What Is Interchange Plus Pricing?

Accepting credit cards increases customer convenience and helps increase your sales, but the cost of merchant services can be a bit confusing and eat into your profits. You don’t want to pay more than you need to for payment processing, but how do you choose a merchant account provider that charges the best rates? Knowing how much you will pay in advance for credit card processing isn’t easy, especially when the provider uses a complicated pricing system like tiered pricing.

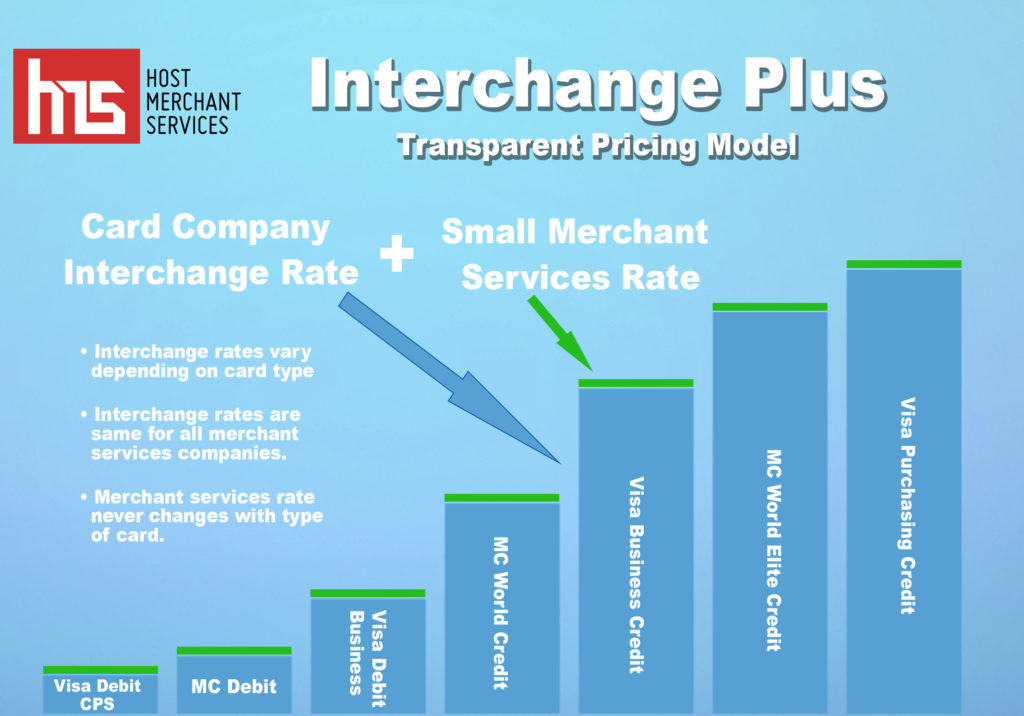

As a merchant, the safest and most upfront pricing model is interchange plus pricing, also known as cost plus pricing. Unlike other pricing models, the interchange plus system breaks down the charges so you can see the markup you are charged to process a transaction. Here’s a look at how interchange plus pricing works and how it protects you from being overcharged.

Understanding Interchange Fees

When a credit card transaction is processed, there are several entities involved. The first is the acquiring bank or merchant services provider. The card issuing bank physically issues the card that the customer is using. The credit card association, which may be Mastercard, Visa, or Discover, is responsible for setting the credit card processing rates for these transactions.

Every debit and credit card has a pre-set interchange rate that the merchant account provider pays to the issuing bank. This is the interchange rate. Debit cards have the lowest interchange rates while high-end rewards cards have the highest rates. Rates can also be lower if the credit card is dipped or swiped on a credit card machine compared to online or keyed sales.

There are hundreds of interchange fees that are comprised of a percentage fee of the volume of the sale and a flat fee per transaction.

How Interchange Plus Pricing Works

Interchange plus pricing is the most beneficial for merchants due to its simplicity and transparency. With this pricing model, merchants pay the actual interchange fee “plus” an additional markup. The “plus” is the amount that exceeds the interchange costs and it covers expenses for the merchant account provider. The markup may be a per-transaction fee or a percentage.

A common alternative to interchange plus pricing is a tiered pricing system, which turns the hundreds of interchange rates into just three tiers: qualified, mid-qualified, and non-qualified. The processor determines which transactions fall into which categories based on criteria like whether a credit card machine is used and whether the transaction was processed same-day.

With tiered pricing, you can never tell which percentage of the processing fee goes tot he credit card association and issuing bank and how much goes to the merchant account provider. This pricing model makes it very easy to hide interchange fees so the processing company can charge a higher markup.

Why Cost Plus Pricing Makes Sense

Tiered and flat-rate pricing models make it easy to overcharge merchants because you never know how much you are paying over interchange. Interchange plus pricing shows you the actual interchange costs for every transaction to see precisely what you are paying over interchange. The cost plus model encourages competition and reasonable markups to save you money on payment processing. While payment processors can still charge whatever they want as a markup, you can easily compare merchant accounts to find the service with the lowest effective rate.