If you’re planning to sell vapes online, one of the first hurdles you will need to overcome is finding merchant services that accept your business. The sale of electronic cigarettes, vape, and related products is considered high risk. This means many merchant account providers will turn you away. Even Square, PayPal, and other processing platforms have been known to freeze high-risk merchant accounts with no warning. So, how can you get payment processing for vape products online? Let us understand today.

Vaping is a massively growing industry that generates over $1 billion in revenue every year and has been shown to help many people quit tobacco use for good. Unfortunately, banks have not been accepting of the industry, and new FDA rules have made many banks and merchant account providers even more skittish.

The good news is you can get credit card processing services even with a high-risk business as long as you know where to look.

Factors that Affect Online Vape Sales

Given that merchant accounts for vape companies are considered high-risk, it makes it inherently more difficult to get credit card processing. When you add sales online where card not present transactions are taking place, banks up the risk factor. What do you mean by risk? Good question! Banks consider the chance of chargebacks or fraudulent charges the largest risk factor. Any card not present transactions, therefore, have a higher risk level. So, selling vape products online is doubly risky to the banks.

Beyond the banks, New rules enacted in 2016 by the FDA directly impact payment processing for vape products and the types of products you can offer as a merchant. The new FDA rules prohibit manufacturers and companies that change bottle size and flavor from selling new vape products without registering their vape products for FDA approval. You will also have significant hurdles if you want to mix your own liquids, as each new mix is considered a new product subject to FDA approval, a process that can cost up to $1 million and take years.

The biggest change affecting online vape sales is a rule regarding registration with MasterCard and Visa. In the past, online businesses that sold e-cigarette-related products but did not actually sell tobacco were not required to register with Visa and Mastercard or pay the high $1,000 annual fee to accept credit cards. This is no longer true. Now, you must pay a fee of $1,000 every year (which goes to MasterCard and Visa) and register your website to sell vape. In many cases, you are also required to get a letter from a lawyer stating that your business complies with applicable laws like age verification as well.

How to Get a High-Risk Vape Merchant Account

As I previously mentioned, when your business conducts online vape sales, you are considered high-risk. With a standard merchant account, you may not get approved at all, or worse — your account can be reviewed months after you begin accepting credit cards only to get frozen with no warning. A high-risk merchant account is the best option to process vape sales.

While “high risk” may sound shady or expensive, it doesn’t need to be. All this means is your industry is highly regulated by the government, and there are additional hoops to jump through when it comes to payment processing. It can also refer to industries with higher-than-average chargebacks or fraud.

Don’t assume that you have no options just because your business is considered high-risk. Vape merchants need to choose a company that is expert in getting vape accounts approved the right way. HMS is one such company that serves all types of high-risk businesses with quality merchant services and the best in customer service. Unlike many credit card processing companies, They even offer high-risk merchant accounts that work with Shopify to help your business grow without the stress, strict policies, and unreasonable fees other processors may charge.

If you’re looking for cost-effective payment processing to sell vape products on Shopify or anywhere else online, contact us today, and we will help you make the right decision. We look forward to showing you the difference a great card processing company can make in your business!

