. Implantable NFC microchips date to 1987 when they were developed for livestock and pets.

Of course, security and privacy concerns have been raised. Some critics worry that the microchips will gather a mass of incredibly personal data that may fall into the wrong hands. The invasive nature of the implant, as well as the cost, will obviously make it difficult to replace if the payment account on the chip is stolen.

The microchip trend certainly makes sense in Sweden, however, a country that has adopted technology faster than almost any other nation. Coins and notes account for just 1% of Sweden’s economy today. As the country moves toward a cashless economy, financial crimes like bank robbery have plummeted. In 2008, there were 110 bank robberies throughout the country compared to just 2 in 2018. Cash is increasingly being viewed as obsolete.

It’s likely that Sweden’s long-standing history of sharing personal information has helped with the acceptance of microchips in the nation. Sweden is famous for its unique open society which offers easy access to residents’ phone numbers, birthdates, addresses, and even financial information. You can look up a license plate to view vehicle information, search for someone’s name to view their address and job information, and even find out the salaries of other Swedes with a simple phone call.