In the world of card payments, EMV is a big deal. Businesses everywhere want to ensure they are safe and secure when people buy things; EMV helps with that. It’s like a unique lock for your credit or debit card that makes it hard for bad guys to steal your information. To do well today, businesses must understand why an upgrade to EMV is essential. It’s not just about following the crowd; it’s about keeping up with changes in how we buy and sell things so customers feel safe and happy.

What is EMV?

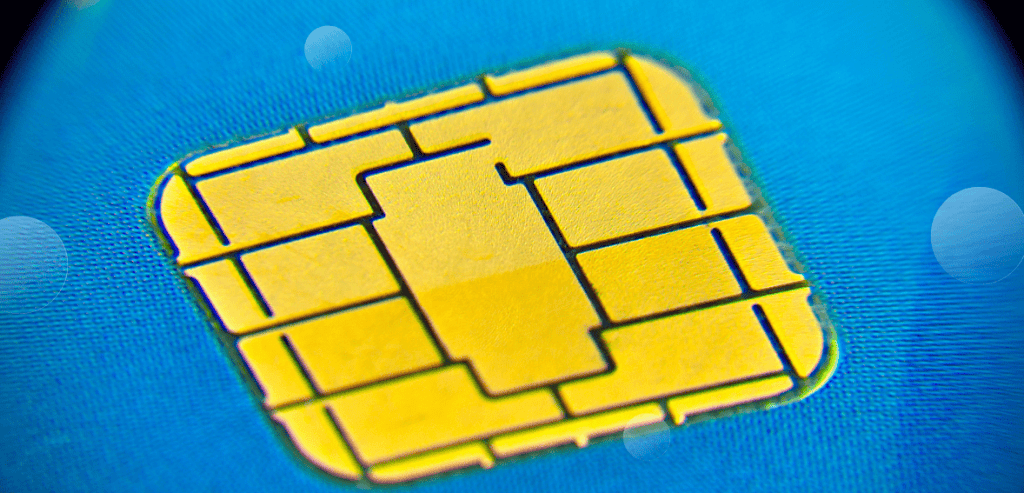

EMV, standing for Europay, Mastercard, and Visa, represents a universal benchmark for credit and debit card transactions worldwide. This standard incorporates microprocessor chips embedded within payment cards, supplanting the conventional magnetic stripe. The fundamental aim of EMV is to bolster security measures and diminish the likelihood of counterfeit fraud, thereby fortifying defenses against unauthorized transactions. By employing dynamic authentication methods,

EMV technology generates unique transaction codes for each payment, rendering it considerably challenging for fraudsters to replicate card data. This shift from magnetic stripes to chip-based authentication marks a significant advancement in payment security, instilling greater confidence among consumers and businesses alike in the integrity of electronic transactions.

Why Upgrade to EMV?

Security Benefits

Businesses are driven to adopt EMV technology primarily due to its superior security features. Unlike magnetic stripe cards that retain static data vulnerable to cloning, EMV cards produce dynamic transaction codes for every payment. This innovation substantially diminishes the likelihood of fraud, posing formidable challenges for cybercriminals attempting to breach cardholder information.

By leveraging dynamic authentication, EMV technology establishes a robust defense mechanism against unauthorized transactions, enhancing overall security in electronic payment systems. The transition from magnetic stripe to chip-based authentication represents a pivotal shift towards safeguarding sensitive financial data and instilling trust among consumers and businesses in the integrity of payment transactions.

Liability Shift

Another significant incentive for upgrading to EMV is the liability shift initiated by payment networks. In areas where EMV adoption prevails, the responsibility for fraudulent transactions transfers to the entity employing the least secure technology. Consequently, businesses not embracing EMV may shoulder the financial repercussions of fraud-related losses.

This policy is a powerful incentive for companies to transition to EMV, underscoring the potential economic risks of maintaining outdated payment systems. By aligning liability with security measures, payment networks incentivize businesses to prioritize adopting EMV technology, thereby fostering a safer and more secure payment ecosystem for consumers and merchants alike.

