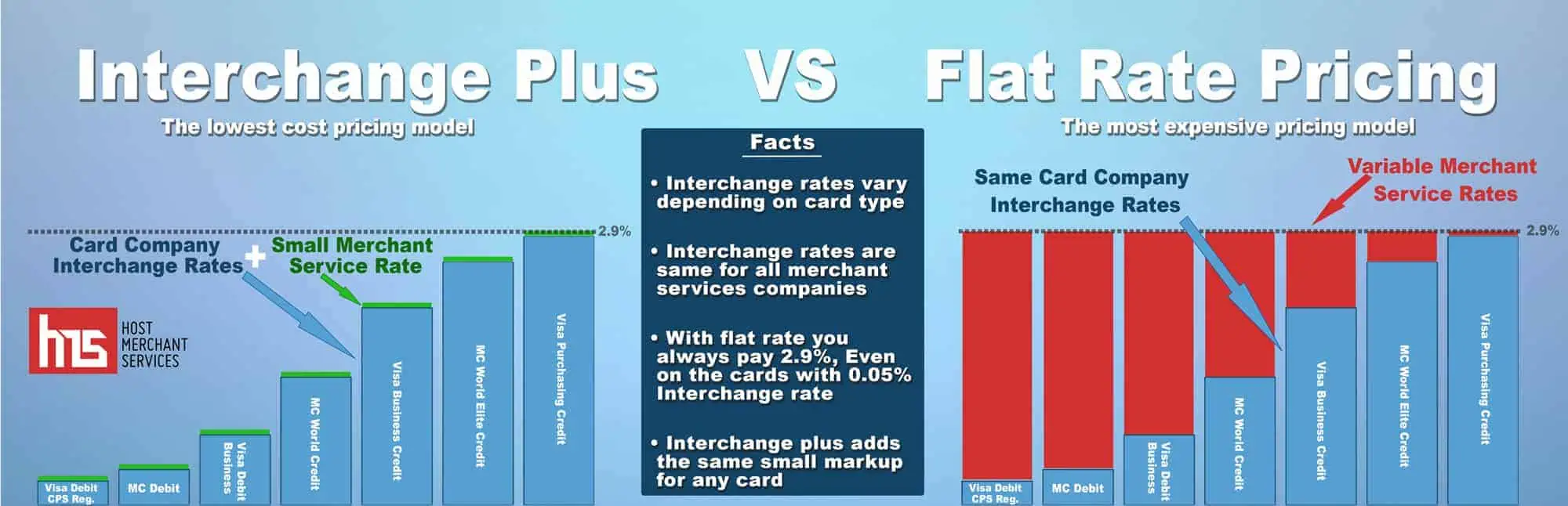

Two of the most common payment processing pricing models you will encounter today are flat rate pricing and interchange plus pricing. Here’s how they compare and why interchange plus pricing is the superior choice for most merchants.

Choosing the right credit card processor can be a difficult task when you consider there are several types of pricing models the processor can offer — some more transparent than others. This means looking for the lowest rate is probably not going to come with the lowest cost.

Understanding Interchange Rates

Interchange rates are payment processing fees set by credit card associations like Visa, Mastercard, and Discover. These interchange fees are paid to the bank that issues the credit card. There are hundreds of different interchange fees based on the type of card (such as Gold, Platinum, or rewards), whether the card is present or not present, and more.

Flat Rate Pricing

Many popular processors today advertise great flat rates with no fees or hassles but this comes at a price: the fee is probably much higher than you would pay with a different pricing system.

It’s easy to see the appeal of flat-rate pricing. While many merchant services come with a long list of fees and different rates for different transactions, a flat-rate provider gives you just one rate to worry about. You always know what you’re going to pay for every transaction.

Of course, flat-rate credit card processing companies have to cover the same fees as other processors. This is how they come up with their rates: they’re high enough to include a huge profit margin.

There’s a very good chance that most of the transactions you process would qualify for a much lower rate with a different pricing model. If you are a small- to medium-sized retailer, for example, most of your transactions are probably debit cards swiped at a credit card machine. These transactions have the lowest interchange rates available. With an interchange plus or cost-plus pricing model, you could be paying 0.50% to 1% — far lower than the 2.75% rate advertised with a flat rate model.

Interchange Plus Pricing

Interchange plus pricing, also known as cost plus, is a transparent pricing model that helps you understand the real cost of credit card processing to get the lowest possible rate. Cost-plus pricing is based on the actual interchange rate “plus” a markup the processor charges. The “plus” component of interchange plus pricing may be a percentage or a flat fee per transaction.

With interchange plus pricing, you can better understand the true cost of merchant services. This pricing method is simple and shows you how much of your processing fee goes toward interchange fees and how much goes to your payment processor. The only drawback to cost-plus pricing is it can make your statements a bit more confusing until you understand the different rates you pay for different transactions.

In the past, cost plus processing was only offered to high-volume merchants but it’s now available to even new and small businesses. With only two rates to consider and transparent pricing, interchange plus is the clear choice for most businesses.