The Growth of the Vaping Industry

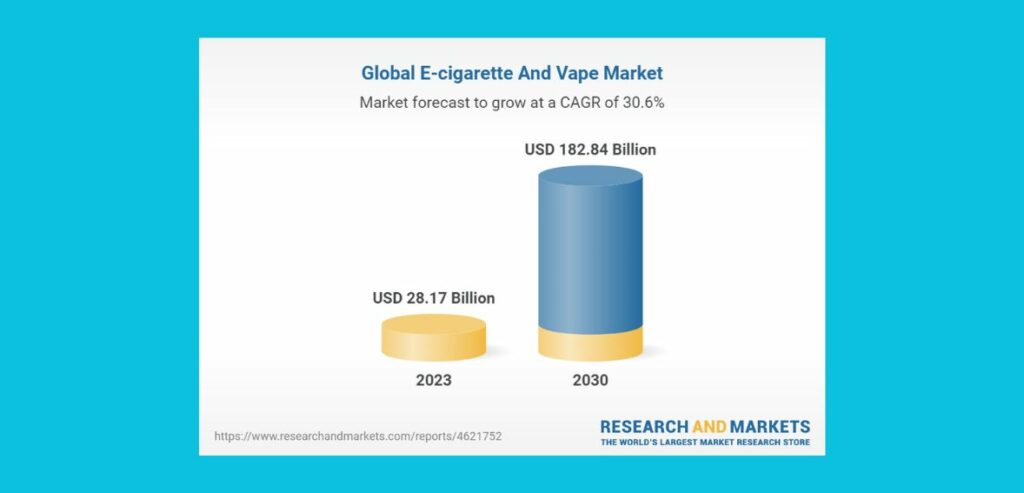

The vaping sector has witnessed huge growth across the world in recent years. Especially the retail market for vapes has increased exponentially. Retailers nowadays sell a huge range of vaping products like e-liquids and accessories. A few years back, the vaping industry was considered a niche market, and now it is a billion-dollar industry.

Vaping culture has gained popularity among both enthusiasts and those seeking alternatives to tobacco products. The shift toward healthier choices and customizable vaping experiences has propelled the growth of the vape industry. Online sellers have taken advantage of this increasing demand by providing access to various vape products at competitive prices.

With technology advancing and consumer preferences changing, the vape industry shows no signs of slowing down. Innovation fuels product development, leading to trends regularly emerging to meet evolving tastes and needs. Whether you’re a vaper or simply curious about exploring this field, expanding the vape industry offers exciting opportunities for businesses and consumers alike.

Obstacles Faced by Vape Companies in Processing Online Payments

The vaping sector has experienced expansion in the past few years, witnessing a rise in online businesses catering to the increasing demand for vaping goods. However, a key issue these businesses encounter is that not many merchant service providers are willing to give payment processing to them. The reason is that the vaping industry is considered to be a high-risk industry.

Numerous traditional payment processors are reluctant to collaborate with vape companies due to uncertainties regarding regulations. This major hurdle can make it challenging for vape businesses to secure a payment processor willing to assist them.

Furthermore, some financial institutions may categorize vape products as high-risk commodities, resulting in higher transaction fees or even outright refusal of services. Such circumstances can greatly impact the vaping companies.

Additionally, stringent age verification protocols required for selling vaping items further complicate the payment processing journey for these businesses. Upholding compliance with regulations while providing customers with a seamless checkout experience poses challenges for vape merchants seeking to accept payments. And therefore, payment processing for vape products become even more relevant.

Understanding Payment Processing in the Vaping Industry

There are many regulations and restrictions associated with the vaping industry. Therefore, only those merchant service providers who understand these rules and restrictions can successfully cater to the requirements of online vaping merchants. Traditional payment processors who deal with non-risky businesses cannot handle the challenges posed by the online vaping industry.

Handling payments for vape products typically involves scrutiny and adherence to compliance measures aimed at mitigating risks related to sales or product safety issues. Vape companies must prioritize transparency regarding their products and business practices to meet the criteria set by payment processors.

Tips to Find a Trustworthy Payment Processing for Vape Products Online

To begin with, it is highly recommended that you start comparing the services provided by payment processors who are experts in high-risk businesses or the vaping industry specifically. After you make a list of some of the best companies that are willing to give you the merchant account for an online vaping store, check their reviews and what other merchants are saying. You should always trust reputed sources when it comes to reviews.

Once you shortlist some of the best providers in the industry you should then compare the fees they charge. Remember, the vaping industry is a high-risk industry, and the charges might be high. You should also thoroughly check the hidden charges. Sometimes, the visible charges are lower, but hidden charges might be high.

There are a few merchant service providers who also offer tailored products. As a vaping merchant, an age verification tool might be very useful. Feel free to reach out to discuss your needs and concerns before deciding.

Conclusion

The vape product industry is growing at a rate of 10 percent per year. And this is the right time to get involved and make some profits. And in this endevour, a robust payment processor can make a big difference. Although it is difficult to find payment processing for vape products online. But with a little understanding and research, you can find one. Remember to explore processors, go through reviews, and compare fees to discover the best processor.