Consumer Trust

EMV technology is pivotal in nurturing consumer trust, particularly amid escalating apprehensions regarding data breaches and identity theft. In an era where consumers prioritize security, businesses that embrace EMV signify their dedication to safeguarding customer information. This proactive stance not only enhances brand reputation but also fosters customer loyalty. By adopting EMV, businesses signal their responsiveness to evolving security concerns, instilling consumer confidence regarding the integrity of their transactions.

Consequently, customers are more inclined to patronize businesses prioritizing their security, establishing a symbiotic relationship where trust begets loyalty. EMV is a tangible manifestation of a business’s commitment to protecting its customers’ sensitive data, thereby fortifying the foundation of faith upon which lasting relationships are built.

Transitioning to EMV

The transition to EMV encompasses steps, beginning with procuring EMV-compatible hardware and software. This entails installing EMV-compliant point-of-sale terminals and updating payment processing systems to accommodate chip card transactions. Furthermore, staff members may need training to acquaint themselves with the technology and facilitate seamless operations.

Despite the apparent initial costs of EMV adoption, the long-term advantages far surpass the investment. As key benefits, businesses can anticipate enhanced security measures, mitigate fraud losses, and heightened customer trust. By embracing EMV, businesses fortify their defenses against fraudulent activities, safeguarding their assets and reputation. Moreover, the transition fosters consumer confidence, as patrons perceive EMV adoption as a proactive measure to protect their financial information.

Ultimately, these outcomes culminate in a positive impact on the bottom line, as businesses not only minimize financial risks but also cultivate more robust relationships with their clientele, positioning themselves for sustained success in an increasingly competitive marketplace.

EMV Adoption Around the World

The adoption of EMV technology varies globally, with certain regions leading the way in implementation. Regions like Europe and parts of Asia have embraced EMV extensively, resulting in notable declines in counterfeit fraud. This highlights the efficacy of EMV in thwarting fraudulent activities and safeguarding cardholder data. The widespread adoption of EMV in these areas underscores its effectiveness in addressing security concerns and enhancing trust in electronic payment systems.

As a result, businesses and consumers in regions with high EMV penetration enjoy increased protection against fraudulent transactions, contributing to a more secure and reliable payment ecosystem. This trend also serves as a compelling example for other regions, encouraging further adoption of EMV technology to bolster payment security on a global scale.

Benefits of EMV for Businesses

Reduced Fraud

EMV technology offers businesses a substantial advantage by significantly reducing fraudulent transactions. The dynamic authentication process facilitated by EMV chips poses a formidable challenge to fraudsters attempting to clone card data or intercept sensitive information during transactions. By generating unique transaction codes for each payment, EMV chips effectively thwart unauthorized access to cardholder data, thereby minimizing the risk of fraud.

This enhanced security feature protects businesses from financial losses associated with fraudulent activities and fosters consumer confidence in the safety of electronic transactions. As a result, businesses adopting EMV technology can operate within a more secure payment environment, mitigating risks and reinforcing trust among customers.

Increased Customer Satisfaction

Businesses can bolster customer satisfaction and trust by providing a secure payment experience through EMV technology. Customers value the heightened security measures EMV offers, which instill confidence in their card transactions. Knowing that their financial information is better protected against fraud, customers feel more at ease when making purchases, thus increasing their trust in businesses prioritizing security.

This enhanced sense of security improves the shopping experience and fosters customer loyalty. As a result, companies implementing EMV technology mitigate the risk of financial loss due to fraud and strengthen their relationships with customers, ultimately driving repeat business and positive word-of-mouth referrals.

Compliance with Industry Standards

Embracing EMV technology guarantees that businesses adhere to industry standards and regulations concerning payment security. This compliance not only shields businesses from potential fines and penalties but also showcases their dedication to upholding best practices in data protection. By aligning with established standards, businesses signal their commitment to safeguarding sensitive financial information, thus bolstering trust among customers and stakeholders.

Moreover, compliance with EMV standards enhances the overall security posture of businesses, reducing the likelihood of data breaches and fraudulent activities. Ultimately, by prioritizing EMV adoption, companies mitigate regulatory risks and strengthen their reputation as trustworthy entities, prioritizing the security and privacy of their customers’ payment data.

Challenges of EMV Implementation

Despite the clear advantages of EMV adoption, businesses may need help with implementation. Technological barriers, such as compatibility issues with current systems, can be formidable challenges. Integrating EMV technology with existing infrastructure may require extensive modifications, leading to potential disruptions in operations. Furthermore, educating staff and customers about the benefits of EMV and the procedural changes it entails demands significant time and resources.

Staff members need training to operate new systems effectively, while customers must be informed about the enhanced security measures and any alterations to payment processes. Overcoming these challenges necessitates careful planning, investment in training programs, and effective communication strategies. By addressing these obstacles proactively, businesses can navigate the complexities of EMV implementation and reap the long-term benefits of enhanced security and consumer trust.

Tips for a Smooth Transition

Navigating the challenges of EMV implementation requires businesses to adopt a strategic approach. Firstly, meticulous planning and resource allocation are essential for a smooth transition. It involves assessing current systems, identifying necessary upgrades, and setting realistic timelines to minimize disruption. Secondly, investing in comprehensive staff training ensures that employees are proficient in handling EMV technology and can assist customers seamlessly during transactions. Effective customer communication is equally crucial, as it helps manage expectations and alleviate concerns about the transition.

Providing clear information about EMV’s benefits, any changes in payment procedures, and potential inconveniences ensures transparency and fosters goodwill. By prioritizing these strategies, businesses can mitigate challenges associated with EMV implementation and facilitate a seamless transition that minimizes disruption to operations and enhances customer satisfaction. This proactive approach ensures compliance with industry standards and positions businesses for long-term success in the ever-evolving payment technology landscape.

Future of EMV Technology

With ongoing technological advancements, the future of EMV holds considerable potential for innovation and progress. Continuous developments aim to introduce new features and functionalities to bolster the security and usability of EMV cards. These innovations ensure businesses stay ahead in combating emerging threats and satisfying evolving customer demands. By integrating cutting-edge technologies and refining existing systems, the EMV ecosystem adapts to the dynamic landscape of payment security.

EMV technology evolves in parallel as cyber threats evolve, providing businesses with robust defenses and customers with enhanced peace of mind. The ongoing commitment to innovation underscores EMV’s enduring relevance in safeguarding electronic transactions and maintaining trust in digital payment. As a result, businesses can anticipate continued advancements in EMV technology, further solidifying their position as a cornerstone of secure payment solutions.

Conclusion

In conclusion, upgrading to EMV technology is not just a matter of compliance but a strategic investment in security and customer trust. By embracing EMV, businesses can protect against fraudulent activities, enhance customer satisfaction, and position themselves for long-term success in today’s rapidly evolving payments landscape.

FAQs

What does EMV stand for?

EMV stands for Europay, Mastercard, and Visa, the three companies that developed the standard.

Is EMV technology mandatory?

While EMV adoption is not mandatory, businesses not upgrading may be liable for fraudulent transactions in regions where EMV is prevalent.

How does EMV protect against fraud?

EMV technology uses dynamic authentication to generate unique transaction codes for each payment, making it difficult for fraudsters to replicate card data.

Does upgrading to EMV require new hardware?

Businesses must install EMV-compliant point-of-sale terminals and update their payment processing systems to support chip card transactions.

What are the consequences of not upgrading to EMV?

Businesses not upgrading to EMV may face increased liability for fraudulent transactions and risk damaging their reputation due to perceived security vulnerabilities.